Hyperscale Cloud Market Size, Share & COVID-19 Impact Analysis, By Enterprise Type (Small & Medium Enterprises and Large Enterprises), By Application (IoT Applications, Cloud Computing, Big Data Analytics, and Others), By Industry (Manufacturing, Energy & Utilities, BFSI, Healthcare, E-Commerce & Retail, IT & Telecom, Automotive, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

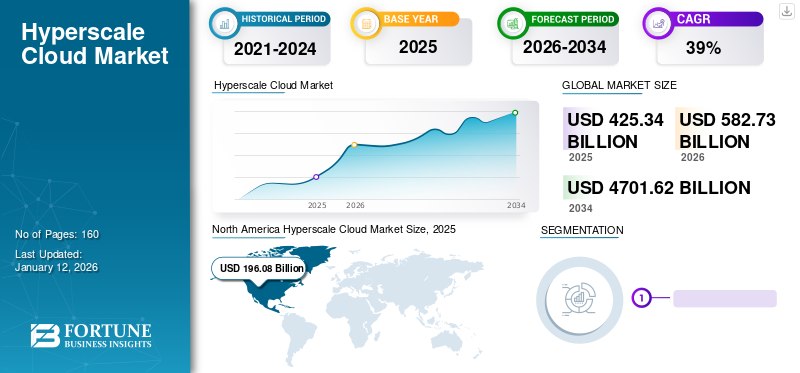

The global hyperscale cloud market size was valued at USD 425.34 billion in 2025 and is projected to grow from USD 582.73 billion in 2026 to USD 4,701.62 billion by 2034, exhibiting a CAGR of 29.80% during the forecast period. North America dominated the global market with a share of 46.10% in 2025.

Hyperscale cloud refers to cloud computing infrastructure designed to deliver vast computing resources and storage capabilities for large-scale applications. Hyperscale cloud applications can scale IT infrastructure on demand using off-site data centers, which are ideal for Big Data, cloud computing, and other distributed systems. This aids customers in reducing downtime, minimizing operational complications, reducing costs, and facilitating efficient scaling.

In the report, we have considered key players providing hyperscale services such as Alibaba Group, Alphabet Inc., Amazon.com, Inc., Microsoft Corp., and others. Organizations are adopting hyperscale computing solutions as they deliver a cost-effective approach to address a demanding set of requirements. For instance, HPE Apollo high-density hyperscale computing in a Big Data analytics project can be the most economical approach, owing to the computing and scaling density available in hyperscale.

Moreover, hyperscale is a fundamental component of the modern technology landscape, powering numerous industries and driving innovation in the digital space.

COVID-19 IMPACT

Increased Reliance on Cloud Technologies to Survive the Pandemic Led to Greater Product Demand

The emergence of COVID-19 and the subsequent enforcement of social distancing resulted in a sharp rise in cloud computing usage catering to work-from-home policies over the following months. Schools, office buildings, leisure centers, entertainment venues, and restaurants were abruptly shut down. This led to a sudden increase in video conferencing, remote working, long-distance learning, streamed video content, and online gaming that rely on cloud computing for their performance.

Moreover, retailers are projected to expand their e-commerce capabilities, leveraging hyperscale resources to handle increased online transactions. Additionally, Zoom Video Communications Inc. experienced a massive increase in users, relying on such cloud providers to handle the skyrocketing demand. In April 2020, NICE, a cloud contact center provider, partnered with Zoom Video Communications, Inc. to enable and deliver remote workers with faster and more personalized customer experiences.

Thus, the pandemic accelerated the adoption and expansion of hyperscale cloud services across industries.

LATEST TRENDS

Download Free sample to learn more about this report.

Increasing 5G Adoption and Escalating Edge Computing to Bolster Market Growth

Today’s network operators are rushing to software-defined infrastructure to monetize their 5G investment. With rising challenges in the hyperscale ecosystem related to memory, storage, bandwidth, computing power, and speed, 5G technologies are pushing more intelligence to the edge and turning unprecedented challenges into opportunities for operators worldwide. 5G networks offer higher data transfers and lower latency, enabling smoother real-time applications such as online gaming, video gaming, and augmented reality/virtual reality.

Moreover, IoT and connected devices have increasingly leveraged 5G technologies to showcase their potential. Hyperscale vendors are capitalizing on the 5G-enabled IoT by offering specialized platforms to manage the massive data generated by these connected devices. For instance, in February 2023, Arrcus, a hyperscale networking software company, launched the Arrcus Connected Edge (ACE) platform to enable communication service providers to renovate networks across the edge and cloud and reduce 5G infrastructure costs.

Therefore, hyperscalers are striving to create a more connected and responsive digital ecosystem by realizing and unlocking the full potential of 5G.

HYPERSCALE CLOUD MARKET GROWTH FACTORS

Re-Platforming of Cloud by SaaS Vendors to Yield Better Hyperscale Benefits Drives Market Growth

Software as a Service (SaaS) applications in hyperscale environments aid businesses in avoiding the upfront costs associated with software installations. They are hosted and delivered over the internet, providing users with accessibility from anywhere.

Moreover, usage-based subscription fees allow businesses to benefit from the economies of scale of hyperscalers. This cost-efficient model lures small & medium businesses to shift and re-platform to hyperscale infrastructure, thus driving the market.

For instance, in May 2021, Commvault expanded its Metallic Software as a Service (SaaS) portfolio to meet the growing demand for enterprises to manage their data intelligently. The addition includes HyperScale X for Metallic, which delivers choice for hybrid cloud data protection.

RESTRAINING FACTORS

Cost Considerations and Integration of Hyperscale Cloud with Existing IT Systems to Impede the Market

The market unveils many advantages and opportunities, aiding organizations in building a more connected world. However, vendors face some challenges related to data insecurity and unexpected downtime. With the growing reliance of businesses on hyperscale data centers for IT operations, any downtime can have a considerable impact and sometimes result in terrible complications. According to FORTUNE media organization, in October 2021, Facebook lost nearly USD 100 million due to downtime.

Another challenge hyperscale networks face is the potential for data breaches and cyberattacks. If hyperscale data is breached, it may have financial and reputational impacts on businesses. Additionally, the need to incur capital expenditures alongside technological advancements is hindering market growth.

Despite the plethora of constraints, the market is expected to have great potential and grow exponentially, creating a better-connected world.

SEGMENTATION

By Enterprise Type Analysis

Increasing Cloud Adoption Among SMEs to Hold Transformative Potential in the Market

Based on enterprise type, the market is segmented into small & medium enterprises and large enterprises.

The small & medium enterprises segment is expected to grow at the highest CAGR in the coming years due to the rising adoption of cloud services. According to Access Partnerships’ (AWS commissioned) 2022 analysis, between 2022 and 2030, the UAE’s SMEs and start-ups are projected to gain around USD 17.1 billion from hyperscale computing.

However, the large enterprises segment holds the highest market share of 53.66% in 2026, owing to their legacy IT infrastructure capabilities. Hyperscale vendors offer a range of region and availability zone options, allowing enterprises to expand their global footprint and reach new markets without additional infrastructure investments.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Extended Adoption of Predictive Analysis and Use of Advanced Big Data Tools to Propel Segmental Growth

Based on application, the market is classified into Internet of Things (IoT) applications, cloud computing, Big Data analytics, and others.

The Big Data analytics segment is expected to grow at the fastest CAGR over the forecast period, owing to the on-demand scalability capabilities offered by hyperscale computing. Such cloud platforms provide robust data storage options, such as Amazon S3 and Azure Blob Storage, allowing businesses to store large data sets in the cloud.

The cloud computing segment accounts for the highest global hyperscale cloud market share of 37.34% in 2026. The growth is attributed to enterprises' growing adoption of cloud infrastructure and the re-platforming of cloud to hyperscale by SaaS vendors.

By Industry Analysis

Fast-Changing Consumer Preferences and Mobile-Centric Consumer Behaviors to Likely Propel the E-Commerce & Retail Industry

Based on industry, the market is divided into manufacturing, energy & utilities, BFSI, healthcare, e-commerce & retail, IT & telecom, automotive, and others.

The e-commerce & retail segment is expected to potentially grow over the forecast period owing to the ever-growing demand for online shopping. Hyperscale computing is transforming the retail industry in many ways, from better inventory, price, and warehouse management to personalized shopping and improved customer experience and security.

However, the IT & telecom segment holds the largest market share of 31.29% in 2026, and is expected to continue its dominance. Hyperscale computing aids IT & telecom operators in managing big datasets better and increasing operational efficiency with less downtime, simpler data backups, and scalability.

REGIONAL INSIGHTS

North America Hyperscale Cloud Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market is studied across North America, South America, Europe, Asia Pacific, and the Middle East & Africa.

North America dominated the market with a valuation of USD 196.08 billion in 2025 and USD 255.87 billion in 2026, owing to the growing emphasis on processing large volumes of digital data. Moreover, the presence of large hyperscalers, such as AWS, Microsoft, Google, and others, adds to the regional growth. According to AAG's (IT technology firm) July 2023 analysis, Amazon, Microsoft, and Google accounted for 66% of the cloud market at the beginning of 2023. In addition, the analysis stated that cloud computing in healthcare in the U.S. is expected to grow by 40% between 2020 and 2025. The U.S. market is projected to reach USD 80.74 billion by 2026.

Asia Pacific is expected to grow at the highest CAGR over the forecast period, owing to growing urbanization and rapid utilization of digital technologies. Additionally, key regional players are focused on improving and expanding their cloud infrastructure, thus developing robust networks. For instance, in August 2022, Google planned to establish three new cloud regions in Thailand, Malaysia, and New Zealand to meet the increasing demand for cloud services. The Japan market is projected to reach USD 60.06 billion by 2026, the China market is projected to reach USD 63.14 billion by 2026, and the India market is projected to reach USD 56.59 billion by 2026.

Europe is witnessing a lot of committed investments in hyperscale infrastructure, which is expected to grow significantly over the years. For instance, in June 2023, evroc, a European hyperscaler, planned to build Europe’s sustainable hyperscale cloud, thus driving the European cloud market. Moreover, the expansion of AI and machine learning, streaming content, 5G mobile edge, and gaming services are some factors driving the Europe market. The UK market is projected to reach USD 12.62 billion by 2026, while the Germany market is projected to reach USD 22.87 billion by 2026.

The Middle East & Africa also holds great potential in the market owing to large enterprises moving some of their applications, storage, and computing resources to the public cloud. SMEs in the region are considering shifting their on-premises IT infrastructure and are rapidly adopting SaaS solutions. Moreover, the increasing establishment of hyperscale players, such as AWS, IBM, Microsoft, and Oracle, in the region drives the hyperscale cloud market growth.

To know how our report can help streamline your business, Speak to Analyst

Similarly, South America is experiencing a burgeoning demand for cloud services across countries, including Brazil, Argentina, Chile, and others. According to Cloudscene, a data-driven marketplace platform, Brazil has over 120 data centers nationwide.

KEY INDUSTRY PLAYERS

Collaborations & Partnerships among Hyperscalers Propel Market Growth

Key players in the market are collaborating and integrating with similar companies to bring significant financial gains to both parties. Partnerships aid businesses in increasing sales and cutting costs by sharing or combining resources. For instance, in October 2021, Thales and Google partnered to co-develop a sovereign hyperscale offering for France. The new cloud offering aided French companies and other public sector organizations with all the security, power, and flexibility offered by respective technologies from both companies.

List of Key Companies Profiled in Hyperscale Cloud Market:

- Alibaba Group (China)

- Google LLC (Alphabet, Inc.) (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Hewlett-Packard Enterprise Development LP (U.S.)

- Fujitsu Limited (Japan)

- IBM Corporation (U.S.)

- Microsoft Corporation (U.S.)

- Oracle Corporation (U.S.)

- Salesforce, Inc. (U.S.)

- VMware, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- June 2023: Informatica expanded its ecosystem in Australia and New Zealand by partnering with global hyperscalers such as Microsoft, Amazon Web Services (AWS), and Google Cloud. The partnership aided in expanding Informatica’s ecosystem and growth within the local market.

- March 2023: Amazon Web Services, Inc. collaborated with NVIDIA to build Artificial Intelligence (AI) infrastructure for training and developing Generative AI applications and ML models. The development includes new supercomputing hyperscale clusters called EC2 UltraClusters.

- February 2023: MongoDB launched a hyperscale cloud region in New Zealand. The company leveraged its hyperscale capabilities by partnering with key hyperscalers such as AWS, Microsoft Azure, and Google Cloud Platform.

- February 2023: mCloud Technologies Corp. joined Google Cloud with other Google Cloud partners at the Informa LEAP 2023 tech conference. The company launched sustainable applications that can be built on the Google hyperscale cloud.

- July 2022: Oracle launched a hyperscale cloud region in Mexico. The Oracle Cloud Infrastructure (OCI) allowed customers across Mexico and Central America to connect directly and privately through OCI FastConnect.

REPORT COVERAGE

An Infographic Representation of Hyperscale Cloud Market

To get information on various segments, share your queries with us

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 29.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Enterprise Type, Application, Industry, and Region |

|

By Enterprise Type |

|

|

By Application |

|

|

By Industry |

|

|

By Region |

|

Frequently Asked Questions

The market is projected to reach USD 4,701.62 billion by 2034.

In 2025, the market was valued at USD 425.34 billion.

The market is projected to grow at a CAGR of 29.80% during the forecast period.

The cloud computing segment is expected to lead the market.

Re-platforming of the cloud by SaaS vendors to yield better hyperscale benefits is driving the market growth.

Alibaba Group, Alphabet Inc, Amazon Web Services, Inc., Hewlett Packard Enterprise Development LP, Fujitsu Limited, IBM Corporation, Microsoft Corporation, Oracle Corporation, Salesforce, Inc., and VMware, Inc. are the top players in the market.

North America is expected to hold the highest market share.

By industry, e-commerce & retail is expected to grow with a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic