Dental Crowns and Bridges Market Size, Share & Industry Analysis, By Product Type (Crowns and Bridges), By Type (Pre-fabricated and Customized), By Material (Ceramics, Porcelain Fused to Metals, and Metals), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

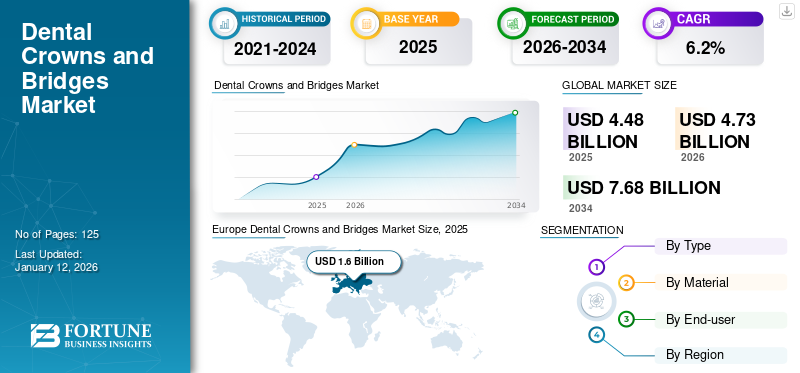

The global dental crowns and bridges market size was valued at USD 4.48 billion in 2025 and is projected to grow from USD 4.73 billion in 2026 to USD 7.68 billion by 2034, exhibiting a CAGR of 6.2% during the forecast period. Europe dominated the dental crowns and bridges market with a market share of 35.7% in 2025.

Dental crowns and bridges are the common restorative solutions for damaged or missing teeth. Crowns, also known as caps, encase individual teeth in order to restore their shape, size, and strength while improving their appearance. They are often used for the severely decayed or the fractured teeth. Bridges, on the other hand, replace the missing teeth by bridging the gap between the healthy teeth. Both dental crowns and bridges are typically made from porcelain, ceramic, or metal alloys, tailored to match the natural teeth. These treatments restore dental function, enhance dental aesthetics, and promote oral health through the prevention of further damage or shifting of adjacent teeth.

The global market is expanding owing to the increasing occurrence of tooth decay and periodontal diseases. The tooth decay can be treated by the placement of the crown or bridges, which helps maintain oral health. Furthermore, the growing awareness about oral health and the rising demand for cosmetic dentistry procedures are expected to increase the adoption of these prosthetic devices in the market. Moreover, the advancements in dental technologies leading to the innovations of improved materials and techniques for crown and bridge fabrication contribute significantly to the market's growth. In addition, the surge in dental tourism for restorative dental treatment further boosts market growth.

The COVID-19 pandemic had a significant negative impact on the dental crowns and bridges, causing disruptions in dental services globally. Lockdowns and restrictions led to a decline in the number of dental visits and elective dental procedures, which resulted in a reduction in the rates of prosthetic treatment. This resulted in the reduced demand for dental bridges and crowns. In addition, the supply chains were disrupted, leading to shortages of materials and delays in the production of prosthetic solutions, such as crowns and bridges. However, as the restrictions were eased and the vaccination rates increased, the market gradually recovered in 2021 and 2022. The resumption of dental visits across the countries has gradually increased the rates of dental treatments including these products in the post-pandemic years.

Global Dental Crowns and Bridges Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 4.48 billion

- 2026 Market Size: USD 4.73 billion

- 2034 Forecast Market Size: USD 7.68 billion

- CAGR: 6.2% from 2026–2034

Market Share:

- Europe dominated the dental crowns and bridges market with a 35.7% share in 2025, driven by advanced healthcare infrastructure, high disposable income, and a strong emphasis on dental aesthetics.

- By product type, crowns are expected to retain the largest market share, supported by technological advancements in materials and the growing demand for aesthetically pleasing, durable dental restorations.

Key Country Highlights:

- United States: The region’s well-established dental infrastructure and rising awareness of cosmetic dental procedures are fueling the demand for crowns and bridges.

- Europe: The presence of leading dental technology firms and increasing preference for high-quality restorative dental treatments supports regional growth.

- China: Rising healthcare reforms, growing consumer focus on dental aesthetics, and increasing per capita spending on dental care drive the market.

- Japan: The country’s high rate of dental visits, combined with technological adoption in dental practices, is accelerating demand for advanced crowns and bridges.

Dental Crowns and Bridges Market Trends

Digitalization of the Manufacturing of Dental Crowns and Bridges is a Key Trend

Digital dentistry encompasses the utilization of computer-controlled technology for the designing and development of prostheses, including equipment such as 3d printing, scanners, software, and milling machines. Utilization of advanced technologies such as CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) systems, 3D printing, and intraoral scanners, dental laboratories can now create highly accurate, customized crowns and bridges with unprecedented efficiency and precision. Furthermore, technologies such as 3D printing and CAD/CAM streamline the production process, offering customized solutions with faster turnaround times and lower costs.

