Battery Plate Market Size, Share & COVID-19 Impact Analysis, By Battery Type (Lead Acid Battery, Lithium Ion Battery, and Others), By End-user (Automotive, Aerospace & Defense, and Others), and Regional Forecast, 2026-2034

Battery Plate Market Size

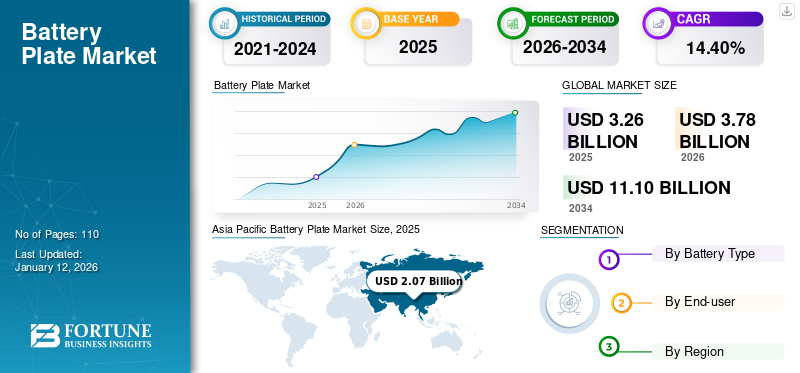

The global battery plate market size was valued at USD 3.26 billion in 2025 and is projected to grow from USD 3.78 billion in 2026 to USD 11.10 billion by 2034, exhibiting a CAGR of 14.40% during the forecast period. Asia Pacific dominated the global market with a share of 63.56% in 2025. The battery plate market in the u.s. is projected to grow significantly, reaching an estimated value of USD 1.82 billion by 2032.

Battery plates are built in a lattice grid, assisting the energetic cloth and behavior of the electricity. The battery plate is an imperative part of the battery’s inner shape that can keep and discharge expenses and offer energy to numerous devices. With the non-stop improvement of technology and increasing investments, the overall performance of lithium-ion batteries is continuously improving.

The COVID-19 pandemic significantly disrupted the battery industry, impacting both demand and supply for battery plates. Lockdowns, reduced electric vehicle demand, and global trade disruptions affected the market. Supply chain hindrances, particularly in lithium, cobalt, and nickel mining, contributed to the challenges. China, a crucial player in battery manufacturing, faced disruptions, prompting a U.S. Senate Committee hearing in June 2020 on the pandemic's impact on mineral supply chains, focusing on battery plates and the mining industry.

Battery Plate Market Trends

Dramatic Cost Reductions Propel Market Growth Amidst Electrification Boom

The cost of lithium-ion batteries used in phones, laptops, and cars has dropped dramatically over the past three decades. It has been a significant driver of the rapid growth of battery plate technologies. Scientists at the Massachusetts Institute of Technology have found that since lithium batteries were first put on the market in 1991, their cost has decreased by 97%. A one-kilowatt-hour battery cost USD 7,500 in 1991 and was only USD 181 in 2018, which is 41 times less. Promisingly, prices will continue to fall, and historically, costs halved by half between 2014 and 2018.

In addition to the lowering cost of lithium-ion batteries, which will drive the continuous electrification of transportation, it could also potentially increase the use of batteries in stationary applications to compensate for intermittent access to clean energy sources, such as solar and wind energy. The rise in lithium-ion battery use will lead to the battery plate market growth in the coming years.

Download Free sample to learn more about this report.

Battery Plate Market Growth Factors

Rising Investment in Battery Cell Production to Reduce Fuel Consumption Leading to Market Growth

The outpouring in demand for electric vehicles has boosted the demand for battery cell production globally. The demand for batteries is skyrocketing with 30% year-on-year growth and has the potential to reach 30,000 GWh by 2030, according to NITI Aayog (National Institution for Transforming India). OEMs are also beginning to announce the dates of their final ICE phase-outs. However, most major original equipment manufacturers have undertaken to increase EV sales significantly over the next few years. They are set to define a phase-out period for ICE vehicles. Therefore, the objective of an OEM to progressively phase out ICEs by 2050 will significantly impact 50% of global vehicle sales.

With the massive rise in demand for EV OEMs, battery components manufacturing has to increase with the required growth rate. This rise in demand has led to new battery cell manufacturing companies planning to build gigafactories, unlocking opportunities for battery component manufacturers to secure new supply contracts. With the rising trend of reducing fuel consumption, this market is growing significantly and will have a high growth in the forecast period.

Growing Penetration of Energy Storage Increasing Battery Cells Production Driving Market Growth

Battery energy storage is necessary for a successful transition to renewable energy due to the intermittent nature of solar and wind power. These systems shall accumulate, store, and dispatch energy often drawn from renewable sources on a timely basis to comply with peak production and consumption cycles. As a result, battery storage is essential in bridging the gap between the production of renewable energies and consumption, which cannot be tolerated by green energy architecture.

