Dental Material Market Size, Share & Industry Analysis, By Material (Metallic, Ceramic, Polymers, Natural, and Others), By Application (Implants, Prosthetics, Orthodontics, and Others), By End-user (Dental Product Manufacturers, Dental Laboratories, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

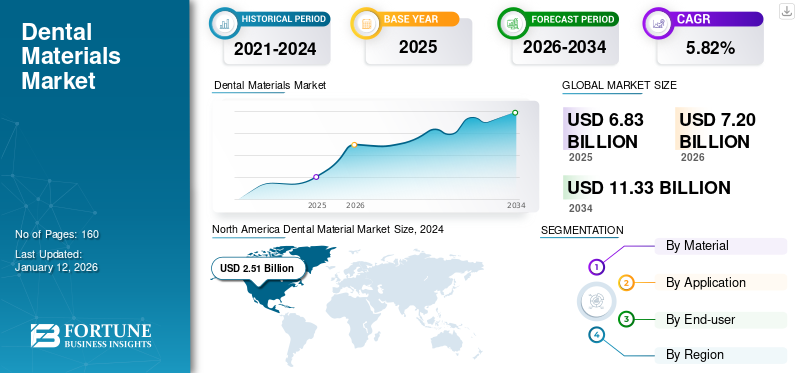

The global dental material market size was valued at USD 6.83 billion in 2025. The market is projected to grow from USD 7.20 billion in 2026 to USD 11.33 billion by 2034, exhibiting a CAGR of 5.82% during the forecast period. North America dominated the dental materials market with a market share of 38.53% in 2025.

Dental materials, also known as dental biomaterials, are specialized materials used in dental care for the restoration, repair, and regeneration of teeth and oral tissues. These materials, which include metals, ceramics, polymers, and biocompatible natural substances, such as collagen and bioactive glass, are designed to be compatible with the body. They are utilized in various applications, such as dental implants, crowns, bridges, and tissue regeneration. Dental materials aim to enhance both functionality and aesthetics, promoting healing and long-term success in dental procedures while minimizing risks, such as inflammation or rejection.

Several key factors, including the rising prevalence of dental diseases, such as tooth decay and gum disorders, and the growing demand for cosmetic dentistry, drive the market. An aging population, which leads to more tooth loss and oral health issues, also contributes to the global dental biomaterials market growth. Additionally, advancements in biomaterial technology, increasing awareness of oral health, and a growing preference for minimally invasive procedures are boosting demand. The expansion of dental tourism and the adoption of biocompatible and natural materials further propel the market forward.

The COVID-19 pandemic negatively impacted the dental material market due to widespread lockdowns, clinic closures, and postponed elective dental procedures. As dental practices were limited to emergency cases, the demand for biomaterials, particularly in cosmetic and non-urgent restorative dentistry, significantly declined. Supply chain disruptions also affected the availability of materials. However, as restrictions eased and dental practices resumed normal operations, the market began recovering, driving demand for delayed treatments.

Dental Material Industry Landscape Overview

Market Size & Forecast:

- 2025 Market Size: USD 6.83 billion

- 2026 Market Size: USD 7.20 billion

- 2034 Forecast Market Size: USD 11.33 billion

- CAGR: 5.7% from 2026–2034

Market Share:

- Leading Region: North America dominated the dental materials market with a 38.53% share in 2025. This leadership is driven by advanced healthcare infrastructure, high dental care standards, strong emphasis on innovation, and substantial R&D investments. High prevalence of dental diseases and increased oral health awareness further support demand.

- Leading Product Type: The metallic segment holds the largest market share due to the growing demand for dental implants and restorative procedures. Metals such as titanium alloys provide superior strength, durability, and biocompatibility, making them ideal for crowns, bridges, and implants.

Key Country Highlights:

- Japan: Demand is driven by advanced dental technologies and an aging population requiring durable, high-quality dental restorations. Increased focus on minimally invasive and biocompatible materials aligns with stringent healthcare standards and patient safety.

- United States: The region benefits from high dental disease prevalence, advanced healthcare infrastructure, and strong R&D efforts. The CDC estimates that 70.1% of adults aged 65+ have periodontal disease, increasing demand for dental biomaterials. Growing cosmetic dentistry trends and innovations like 3D printing further boost market growth.

- China: Rising dental care needs fueled by increasing prevalence of dental caries and malocclusions, coupled with growing healthcare expenditure and investments in dental research, drive rapid market expansion. Increased adoption of cost-effective biomaterials and infrastructure development also contribute.

- Europe: Growth is supported by a large population with dental diseases requiring restorative treatments. Strong patient awareness, advanced dental technologies, and government initiatives toward oral health promote the use of innovative dental materials. Countries like Germany, U.K., and France lead demand.

Dental Material Market Trends

Increasing Adoption of Biocompatible and Natural Biomaterials

Dental treatments become more advanced, and there is a growing emphasis on the use of materials that not only provide durability and functionality but also ensure compatibility with the body’s natural processes. Biocompatible materials, such as bioactive glass, calcium phosphates, and collagen-based products, have become highly sought after due to their ability to integrate seamlessly with oral tissues, promoting faster healing and reducing the risk of inflammation or rejection.

Furthermore, they are more aware of the benefits of natural biomaterials, particularly their potential to stimulate tissue regeneration and provide long-term stability. These materials offer enhanced safety profiles, making them ideal for use in restorative and regenerative dental procedures, including implants and bone grafts. Additionally, with the growing focus on eco-friendly and sustainable healthcare solutions, natural biomaterials are viewed as a greener alternative to traditional synthetic options.

This shift toward biocompatible and natural materials is driving innovation within the industry, encouraging the development of more advanced, patient-friendly solutions.

- North America witnessed a growth from USD 2.63 Billion in 2025 to USD 2.77 Billion in 2026.

Download Free sample to learn more about this report.

Dental Material Market Growth Factors

Rising Prevalence of Dental Diseases to Propel Market Growth

The rising prevalence of dental diseases, such as tooth decay, gum disease, and dental caries, is driving significant growth in the dental biomaterial market. Poor oral hygiene, changing dietary habits, and an aging population are contributing to the increasing incidence of dental issues globally.

- For instance, the WHO Global Oral Health Status Report (2022) estimated that oral diseases affect close to 3.5 billion people across the globe, with 3 out of 4 people affected living in middle-income countries.

This surge in dental problems is pushing the demand for advanced treatments, which in turn boosts the need for innovative dental materials used in implants, crowns, and bridges. Biomaterials, such as ceramics, polymers, and metals, are essential in restoring dental function and aesthetics.

Furthermore, advancements in biomaterial technology have improved the success rates of dental procedures, encouraging both patients and dentists to adopt them widely. As a result, the rising occurrence of dental diseases, such as periodontal diseases, is propelling the growth and innovation within the dental biomaterial market, meeting the increasing demand for more effective and durable solutions in dental care.

Growing Demand for Cosmetic Dentistry to Boost Demand for Biomaterials

In recent years, people increasingly seek aesthetic enhancements, such as teeth whitening, veneers, crowns, and dental implants, which have surged the high-quality dental materials for cosmetic dentistry. These materials, including ceramics, polymers, and composites, play a vital role in creating durable, natural-looking restorations that improve both function and appearance.

- For instance, the British Orthodontic Society survey in August 2023 reported that there was a 76.0% surge in adults seeking tooth-aligning treatment after the COVID-19 pandemic.

Furthermore, the rising awareness of cosmetic dentistry procedures, coupled with a greater focus on personal aesthetics and smile makeovers, is pushing patients to opt for advanced dental solutions. Additionally, the increasing disposable income and willingness to invest in elective cosmetic procedures further contribute to the expansion of the market. As cosmetic dentistry continues to evolve with innovations in technology and materials, the dental biomaterial market is expected to grow, catering to the rising demand for aesthetically pleasing dental solutions.

RESTRAINING FACTORS

Limited Reimbursement Policies to Hinder Market Growth

Limited reimbursement policies are hindering the growth of the dental material market by restricting patient access to advanced dental treatments. Many dental procedures involving biomaterials, such as implants, crowns, and veneers, are often classified as cosmetic or elective, leading to inadequate or no coverage under insurance plans. The limited reimbursement leaves patients to bear the full financial burden of these expensive procedures, hindering the adoption of these materials.

- For instance, as per the article published by BMC Health Services Research in April 2024, it was understood that the lower-income groups in Finland tended to use dental care services with a limited frequency, and they often had poorer dental health than the higher-income groups due to limited insurance coverage in the country.

Furthermore, the high out-of-pocket costs limit the adoption of advanced biomaterials and hinder the broader expansion of the market. Moreover, the lack of consistent insurance coverage and reimbursement across different regions exacerbates the problem, hampering dental material market growth.

Dental Material Market Segmentation Analysis

By Material Analysis

Metallic Segment Leads the Market Owing to Growing Demand for Implant Procedures

On the basis of material, the market segments include metallic, ceramic, polymers, natural, and others.

The metallic segment holds the largest share in the market for dental materials due to its superior strength, durability, and biocompatibility, making it ideal for dental implants, crowns, and bridges. Metals, such as titanium and its alloys, are widely used for their ability to integrate well with bone and withstand mechanical stress. Additionally, their long lifespan and proven success in dental applications further drive the demand for metal-based biomaterials in the market.

Furthermore, growing demand for restorative procedures, such as placement of crowns, bridges, dentures, and implants, is expected to increase the demand for dental biomaterials over the forecast period.

The ceramic segment held a substantial market share. The growth is due to its excellent aesthetic properties, biocompatibility, and resistance to wear and corrosion. Ceramics, such as zirconia and porcelain, are preferred for dental restorations, such as crowns and veneers, as they closely mimic the appearance of natural teeth. Additionally, their high strength and durability, combined with minimal risk of allergic reactions, make ceramics a popular choice for both patients and dental professionals.

- According to the National Center for Health Statistics, a single crown is the most frequently performed restorative procedure. In the U.S. alone, approximately 2.3 million implant-supported crowns are produced each year.

By Application Analysis

Prosthetics Segment Dominates the Market Due to Increasing Demand For Dental Restorations

Based on application, the market is segmented into implants, prosthetics, orthodontics, and others.

The prosthetics segment led the market accounting for 37.68% market share in 2026, bridges, and dentures, driven by a rising prevalence of tooth loss and aging population. Prosthetics offer both functional and aesthetic solutions, improving patient quality of life. Additionally, advancements in materials, such as ceramics and metal alloys, have enhanced the durability, appearance, and biocompatibility of prosthetic devices, further boosting their adoption in dental care.

- For instance, according to the study published by NCBI in May 2021, the overall prevalence of dental caries in India is estimated to be approximately 54.16%. This high occurrence is anticipated to drive increased adoption of customized dental products throughout the forecast period.

In 2024, the orthodontics segment held a substantial share of the market due to the growing demand for braces, aligners, and other corrective devices aimed at improving dental alignment and bite issues. Rising awareness of oral health, along with an increasing focus on aesthetic appearance, has driven more people, including adults, to seek orthodontic treatments. Technological advancements, such as clear aligners and 3D printing, have further boosted the segment by offering more efficient, customized, and patient-friendly solutions.

- The implants segment is expected to hold a 19.2% share in 2024.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Dental Product Manufacturers Hold a Leading Market Share Due to Continuous Demand for Innovative and High-Quality Materials

In terms of end-user, the market is classified into dental product manufacturers, dental laboratories, and others.

Dental product manufacturers dominate the market due to the continuous demand for innovative and high-quality materials used in restorative, prosthetic, and orthodontic treatments. These manufacturers invest heavily in research and development to create advanced products that meet evolving clinical needs and patient expectations. Additionally, their ability to offer a wide range of products, from dental implants to biomaterials for restorations, helps them capture a significant portion of the market.

Dental laboratories hold a substantial share of the dental material market due to their critical role in fabricating customized dental prosthetics, restorations, and orthodontic devices. These labs use advanced materials and technologies to create precise, patient-specific solutions, driving demand for high-quality biomaterials. The increasing complexity and customization of dental treatments, coupled with advancements in digital technologies and 3D printing, further contribute to the significant share of dental laboratories in the market.

The others segment includes dental academies and research institutes, dental hospitals, and clinics. The segmental growth is attributed to the growing number of visits to these healthcare facilities for dental treatment.

REGIONAL INSIGHTS

In terms of region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Dental Material Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a revenue of USD 2.77 billion in 2026. North America holds the largest share of the market due to its advanced healthcare infrastructure, high dental care standards, and strong emphasis on innovative dental technologies. The region benefits from substantial investments in research and development, leading to the introduction of cutting-edge biomaterials. Additionally, a high prevalence of dental issues, increased awareness of oral health, and a well-established network of dental professionals and institutions further drive demand in the region. The U.S. market is projected to reach USD 2.58 billion by 2026.

- For instance, it has been estimated by the Centers for Disease Control and Prevention that 70.1% of adults aged 65 years and above have periodontal disease in the U.S.

The market in Europe is estimated to hold the second position in the global market due to the presence of larger population suffering from dental diseases, which may require some kind of dental restorations. The region benefits from advanced dental technologies and a high level of patient awareness regarding oral health, driving demand for innovative and high-quality dental materials. The UK market is projected to reach USD 0.26 billion by 2026, and the Germany market is projected to reach USD 0.46 billion by 2026.

Asia Pacific is expected to exhibit a faster compound annual growth rate owing to the growing prevalence of dental caries and malocclusions and increasing per capita healthcare spending. Furthermore, the region's rising dental care needs, coupled with advancements in technology and higher investments in dental research, drive strong demand for innovative and cost-effective dental materials. The Japan market is projected to reach USD 0.41 billion by 2026, the China market is projected to reach USD 0.51 billion by 2026, and the India market is projected to reach USD 0.18 billion by 2026.

In addition to this, market players in this region are putting in efforts and higher investments, which, in turn, will surge the demand for dental materials. Latin America & the Middle East & Africa accounted for a comparatively lower share of the market owing to the presence of a huge unpenetrated market.

KEY INDUSTRY PLAYERS

Diverse Product Portfolio Has Helped Mitsui Chemicals, Inc. and KURARAY CO., LTD. to Dominate the Global Market

The market is consolidated, with a few key players accounting for a significant share. Major companies, such as Mitsui Chemicals, Inc. and KURARAY CO., LTD., have strong and diverse product portfolios and extensive distribution networks in both developed and emerging markets. These companies are expected to maintain a dominant position during the forecast period. In addition to their diverse product offerings, these market leaders are heavily focused on acquisitions and partnerships, positioning them to strengthen their presence in the global market. Other companies, such as DSM, Medtronic, and Zimmer Biomet, also held a significant market share in 2024. The consistent focus of these companies on the introduction of new products is expected to strengthen their market share during the forecast period.

List of Top Dental Material Companies:

- Mitsui Chemicals, Inc. (Japan)

- KURARAY CO., LTD. (Japan)

- 3M (U.S)

- Zimmer Biomet (U.S.)

- Danaher (U.S.)

- Medtronic (Ireland)

- DSM (Netherlands)

- Dentsply Sirona (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- July 2024 - Topzir Biotech introduced its latest innovation in the field of dentistry, the revolutionary dental zirconia ceramic blocks.

- June 2024 - HASS Bio introduced Amber Mill H in additional sizes, 8T and 10T. This expansion ensures a wider range of options to accommodate diverse dental needs.

- February 2023 - SprintRay Inc. announced the U.S. commercial launch of its Ceramic Crown 3D Printing Ecosystem, a complete solution set to transform same-day, chairside delivery of ceramic dental restorations.

- August 2021 - Botiss launched a new generation of dental material, NOVAMag, for dentists seeking a biomaterial that is mechanically strong yet completely bioresorbable, being replaced over time with natural bone.

- November 2019 – Vista Apex launched RE-GEN, a suit of bioactive materials comprised of flowable composite, bulk fill and resin cement, pit and fissure sealant, and the world’s first-ever bioactive universal and self-etch adhesives.

REPORT COVERAGE

The dental material market report presents an in-depth analysis, focusing on essential product categories and applications. Additionally, the report provides valuable insights into market trends and highlights significant industry developments that are responsible for increasing the dental biomaterials market size. Along with these aspects, the report covers several factors that have fueled the growth of the advanced market in recent years. It includes detailed information on the key players within the market, SWOT analysis, and the competitive landscape. Furthermore, the report offers the impact of COVID-19 on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.82% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Material

|

|

By Application

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 7.20 billion in 2026 and is projected to reach USD 11.33 billion by 2034.

In 2025, the market value of North America stood at USD 2.63 billion.

Growing at a CAGR of 5.82%, the market will exhibit steady growth in the forecast period.

The metallic segment leads the market.

The increasing prevalence of dental disorders and growing geriatric population are major factors driving market growth.

Mitsui Chemicals, Inc., KURARAY CO., LTD., 3M, and Danaher, among others, are major players in the global market.

North America dominated the market share in 2025.

Growing demand for dental products, such as dental implants, prosthetics, and orthodontics to treat various dental disorders, is expected to drive product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us