Dental CAD/CAM Market Size, Share & Industry Analysis, By Product (Equipment {Milling Machine, Scanners, and Others} and Software), By Type (Chair-side and Laboratory), By End-user (Dental Hospitals & Clinics, Dental Laboratories, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

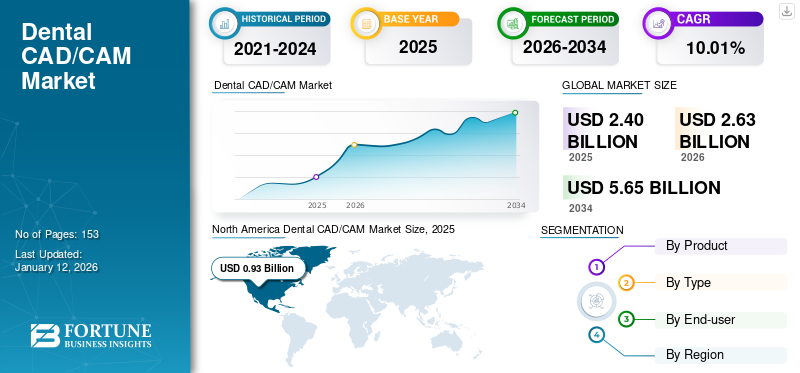

The global dental CAD/CAM market size was valued at USD 2.4 billion in 2025 and is projected to grow from USD 2.63 billion in 2026 to USD 5.65 billion by 2034, exhibiting a CAGR of 10.01% during the forecast period. North America dominated the dental cad/cam market with a market share of 38.76% in 2025.

Dental CAD/CAM system involves the use of computer-aided design to manufacture and advance the creation of dental restorations, such as bridges, crowns, veneers, fixed dental, inlays & onlays, and prostheses, including dental implants, among others. It involves the combination of software and machinery to design and fabricate dental prostheses with precision and efficiency. The advanced technology offers several benefits, such as faster treatment, improved accuracy, stronger, more durable restorations, and better patient outcomes.

The growth of the market is highly influenced by the rising prevalence of dental disorders worldwide. Moreover, the rising adoption of chair-side dental CAD/CAM systems, growing awareness about modern technologies to design dental prostheses accurately, and increasing disposable incomes are the significant factors expected to surge the global dental CAD/CAM market growth.

- For instance, according to the World Health Organization (WHO), in March 2023, an estimated 2.0 billion individuals and 514.0 million children suffered from caries of primary teeth. Due to these tooth conditions, individuals face the need for quicker treatment with advanced equipment. As a result, the demand for dental CAD/CAM equipment is expected to increase, thereby propelling the market.

The outbreak of the COVID-19 pandemic had a negative impact on the dental CAD/CAM industry due to the postponement of elective dental procedures. Several companies experienced a decline in revenue for dental CAD/CAM scanners and visualization software in 2020 due to lower demand for intraoral scanners and related software. For instance, according to the NHS, the number of individuals seeking routine dental services in England decreased by 0.3 million in April 2020 compared to 2.4 million in March 2020.

However, the relaxation of lockdown restrictions and implementation of several safety measures for dental treatments, along with the advancement in CAD/CAM technology, normalized the market in 2021. However, the market declined in 2022 & 2023. This decline is evident from the decreased revenue of companies operating in the market. For instance, in the third quarter of 2023, Patterson Companies, Inc. reported a decline of 4% year-over-year in the dental segment internal sales. This decline was primarily due to a decline in digital and CAD/CAM technology products.

Despite these declining revenues from the companies, the market growth is expected to normalize in the coming years, driven by technological advancements, CAD/CAM product launches, and increasing investments.

Dental CAD/CAM Industry Landscape Overview

Market Size & Forecast:

- 2025 Market Size: USD 2.4 billion

- 2026 Market Size: USD 2.63 billion

- 2034 Forecast Market Size: USD 5.65 billion

- CAGR: 10.01% from 2026–2034

Market Share:

- Region: North America dominated the dental CAD/CAM market with a 38.76% share in 2025, driven by increasing digitalization of dental practices, rising number of practicing dentists, and widespread adoption of advanced CAD/CAM technologies.

- By Type: The chair-side CAD/CAM systems segment held the largest market share in 2026, attributed to faster restoration turnaround, improved patient outcomes, and rising adoption among solo dental practitioners and large dental groups.

Key Country Highlights:

- Japan: Demand is growing due to the country’s aging population, increased prevalence of dental diseases, and national focus on precision and digital technology in healthcare. The expansion of high-tech dental clinics is also accelerating CAD/CAM adoption.

- United States: The presence of over 200,000 active dentists and increasing investments in AI-integrated CAD/CAM tools are driving rapid adoption. The trend toward chair-side restorations and single-visit dental procedures is significantly contributing to market growth.

- China: The expanding dental infrastructure and rising middle-class population are fueling demand for digital dental treatments. Government-supported initiatives like the National Oral Health Programme are boosting awareness and utilization of CAD/CAM solutions.

- Europe: Growth is fueled by aging demographics, widespread reimbursement for dental restorations (especially in countries like Germany and France), and rising demand for aesthetic dental solutions, all of which are pushing adoption of digital dentistry technologies such as CAD/CAM.

Dental CAD/CAM Market Trends

Growing Adoption of Chair-side CAD/CAM Systems to Surge the Market Growth

In recent years, chair-side CAD/CAM systems have been trending due to the proven evidence of effectiveness and accuracy for restoration of design associated with these systems. Moreover, the benefits associated with these systems include better patient comfort, reduced number of appointments needed, reduced procedure time, reduced risk of infection, and improved quality of treatment.

In addition, the chair-side CAD/CAM systems also offer a competitive advantage to dental professionals by allowing them to provide digital services more rapidly. As a result, a large number of dentists are increasingly adopting chair-side CAD/CAM systems. Moreover, the major dental companies are highly involved in promoting the advantages of chair-side CAD/CAM systems and educating dental professionals about the capabilities of these systems. Therefore, the adoption of these systems is increasing from large dental groups to individual practitioners.

Download Free sample to learn more about this report.

Dental CAD/CAM Market Growth Factors

Rising Significance of Cosmetic Dentistry to Fuel Demand for Digital Equipment Drives Market Expansion

Cosmetic dentistry growth is propelled by various factors, such as increasing dental care spending and beauty standards. This led to a high demand for procedures, including veneers, crowns, teeth whitening, and invisible braces. These procedures rely on CAD/CAM technology for design and fabrication, which is expected to fuel the demand for CAD/CAM systems, thereby spurring market growth.

- For instance, according to West Hollywood Holistic Dental Care, in August 2021, around 15.0 million individuals in the U.S. underwent bridge or crown placement procedures.

- For instance, according to the American College of Prosthodontists, in January 2024, nearly 2.3 million implant-supported crowns are produced in the U.S. every year.

The considerably increasing population opting for an extensive range of cosmetic dentistry procedures is predicted to boost the demand for well-defined intraoral scanners to reduce the scanning time. The digital impressions taken with intraoral scanners are more comfortable for patients compared to the traditional method, increasing the adoption of these devices in the upcoming years. These factors, along with the introduction of advanced intraoral scanners by prominent players, result in higher adoption of these devices, which is estimated to boost the global dental CAD/CAM market growth in the coming years.

Growing Adoption of Digital Dentistry to Propel the Demand for CAD/CAM Solutions

CAD/CAM solutions play a crucial role in digital workflow for manufacturing and designing dental prosthesis. The use of CAD/CAM technology in prosthodontics allows for digital design and fabrication of crowns, bridges, and veneers, offering more accurate fits and superior aesthetics. Hence, the increasing acceptance of digital dentistry propels the demand for CAD/CAM systems.

The use of digital scanners and CAD/CAM (computer-aided design/computer-aided manufacturing) machines have been employed in various dental clinics and medical facilities, allowing dentists to implement modern dental treatment approaches. Such modernization of dental practices and the growing adoption of the latest technology in dentistry are poised to augment the market growth.

- For instance, in June 2023, according to the NCBI, a total of 40.9% of respondents in India have used CAD/CAM for 0 to 5 years in their practice.

Moreover, digital dentistry facilitates the planning for dental implant surgery through computer-guided surgery. CAD/CAM technology allows for precise placement of implants, improving patient comfort. In addition, it assists in designing surgical guides and also reduces the risk of complications. These benefits of CAD/CAM systems in dental implantation procedures increase their adoption, spurring market growth.

RESTRAINING FACTORS

Expensive Dental CAD/CAM Systems in Emerging Countries to Hamper the Market Growth

Recently, there have been a number of innovations in CAD/CAM systems to achieve the best results. Despite the several innovations in this system regarding accuracy and efficiency, the initial cost of the software and equipment is quite high. The high cost of this equipment has limited its adoption in emerging countries, such as China, India, and Brazil, thereby hampering the market growth.

- For instance, according to All3DP, in September 2023, the average price of a complete CAD/CAM system was between USD 90,000.0 and USD 112,000.0, which includes the cost of a milling machine, CAD/CAM scanner, and associated software.

In addition, various countries lack reimbursement policies for dental procedures as these procedures do not fall under essential health services by government agencies and insurance companies. Therefore, the reimbursement policies for these procedures are not readily available. In such a scenario, high costs and limited reimbursement are expected to restrict the market growth during the forecast period.

Dental CAD/CAM Market Segmentation Analysis

By Product Analysis

Equipment Segment Accounted for Largest Share Fueled by the Growing Concerns of Oral Health

Based on product, the market is segregated into equipment and software. The equipment is further sub-segmented into milling machines, scanners, and others.

The equipment segment accounting for 76.23% market share in 2026. The major factor influencing the segment growth is the growing demand for digital dentistry. CAD/CAM dental systems enable the digital veneering workflow and automate the production and quality standardizations of dental restorations, contributing to the increasing demand for digital dentistry. In addition, the increase in the incidence of dental caries, the growing concern for oral health, and the rising number of aged individuals also contribute to the growth of the equipment segment.

Furthermore, the equipment segment is sub-categorized into milling machines, scanners, and others. Dental milling machines enable the creation of highly personalized veneers, crowns, and other prosthetics that match patient-specific needs, driving the demand for these products. Scanners play a crucial role in capturing precise digital impressions of patient’s teeth and gums, which further aids in designing and fabricating restoration using CAD/CAM technology.

The software segment is projected to expand at a substantial rate during the forecast period. The segment growth is attributed to the increased focus of prominent players on the introduction of an advanced version of the software for CAD/CAM systems. For instance, exocad GmbH, a dental CAD/CAM software provider, in July 2022, introduced DentalCAD 3.1 Rijeka, a next-generation CAD software for labs and full-service clinics. Moreover, the increase in the research & development investments by the major companies for the advancement of premium software is projected to fuel the segment growth over the forecast timeframe.

To know how our report can help streamline your business, Speak to Analyst

By Type Analysis

Chair-side Segment Dominated the Market Owing to its High Demand

By type, the market is segmented into chair-side and laboratory.

Among the types, the chair-side segment dominated the global market in 2024. This growth is mainly attributed to the operational and distinct advantages offered by the chair-side systems. These benefits include reduced procedure time, better patient satisfaction, and improved quality. The benefits have led to the preferential shift of healthcare providers' chair-side systems, driving the segment growth. Furthermore, the advancement in chair-side CAD/CAM systems, increasing their availability, is anticipated to boost the market growth during the forecast timeframe.

- For instance, in April 2023, exocad GmbH announced the launch of ChairsideCAD 3.1 Rijeka, the latest version of its CAD software for single-visit restorations. This helped in the customization of tooth abrasion in real-time and provided the clinicians with the ability to reuse anatomical designs for multiple restorations, which is expected to increase the adoption of the product, thereby boosting segment growth.

The laboratory segment is expected to expand at a substantial growth rate during the projected period. The laboratory segment with a share of 50.44% in 2026. The rising preference toward laboratory systems, especially in emerging countries due to the introduction of new laboratory CAD/CAM systems, is expected to boost segmental growth. For instance, in December 2022, PLANMECA OY introduced Planmeca PlanMill 60 S. The device is a milling unit specifically designed to serve in dental laboratories.

By End-user Analysis

Dental Hospitals & Clinics Segment Held the Majority Share Owing to Rising Number of Dentists

On the basis of end-user, the market is categorized into dental laboratories, dental hospitals & clinics, and others.

In 2024, the dental hospitals & clinics segment dominated the market owing to factors, such as the growing number of dentists in dental service organizations, the consolidation of dental clinics in developed nations, and solo practices within hospitals and clinics. Furthermore, the rising number of patients visiting hospitals & clinics is anticipated to boost the demand for CAD/CAM technology, consequently fueling market expansion.

The dental laboratories segment is expected to grow at a substantial rate during the forecast period. The dental laboratories segment contributing 45.63% globally in 2026. This growth is primarily influenced by the dental laboratories offering valuable services to their clients. Moreover, a number of dentists are outsourcing their fabrication of restorations to dental labs, which is also expected to boost the segment growth.

The others segment is expected to grow at a moderate CAGR during the forecast timeframe. The growth is attributed to the growing demand for digital dentistry, which is expected to increase the adoption of scanners and software in academic institutions. This increased adoption is expected to propel the segmental growth.

REGIONAL INSIGHTS

North America

North America Dental CAD/CAM Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global dental CAD/CAM market share with a revenue of USD 1.02 billion in 2026. This noteworthy revenue is primarily attributed to the growing digitalization in the dental field. Moreover, the strong presence of key market players in this region is expected to propel North American market growth in the coming years. The U.S. market is valued at USD 0.95 billion by 2026.

For instance, according to the American Dental Association (ADA), IN 2023, there were 202,304 active dentists, which was 201,927 in 2021 in the U.S. Such a large number of dentists is expected to propel the adoption of these devices.

Europe

Europe is anticipated to be the second-largest region in terms of market revenue. The increasing number of aged individuals prone to dental diseases is a significant factor driving the market growth in the European region. Moreover, the favorable insurance coverage for dental restoration in Germany, France, and other countries in Europe is expected to spur the market growth of this region. The UK market is valued at USD 0.11 billion by 2026, and the Germany market is valued at USD 0.22 billion by 2026.

Asia Pacific

The Asia Pacific is expected to expand at the highest growth rate during the forecast period. The rising number of dental clinics, and consolidation among these settings in countries, such as China, India, and Japan, is expected to drive market growth, increasing the adoption of technologically advanced digital dentistry solutions. Moreover, the increasing investments by private organizations and government initiatives to raise awareness of oral health are significant factors driving the market growth in the region. The Japan market is valued at USD 0.12 billion by 2026, the China market is valued at USD 0.14 billion by 2026, and the India market is valued at USD 0.05 billion by 2026.

For instance, in February 2024, according to the Ministry of Health & Family Welfare, the Government of India initiated a National Oral Health Programme to deliver combined and inclusive oral health care in the existing healthcare facilities.

The market in Latin America and the Middle East & Africa is estimated to grow significantly due to the strong distribution network of key market players integrated with the introduction of advanced systems in Brazil, the UAE, and Saudi Arabia. Furthermore, the increasing healthcare spending and growing medical tourism in the region is anticipated to augment the market growth.

List of Key Companies in Dental CAD/CAM Market

Comprehensive Product Portfolios with an Extensive Range of Premium CAD/CAM Software by Prominent Players to Fuel Market Expansion

The market is vastly fragmented, with the presence of a few major players, including Align Technology, Inc., Dentsply Sirona, and Institut Straumann AG. These companies are continuously focused on implementing strategies, including partnerships, collaboration, and acquisition, to increase their brand presence and customer base. As a result, these companies account for a significant dental CAD/CAM market share in 2024.

Other market players, such as 3Shape A/S, are focusing on updating their existing CAD/CAM software in order to boost their brand presence in the untapped market. For instance, in December 2021, 3Shape A/S announced the launch of the 3Shape Dental System. The system helped in smooth workflow with the addition of features, such as real-time communications and auto case status update timeline.

Other players, such as Medit Corp., PLANMECA OY, YENADENT, and Axsys Dental Solutions, through their strategic development for the introduction of novel products and penetration in various emerging countries, are expected to propel their presence in the market.

LIST OF KEY COMPANIES PROFILED:

- Align Technology, Inc. (U.S.)

- Dentsply Sirona (U.S.)

- Axsys Dental Solutions (U.S.)

- Medit Corp. (South Korea)

- Institut Straumann AG (Switzerland)

- PLANMECA OY (Finland)

- 3Shape A/S (Denmark)

- YENADENT (Turkey)

KEY INDUSTRY DEVELOPMENTS:

- December 2023 - exocad GmbH introduced DentalCAD 3.2 Elefsina, the latest version of its globally renowned CAD software for labs and full-service clinics. This version is integrated with over 60 new features for more automation and speed.

- May 2023 - Glidewell partnered with Overjet to utilize Overjet’s AI technology in the dental practice. Overjet’s AI solution paired with the glidewell.io In-Office Solution, an AI-driven chairside CAD/CAM system for restorative treatment with enhanced accuracy.

- April 2023 - HASS, a manufacturer of CAD/CAM in South Korea, partnered with imes-icore and Pritidenta to produce their first aesthetic and innovative nano-lithium disilicate CAD/CAM disc, Amber Mill Disk. The partnership with imes-icore enabled the effective milling of the discs to fabricate several restorations simultaneously, while a partnership with Pritidenta helped to manage the incorporation into the existing CORiTEC material portfolio.

- March 2023 - PLANMECA OY introduced new AI-based tools for Planmeca Romexis. This software platform supports a versatile range of 2 Dimensional and 3 Dimensional imaging and CAD/CAM work and provides a complete solution for all specialties and clinics of all sizes.

- February 2023 – HASSBio America entered into a strategic partnership with Roland DGA Corporation to combine Roland DGA Corporation's state-of-the-art DWX-42W wet milling solution with its newly launched Amber Mill Direct. This combined solution allowed dental practices to deliver chairside restorations within one hour.

REPORT COVERAGE

The global dental CAD/CAM market report covers a comprehensive analysis of the market segments such as products, types, end-users, and presence of major market players. Further, this report provides insights into the market trends a market analysis based on key players, and highlights the key industry developments. Additionally, to the factors mentioned above, the research report covers a number of factors that have propelled the global market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.01% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product

|

|

By Type

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 2.63 billion in 2026 and is projected to reach USD 5.65 billion by 2034.

The market will exhibit steady growth at a CAGR of 10.01% during the forecast period (2026-2034).

By product, the equipment segment led the market.

The increasing prevalence of dental disorders, growing awareness of aesthetic dentistry, rising geriatric population, and significant technological advancements are the key drivers for market growth.

Align Technology, Inc., Dentsply Sirona, and Institut Straumann AG are the top players in the market.

North America dominated the market in 2026.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us