Government subsidies, private investments, and regulatory policies support the growing energy storage market. With the transition to an electric grid system, the demand for battery cells has boosted battery cell production and the battery plates market. The U.S. Department of Energy has acknowledged that specific storage technologies are best suited for certain applications. Department of Energy Continues to pursue various energy storage research and development activities to guarantee an affordable and sustainable ongoing energy supply. To make stored renewable energy a viable option for managing peak demand, the Indian government aims to achieve a leveled storage cost of USD 0.06 to USD 0.08per kilowatt hour. The support is made available in five tranches of between 40 % and 60 % of the capital cost of the planned capacity utilizing viability gap funding or VGF.

RESTRAINING FACTORS

Product Failures Due to Manufacturing and Supply Chain Issues Hinder Market Growth

Batteries have complex designs due to additional safety circuits and precise voltage, current, and temperature control. When a battery cell or circuits are mechanically stressed or damaged, there may be safety problems. If any of these two components are damaged, the battery may fail immediately or cause a defect before the failure occurs. Factors such as the extent of the age of the cell, mechanical damage, the ambient temperature, and the state of charge determine the cell failure mode. If the cell is mechanically stressed, a separator in the cell may not be able to shut down, and thus, there could be a cathode-anode short circuit. The lithium-ion cells and batteries may be seriously damaged due to improper design and production practices. The fire, smoke, and thermal runaway result from these failures. Failures may remain unnoticed until they are triggered by the use of the product.

Battery Plate Market Segmentation Analysis

By Battery Type Analysis

Lithium Ion Battery Segment to Lead the Market Due to Rise in EV Manufacturing

Based on product type, the market is segmented into lead acid battery, lithium ion battery, and others.

The lithium-ion battery segment held the largest battery plate market with a share of 71.20% in 2026, and is expected to lead the market during the forecast period. Demand for automobile lithium-ion batteries increased by about 65% to 550 gigawatts in 2022 from 330 gigawatts in 2021, primarily due to the increase in electric vehicle sales, with new registrations more than 55% above the 2021 level. In China, demand for batteries for vehicles increased by more than 70%, while sales of electric cars increased by 80% in 2022 compared to 2021, with a slight slowdown in the growth of demand for batteries due to the increasing share of PHEVs. Even though electric car sales only increased by around 55% between 2021 and 2022, battery demand for vehicles in the U.S. increased by about 80%.

The lead-acid battery plays a key role in supporting national security, transportation, communications and climate change mitigation, helping to shape the future of post-pandemic economic recovery. With growing demand for the automobile sector, lead acid batteries are a secondary source and so thus the growth of battery plates depends on it.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Growing Shift to Electric Vehicles to Drive Automotive Segment Market Growth

Based on end-user, the market is segmented into automotive, aerospace & defense, and others.

With the growing market trend of EV manufacturing, the automotive segment is the fastest-growing segment with a share of 52.91% in 2026. Depending on individual markets, the global shift to electric vehicles (EVs) is moving at very different speeds. In most countries except China, interest in hybrid technology is also high compared to full-battery electric vehicles. The shift toward electric vehicles has been mainly driven by strong consumer confidence that it will significantly impact the cost of vehicle operations, despite official statements about the need to address climate change. The top 3 companies in the automotive market, which include BMW, General Motors, and Toyota, are launching many new versions of EVs across all types, and this shows the significant change in the automotive sector, which is helping to boost the market.

For instance, in September 2023, BMW India announced the new BMW iX1 electric SUV, which has already been sold out for 2023. Mercedes-Benz unveiled its Concept CLA Class, an electric vehicle built on a new architecture underpinning future battery cars from the German auto giant.

Battery plate plays an important role in the aerospace & defense sector with growing innovation. Most small private jets use lead acid batteries. Most business and commercial aircraft use nickel-cadmium (Ni-Cd) batteries. However, other types of lead-acid batteries are available, such as valve-regulated lead-acid batteries (VRLA). Due to the growth of aerospace, the battery plate market is on rise as well.

REGIONAL INSIGHTS

The global market is studied across North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Battery Plate Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market due to multiple factors, such as automobile manufacturing, lithium-ion battery production, and massive consumer demand in China, India, and Japan. Asia Pacific dominated the global market in 2025, with a market size of USD 2.07 billion. The Japan market is projected to reach USD 0.35 billion by 2026, and the India market is projected to reach USD 0.54 billion by 2026.

As reported by the International Energy Agency, China accounted for 60% of the electrical car registrations in 2022, with 13.8 million electric cars on roads. Contemporary Amperex Technology Co. Limited (CATL) is a company based in China that captures 37% of the total electric vehicle market globally. With the reduction in the production cost of EVs provided by companies in China, the global EV market and the components of battery manufacturing are concentrated in China. the China market is projected to reach USD 1.11 billion by 2026,

In August 2022, the Japanese Ministry of Industry stated that they require USD 24 billion from the private and public sectors to develop a competitive manufacturing base for batteries’ component production and assembly. The government expects that about 380,000 tons of lithium, 310,000 tons of nickel, 60,000 tons of cobalt, 600,000 tons of graphite and 50,000 tons of manganese will be needed annually in order to produce 600 gigawatts of batteries by 2030.

Furthermore, China, the European Union and the United States represent 75 % of the total worldwide demand for batteries. The main driver of battery demand is electric cars, with 93% of the world's sales in China, Europe, and the U.S. in 2021. This suggests that Europeans and Americans are driving higher demand for batteries, however Asia supplies them. The UK market is projected to reach USD 0.04 billion by 2026, while the Germany market is projected to reach USD 0.09 billion by 2026.

North America

Both the automotive and aerospace sectors in North America are having escalating growth which is leading the growth of this market. In North America, the defense sector is the leading buyer of battery plates. Each year, the Department of Defense makes significant purchases of specialized, custom battery models to power critical weapons systems, which presents challenges for affordability and marketability. According to the 2022 Securing Defense-Critical Supply Chains report, the DOD has an opportunity to leverage the commercial market better to optimize its purchasing power in 2022 with USD 515 billion in active global automotive investment.

Europe

European cell manufacturers have announced that Europe will have up to 1 TWh of cell production capacity this decade. The remaining 43% reported maximum production capacity comes from mainly Asian cell manufacturers, excluding Chinese, mostly Korean firms.

There are only five countries in Europe, including Germany, where most of the reported manufacturing capacity does not come from European companies. While this makes Germany the country with the most announced capacity of companies outside Europe (279 GWh), it is also the country with the highest announced capacity of European companies (151 GWh). In addition to Germany, more than 100 GWh were announced by European companies in Sweden (with extensive announcements by Northvolt) and Italy (ACC, FAAM and Italvolt). Apart from Germany, non-European cell manufacturers are mainly found in Hungary - with announcements from Chinese companies CATL and EVE. The U.S. market is projected to reach USD 0.74 billion by 2026.

Key Industry Players

Enersys is the Leading Manufacturer of Battery Components Due to Growing Product Portfolio for Battery Plates

EnerSys is a global company in battery manufacturing, energy systems, chargers, monitoring & fleet management, and others. The company has a wide range of battery product portfolios, including series, such as NexSys, PowerSafe, Genesis, and others. With the rise in the manufacturing of batteries, the company has acquired leading companies in the battery market. The company acquired Northstar Battery Company in 2019 with a valuation of USD 500 million.

List of Top Battery Plate Companies:

- Enersys (U.S.)

- Exide Technologies (U.S.)

- Toshiba Corporation (Japan)

- G.S. Yuasa (Japan)

- Amara Raja Batteries Limited (India)

- Kijo Battery Group (China)

- Microvast Holding Inc. (U.S.)

- Crown Battery (U.S.)

- CSB Energy Technology Co. Ltd. (U.S.)

- Fiamm Energy Storage Solutions SpA (Italy)

KEY INDUSTRY DEVELOPMENTS:

- September 2023: Exide Technologies invested over USD 11.2 million in its subsidiary Exide Energy Solutions Ltd, which is a manufacturing company of advanced chemical battery cells. The company is engaged in the production of advanced chemistry and form factor batteries, including however not restricted to shapeless, tube or prismatic battery cells, which are also capable of being produced, assembled, and sold, as well as various ancillary actions.

- April 2023: EnerSys announced that it had acquired Industrial Battery and Charger Services Limited (IBCS) based in the U.K., which is a leading battery service and maintenance provider. The acquisition showcased the strategic move to expand its business in the U.K. With this acquisition, Enersys can provide a wide range of battery technology, maintenance, and services in the U.K. market.

- October 2022: Toshiba Corporation and EVage Automotive Pvt. Ltd. signed a partnership in which Toshiba will provide its SCiB™ rechargeable lithium-ion cells for the power generation of 10,000 EVage electric commercial vehicles. Under the agreement, EVage will have sufficient quantities of cells in 2023 to cope with its substantial production ramp-up and meet a range of thousands of existing reservations for delivery vehicles in India.

- September 2022: The KIJO group announced a new technology, “graphene technology battery,” which will have a strong battery plate of graphene as a raw material and will be specifically used for the two-wheeler E.V.s.

- September 2021: Crown Battery launched V-Force Lithium-ion technology to enhance the power of the battery electric forklift for long battery life. The VForce energy storage systems are made of lithium-ion batteries and chargers, which are now available for all Crown's heavy-duty trucks in its portfolio.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading product applications. Besides, the report offers insights into the latest market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.40% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Battery Type, End-user, and Region |

|

Segmentation |

By Battery Type

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the global market was valued at USD 3.26 billion in 2025.

The global market is projected to record a CAGR of 14.40% during the forecast period

The market size of Asia Pacific stood at USD 2.07 billion in 2025.

Based on end-user, the automotive segment leads the market.

The global market size is expected to reach USD 11.10 billion by 2034.

Rising investment in battery cell production to reduce fuel consumption and increasing energy storage penetration in battery cell production will drive the market growth.

EnerSys, GS Yuasa, Exide Technologies, Amara Raja Batteries Ltd. And Toshiba Corporation are the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us