Blood Glucose Monitoring System Market Size, Share & Industry Analysis, By Device Type (Continuous Glucose Monitoring (CGM) Systems [Sensors and Transmitters & Receivers] and Self-Monitoring Blood Glucose (SMBG) Systems [Blood Glucose Meters, Test Strips, and Lancets]), By Type (Non-invasive and Invasive), By Modality (Wearable and Non-wearable), By Patient Type (Type 1 Diabetes and Type 2 Diabetes), By Distribution Channel (Retail Sales and Institutional Sales), and Regional Forecast, 2026-2034

Blood Glucose Monitoring System Market

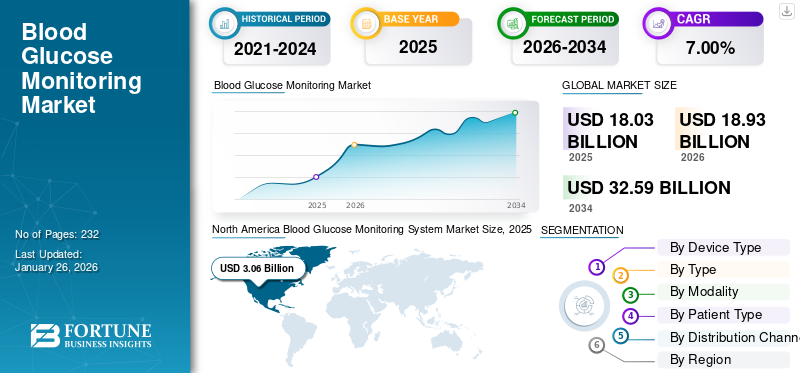

The global blood glucose monitoring system market size was valued at USD 18.03 billion in 2025. The market is projected to grow from USD 18.93 billion in 2026 to USD 32.59 billion by 2034, exhibiting a CAGR of 7.00% during the forecast period. North America dominated the blood glucose monitoring system market with a market share of 44.20% in 2025.

A blood glucose monitoring system refers to the device used to track the glucose levels in the blood for the management of diabetes among the patient population. The increasing prevalence of type 1 and type 2 diabetes is one of the crucial factors supporting the growing demand for regular monitoring among patients. The increasing patient pool, growing technological advancements in these systems, improving healthcare access, and increasing healthcare expenditure are some of the additional factors contributing to the growth of the global market.

- According to the data published by the International Diabetes Federation (IDF), approximately 589.0 million adults aged 20–79 were living with diabetes globally in 2024.

Key players such as F. Hoffmann-La Roche Ltd., Abbott, Dexcom, Inc., and others are focusing on research and development activities to develop and introduce novel monitoring systems, which is anticipated to drive the adoption of these products, thereby boosting the share of the global blood glucose monitoring system market.

Global Blood Glucose Monitoring System Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 18.03 billion

- 2026 Market Size: USD 18.93 billion

- 2034 Forecast Market Size: USD 32.59 billion

- CAGR: 7.00% from 2026–2034

Market Share:

- North America dominated the blood glucose monitoring system market with a 44.20% share in 2025, driven by the rising prevalence of diabetes, increasing adoption of technologically advanced medical devices, and robust reimbursement policies.

- By device type, continuous glucose monitoring (CGM) systems held the largest market share owing to the rising diabetic population, real-time monitoring benefits, and increasing product launches by key players.

Key Country Highlights:

- United States: Growth is fueled by the increasing adoption of wearable glucose monitors, rising awareness of diabetes management, and strong focus of manufacturers on product innovation.

- Europe: The market is driven by the increasing availability of advanced CGM systems in homecare settings, rising focus on early diagnosis, and regulatory approvals of innovative devices.

- China: Growth is supported by expanding healthcare infrastructure, partnerships with global players to develop CGM systems, and rising demand for continuous glucose monitoring among the diabetic population.

- Japan: Market expansion is attributed to technological advancements in non-invasive monitoring, rising elderly diabetic population, and growing adoption of integrated digital health solutions for diabetes management.

Market Dynamics

Market Drivers

Increasing Prevalence of Diabetes to Support Market Growth

The increasing prevalence of type 1 and type 2 diabetes among the patient population in developed and developing nations is resulting in a higher number of patient admissions worldwide requiring blood monitoring, further supporting the demand for these products in the market. Additionally, increasing urbanization and a shift toward sedentary lifestyles in developed and developing nations are key factors driving the rising prevalence of diabetes among the population.

- For instance, according to the 2024 data published by the International Diabetes Federation (IDF), about 65.6 million adults are affected by diabetes, which is expected to increase to 72.4 million people by 2050 in Europe.

A significant increase has been observed in the number of patients suffering from type 1 or insulin-dependent type 2 diabetes, which has been instrumental in the uptake of blood glucose monitoring products globally. For instance, a 2023 article published by Mary Ann Liebert, Inc. reported that more than 9.0 million people were using continuous glucose monitoring devices for their day-to-day diabetes management.

Therefore, increasing diabetic population, growing product launches by key players, and adequate reimbursement policies are boosting the adoption and demand for the product, thereby contributing to the global blood glucose monitoring system market growth.

Market Restraints

High Cost Associated with CGM Systems to Hamper the Adoption in Developing Nations

There is an increasing emphasis on technological advancements in CGM devices, which is resulting in increasing costs associated with these products. The costs typically include expenses related to readers, sensors, batteries, and other essential components, along with the recurring consumables required for regular use.

- For instance, the average yearly continuous glucose monitor (CGM) cost can range from USD 2,000 to USD 7,000.

The high cost associated with these diabetes monitoring devices, coupled with inadequate reimbursement policies, particularly in developing nations such as Brazil, China, India, and others, is resulting in a reduced adoption of CGM devices, thereby hampering market growth.

- According to a 2023 article published by FIND, an international non-profit organization, it is estimated that around 55,000 people were living with type 1 diabetes in Kenya and South Africa, and only 16.0% of these individuals use CGMs for diabetes management in South Africa.

Additionally, the introduction of innovative and advanced CGM systems, such as advanced hybrid closed-loop systems, by leading market players has led to a considerable rise in the cost of these devices.

Market Opportunities

Introduction of Non-invasive CGM to Present Huge Growth Opportunities for Key Players

There is a large patient population in developed and emerging countries suffering from insulin-dependent diabetes that requires continuous monitoring of blood glucose levels. Currently, most diabetes patients monitor their blood glucose by drawing blood via finger prick using a self-monitoring blood glucose monitor (SMBG) or invasive continuous glucose monitoring (CGM) systems.

However, several research studies have shown that patients have lower adherence toward SMBG and CGM devices due to the pain and inconvenience associated with these invasive blood glucose monitoring devices.

Thus, these parameters present a huge growth opportunity for market players to focus on research and development activities and introduce non-invasive continuous blood glucose monitoring (CGM) systems to provide effective and convenient monitoring devices to the patient population in the market.

At present, only a few market players are emphasizing on the non-invasive CGM segment, with limited products introduced to the market. These factors present a huge opportunity for new entrants to establish their strong foothold by addressing this unmet need.

- In May 2025, Afon Technology launched the Glucowear device, a non-invasive glucose sensor that continuously monitors blood sugar levels in real-time to strengthen its product portfolio.

Market Challenges

High Proportion of Undiagnosed Diabetes Population to Hamper Product Adoption

Type 2 diabetes often has a long pre-detection period, which leads to a considerably large proportion of cases remaining undiagnosed. Limited awareness among the general population and physicians is a vital factor behind this trend, impacting both developed and developing nations.

Globally, every 1 out of 2 diabetic patients is currently undiagnosed. Additionally, the proportion of the undiagnosed diabetes population is much higher in low-to middle-income countries compared to developed economies. The major reason for the higher percentage of undiagnosed population in emerging countries includes a lack of awareness among the general population toward diseases and lower emphasis by national and regional governments on early diagnosis of chronic diseases.

- According to the 2024 data published by the National Center for Biotechnology Information (NCBI), it was estimated that 240 million individuals are living with undiagnosed diabetes, with nearly half of all adults with diabetes unaware of their illness.

Other Prominent Challenges

- Lack of Standardized Regulations to Hamper Market Growth: The lack of uniform global regulatory frameworks for glucose monitoring devices leads to inconsistencies in product approvals and safety standards. Concerns have been raised about the approval of some CGMs without robust clinical validation, which is further expected to limit the market's growth.

- Accuracy Issues with Non-Invasive Devices to Limit Product Adoption: Non-invasive monitors still face clinical accuracy concerns, particularly in comparison to invasive blood-based systems. This is a key hurdle in securing approvals from regulatory agencies such as the Food and Drug Administration (FDA).