- For instance, in February 2023, Stratasys announced that it had obtained its first FDA clearance for TrueDent resin, which is used for the 3D printing of multicolor temporary crowns and bridges. It enables batch production of highly aesthetic, multicolor monolithic dental products on a single mixed part.

Moreover, the market players have increased their focus on the development of stronger and aesthetically pleasing materials. Furthermore, the cost-effectiveness and scalability of digital manufacturing make it increasingly accessible to dental practices of all sizes.

Download Free sample to learn more about this report.

Dental Crowns and Bridges Market Growth Factors

Growing Prevalence of Periodontal Diseases to Stimulate Market Growth

Dental caries, a prevalent oral health issue in terms of the global scenario, imposes a considerable burden, including pain and discomfort for the patients. Similarly, tooth decay and periodontal diseases often necessitate urgent attention globally. Tooth decay may often require a crown or bridge for the restoration of the strength of the teeth and to protect the tooth from further damage.

- For instance, according to the study published by Frontiers in Public Health in April 2021, the highest prevalence of dental caries in East Africa was found in Eritrea, which was 65.2%, followed by Sudan, which was 57.8%

The widespread prevalence of oral ailments, coupled with tooth loss, fuels the demand for dental products globally. In addition, lifestyle factors such as unhealthy diets, excessive sugar consumption, tobacco, and alcohol use, alongside poor oral hygiene practices, contribute to this trend, further boosting the market growth for dental crowns and bridges.

These issues have become increasingly prevalent across several demographics, and the demand for restorative dental procedures such as crowns and bridges surges. These dental products offer effective solutions for the restoration of the functionality and aesthetics of damaged or missing teeth, thereby addressing oral health concerns and enhancing the quality of life for the patients.

- For instance, according to the study published by the Brazilian Journal of Oral Science, 74.4% of the total of 2,058 students who participated in the study reported a desire for esthetic dental treatment.

Such increasing cases of oral health issues serve as a significant driver for the global dental crowns and bridges market growth.

Increased Focus Toward Aesthetic Solutions to Boost Revenue Growth

In recent years, there has been a growing emphasis on aesthetically pleasing dental outcomes, especially in the female demographics. Dental crowns and bridges play a pivotal role in the restoration of the function and the appearance of damaged or missing teeth.

As more individuals prioritize their dental appearances, there is an increased demand for cosmetic dentistry procedures, including the placement of crowns and bridges. Patients are seeking natural-looking, durable restorations that seamlessly blend with their existing teeth, enhancing their smile and overall facial aesthetics.

- For instance, according to the study published by NCBI, in October 2022, 90.7% of the dental practitioners from the study believed that there is an increase in the demand for aesthetic dental procedures, and a major contributor toward this demand is the increased usage of social media. Such demand is expected to contribute to the adoption of crowns and bridges.

Furthermore, the advancements in dental materials and technology have enabled the creation of crowns and bridges that mimic the natural appearance of human teeth more closely than ever before. Such innovations satisfy the patient's expectations for aesthetics and contribute to the profitability of dental businesses by offering premium solutions that command higher prices. In conclusion, the augmented importance of aesthetics is fueling the global dental crowns and bridges market size.

RESTRAINING FACTORS

Minimal Reimbursement for These Products May Hinder Market Growth

In many healthcare systems globally, dental procedures are often not as generously covered as other medical treatments. This limited reimbursement forces patients to bear a significant portion of the cost of dental crowns and bridges out of their pocket, deterring them from seeking these treatments or leading them to opt for cheaper alternatives.

- For instance, according to the article published by BMC Health Services Research in April 2024, it was seen that the lower income groups in Finland tended to use dental care services with a limited frequency, and they often had poorer dental health than the higher income groups due to limited insurance coverage in the country.

For dental practices and manufacturers, the limited reimbursement reduces the demand for these dental products, which is poised to impact the market’s growth during the forecast period. Moreover, the limited reimbursement discourages innovations and investments in the development of new materials and technologies for these products, as the return on investment may be uncertain due to the restricted demand in the market.

Overall, the limited reimbursement for these products create a challenging operating environment for the stakeholders in the dental industry. The market growth constrains potentially hampering access to essential dental care for patients who cannot afford it without adequate coverage.

Dental Crowns and Bridges Market Segmentation Analysis

By Product Type Analysis

Crowns Segment Secured the Largest Share Due to Strong Demand

Based on product type, the market is segmented into bridges and crowns.

The crowns segment accounted for the largest share of 75.26% in 2026 and is also anticipated to register the fastest growth during the forecast period. The advancements in materials and manufacturing technologies have significantly enhanced the durability, aesthetics, and customization options for crowns, making them a preferred choice among dental professionals and patients. Furthermore, the adoption of advanced technologies, such as CAD/CAM, for the production of dental restorative solutions is expected to boost the market for these products in the future.

- As per the National Center for Health Statistics, a single crown is the most common restorative procedure. Nearly 2.3 million implant supported crowns are made annually in the U.S. alone.

In 2024, the bridges segment accounted for a substantial share of the market. The segmental growth is due to several key factors, such as the product’s ability to offer a reliable solution for the replacement of the missing teeth and providing stability and functionality for the patients. Moreover, the increasing prevalence of dental conditions requiring tooth restorations with the help of these solutions further contributes to the growth of this segment.

By Type Analysis

Customized Segment Dominated Owing to Several Benefits

Based on type, the market is segmented into prefabricated and customized.

The customized segment held the largest share of the market of 94.5% in 2026 and is also anticipated to register the fastest growth during the forecast period. The growth is due to its tailored approach toward patient care as it fits each patient's unique oral anatomy, ensuring optimal comfort, function, and aesthetics. This personalized approach enhances the patient satisfaction and the clinical outcomes. In addition, the advancements in digital scanning and CAD/CAM technologies have streamlined the customization process, making it more accessible and cost-effective for dental practitioners. Furthermore, the growing cases of dental disorders, such as dental caries, are expected to increase the demand for these restorative products among the population, thereby propelling segmental growth.

- For instance, according to the study published by NCBI in May 2021, the overall prevalence of dental caries was estimated at around 54.16% in India. Such high prevalence is expected to increase the adoption of customized products during the forecast period.

In 2024, the prefabricated segment accounted for a substantial share of the market. The prefabricated products often offer standardized sizing and materials, ensuring predictable outcomes and reducing the risk of errors. This combination of affordability, convenience, and reliability has made them the preferred choice among many dental practitioners and patients for prefabricated crowns.

By Material Analysis

Ceramics Segment Dominated the Market Driven by Natural Looking Appearance

By material, the market is classified into ceramics, porcelain fused to metal, and metals.

The ceramics segment registered the largest global dental crowns and bridges market share of 48.84% in 2026 and is expected to sustain its dominance during the forecast period. Ceramic materials closely mimic the natural appearance of teeth, making them a popular choice for dental restorations, particularly in highly visible areas. Furthermore, the advancements in ceramic technology have led to the development of stronger and more fracture-resistant materials, ensuring long-term performance and thereby propelling the segmental growth.

The metals segment held a moderate share in the market in 2024 and is expected to grow at a significant CAGR during the forecast period. Metals such as gold, titanium, and alloys offer exceptional strength and durability, ensuring longevity and stability for dental restorations. In addition, their biocompatibility for various oral conditions contributes to their widespread adoption by dental professionals and patients. Moreover, these materials are cost-friendly compared to the other materials, which is expected to increase their adoption in the market.

In 2024, the porcelain fused to metal accounted for a substantial market share. This material is suitable for a wide range of clinical cases, from single crowns to extensive bridgework, which is expected to propel the growth of the segment during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Solo Practices Segment Held the Lion’s Share Owing to the Large Presence of Professionals in These Settings

In terms of end-user, the market is segmented into solo practices, DSO/group practices, and others.

In 2026, the solo practices segment held the highest share of 62.58% in the market and is expected to grow at a substantial CAGR during the forecast period. The growth is influenced by the large availability of dentists, particularly those operating these solo practices. These solo practitioners play a crucial role in providing dental treatments, including crown and bridge placements, to a substantial portion of the population, especially when compared to other practice settings.

- For instance, according to Eurostat, the number of dentists per 100,000 inhabitants was 85.7 in Germany and 84.1 in Italy in 2021. The increasing number of visits for dental caries in these settings is expected to surge the demand for restorative solutions, such as crowns and bridges.

In 2024, the DSO/group practices segment held a substantial share of the market. The segmental growth is due to the advanced technologies and specialized expertise in these settings, allowing for the efficient production and delivery of these products. Moreover, their ability to provide comprehensive dental care under one roof appeals to patients seeking convenience and continuity of care, propelling the segmental growth.

REGIONAL INSIGHTS

By region, the market for dental crowns and bridges is segregated into Latin America, Asia Pacific, Europe, North America, and the Middle East & Africa.

