Bioinformatics Market Size, Share & Industry Analysis, By Offering (Software and Services), By Application (Metabolomics, Pharmacology, Genomics, Transcriptomics, and Others), By End-User (Pharmaceutical & Biotechnology Companies, CROs & Research Institutes, and Others), and Regional Forecast, 2026-2034

Bioinformatics Market Size

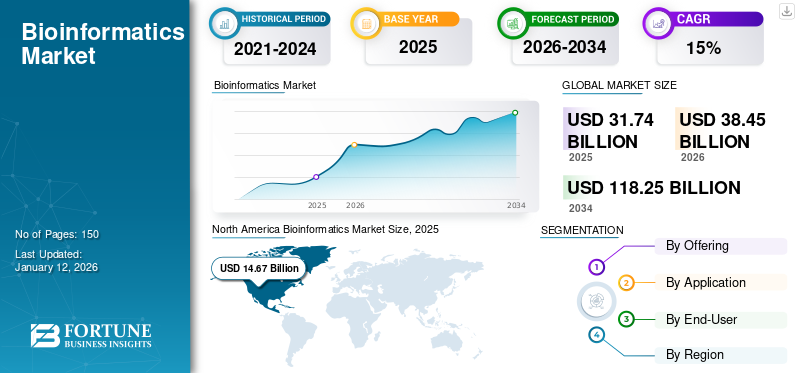

The global bioinformatics market size was valued at USD 31.74 billion in 2025. The market is projected to grow from USD 38.45 billion in 2026 to USD 118.25 billion by 2034, exhibiting a CAGR of 15.08% during the forecast period. North America dominated the bioinformatics market with a market share of 46.23% in 2025.

Bioinformatics is a computer-assisted data management discipline that helps gather, analyze, and present information to study life processes in healthy and diseased states, and discover novel and better drugs. The rising prevalence of chronic diseases is surging the demand for innovative treatment interventions. This is increasing the number of clinical studies being undertaken to gather enough data and provide effective treatment solutions.

The increasing volume of data generated by these clinical studies to interpret and analyze the data has surged the demand for creating advanced solutions. The expanding use of these solutions in analyzing genomic data to guide treatment decisions is increasing the number of collaborations between research institutions and pharmaceutical companies. Moreover, the growing use of these platforms and services in every step of drug discovery, which includes target identification, drug design, and toxicity prediction, has accelerated the drug discovery process.

This is likely to broaden the treatment spectrum for treating a range of diseases and subsequently contribute to the market’s growth during the forecast period. Moreover, a rising number of initiatives and programs aimed to promote the use of these solutions in healthcare is driving the market growth.

- In October 2023, the Canadian government invested USD 15 million to develop a first-of-its-kind Pan-Canadian genome library. Such investments made by government entities encourage research projects, which subsequently surges the demand for tools and techniques needed for data analysis.

During the COVID-19 pandemic, the global market witnessed positive growth due to the effective implementation of these solutions to study and identify suitable vaccines against the infection. Bioinformatics solutions helped in studying the large amount of genomic sequence information to understand the functioning of the virus and identify potential targets for treatment. Various tools and techniques were used to develop models to predict infection patterns and identify effective treatment options. Since 2021, owing to the positive outcomes observed in the clinical research of COVID-19, the applications of this software and services have expanded, which is anticipated to help the market maintain steady growth during the forecast period.

Global Bioinformatics Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 31.74 billion

- 2026 Market Size: USD 38.45 billion

- 2034 Forecast Market Size: USD 118.25 billion

- CAGR: 15.08% from 2026–2034

Market Share:

- North America dominated the bioinformatics market with a 46.23% share in 2025, driven by strong presence of solution providers, extensive distribution networks, and rising initiatives to promote bioinformatics adoption in healthcare.

- By offering, the software segment accounted for the largest market share in 2024 due to high adoption of sequencing and analysis platforms in clinical research and drug discovery programs.

Key Country Highlights:

- United States: Adoption is driven by an increasing number of genomic sequencing initiatives and government-supported programs to enhance data-driven healthcare research.

- Europe: Growth is supported by rising investments in genomics research, technological advancements in next-generation sequencing, and demand for personalized medicine.

- China: The rising number of clinical trials and large-scale collaborations between pharmaceutical companies and research institutions are propelling the adoption of bioinformatics solutions.

- Japan: Increased focus on AI-driven genomics platforms and strategic partnerships with global biotech companies are accelerating the use of bioinformatics in drug discovery and epigenetic research.

Bioinformatics Market Trends

Growing Use of Artificial Intelligence and Machine Learning

One of the prevailing global bioinformatics market trends observed is the use of artificial intelligence and machine learning technologies to extract meaningful patterns from large and complex datasets. This accelerates the drug discovery process, improvises prediction models, and introduces personalized medicine.

- In July 2023, Japanese genetic research and testing firm Genesis Healthcare introduced GenesisGaia, a generative AI software platform for genomics data. A population genomics platform at heart, GenesisGaia applies its technology to genomic datasets in an effort to reduce pharmaceutical R&D bottlenecks.

- In July 2023, FOXO Technologies Inc. launched bioinformatics services to accelerate breakthroughs in biotechnology and redefine the emerging field of epigenetic research. The company uses AI-driven bioinformatics and DNA microarray technology to develop and commercialize epigenetic biomarkers for health and aging.

This field is a rapidly evolving one with immense potential to transform drug discovery and personalized medicine. The integration of artificial intelligence, machine learning, next-generation sequencing, and big data analytics has propelled the adoption rate of these platforms and services. With the expanding frontiers of biological data, it is crucial to collaborate with industry experts to unlock the full potential of the market.

Download Free sample to learn more about this report.

Bioinformatics Market Growth Factors

Increased Funding for Genomics Research to Surge Demand for Bioinformatic Solutions

Bioinformatics is an emerging discipline that uses skills and technologies from computer science and biology to understand and analyze biological data. One field where it plays a significant role is genomics, which generates vast amounts of data. It helps provide meaningful insights that can be used for the diagnosis of a rare condition, to identify and monitor contagious organisms among a population, and identify the best treatment for a patient with cancer. To explore whole-genome sequencing and introduce novel treatment interventions for rare and chronic diseases, government and non-government organizations are actively investing in genomic research.

- For instance, in December 2022, the U.K. government invested £175 million (USD 223.02 million) in genomics research. This investment was made to explore the effectiveness of using whole-genome sequencing in treating genetic diseases identified in newborn babies. This study was led by Genomics England in partnership with the National Health Service (NHS).

The collection and storage of genetic mutations that have been identified and found to be associated with resistance have led to the creation of many genomics-based tools, such as PhyResSE, TB-Profiler, and Mykrobe Predictor, among others. These knowledge management tools allow researchers to predict drug resistance immediately after obtaining a sample’s genetic sequencing data, which is anticipated to be an effective implementation of these solutions. This will surge the demand for more innovative and effective bioinformatics platforms and services, eventually driving the bioinformatics market growth.

RESTRAINING FACTORS

Lack of Standardization in Data Formats and Analysis Methods May Limit Market Growth

Despite increasing investment in introducing novel tools and methods in the market, one of the major impediments is the lack of standardization in data formats, which may impact the process of extracting meaningful insights and lead to ineffective implementation of these solutions.

- According to a study published by PLOS Digital Health in October 2023, health-related information holds great potential in advancing health research and improving patient care delivery. However, over 80% of this digital data in healthcare is available as unstructured data, which requires novel ways to process and standardize, and proves to be a challenge to health researchers.

In addition to this, processing large amounts of unstructured genomic data may delay the analysis process, leading to an increase in the manufacturing cost of a novel medication. Moreover, the emerging field limits its exposure to large-scale projects and also influences the interest of market players to implement these solutions to avoid financial risks. These are some of the factors that may limit the adoption or penetration rate of these solutions, subsequently limiting the market growth.

Bioinformatics Market Segmentation Analysis

By Offerings Analysis

Software Segment Dominated Market Due to Higher Adoption

On the basis of offerings, the market is segmented into software and services.

The software segment dominated the global market share of 79.67% in 2026 owing to the increasing number of companies offering platforms and tools across the globe. The advantages offered by sequencing and analysis platforms is increasing the utilization rate of bioinformatics software in various research studies. This is increasing the R&D investment of market players, subsequently driving the segment’s growth.

- In March 2022, ARUP Laboratories launched Rio, a new bioinformatics pipeline and analytics platform, to provide better and faster next-generation sequencing test results.

The services segment held a comparatively lower global bioinformatics market share in 2024. The segment’s growth is attributed to the surging demand for these services in clinical and research domains. Moreover, the rising number of government initiatives and programs to promote the effective implementation of these solutions in healthcare is propelling the segment’s growth.

- In June 2021, the U.S. Department of Health and Human Services (HHS) allocated USD 80 million in funding to strengthen the U.S. public health informatics and data science.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Increasing Investment in Genomics Led to its Dominance in Market

In terms of application, the market is segmented into metabolomics, pharmacology, genomics, transcriptomics, and others.

The genomics segment held a dominating share of the global market contributing 35.29% globally in 2026. The segment’s growth is attributed to the increasing investment of public and private organizations in genomic research. The continuous advancement of DNA sequencing technology is also propelling the segment’s growth. Integration of computation tools and methods helps in decoding, assembling, and analyzing genomes. The wide range of applications offered by bioinformatic solutions in genomics is driving the segment’s growth.

- In January 2022, SeqOne Genomics, a French company, raised USD 22.2 million in Series A investment round to help hospitals and pharmaceutical companies analyze genomics through cloud-based software.

Followed by genomics, the pharmacology and metabolomics segments held a considerable market share in 2024. Bioinformatics plays a crucial role in several aspects of drug discovery, drug metabolism, and pharmacology. The growing utilization of these tools facilitates the process of identifying and characterizing drug metabolites, which are some of the factors that will drive these segments' growth during the forecast period. The transcriptomics and the others segments are estimated to record a comparatively lower CAGR due to the availability of limited clinical data in these areas.

By End-User Analysis

Growing Collaborations led to Dominance of Pharmaceutical & Biotechnology Companies Segment

On the basis of end-user, the market is segmented into pharmaceutical & biotechnology companies, CROs & research institutes, and others.

The pharmaceutical & biotechnology companies segment held a dominant market share in accounting for 45.13% in 2026. The segment’s growth is attributed to the growing focus of the pharmaceutical industry on the integration of software and services in its drug discovery programs through strategic alliances, which is driving the demand for these solutions. In April 2023, Agilent Technologies Inc. partnered with Theargen Bio, an AI-based biopharmaceutical company, to boost precision oncology through advanced bioinformatics solutions in South Korea.

The CROs & research institutes segment held a notable share of the global market in 2024. Increasing funding for research projects at the academic and research institute level to conduct pilot studies is expected to drive the adoption rate of these solutions, subsequently accelerating the segment’s growth. The others segment includes academic institutes, hospitals, and clinics where integration of these solutions will offer lucrative opportunities for the segment’s growth.

REGIONAL INSIGHTS

Geographically, the global market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Bioinformatics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America accounted for the highest market share and recorded a revenue of USD 11.98 billion in 2024. The strong presence of companies offering these solutions across the globe with a vast distribution network is one of the key factors contributing to the region’s dominance. Moreover, the increasing number of initiatives and programs to promote the use of these solutions in healthcare to analyze large amounts of clinical data is contributing to the market’s growth across the region. The U.S. market is projected to reach USD 16.2 billion by 2026.

- According to an article published by the University of Washington in March 2022, almost 100,000 highly diverse whole genome sequences are available in the U.S. through the National Institutes of Health's All of Us Research Program.

Europe

Europe held a notable market share in 2024. The increasing funding for clinical research, especially for genomics, is surging the demand for these solutions across the region. The growing demand for personalized medicine and continuous advancements in technologies, such as next-generation sequencing and high-performance computing are expected to boost the market’s growth in Europe during the analysis period. The UK market is projected to reach USD 2.96 billion by 2026, while the Germany market is projected to reach USD 3 billion by 2026.

- In November 2023, the U.K. Research and Innovation invested more than USD 102.50 million in the European Bioinformatics Institute (EMBL-EBI) to meet the rising data needs of the life sciences community.

Asia Pacific

Asia Pacific is projected to record the highest CAGR during the forecast period. Increasing clinical trials across the region are boosting the volume of clinical research data, which will create the need for more advanced tools and techniques to analyze and extract meaningful insights. This is anticipated to surge the demand for these solutions across the region. The Japan market is projected to reach USD 3.16 billion by 2026, the China market is projected to reach USD 1.88 billion by 2026, and the India market is projected to reach USD 1.45 billion by 2026.

- As per an article published by the ClinicalTrials Arena in March 2023, Asia Pacific had the highest number of clinical trials in all therapeutics areas in 2018 and 2022. China, Australia, South Korea, Japan, and India accounted for a major share of the phase 1 trials.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa are expected to register a comparatively lower CAGR during the study period. The limited presence of companies offering these solutions and lack of a well-established healthcare infrastructure are some of the factors slowing the market’s growth across these regions.

Key Industry Players

Well-Established Presence of Market Players Led to Their Dominance

Bioinformatics is an emerging field, and in terms of the competitive landscape, some companies hold substantial shares of the global market. QIAGEN, Illumina Inc., and Agilent Technologies, Inc., among others, have established their position in this market through strong product offerings and well-established distribution networks across the globe. These firms are focusing on exploring this market further by forming strategic alliances with academic and research institutes.

- In January 2023, Illumina Inc. and Nashville Biosciences LLC signed an agreement with Amgen to sequence approximately 35,000 DNA samples whole-genome.

Some other prominent players, such as Thermo Fisher Scientific Inc., IBM Corporation, and Eurofins Scientific, among others, have established their presence in the market, offering a wide range of services with advanced technologies. Emerging players, such as DNAnexus, Inc., Genebio, and Compugen Ltd. are focused on expanding their product presence by entering strategic collaborations and partnerships with well-established players.

- In August 2023, DNAnexus Inc., a provider of cloud-based genomic and biomedical data access and companion analysis software, collaborated with BigOmics Analytics, a Swiss biomedical data analysis company. The partnership aimed to make advanced precision medicine easier for researchers and to improve patient care with the help of big data.

LIST OF TOP BIOINFORMATICS COMPANIES:

- DNAnexus, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- IBM Corporation (U.S.)

- Labvantage - Biomax GmbH (Germany)

- Genebio (Switzerland)

- Compugen Ltd. (Israel)

- Eurofins Scientific (Luxembourg)

- QIAGEN (Netherlands)

KEY INDUSTRY DEVELOPMENTS

- October 2023 – Bionl, Inc., a pioneering company in biomedical and bioinformatics research, launched a no-code biomedical research platform that enables researchers, students, and professionals to investigate biomedicine using natural language queries.

- October 2023 – BioBam Bioinformatics launched OmicsBox 3.1 to empower researchers, scientists, and bioinformaticians in their pursuit of advanced omics data analysis and interpretation.

- April 2023 – Absci Corp. collaborated with Aster Insights (formerly named M2GEN) to expedite the development of new cancer medicines.

- December 2022 – Analytical Biosciences Limited partnered with Mission Bio to co-develop bioinformatics packages for translational and clinical research applications in hematological cancers.

- April 2022 – ATCC signed an agreement with QIAGEN to provide sequencing data from its collection of biological data. QIAGEN Digital Insights aims to establish a database from this information to develop and deliver high-value digital biology content for the biotechnology and pharmaceutical industries.

REPORT COVERAGE

The report offers a detailed market analysis and overview. It focuses on key aspects, such as competitive landscape, types, applications, end users, and key regions. Besides this, it offers insights into the market drivers, trends, dynamics, COVID-19 impact on the market, and other key insights. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.08% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Offering

|

|

By Application

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 31.74 billion in 2025 and is projected to reach USD 118.25 billion by 2034.

In 2025, the markets value in North America stood at USD 14.67 billion.

The market will exhibit rapid growth at a CAGR of 15.08% during the forecast period of 2026-2034.

By offering, the software segment held a leading position in the market in 20254.

The growing prevalence of chronic diseases and increasing volume of data generated by clinical research to create advanced tools and techniques for analysis are some of the factors driving the demand for this technology.

QIAGEN, Illumina, Inc., and Agilent Technologies, Inc. are some of the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us