Carbon Black Market Size, Share & Industry Analysis, By Process (Furnace Black, Thermal Black, Acetylene Black, and Others), By Grade (Standard Grade and Specialty Grade), By Application (Tire, Non-Tire Rubber, Inks & Toners, Plastics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

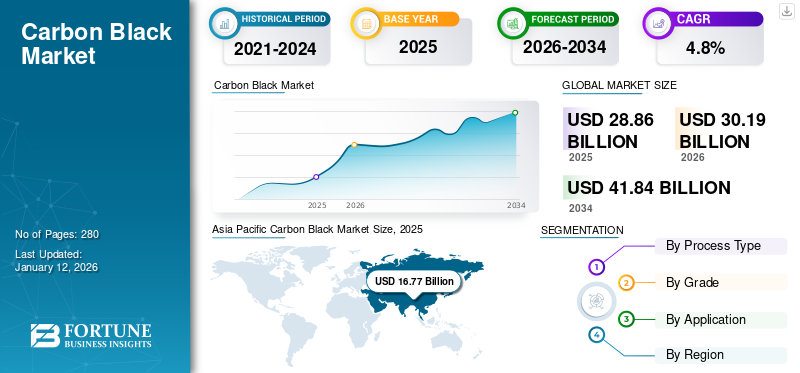

The global carbon black market size was valued at USD 28.86 billion in 2025. The market is projected to grow from USD 30.19 billion in 2026 to USD 41.84 billion by 2034, exhibiting a CAGR of 4.8% during the forecast period. Asia Pacific dominated the carbon black market with a market share of 16.77% in 2025. Moreover, the U.S. carbon black market is projected to reach USD 5.38 billion by 2032, supported by its key role in tire manufacturing and industrial rubber applications.

Carbon black is obtained from the thermal decomposition of heavy petroleum raw materials such as ethylene cracking tar, coal tar, or FCC tar. The product’s growing adoption is attributed to its beneficial characteristics, such as the absorption of ultraviolet (UV) light and converting it into heat, improved thermal conductivity and increased tire tread wear and rolling resistance. It is also used in carcasses, inner liners, treads, and sidewalls of tires, enhancing their overall strength and lifespan. In addition, it is used in a diverse group of materials to enhance their physical, electrical, and optical properties.

A huge quantity of the compound is utilized specifically in tires for exceptional rubber reinforcement. It is a unique coloring agent due to its black pigment and thus is extensively used in printing inks, resin coloring, paints, and toners. In addition, it is utilized in numerous different applications as an electric conductive agent consisting of antistatic films, fibers, and floppy disks. Therefore, its wide array of application areas, including its increasing use in tire manufacturing, is anticipated to foster market growth during the forecast period.

Cabot Corporation, Orion SA, Birla Carbon, PCBL Chemical, and Tokai Carbon are a few major players in the market. The companies are driving the market through inline organic and inorganic investments, as these companies are capitalizing aggressively to leverage the market's maximum potential.

Global Carbon Black Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 28.86 billion

- 2026 Market Size: USD 30.19 billion

- 2034 Forecast Market Size: USD 41.84 billion

- CAGR: 4.8% from 2026–2034

Market Share:

- Asia Pacific dominated the carbon black market with a 17.587% share in 2026, driven by high tire production and plastic goods manufacturing in China and India, along with growing R&D and product innovation across the region.

- By grade, standard grade is expected to retain the largest market share in 2025, supported by its widespread use in tire and non-tire rubber applications and its cost-effectiveness as a reinforcing agent in industrial goods.

Key Country Highlights:

- United States: The market is projected to reach USD 5.38 billion by 2032, supported by strong demand from tire manufacturing and industrial rubber sectors, including belts, hoses, and vibration control components.

- China: As the largest producer and consumer globally, China’s demand is fueled by extensive tire and plastic goods production, alongside continued industrial expansion.

- Europe: Home to major global tire manufacturers, Europe sustains steady demand for carbon black in high-performance tire production and specialty applications across plastics and coatings.