Europe

Europe Dental Crowns and Bridges Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in Europe was valued at USD 1.6 billion in 2025. The market growth is due to its advanced healthcare infrastructure, affluent population, and strong emphasis on dental aesthetics. Leading dental technology firms and manufacturers in the region also drive innovation, ensuring the innovation and presence of high-quality products. Owing to the widespread accessibility to dental clinics, the region sustains a steady demand for these procedures. These factors collectively position the region as dominant in the market. The UK market is estimated to reach USD 0.21 billion by 2026, while the Germany market is estimated to reach USD 0.46 billion by 2026.

North America

North America held the second-largest position in the market in 2024. The region boasts a well-established healthcare infrastructure and high levels of disposable income, enabling widespread access to dental services. Moreover, increasing awareness of oral health and aesthetics drives demand for dental restorations such as bridges and crowns. The U.S. market is estimated to reach USD 1.43 billion by 2026.

Asia Pacific

Asia Pacific is projected to register the highest CAGR during the forecast period for dental crowns and bridges. The market is primarily driven by healthcare industry reforms, increased consumer awareness regarding cosmetic dentistry options, and rising per capita spending on dental care, collectively fueling the demand and expansion in the market. Furthermore, the large number of dentists in the region is expected to contribute to the high number of prosthetic procedures, including crowns and bridges. The Japan market is estimated to reach USD 0.24 billion by 2026, the China market is estimated to reach USD 0.35 billion by 2026, and the India market is estimated to reach USD 0.11 billion by 2026.

The Middle East & Africa and Latin America are gaining attraction due to the growing trends of medical tourism in these regions. In addition, growing cases of dental caries and a large number of root canal treatments, which might require restorative solutions, such as dental crowns and bridges, further boosts market growth.

KEY INDUSTRY PLAYERS

Prominent Companies Embrace New Technologies to Intensify Competition

The market is highly fragmented with the presence of domestic companies in each country. The prominent players in the market are 3M, Directa AB, Altimed JSC, and Cheng Crowns. Most of these players are accentuating innovations and new product launches by using technologically advanced methods to streamline treatments and improve patient care. Furthermore, the large geographical presence in the market is also contributing to its prominent position in the market. Moreover, innovative product offerings, superior quality, and extensive research and development efforts are other factors which are leading these companies’ position in the market.

Moreover, other players, such as Glidewell, Acero Crowns, and other small & medium-sized domestic players, are adopting pioneering strategies and are focusing on mergers and acquisitions to expand their market share and consumer base.

LIST OF TOP DENTAL CROWNS AND BRIDGES COMPANIES:

- Cheng Crowns (U.S.)

- Altimed JSC (Belarus)

- Acero Crowns (U.S.)

- Directa AB (Sweden)

- Hu-Friedy Mfg (U.S.)

- DDS Lab Inc (India)

- Glidewell (U.S.)

- Dental Lab India (India)

- Illusion Dental Lab (India)

KEY INDUSTRY DEVELOPMENTS:

- March 2024 – Directa introduced a new product range in its portfolio, Ceramir CAD/CAM BLOCKS. These blocks can be used for a wide range of prosthetic indications, such as crowns, bridges, and others.

- July 2023 – Corpus Partners, via its Canadian Dental Laboratories Limited Partnership, acquired Hallmark Dental Laboratory in order to expand its footprint into Atlantic Canada.

- August 2019 – Henry Schein, Inc. announced the acquisition of a greater part equity stake in Clinic Lands. Clinic Lands is an innovative distributor serving dental practices throughout Sweden, Denmark, and Norway. This acquisition allowed Henry Schein, Inc. to expand its operation in 32 countries around the world.

REPORT COVERAGE

An Infographic Representation of Dental Crowns and Bridges Market

To get information on various segments, share your queries with us

The report presents a comprehensive analysis with a focus on critical aspects, including the prominent companies, regional analysis, and key segments such as material and product type. In addition, it provides valuable insights into market trends and significant industry advancements. Furthermore, the report discusses the prevalence/incidence of key dental diseases, technological advancements, and developments. It also explores factors that have driven market growth in recent years. Moreover, the report includes a qualitative analysis of the impact of the COVID-19 pandemic on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.2% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Product Type

|

|

By Type

|

|

|

By Material

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 4.73 billion in 2026 and is projected to reach USD 7.68 billion by 2034.

The market is expected to exhibit a CAGR of 6.2% during the forecast period.

In 2025, the Europe market stood at USD 1.6 billion.

By type, the customized segment held the leading position in 2026.

The rising prevalence of dental disorders, such as tooth decay and other oral diseases, the adoption of CAD/CAM to produce advanced products, and the growing geriatric population drive market growth.

3M, Directa AB, Altimed JSC, and Cheng Crowns are the top players in the market.

Europe dominates the market by holding the largest market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic