Dental Crowns Market Size, Share & Industry Analysis, By Type (Prefabricated, and Customized), By Material (Ceramics, Metal, and Porcelain Fused to Metals), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

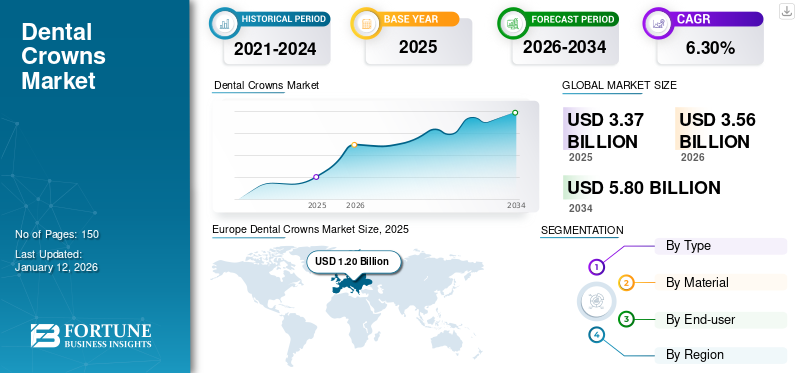

The global dental crowns market size was valued at USD 3.37 billion in 2025. The market is projected to grow from USD 3.56 billion in 2026 to USD 5.8 billion by 2034, exhibiting a CAGR of 6.30% during the forecast period. Europe dominated the dental crowns market with a market share of 35.66% in 2025.

Dental crowns are a tooth-shaped cap placed over a damaged or decayed tooth. It restores the tooth's shape, size, and strength while improving its appearance. Crowns are custom-made from porcelain, metal, or a combination, ensuring a perfect fit over the tooth. They protect weakened teeth, cover dental implants, and enhance the aesthetics of misshapen or discolored teeth. These products play a vital role in maintaining oral health by strengthening teeth and preventing further damage.

The market’s growth is attributed to the increasing prevalence of oral disorders such as tooth decay, trauma, and tooth loss, and the growing number of dental prosthetic procedures worldwide. Moreover, the high demand for cosmetic dentistry procedures to improve dental aesthetics, including the placement of crowns, is expected to fuel market growth during the forecast timeframe. Additionally, the growing awareness of the importance of oral health is expected to increase the number of patients seeking dental treatments, including crowns, which is expected to boost the growth of the market.

The COVID-19 pandemic led to a significant decrease in the demand for crowns due to the closures and restrictions on dental facilities. The restrictions imposed by the government declined the number of patient visits and delayed the dental prosthetic procedures, which impacted the sales of these products. However, in 2021, as dental services gradually resumed and safety protocols were implemented, the market showed signs of recovery. Furthermore, the increased awareness of oral health and growing demand for cosmetic dentistry also contributed to the market's fall back to the pre-pandemic levels in 2022.

Dental Crowns Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 3.37 billion

- 2026 Market Size: USD 3.56 billion

- 2034 Forecast Market Size: USD 5.8 billion

- CAGR: 6.30% from 2026–2034

Market Share:

- Europe dominated the global dental crowns market with a 35.66% market share in 2025, primarily due to strong government initiatives promoting oral healthcare, growing use of CAD/CAM technologies in dental laboratories, and a rising number of restorative and cosmetic dental procedures across countries like Germany, the U.K., and France.

- By type, customized crowns are expected to retain the largest market share in 2025. This dominance is driven by growing adoption of digital dentistry technologies, increasing demand for personalized aesthetic solutions, and enhanced precision and durability offered by customized crowns over prefabricated alternatives.

Key Country Highlights:

- Japan: The market is driven by an aging population with a high incidence of tooth loss, coupled with a growing trend toward aesthetically advanced, minimally invasive restorative solutions. The integration of CAD/CAM systems in dental practices supports market expansion.

- United States: Increasing adoption of digital dentistry, rising awareness of oral aesthetics, and a high number of prosthodontists and dental clinics are fueling demand. The prevalence of partial or complete tooth loss among adults, along with high disposable incomes, supports growth in custom and ceramic crowns.

- China: Rising prevalence of dental caries and tooth loss, increased investments in dental infrastructure, and growing awareness of oral hygiene are propelling the demand for crowns. Additionally, the country is witnessing an increasing adoption of digital technologies for faster and more precise crown manufacturing.

- Europe: Backed by strong dental insurance coverage, government-led oral health programs, and technological advancements in materials like zirconia and lithium disilicate, Europe remains the global leader in the dental crowns market. Countries like Germany and Italy are major contributors due to the presence of a large number of dental labs and prosthodontists.

Dental Crowns Market Trends

Increasing Adoption of Digital Dentistry in Crowns Manufacturing

In recent years, the transformation in dental practices from conventional methods to digital technology for the manufacturing of dental crowns has been widely used in these settings. The application of CAD/CAM technology is expanding widely due to the various benefits associated with these technologies. For instance, it minimizes the complications involved in the manufacturing of crowns. Furthermore, workflow optimization, increased productivity, and limitless repeatability are some of the advantages of using CAD/CAM technology in dental practices.

For instance, in March 2024, Desktop Health launched a new program for dentists designed to simplify the adoption of digital technologies in order to improve patient care and practice efficiency. Such a focus on companies launching digital technologies for dentists is expected to increase the demand for dental crowns during the forecast period.

Additionally, digital dentistry enables the customization and personalization of these products to match each patient's unique oral anatomy and aesthetic preferences. This level of customization enhances patient satisfaction and contributes to better treatment outcomes. Moreover, the COVID-19 pandemic accelerated the adoption of digital dentistry as it facilitates remote consultations and reduces the need for physical appointments.

Download Free sample to learn more about this report.

Dental Crowns Market Growth Factors

Increasing Prevalence of Oral Health Issues to Drive Market Growth

The growing prevalence of dental caries and tooth loss has increased the adoption of dental prosthetics, such as dental crowns, worldwide.

Dental caries and tooth decay are prevalent oral health issues affecting millions globally. Factors such as poor oral hygiene, unhealthy dietary habits, and aging contribute to the increased prevalence of dental caries and tooth loss across all regions.

- For instance, according to The WHO Global Oral Health Status Report (2022), oral diseases are estimated to affect close to 3.5 billion people across the world. Such a large population suffering from oral diseases is expected to increase the demand for prosthetic solutions, such as crowns.

These factors have increased the demand for these products to restore the aesthetics and function of damaged or missing teeth. These products serve as prosthetic caps that cover the entire visible surface of a tooth, providing strength, protection, and improved appearance.

Growing Demand for Aesthetic Improvements in Dental Industry to Boost Market Growth

The growing disposable incomes and changing lifestyles in developed countries have led to an increased willingness to invest in cosmetic dental procedures, further propelling the adoption of these products in these countries.

Dental crowns play a pivotal role in addressing aesthetic concerns by providing natural-looking solutions for damaged, discolored, or misshapen teeth. These crowns are designed to mimic the color, shape, and translucency of natural teeth, thereby improving the overall appearance of the smile.

For instance, according to the study published by the Journal BMC Oral Health in March 2021, tooth alignment and tooth color were the most cited reasons for adolescents’ dissatisfaction with their smile, 34% and 33%, respectively, in a cross-sectional study of the Eastern Province of Saudi Arabia. Such a large proportion of unsatisfied adolescents is expected to boost the demand for crowns to improve their smiles.

The advancements in dental materials, such as ceramic and zirconia, have enabled the development of highly aesthetic crowns that offer superior aesthetics and durability. In recent years, patients, especially women, have increasingly been opting for these aesthetically pleasing options to achieve the desired cosmetic enhancements while maintaining optimal oral health. Hence, these factors contribute to the global dental crowns market growth.

RESTRAINING FACTORS

Limited Reimbursement in Developing Countries for Dental Crowns Hampers Market Growth

Limited reimbursement options in developing countries pose a significant restraint on the market. In many developed nations where dental procedures, including crown placements, are often partially or fully covered by insurance plans, reimbursement options in developing countries are often inadequate. This creates a financial barrier for patients seeking dental treatments, including the placement of these products.

For instance, according to an article published by a dental clinic named Dentistry At Its Finest, the cost of a dental crown ranges from USD 500 to USD 3,000 per tooth. Also, the average retail price of crowns depends on the type of material, such as ceramic products, which cost between USD 800 – USD 3,000 per tooth. Similarly, the cost of porcelain fused to metal (PFM) crowns varies between USD 800 and USD 1,400 per tooth.

The insufficient reimbursement support and the out-of-pocket expenses for dental procedures can be high for many individuals in developing countries. As a result, patients may opt for alternative, less expensive treatment options or delay seeking dental care altogether, leading to a hindrance in the demand for these products.

Furthermore, the high cost of these products in developing countries poses a limit in the adoption among patients, thereby hampering the market growth

Dental Crowns Market Segmentation Analysis

By Type Analysis

Customized Segment to Hold the Largest Share owing to various Benefits Associated with Product

Based on type, the market is segmented into prefabricated and customized.

In 2025, the customized segment held the largest share of the market owing to the various factors associated with it, such as offering precise fitting, superior aesthetics, and optimal functionality, solving dental conditions effectively. Moreover, advancements in digital technologies have streamlined the customization process, making it more accessible and efficient. This combination of customization, quality, and technological advancements is expected to boost segmental growth during the forecast period.

The prefabricated segment accounted for a significant market share in 2024. This significant share can be attributed to the growing use of prefabricated crowns before planting the permanent crown to protect the tooth or filling. In contrast, a permanent crown is made from another material. Furthermore, the benefits associated with these crowns, such as requiring minimum chairside time, efficiency, and simplicity in addressing common dental issues, are expected to propel the segmental growth during the forecast period.

By Material Analysis

Ceramics Segment to Hold a Major Share Owing to Growing Adoption of the Material in Prosthetic Procedures

By application, the market is segmented into ceramics, metal, and porcelain fused to metals.

In 2026, the ceramics segment accounted for the largest market share 48.55% and is projected to register the highest CAGR during the forecast period. The segmental growth is due to its aesthetics, biocompatibility, and durability. The crowns manufactured from these materials offer a natural appearance, blending seamlessly with surrounding teeth and satisfying patient preferences for aesthetics.

Furthermore, the benefits of ceramic materials include minimal risk of allergic reactions and strength of the crown. Moreover, the advancements in ceramic manufacturing techniques have resulted in versatile options, increasing the adoption of ceramic crowns and thereby propelling segmental growth.

The porcelain fused to metal segment accounted for a significant market share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The porcelain fused to metal materials offers the durability of metal substructures fused with the natural-looking porcelain, increasing its demand among patients for dental restoration. Furthermore, its cost-affordability comparable to other materials further contributes to a significant share of the market.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Solo Practices to Hold a Major Share due to Increasing Patient Visits for Restorative Solutions in these Settings

As per the end-user segment, the market is segmented into solo practices, DSO/group practices, and others.

In 2025, the solo practices segment held the largest dental crowns market share 62.48% and is expected to expand at a substantial CAGR during the forecast timeframe, 2025-2032. The segmental growth is attributed to a large number of dentists working in solo practices. Moreover, the rising number of patient visits in solo practices opting for prosthetic procedures is expected to drive segmental growth during the forecast timeframe.

- For instance, according to CDC, in the U.S. 86.9% of children had a dental visit in 2019, which reflects the potential of the U.S. market for these products.

The DSO/group practices segment is projected to grow at the highest CAGR during the forecast period, 2025-2032. The segmental growth is due to the growing awareness pertaining to the benefits offered by a DSO compared to solo practices, such as decreased expenses to restructuring the unique operational environment. Hence, the DSO/group practices segment is estimated to propel in the forecast timeframe.

The others segment includes community healthcare centers, and hospitals. The segmental growth is due to the growing cases of restorative dental procedures, such as crowns.

REGIONAL INSIGHTS

Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Europe Dental Crowns Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the market with a revenue of USD 1.20 billion in 2025 and is expected to continue its dominance during the forecast timeframe. The dominant share is attributed to growing initiatives by the government to create awareness about oral health, thus boosting product demand. Moreover, the increasing number of dental CAD/CAM machines in the region is expected to increase the adoption of crowns among dental facilities.The UK market is projected to reach USD 0.15 billion by 2026, while the Germany market is projected to reach USD 0.35 billion by 2026.

North America held the second-highest share in 2024. The share is attributable to several factors, such as the increasing adoption of advanced technology based dental crowns across the U.S., the rise in the prevalence of dental ailments, the presence of major manufacturers, growing partnerships among the major companies of prosthetics, and a few others. For instance, according to the American College of Prosthodontists, more than 36.0 million Americans do not have any teeth, and 120.0 million people in the U.S. are missing at least one tooth.The U.S. market is projected to reach USD 1.08 billion by 2026.The Japan market is projected to reach USD 0.18 billion by 2026, the China market is projected to reach USD 0.26 billion by 2026, and the India market is projected to reach USD 0.08 billion by 2026.

Asia Pacific is expected to grow at the highest CAGR over the projected years. The growth is attributed to the higher prevalence of tooth decay and tooth loss, developing healthcare infrastructure, and increasing adoption of advanced technologies, such as CAD/CAM in manufacturing crowns. Furthermore, increasing awareness regarding oral health is anticipated to boost the growth of the market in the region.

The Middle East & Africa and Latin America markets are expected to grow at a significant CAGR during the forecast period. The growth is attributed to increasing dental care expenditures and the growing incidence of tooth loss across these regions.

Key Industry Players

Companies with Technologically Advanced Product Portfolios to Hold Key Market Share

The market is highly fragmented, with the presence of a vast number of dental laboratories across the globe. 3M, Directa AB, Altimed JSC, and Cheng Crowns are the key players in the market. These companies held a significant market share in 2024. These are some companies at prominent positions due to factors such as robust and diversified product portfolios, strong geographical presence, and large customer base across developed countries. Furthermore, strategic initiatives, such as acquisitions of other companies and new product launches, are expected to help key players maintain and strengthen their positions in the global market.

Other companies operating in this market include Glidewell, Acero Crowns, and other small & medium-sized players. These companies are engaged in various strategic activities such as partnerships, collaborations, and geographic expansions to gain market share in the coming years.

LIST OF TOP DENTAL CROWNS COMPANIES:

- Cheng Crowns (U.S.)

- Altimed JSC (Belarus)

- Acero Crowns (U.S.)

- Directa AB (Sweden)

- Hu-Friedy Mfg (U.S.)

- DDS Lab Inc (India)

- Glidewell (U.S.)

- Dental Lab India (India)

- Illusion Dental Lab (India)

KEY INDUSTRY DEVELOPMENTS:

- December 2023 - exocad GmbH launched DentalCAD 3.2 Elefsina. The device is the latest version of its globally renowned CAD software for labs and full-service clinics to manufacture crowns.

- May 2023 - Overjet partnered with Glidewell in order to utilize Overjet’s AI technology in the dental practice. Overjet’s AI solution is paired with the glidewell.io In-Office Solution, an AI-driven chairside CAD/CAM system for restorative treatment, such as dental crowns, with enhanced accuracy.

- April 2023 – HASS partnered with imes-icore and Pritidenta to produce their first aesthetic and innovative nano-lithium disilicate CAD/CAM disc, Amber Mill Disk. The partnership with imes-icore enabled the effective milling of the discs to fabricate several restorations, such as dental crowns. In contrast, a partnership with Pritidenta helped to manage the incorporation into the existing CORiTEC material portfolio.

- February 2023 - SprintRay Inc. announced the U.S. commercial launch of their Ceramic Crown 3D Printing Ecosystem.

- May 2022 - WSU’s Delta Dental of Kansas dental clinic, located in the U.S. is moving to 3D dentistry with the capacity to produce crowns and other dental prosthetics.

REPORT COVERAGE

The dental crowns market report provides a detailed competitive landscape. The market research report focuses on key aspects such as key industry developments such as mergers, partnerships, and acquisitions. Moreover, it provides analysis of different segments in various regions, profiles of key companies offering dental crowns, and the impact of COVID-19 on the market. The report also encompasses qualitative and quantitative insights that contribute to the market growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.30% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Material

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

The global dental crowns market size is projected to grow from $3.56 billion in 2026 to $5.80 billion by 2034, at a CAGR of 6.30% during the forecast period

In 2025, the European market stood at USD 1.20 billion.

The market is expected to exhibit a CAGR of 6.30% during the forecast period.

The customized segment led the market.

The rising prevalence of dental disorders, such as tooth decay and other oral diseases, along with the rise in the geriatric population.

3M, Directa AB, Altimed JSC, and Cheng Crowns are the top players in the market.

Europe dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us