- Brazil: Brazil leads the Latin America region, with demand driven by tire manufacturing and use of carbon black in plastics, inks, coatings, and construction materials.

- South Africa: The country’s growing automotive industry and expanding use in industrial rubber products support moderate market growth in the Middle East & Africa region.

MARKET DYNAMICS

MARKET DRIVERS

Ongoing Demand for Tires from the Automotive Sector to Boost Market Growth

Demand for carbon black in the rubber industry is largely driven by the growth and development of the automotive tire, commercial tire, and mechanical rubber goods (MRG) industries. There is also an increase in number of replacement and OEM tires produced. Replacement of tires is influenced by the number of miles driven, truck traffic, and vehicle trends. The expanding market for larger vehicles, such as trucks and buses, is further likely to fuel the carbon black market growth over the forecast period. Larger tires will create a greater demand for carbon black as it is a critical ingredient in tire manufacturing and is used to improve the durability and performance of rubber. Currently, there is a growing demand for automobiles from developing countries such as China, India, Vietnam, South Africa, and others. This is increasing the demand for tires, thereby boosting the market growth.

Rising Demand for Specialty Carbon Black to Fuel Market Growth

Specialty carbon black offers a range of unique properties, such as exceptional UV protection and conductivity, that provide critical values to end-users. It is produced through partial combustion of hydrocarbons to meet application-specific functionalities and end-user performance requirements. Specialty compounds with smaller particle sizes offer darker mass tones, excellent jetness, and better UV protection than regular grades, making them suitable for various niche applications. Additionally, it delivers high mechanical performance and physical strength. As a result, it is used in various applications, including molded parts, film and sheet, wire and cable, and pipes. Its unique properties and growing demand from various applications will drive market growth.

MARKET RESTRAINTS

Fluctuating Crude Oil Prices and Stringent Environmental Regulations May Hinder Market Growth

Fluctuating crude oil prices can significantly impact the market as its production relies heavily on oil and natural gas. Price volatility in these commodities can significantly impact manufacturing costs, hampering overall profit margins. In response to oil price changes, manufacturers may change their pricing strategies, which may affect their relationships with existing customers. Hence, these factors can challenge the manufacturers to maintain stable profitability.

Market players are subject to extensive domestic, foreign, federal, state, and local laws and regulations governing environmental protection and occupational health and safety. Certain national and international health organizations have classified carbon black as a possible or suspected human carcinogen. For instance, according to the Climate and Clean Air Coalition, black carbon affects the health of ecosystems in several ways. The environmental regulatory bodies are implementing stringent environmental regulations on activities that may affect the environment. Therefore, stringent environmental laws, especially in developed regions, pose a challenge to traditional manufacturing processes, thus hindering market growth.

MARKET OPPORTUNITIES

Increasing Adoption of Electric Vehicles to Create Beneficial Opportunities for Market Players

The evolution of the automotive industry over the past few years has had a massive impact on Electric Vehicle (EV) production. EVs are designed to replace conventional traveling methods with technological advances, low carbon emission, low maintenance, and smoother drive. According to industry experts, EVs emit 40% less CO2 than combustion cars over a car's lifetime. Additionally, as per the International Energy Agency (IEA), the volume of sales of electric cars was around 10 million worldwide in 2022 and is expected to grow another 35% this year to reach 14 million annually. However, the added battery weight and greater torque of electric vehicles have elevated the tire wear by as much as 30% compared to traditional internal combustion engine vehicles. Consequently, this is leading to an increase in end-of-life tires (EOLTs) throughout an electric vehicle's lifespan. As a result, to address this challenge, the demand for high-performance carbon black is on the rise, which can offer low rolling resistance with increased tread durability. Therefore, the increasing adoption of electric vehicles will create lucrative opportunities for market players during the forecast period.

CARBON BLACK MARKET TRENDS

Rising Product Demand for Manufacturing of Plastic Goods to Drive Market Growth

Carbon black is mainly used in plastics as a conductive filler material, pigment, and particulate reinforcing agent. As a filler, it is used in manufacturing a variety of plastic products such as industrial bags, pipes, photographic containers, films, and stretch wraps. This demand is attributed to its antistatic properties, thermal conductivity, and high strength. Furthermore, it acts as a UV light absorber that aids in protecting plastic from discoloration, chalking, fading, and cracking.

Black color is preferred for most of the electronics produced across the globe. This makes the chemical compound a viable solution for electronic products, including computers, televisions, laptops, and smartphones, thus increasing the product demand from the electronic industry. These factors collectively boost product consumption in the manufacturing of plastic goods and are anticipated to fuel market growth.

Transition Toward Sustainability and Recycled Carbon Black (rCB) to Fuel Market Growth

Sustainable development requires an integrated approach that takes into consideration environmental concerns along with economic development. As the world shifts toward a greener and more sustainable future, the role of recycled carbon black (rCB) is becoming more crucial in powering this transformation. rCB is a sustainable alternative to virgin carbon black (vCB) and can be made from 100% used tires or rubbers. It serves similar application areas as cVB, including rubber, plastics, and coatings. Adoption of rCB will reduce carbon emissions and conserve the raw materials used to produce vCB. Owing to these benefits, there's a growing demand for bio-based and rCB, driven by consumer and regulatory focus on sustainability. Companies such as Bolder Industries, Black Bear Carbon, Recovered Carbon Black, and many others are leading this trend. Therefore, the transition toward sustainability and rCB is set to reshape the market.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic adversely impacted business operations in numerous ways, including the temporary suspension of production, which caused disruptions in the supply chain. Lockdown measures, economic uncertainty, and reduced consumer spending decreased sales of vehicles, building materials, and electronic devices, leading to lower demand for tires and rubber goods, resulting in lower sales in the market.

However, as lockdowns eased up by the fourth quarter of 2020, the demand and prices increased considerably, owing to strong growth from the tire industry. By 2021, after the pandemic, 40% of advanced economies had recovered and, in a few cases, exceeded the 2019 output levels. A similar trend was observed in the market, where demand spiked in 2021, which surged the prices, providing high-profit margins to the manufacturers.

TRADE PROTECTIONISM AND GEOPOLITICAL IMPACT

The impact of trade on the chemical compound is significant, primarily as its production is considered an emission-intensive industry, depicting that international trade can lead to "carbon leakage," where countries with stricter environmental regulations may import carbon-intensive products from regions with lesser standards. Such a scenario can potentially contradict the efforts of nations that are trying to reduce their emissions, which can also affect the competitiveness of producers depending on the carbon pricing policies in different regions. As a result, global trade dynamics can significantly influence product prices.

Segmentation Analysis

By Process

Furnace Black Dominated the Market Owing to the Surging Demand from Rubber Producers

On the basis of process type, the market is segmented into furnace black, acetylene black, thermal black, and others.

Furnace black held a dominant global carbon black market share of 79.86% in 2026. This type of product is produced by unfinished petroleum oil or coal oil combustion using an oil furnace. The process allows mass production with different particle structures and sizes. Additionally, it is greatly utilized as a strengthening agent in rubber production.

The thermal black segment is the second largest segment in the global market. The growth is attributed to its UV absorbent properties, which propels its demand in the plastic industry.

Acetylene black is produced from acetylene gas using a thermal decomposition process. The product’s extreme conductivity and high purity aid its usage in producing silicon products, electric power cables, and dry cells.

Other production methods include gas black, lamp black, channel black, and pyrolyzed tire char—rCB, which contribute mainly to the specialty black sector and are utilized for a few specific and niche applications.

By Grade

Standard Grade Segment Held a Dominant Share Due to Its Increasing Industrial Applications

Based on grade, the market is bifurcated into specialty grade and standard grade.

The standard segment accounted for a major market share in 2024 and will likely continue its dominance during the forecast timeframe. Demand for standard-grade products is anticipated to grow due to their massive utilization in tire and non-tire rubber applications. Standard grade is the most widely used and cost-effective rubber reinforcing agent in tire and non-tire applications. It is also used in a diverse group of materials to enhance their physical, electrical, and optical properties, which will drive its demand moderately during the forecast period. The segment is expected to dominate the market share of 11.43% in 2026.

The specialty grade segment is anticipated to have a significant growth rate due to its increasing use in ink & toners and plastic industries. This segment is anticipated to forecast a CAGR of 6.9% during the forecast period. This type is used in a variety of applications, including coatings, polymers, and printing industries, and in special applications, driving its demand at a significant rate.

By Application

To know how our report can help streamline your business, Speak to Analyst

Tire Segment Dominated the Market Due to Higher Product Demand from the Automotive Industry

Based on application, the market is segmented into tire, non-tire rubber, inks & toners, plastics, and others.

The tire segment is likely to dominate the market share by 61.31% in 2026. The product accounts for about 30% of the overall weight of a tire produced. Moreover, decent growth in the automotive industry has fueled the consumption of tires, contributing to growing product demand. It is a crucial reinforcing agent and pigment used in tire manufacturing, enhancing strength, durability, and resistance to wear and tear. It also acts as a UV stabilizer, absorbing and dissipating harmful UV rays that can cause tires to crack and deteriorate over time. Such significant advantages and consistent demand for tires will drive the segment's growth significantly during the forecast period.

The non-tire rubber segment is anticipated to showcase significant growth, owing to the usage of the product as a shock absorbent and reinforcing material in the manufacturing of several industrial rubber goods. Industrial rubber products, such as conveyor belts, soles of shoes, rubber roofing, rubber mats, seals, hoses, gaskets, and cables, primarily consist of carbon black.

The demand for black pigment from the end-users, such as printing inks, plastics, paints, and coatings, is expected to increase due to consumer preference for black-colored products. This will increase the product consumption as a pigment in plastics and ink & toner applications.

The plastics segment is likely to capture CAGR of 5.9% during the forecast period.

CARBON BLACK MARKET REGIONAL OUTLOOK

The market is studied across the regions, including North America, Latin America, Europe, the Middle East & Africa, and Asia Pacific.

Asia Pacific

Download Free sample to learn more about this report.

The Asia Pacific market size stood at USD 16.77 billion in 2025 and is predicted to dominate the global market during the forecast period. In 2023, the market value led the region by USD 4.24 billion. China is the largest producer and consumer of this product. The market growth in China is attributed to the increasing use of the product in tire and plastic goods production. Furthermore, rising research & development activities, coupled with advancements in the product, will boost the consumption of the product in the region. The market value in China is expected to be USD 9.14 billion in 2026.

On the other hand, Japan is projecting to hit USD 2.52 billion and India is likely to hold USD 1.98 billion in 2026.

Asia Pacific Carbon Black Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America region is to be anticipated the third-largest market with USD 5.02 billion in 2026. The market growth is attributed to the rising adoption of specialty grades in ink & toner applications. Further, the rising use of furnace black in belts, vibration isolation devices, air springs, and hoses will fuel the market growth in this region. In North America, the U.S. is identified as the largest market, with a projected market size of USD 5.73 billion by the end of 2032. The U.S. market size is estimated to reach USD 4.44 billion in 2026.

Europe

Europe is anticipated to account for the second-highest market size of USD 5.31 billion in 2026, exhibiting the second-fastest growing CAGR of 4% during the forecast period. Europe is the hub for many major leading tire manufacturers, and it dominates tire production on a global scale. Companies such as Michelin (France), Continental (Germany), Nokian (Finland), Trelleborg (Sweden), Prometeon (Italy) and others. The presence of such prominent manufacturers creates significant demand for the product, as it is a crucial ingredient in tire production. The market value in U.K. is expected to be USD 0.57 billion in 2026.

On the other hand, Germany is projecting to hit USD 1.41 billion and France is likely to hold USD 0.84 billion in 2025.

Latin America

The Brazil market dominates the Latin America region. The Brazilian industry is primarily focused on the tire manufacturing sector, with a significant portion of the product used in the production of rubber goods, plastics, inks, coatings, and building materials. The country's growing automotive industry and overall economic development will drive the nation’s market growth moderately. Latin America region is to be anticipated the fourth-largest market with USD 1.25 billion in 2026.

Middle East & Africa

The market in the Middle East is primarily driven by the growing automotive sector, with a significant focus on tire production, leading to a high demand as a key component in tire manufacturing. With countries implementing various strategies to expand their economies, a progressive environment is being created for market growth. South Africa is experiencing growth due to a combination of factors, including a thriving automotive industry and expanding industrial rubber applications. The GCC market size is estimated to be USD 0.35 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Capacity Expansion to be the Key Strategy of Leading Companies

Capacity expansion is an important strategy employed by key market leaders, such as Cabot Corporation and Orion Engineered Carbons S.A., to maintain their positions in the market. Market players are adopting strategies such as product diversification, sustainable practices, and strategic alliances to maintain their competitive edge and cater to evolving market demands. Particularly key players are investing in expanding their manufacturing capacities, in high-growth regions such as India and China. For instance, prominent players such as Cabot Corporation and Birla Carbon Black Company have expanded their production bases across the globe with 42 and 17 manufacturing facilities respectively. Such strong strategic initiatives will keep stirring the market growth during the forecast period.

LIST OF KEY CARBON BLACK COMPANIES PROFILED

- Cabot Corporation (U.S.)

- Birla Carbon Thailand Public Co. Ltd. (Thailand)

- Orion Engineered Carbons SA (Germany)

- Ralson Carbon Company (India)

- Coraplus PTE. LTD. (Singapore)

- Phillips Carbon Black Limited (India)

- Omsk Carbon Group (Germany)

- OCI COMPANY Ltd. (South Korea)

- Himadri Speciality Chemicals Ltd. (India)

- Longxing Chemical Industry Co., Ltd. (China)

- TOKAI CARBON CO., LTD. (Japan)

KEY INDUSTRY DEVELOPMENTS

- May 2023: Orion Engineered Carbons expanded its production capacity for gas black in Germany. With this capacity expansion, the company strengthened its leadership in the specialty carbon black market.

- December 2022: International CSRC Investment Holdings Co., Ltd has a short-term (2022-2024) goal to invest in research & development to develop various types of specialty carbon blacks such as antistatic, static dissipative, and conductive carbon blacks. This strategic product development will allow the company to increase its share in the global market.

- October 2021: Cabot Corporation launched VULCAN 3-LP carbon black, a new low Polycyclic Aromatic Hydrocarbon (PAH) product for rubber applications. The launch would help the company demonstrate its ongoing commitment to providing innovative solutions in response to the product performance needs of its customers.

- June 2021: Orion Engineered Carbons S.A. launched ECORAX Nature, a new renewable carbon black product for rubber applications. The solution is produced using plant-based oils of industrial-grade that are non-fossil derived and renewable.

- May 2021: Birla Carbon partnered with Circle, a key producer of Sustainable Carbonaceous Materials. The partnership will create the single largest source of Sustainable Carbonaceous Materials for the tire, mechanical rubber goods, and plastic industries.

REPORT COVERAGE

The global market research report provides detailed market analysis and focuses on crucial aspects such as leading companies, processes, grades, and applications. Also, the report offers insights into market trends and highlights vital industry developments and the competitive landscape. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.8% from 2026-2034 |

|

Unit |

Volume (Kilotons), Value (USD Billion) |

|

Segmentation |

By Process

|

|

By Grade

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 30.19 billion in 2025 and is projected to reach USD 41.84 billion by 2034.

Growing at a significant CAGR of 4.8%, the market will exhibit considerable growth over the forecast period (2026-2034).

Based on the process, the furnace black segment led the market in 2025.

The growth of the automotive industry is the key factor driving the market.

Based on application, the tire segment is leading the market.

China held the largest share of the global market in 2025.

Increasing product demand from tire applications and rapid growth in the plastic and automotive industries are anticipated to drive the adoption of the product.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us