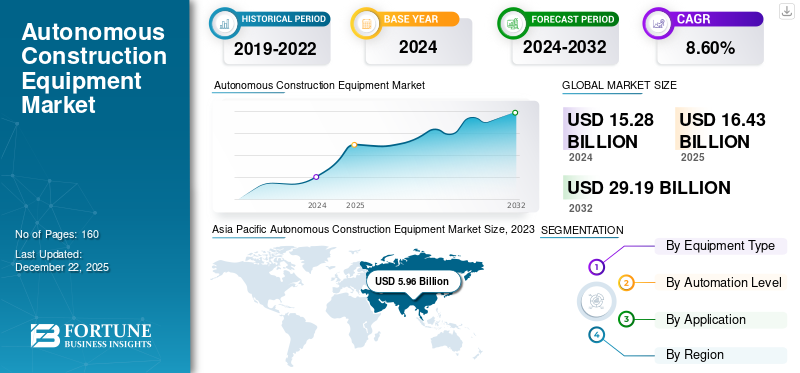

Autonomous Construction Equipment Market Size, Share & Industry Analysis, By Equipment Type (Earthmoving Equipment, Material Handling Equipment, Screening and Mixing Equipment, Excavation Equipment, and Other Equipment), By Automation Level (Semi-Autonomous and Fully Autonomous), By Application (Residential, Commercial, and Industrial), and Regional Forecast, 2026-2034

Autonomous Construction Equipment Market Size

The global autonomous construction equipment market size was valued at USD 16.43 Billion in 2025 and is projected to grow from USD 17.71 Billion in 2026 to USD 35.22 billion by 2034, exhibiting a CAGR of 9.00% during the forecast period. The Asia Pacific dominated the autonomous construction equipment market with a share of 42.20% in 2025.

Autonomous construction equipment is a modern automated equipment that can effectively perform operations on constructive sites with maximum proficiency and higher output rates. This equipment is equipped with the latest sensors, GPS, LIDAR, computer vision, Artificial Intelligence (AI), and other automated tools which makes them ideal options for operations in construction fields.

Download Free sample to learn more about this report.

The autonomous equipment demand is growing due to labor shortage in many developed countries and skilled workforce in other developing nations. Also, the substantial growth was further fueled by technological advancements, investments in infrastructure development projects, economic factors, and regulatory developments. Additionally, high acceptance in construction field especially in material handling and other construction activities continued to drive market expansion across all regions.

The COVID-19 pandemic had a negative impact on the autonomous construction equipment industry that initially disrupted supply chains and slowed down construction effect globally. Post-pandemic, the trend toward remote control operations and automation accelerated, thereby boosting demand for autonomous construction solutions. The shift has highlighted the potential of autonomous construction equipment in post-pandemic situations.

Autonomous Construction Equipment Market Trends

Innovations and AI Advancements to Reshape Construction Equipment Market Trends

The construction equipment market is influenced by technological trends, such as AI integration, IoT, GIS mapping, and real-time tracking. These advancements are making the operational fields profitable, enhancing perception capabilities, and increasing the potential of hybrid autonomous equipment. Also, AI and IoT technology in the construction equipment industry enables better connectivity, real time monitoring, and autonomous operations. Furthermore, AI technology is transforming construction equipment into smart tools and has enabled features, such as predictive maintenance, advanced analytics, autonomous operations, streamlining operations, and reshaping the trends in the construction industry. Thus, innovations and AI advancements are the need of the current construction industry, which is anticipated to bolster the demand for autonomous construction equipment market growth over the projected timeframe.

- For instance, in February 2024, HD Hyundai, a prominent construction solution provider, launched its advanced X-Wise and X-Wise Xite. Both AI intelligence platforms provide smart construction site management and intelligence to maximize safety, efficiency, and productivity at construction sites.

Autonomous Construction Equipment Market Growth Factors

Improved Operational Capability and Electrification of Equipment to Drive Market Demand

Rising labor costs potentially drive autonomous construction equipment due to a workforce shortage at construction sites and high wages as it is primarily outsourced from different geographies. These autonomous construction equipment focus on enhancing efficiency and safety in construction operations. It also benefits businesses by improving productivity, reducing downtime, and enhancing precision in tasks, such as excavation, grading, and material handling. Furthermore, the majority of key players are transforming construction equipment to electric due to strict regulations and high sustainability concerns.

- For instance, in February 2023, Volvo Construction Equipment division extended its midsize electric offering with L120H electro mobility equipment. The Volvo CE has developed the solution fulfilling market appetite with more sustainable solutions in mid-size range. The L120H electric conversion delivers the same powerful performance with 240 KwH battery.

RESTRAINING FACTORS

High Cost of Autonomy and Lack of Expertise in Aftermarket to Affect Market Growth

The struggling construction sector and heavily affected automotive manufacturing and development industry are in dire need of financials. Hence, to shred down their labor intensive model, manufacturers are focused on transforming into a highly automated equipment industry. These manufacturers will need to incorporate automation in their production centers to tackle the scarcity of labor force and pace up manufacturing speed. However, the heavy initial cost of autonomous construction equipment for small and medium-sized enterprises further hinders market growth. Also, the lack of an expert workforce to operate and repair the system is expected to hamper the autonomous construction equipment market share.

Autonomous Construction Equipment Market Segmentation Analysis

By Equipment Type Analysis

Growing Demand for Heavy Earthmovers to Bolster Market Demand

By equipment type, the market is classified into earthmoving equipment, material handling equipment, screening and mixing equipment, excavation equipment, and other equipment.

The earthmoving equipment segment is estimated to acquire the largest market share owing to its extensive application in material transportation. There is a growing demand for electric earthmoving equipment to lessen carbon footprints and achieve higher operational proficiency in construction. This segment dominated the market with a major share of 53.53% in 2026.

The material handling equipment segment is growing steadily due to its easy operation capability, maximum material loading, and handling stiffness, expanding its adoption in the construction sector.

The other equipment, such as loading, cutting, drilling, and other equipment is estimated to steadily expand its footfall in the market with growing infrastructure investment and other construction operations.

The screening and mixing equipment and excavation equipment are projected to sustain a stagnant growth due to growing demand for Ready Mix Concrete (RMC) and affordable housing in smart cities and projects.

By Automation Level Analysis

Automation Integration in Construction Equipment to Fasten Product Adoption

Based on automation level, the market is segmented into semi-autonomous and fully autonomous.

Fully autonomous construction equipment is dominating the segment owing to its high operation capabilities and easy monitoring that enable minimum downtime and Operational Equipment Efficiency (OEE) in the field. Also, fully autonomous construction equipment’s easy Return on Investment (ROI) has increased its adoption. Moreover, realtors investing heavily on automated construction equipment to fill the labor shortage gap will bolster demand in long term. This segment is expected to capture 60.42% of the market share in 2026.

The semi-autonomous construction equipment to experience steady demand owing to less capital expenditure required and easy control over operations which has expanded the potential application across mid and small construction industry. This segment is forecasted to document a CAGR of 39.80% during the forecast period (2025-2032)

By Application Analysis

Growing Investments in Infrastructure Development to Strengthen Residential Construction

Based on the application, the market is segmented to residential, commercial, and industrial.

The residential segment dominates segment with the largest market share owing to increasing application of construction equipment in the residential sector. It is further supported by growing investments across infrastructure development and increasing emphasis by government on affordable housing development. This segment is poised to gain 41.11% of the market share in 2026.

Commercial segment to have steady demand and growing investments powered by private commercial realtors for the development of amusement parks and commercial spaces which is estimated to expand in the long term. This segment is foreseen to expand with a substantial CAGR of 9.0% during the forecast period (2025-2032).

The industrial segment is anticipated to depict steady growth due to the growing manufacturing and industrial units to help expand the market size in the long term.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

The global market is studied across North America, Latin America, Europe, Asia, and the Middle East & Africa.

Asia Pacific dominated the market with a valuation of USD 6.93 billion in 2025 and USD 7.52 billion in 2026. The region dominates the market, fueled by the growing capital expenditure on developing residential properties, railway infrastructure, airports, and other commercial spaces. Additionally, the Chinese government is increasing investments in public, renewable, and residential infrastructure development to increase demand for construction equipment. India is set to reach USD 1.42 billion in 2026, while Japan is predicted to hold USD 0.89 billion in the same year.

Asia Pacific Autonomous Construction Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

China is anticipated to dominate the region driven by the adoption of autonomous construction equipment and to speed up urbanization in rural areas by profoundly investing in residential and infrastructure projects. India is set to witness the highest CAGR during the forecast period owing to the region’s government emphasizing on the development of affordable housing. Also, an increase in the Capex by the government via the Public Private Partnership (PPP) model is expected to boost the growth of public infrastructure, which will significantly raise the demand for automated construction equipment. Subsequently, increasing investment by Japan, Australia, Indonesia, Singapore, and Malaysia is also expected to support growth of Asia Pacific autonomous construction equipment market growth. The Chinese market is foreseen to be valued at USD 3.32 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America is the third largest market set to gain USD 3.33 billion in 2025. North America is set to grow progressively with increasing demand for autonomous construction equipment and the strong presence of Caterpillar and Sany America. Furthermore, explicit efforts of these companies relating to acquisitions, expansions, and partnerships are expected to expand the dominance of prominent players in the market. The U.S. market is expected to grow with a valuation of USD 2.85 billion in 2026.

Europe is the second largest market likely to gain USD 4.44 billion in 2025, recording a substantial CAGR of 9% during the forecast period (2025-2032). Europe is observed as a prominent region owing to increasing demand for new residential units and rising employment levels. The U.K. market continues to expand, projected to reach a market value of USD 0.71 billion in 2025. Germany is home to leading construction equipment manufacturers with an increased focus on sustainability, government initiatives promoting automation, and aging workforce. Furthermore, growth in infrastructure projects and adoption of green building practices across the U.K., France, and Italy are anticipated to increase demand. Germany is poised to be valued at USD 1.59 billion in 2026, while France is likely to hit USD 0.42 billion in the same year.

The Middle East & Africa is the fourth largest market poised to be worth USD 1.17 billion in 2025. The Middle East & Africa is set to witness steady growth due to infrastructural development, rapid urbanization, and investment in smart city projects. Additionally, governments investing heavily in modern infrastructure are anticipated to bolster the demand for automated construction equipment in South Africa and other GCC countries. Israel is likely to stand at USD 0.82 billion in 2025.

Latin America is set to grow steadily owing to investment in infrastructure projects, increased focus on efficiency, and safety on construction and mining sites, pushing the adoption of autonomous equipment.

KEY INDUSTRY PLAYERS

Collaboration and Focus on Sustainability to Develop New Revenue Streams

Key players are collaborating with research institutions to innovate the machinery, which results in an upsurge in market demand. The companies are involved in numerous research projects in some product segments, such as load carriers and haul trucks, to identify and integrate emerging technologies. Many prominent players focus on sustainability strategy to determine the direction of the market in the future. These major upgrades and strategies are projected to leverage new revenue streams for manufacturers in the long term.

- For instance, in May 2021, Liebherr extended its product portfolio of T 274 haul trucks by introducing a new 305t/336 tons haul truck that bridges the gap between T284 (363t/400 tons) and upgraded T264(240t / 265 tons).

List of TopAutonomous Construction Equipment Companies:

- Volvo AB (Sweden)

- Caterpillar (U.S.)

- Komatsu Ltd. (Japan)

- Doosan Infracore Co. Ltd. (South Korea)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- C. Bamford Excavators Ltd. (U.K.)

- Liebherr Group (Switzerland)

- CNH Industrial N.V. (U.K.)

- Hyundai Construction Equipment Co. Ltd. (South Korea)

- Sany Group (China)

- XCMG (China)

KEY INDUSTRY DEVELOPMENTS:

- June 2024: Liebherr, a prominent heavy commercial equipment manufacturer, has launched its advanced LTM 1400 6.1, world’s most powerful 6 axle crane. The crane has a telescopic boom of 70 meters long, and is extremely flexible and economical and features a driver assistance system, increasing safety for everyone.

- May 2024: Caterpillar Inc., announced an investment of USD 90 million to prepare its manufacturing plant at Schertz and Seguin, Texas. The investment is focused on producing new cat C13D industrial engines that will create 25 jobs at Schertz in 2026.

- May 2024: Hitachi Construction Machinery Co., Ltd. inaugurated a Zero Emission EV Lab (EV-LAB), the lab is focused on promoting collaborative creation and partners to achieve zero emission at work sites. The company planned to showcase products, such as battery powered electric excavators, mobile energy storage systems, compact EV trucks, electrically powered crawler carriers, and others.

- March 2024: Hitachi Construction Machinery Co., Ltd. has decided to start the full scale production of dump trucks in fiscal year 2026 with the Hitachi Construction Machinery. Hitachi Construction Machinery is a wholly owned subsidiary that will establish a local production and service framework in the American market.

- April 2023: Caterpillar Inc., a prominent construction equipment manufacturer, launched its AI enabled New Vision link at CONEXPO. The cloud-based customer-facing platform provides an integrated full fleet management, maximizes machine up-time, and optimizes equipment utilization.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.00% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Equipment Type

By Automation Level

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach USD 35.22 billion by 2034.

In 2025, the market was valued at USD 16.43 Billion.

The market is projected to grow at a CAGR of 9.00% during the forecast period.

The earthmoving equipment segment leads in terms of market share.

Improved operational capability and electrification of equipment are key market drivers.

The top players in the market include Volvo AB, Caterpillar, Komatsu Ltd., Doosan Infracore Co. Ltd., Hitachi Construction Machinery Co., Ltd., J.C. Bambord Excavators Ltd., Liebherr Group, CNH Industrial N.V., Hyundai Construction Equipment Co. Ltd., Sany Group, and XCMG.

Asia Pacific region generated the maximum revenue in 2025.

The residential application segment is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us