Blood Glucose Monitoring System Market Trends

Increasing Penetration of Continuous Glucose Monitoring (CGM) Systems Fuels Industry Development

The rising efforts of market players to implement novel and advanced technology in the CGM systems have led to the introduction of several key features, including real-time monitoring for insulin-dependent patients, integration of artificial intelligence and machine learning in the devices, and others.

Additionally, CGM devices offer certain benefits, including being less painful, being minimally invasive, rapid & precise results, and real-time monitoring. Thus, increasing awareness about these benefits is influencing the shift in preference among healthcare providers and patients toward CGM systems.

- For instance, according to the data published by Abbott, the number of Freestyle Libre users globally increased from 5.0 million in 2023 to 7.0 million in 2025.

Moreover, patients with type 1 and type 2 diabetes are advised to monitor their blood glucose levels 3-4 times a day, which causes slight inconvenience to the patient on the SMBG system, owing to the pain and cost of consumables. These challenges are key reasons why both healthcare professionals and patients are adopting CGM solutions.

Additionally, there are a few companies in the global market, especially in Europe, that are focusing on developing and introducing non-invasive CGM devices. The robust efforts of these companies are expected to support continued trend of rising penetration of these devices among patients.

Download Free sample to learn more about this report.

Other Prominent Trends:

- Increasing Adoption of Digital Tools in CGM Devices: Modern CGMs are increasingly integrated with wearable devices and insulin pumps. This trend enhances patient engagement and offers end-to-end diabetes management solutions.

- Increasing Adoption of CGM Devices for Wellness Purposes: Glucose monitoring is no longer limited to people diagnosed with just diabetes. Wellness-focused consumers are adopting CGMs to monitor metabolic health, even without a diagnosis, as highlighted in recent trends across the U.S. and Europe.

Segmentation Analysis

By Device Type

Continuous Glucose Monitoring Systems Segment Dominated Due to Increasing Burden of Diabetes

As per device type, the market is segmented into continuous glucose monitoring (CGM) systems and self-monitoring blood glucose (SMBG) systems.

The continuous glucose monitoring (CGM) systems segment is further bifurcated into sensors and transmitters & receivers. The self-monitoring blood glucose (SMBG) systems segment is classified into blood glucose meters, test strips, and lancets.

The continuous glucose monitoring (CGM) systems segment dominated the market with a share of 63.76% in 2026. The growing prevalence of diabetes among patients, rising focus towards R&D activities by key players to launch innovative products are some factors supporting the segment's dominance.

- In August 2024, Medtronic partnered with Abbott and received the Food and Drug Administration (FDA) approval for its Simplera continuous glucose monitor (CGM) to strengthen its product portfolio.

Additionally, the self-monitoring blood glucose (SMBG) systems segment is expected to lose its market share by the end of the forecast period, owing to the high cost of devices and consumables and the growing penetration of CGM devices globally.

- For instance, according to the data published by Clinton Health Access Initiative Inc., in 2021, it was estimated that if a person uses four test strips per day, the cost of testing strips is projected to be around USD 87.6 and USD 1,285.0 per year.

To know how our report can help streamline your business, Speak to Analyst

By Type

Invasive Segment Led Due to Higher Adoption of These Devices Among the Patient Population

Among type, the market is segmented into non-invasive and invasive.

The invasive segment dominated the market in 2024. The growing use of SMBG devices among the diabetic patient population is one of the major factors responsible for the segment's dominance. Additionally, the relatively lower costs of invasive devices play a significant role in supporting the segment's growth. According to a 2022 article by MDPI, invasive monitoring systems are less expensive and accurate than non-invasive or minimally invasive systems. The invasive segment is projected to dominate the market with a share of 99.95% in 2026.

The non-invasive segment is expected to grow with a considerable CAGR during the study period. The growth is due to the increasing integration of novel techniques and technology, including Raman spectroscopy, that facilitate glucose monitoring through tears, sweat, and saliva. The growing technological advancement, coupled with increasing awareness about the benefits of non-invasive monitors, is expected to support the segment's growth.

- For instance, according to a 2022 article published by the NHS U.K., about 200,000 patients have started using non-invasive continuous glucose monitoring (CGM) devices in the U.K.

By Modality

Increasing Benefits of Wearable BGMs Led to Segment’s Dominance

Amongst modality, the market is bifurcated into wearable and non-wearable.

The wearable segment dominated the market in 2024 due to increasing benefits of wearable blood glucose monitors (BGM), such as improved blood sugar management, increased convenience, and reduced risk of complications. This, along with the growing focus of key players towards the development and introduction of novel products, is anticipated to surge the adoption rate, thereby contributing to the segmental growth.

- For instance, in April 2025, Ambrosia launched A-CGM, a real-time glucose and stress monitoring device with advanced wearable technology, developed in response to the growing market demand.

The non-wearable segment is expected to grow with a considerable CAGR during the forecast period. The presence of a large number of market players with robust portfolios of non-wearable systems is one of the major factors responsible for the growth of the market.

By Patient Type

Type 2 Diabetes Segment Led to its Increasing Prevalence

On the basis of patient type, the market is bifurcated into type 1 diabetes and type 2 diabetes.

The type 2 diabetes segment dominated the market in 2024. The growth is due increasing prevalence of type 2 diabetes, resulting in a growing demand for innovative blood glucose monitors in the market. This, along with increasing awareness and focus of key players toward the introduction of novel products, is contributing to the growing adoption of these devices worldwide. The type-2 diabetes segment will account for 76.28% market share in 2026.

- For instance, according to the 2025 data published by the International Diabetes Federation (IDF), it was reported that type 2 diabetes accounts for over 90% of diabetes cases worldwide.

The type 1 diabetes segment is anticipated to record a notable CAGR due to the increasing use of continuous glucose monitoring (CGM) systems, owing to their clinically proven efficiency in reducing the risks of hypoglycemia in type 1 diabetes patients.

By Distribution Channel

Preference for Retail Channels by Market Players Boosted the Retail Sales Segment Growth

By distribution channel, the market is segmented into institutional sales and retail sales.

The retail sales segment dominated the market in 2024 due to growing strategic initiatives by prominent players to strengthen their presence through retail channels in developed and developing nations globally. The retail sales segments is anticipated to hold a dominant market share of 79.45% in 2026.

- In March 2021, Omron Healthcare, Inc. announced its plan to expand its retail presence across India. The company aimed to increase the number of retailers in India from 30.0% to 40.0% in the financial year 2021-2022.

The institutional sales segment is anticipated to register a comparatively moderate CAGR owing to the lower adoption rate of blood glucose meters in hospitals & clinics. However, due to the outbreak of COVID-19, various medical organizations have recommended expanding access to CGM in hospitals, which is expected to drive the growth of the institutional sales segment during the forecast period.

Blood Glucose Monitoring System Market Outlook

Based on region, the market is segmented across North America, Europe, Asia Pacific, and the Rest of the World.

North America

North America Blood Glucose Monitoring System Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market, reaching a valuation of USD 8.42 billion in 2025. The growing prevalence of diabetes, rising awareness about the benefits of blood glucose monitors, increasing adoption of technologically advanced medical devices, increasing healthcare expenditure, and adequate reimbursement policies, are some of the vital factors supporting the growth of the market.

- For instance, according to the 2025 data published by the International Diabetes Federation (IDF), around 56.2 million adults in North America and the Caribbean (NAC) are living with diabetes, a number expected to reach 68.1 million adults by 2050.

U.S.

Increasing prevalence of type 1 and type 2 diabetes, rising awareness about the benefits of these devices, growing adoption of wearable blood glucose monitors, and increasing focus of key players toward R&D activities to launch new products are some of the factors supporting the growth of the market in the country. The United States blood glucose monitoring market is expected to reach USD 7.66 billion by 2026.

Europe

Europe is also expected to grow with a considerable CAGR during the forecast period. The growth is due to growing awareness toward diabetes management, increasing adoption of these devices in home care settings, and the rising demand for blood glucose monitoring devices for continuous monitoring among the patient population. The United Kingdom blood glucose monitoring market is estimated to reach USD 0.96 billion by 2026, while the Germany blood glucose monitoring market is forecast to reach USD 1.53 billion by 2026.

- For instance, in January 2024, Medtronic received CE approval for the MiniMed 780G system with Simplera Sync, a disposable, all-in-one Continuous Glucose Monitor (CGM) requiring no fingersticks or overtape, to strengthen its product portfolio.

Asia Pacific

Asia Pacific is anticipated to register a substantial CAGR due to the rising prevalence of insulin-dependent diabetes and an increasing geriatric population in this region. Additionally, growing preference toward regular and timely monitoring of glucose levels among patients, rising investment in healthcare infrastructure, particularly in China and India, and growing focus toward acquisitions and collaborations among key players are some of the key factors supporting market growth in the region. The Japan blood glucose monitoring market is anticipated to reach USD 0.90 billion by 2026, the China blood glucose monitoring market is set to attain USD 0.61 billion by 2026, and the India blood glucose monitoring market is likely to reach USD 0.48 billion by 2026.

- In May 2021, Dinova Medtech, a medical device company, partnered with Metronom Health, a U.S.-based company developing CGM systems, and established a joint venture in China, specializing in the development, manufacture, and sale of the CGM system in China.

Rest of the World

The rest of the world is expected to grow with a considerable CAGR during the study period. The increasing prevalence of diabetes among patients, developing healthcare infrastructure, improved healthcare access, rising number of health program initiatives among governmental organizations are some factors contributing to market growth in the region.

- For instance, according to 2025 data published by the International Diabetes Federation (IDF), it was reported that about 24.6 million people were affected by diabetes in Africa.

Competitive Landscape

Key Market Players

Major Players Focus on new Product Launches to Establish their Footprints Globally

The global market is consolidated, with a few prominent companies accounting for the majority of the blood glucose monitoring system market share. Abbott, F. Hoffmann-La Roche Ltd., and Dexcom, Inc., accounted for the major market share in 2024.

The robust and diversified portfolio of blood glucose monitors, increasing focus on R&D activities to launch novel products, along with the wide distribution network in developed and developing nations, are primarily factors responsible for the dominance of these companies globally.

- For instance, Abbott launched Lingo, an over-the-counter continuous glucose monitor, to strengthen its product portfolio globally.

On the other hand, new entrants are currently focusing on introducing novel non-invasive blood glucose monitors to establish their foothold globally.

- In May 2025, Afon Technology, is developing a non-invasive glucose sensor that has the potential to revolutionize the way blood glucose levels are monitored.

Some other notable names in the industry are Medtronic, B. Braun SE, Ascensia Diabetes Care Holdings AG, Terumo Corporation, LifeScan IP Holdings, LLC, and Senseonics.

List of Key Blood Glucose Monitoring System Companies Profiled

- Abbott (U.S.)

- Braun SE (Germany)

- Dexcom, Inc. (U.S.)

- Ascensia Diabetes Care Holdings AG (Switzerland)

- Medtronic (Ireland)

- Hoffmann-La Roche Ltd (Switzerland)

- Terumo Corporation (Japan)

- LifeScan IP Holdings, LLC (U.S.)

- Senseonics (U.S.)

Key Industry Developments

- April 2025 – Dexcom, Inc., received S. FDA approval for Dexcom G7 15-Day CGM for people over the age of 18 with diabetes in the U.S. This helped the company to increase its brand presence.

- November 2024 – Beurer India Pvt. Ltd., launched the GL 22 Blood Glucose Monitor manufactured under the brand’s Make in India initiative combining German precision with advanced technology designed to meet local needs among the individuals.

- August 2024 – Dexcom, Inc., launched Stelo, an over-the-counter continuous glucose monitor for adults, with an aim to strengthen its presence in the U.S.

- February 2024 – Dexcom, Inc. launched Dexcom ONE+, the latest Continuous Glucose Monitoring (CGM), to bring powerful, new diabetes management technology to patients in Belgium, Spain, and Poland.

- January 2024 – Abbott, with Tandem Diabetes Care, Inc., one of the players focusing on insulin delivery and diabetes technology, launched the t:slim X2 insulin pump with Control-IQ technology, the first automated insulin delivery system to integrate with FreeStyle Libre 2 Plus sensor in the U.S. This helped the company to strengthen its product portfolio.

REPORT COVERAGE

The global blood glucose monitoring system market report provides a detailed industry analysis. It focuses on key aspects such as leading companies, device type, type, modality, patient type, and distribution channel. Besides this, it offers insights into the market trends and highlights key industry developments and competitive landscape. In addition to the factors mentioned above, the report encompasses several factors focusing on the market forecast that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.00% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Device Type

|

|

By Modality

|

|

|

By Type

|

|

|

By Patient Type

|

|

|

By Distribution Channel

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 18.03 billion in 2025 and is projected to reach USD 32.59 billion by 2034.

In 2025, North America stood at USD 7.96 billion.

The market will exhibit steady growth at a CAGR of 7.00% during the forecast period.

Based on device type, the continuous glucose monitoring (CGM) systems segment led the market.

The rising prevalence of diabetes and the introduction of advanced products for monitoring blood glucose levels are the key factors driving the market.

F. Hoffmann-La Roche Ltd., Abbott, and Dexcom, Inc. are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us