Digital Pathology Market Size, Share & Industry Analysis, By Product (Hardware (Scanners, Tissue Microarrayer, and Others), Software (Pathology Management, Digital Microscopy Viewers, Image Analyzers, and Others), and Storage Systems), By Application (Disease Diagnosis, Drug Discovery, and Others), By End-user (Hospitals & Clinics, Clinical Laboratories, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

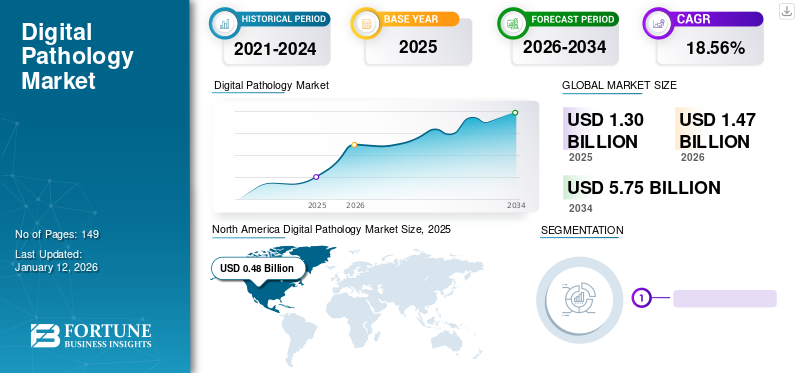

The global digital pathology market size was valued at USD 1.3 billion in 2025 and market is projected to grow from USD 1.47 billion in 2026 to USD 5.75 billion by 2034, exhibiting a CAGR of 18.56% during the forecast period. North America dominated the market with a share of 36.74% in 2025. Moreover, the U.S. digital pathology market size is projected to grow significantly, reaching an estimated value of USD 1.30 billion by 2032, driven by growing digitization in pathology workflow.

Digital pathology is a field that utilizes digital tools to collect, interpret, analyze, and share information. Digital slides are created from either a whole slide scanning device from previously prepared devices or directly with a digital microscope. The digital slide is then further used for analysis through high throughput algorithms, shared Over the Air (OTA), or stored for future use.

The rising prevalence of chronic diseases and increasing hospital admissions for treatment are supporting the demand for pathology tests. Furthermore, rising workload is anticipated to drive adoption of digital tools in the traditional pathology ecosystem. Moreover, the rising applications of these devices in modern medicine and growing awareness of novel diagnostics are expected to increase the patient pool for diagnosis and support market growth.

- For instance, according to an article published by Express Healthcare in 2022, the incorporation of digital tools by pathologists increased the productivity and overall efficiency by 15% as compared to traditional pathology workflows. Therefore, key advantages, such as reduced workload and increased efficiency are anticipated to augment the global digital pathology market growth.

The COVID-19 pandemic accelerated the market progress due to a considerable rise in the digitization of pathological systems. The market’s growth was also attributed to the significant spike in the adoption of these devices, favorable regulations for emergency use cases, and decline in in-person visits to pathologists and physicians. The global market witnessed a growth rate of 31.2% in 2020 as compared to 11.6% in 2019. Frequent lockdowns and social distancing rules were enforced by governments to control the spread of the Coronavirus, which led to a significant reduction in the number of in-person patient consultations.

- For instance, in April 2020, the U.S. FDA enforced a policy for digital pathology devices during the pandemic. Through this policy, the organization expanded the availability of pathology devices for remote reviewing and reporting of scanned digital images of pathology slides.

However, in 2021, the patient volume bounced back to its pre-pandemic levels owing to higher vaccination coverage among the general population. The market was estimated to witness a strong growth rate in 2022, and might record a significant CAGR during the forecast period due to strong adoption of these products and services.

Digital PathologyIndustry Landscape Overview

Market Size & Forecast:

- 2025 Market Size: USD 1.3 billion

- 2026 Market Size: USD 1.47 billion

- 2034 Forecast Market Size: USD 5.75 billion

- CAGR: 18.56% from 2026–2034

Market Share:

- North America dominated the global digital pathology market with a 25.47% share in 2025, driven by a strong digital infrastructure, increasing prevalence of chronic diseases, and early adoption of AI-powered pathology solutions.

- By product type, hardware held the largest share in 2024, attributed to the growing demand for high-throughput scanners and tissue microarrayers in clinical and research laboratories. Among hardware subtypes, scanners are projected to witness the fastest growth due to rapid technological advancements and high demand for timely pathology outcomes.

Key Country Highlights:

- The U.S. is projected to reach USD 1.30 billion by 2032. Growth is supported by robust investments in healthcare digitization, favorable FDA policies (such as remote digital pathology approvals during COVID-19), and increasing partnerships between AI companies and healthcare institutions.

- Japan’s market is driven by adoption of advanced digital pathology tools in academic research and government initiatives supporting AI in healthcare. Companies like Hamamatsu Photonics play a key role in delivering high-resolution scanners tailored for Japanese medical institutions.

- China's market growth is fueled by expanding healthcare infrastructure, rising chronic disease burden, and increased adoption of digital diagnostic tools in hospitals and research centers. Government support for AI and healthcare digitization under national health reforms further boosts market growth.

- Europe holds the second-largest market share in 2024. Growth is driven by regulatory approvals, product innovations (e.g., VENTANA DP 600 slide scanner), and increasing preference for AI-assisted pathology. Patents and collaborations, such as those by Roche and Visiopharm, further enhance regional competitiveness.

Digital Pathology Market Trends

Integration of Artificial Intelligence Will Transform Market

Increasing adoption of Artificial Intelligence-based digital tools by key consumers owing to a higher demand for workflow management is a key trend in the global market. The rising focus of major companies involved in patenting innovative technology on offering a customized platform for key stakeholders provides them with a competitive advantage in the market. Additionally, key manufacturers involved in developing solutions using machine learning and AI are expected to support the increasing demand for advanced pathology solutions, thereby fueling market growth.

- For instance, in December 2021, F. Hoffmann-La Roche Ltd. launched three Artificial Intelligence (AI)-based digital pathology algorithms for deep learning image analysis. The algorithms were Research Use Only (RUO) and developed to help pathologists in evaluating breast cancer markers, Ki-67, ER, and PR.

Furthermore, several companies are focusing on getting regulatory approvals for AI-integrated medical devices to launch products on the market and enhance operations in pathology.

- For instance, in September 2023, Medtech company Sigtuple received the U.S. FDA approval for its blood smear application. This device is used in AI-assisted digital microscopy.

Moreover, strategic initiatives to develop and standardize sharing platforms to enable seamless transfer of data across the industry are anticipated to support the adoption of Artificial Intelligence in pathology and, subsequently, the growth of the market.

- For instance, according to an article published by the MDPI Cancers in 2022, several platform developers, such as Leica Biosystems Imaging, Inc. use Convolutional Neural Network (CNN) as a base algorithm to develop a platform based on deep learning.

- North America witnessed a growth from USD 0.37 Billion in 2023 to USD 0.42 Billion in 2024.

Download Free sample to learn more about this report.

Digital Pathology Market Growth Factors

Rising Burden of Chronic Disorders to Drive Market Progress

Higher incidence of chronic diseases and subsequent increase in the number of tests are estimated to support the product adoption. Increasing product adoption, along with rising efforts of market players to cater to the growing need for diagnostics, is anticipated to drive the growth of the market. Moreover, increasing applications of these platforms, such as in predictive analysis are expected to augment market growth.

- For instance, in April 2022, PreciseDx announced the launch of its digital platform, which can accurately diagnose Parkinson's disease (PD) in patients before the onset of severe symptoms.

Such product launches will support the increasing demand for these systems with added benefits of machine learning.

Moreover, increasing approval for digital tools is expected to boost the adoption of these devices, thereby augmenting the market growth. Additionally, increasing research programs funded by governments to support innovation in digital tools in pathology is anticipated to drive market growth.

- For instance, in March 2022, the U.S. Food and Drug Administration (FDA) awarded Inspirata clearance for its Dynamyx software for primary diagnosis in place of a traditional glass slide. The clearance improved the distribution of the software in the U.S. and provided an open platform for compatibility with scanners available across the industry.

Growing Digitization in Pathology Workflow to Propel Market Progress

The increasing demand for digitization in pathology has given rise to competition among key players in the market. This factor combined with the rising need for drug discovery through the use of high through-put algorithms in the market has prompted major players to invest in developing novel tools to streamline their workload and customize their solutions.

- For instance, in March 2022, Nucleai announced that it had secured a Series B funding of USD 33 million. The company is a developer of an AI-powered pathology platform aiming to predict a patient's response to various treatments. The investment was expected to support the company's continued development of its platform and expand its presence amongst biopharma companies and contract research organizations.

Rising investments by domestic companies and industry stakeholders to launch novel tools, along with the rising number of product launches to cater to the increasing demand for digitalizing diagnostic tools, is anticipated to support the growth of the market.

RESTRAINING FACTORS

High Upfront Costs for Installation of Devices to Hamper Market Growth

Although incorporating and utilizing these systems in modern medicine has its benefits and applications in pathology, digitization of tools incurs a high upfront cost for installation and training to use those systems to regularize the workflow. Digital devices are expensive and require software to analyze, share, and store the data, which may either incur individual costs or be part of an end-to-end full-system product offering.

- For instance, according to an NCBI article published in 2022, the list price of the digital pathology scanners is around USD 100,000 to USD 400,000. Apart from the listed price, integration of digital solutions in pathology also comprises the cost of training pathologists & staff, technical support, digital slide storage systems, and regulatory or licensing costs.

Furthermore, small and even mid-sized pathology laboratories can hardly afford whole slide images (WSI) due to the huge price of high-throughput scanners. On average, WSI cost about USD 237,000 per piece worldwide as of 2020.

In recent years, an increasing number of pathologists are retiring as compared to the number of pathologists joining the workforce. This factor has directly affected the market due to an acute shortage of pathologists. Thus, the high cost of these pathology tools and its installation has decreased the number of consumers adopting and training for these systems, thereby affecting the market adversely.

- For instance, according to an article published by Vachette Pathology in 2022, the total net deficit of pathologists per 100,000 people was found to be 5,700. Moreover, the total number of pathologists is expected to grow by 8.1% to suffice the rising need for pathologists among the patient population. The reduced number of pathologists is anticipated to affect the market negatively.

Digital Pathology Market Segmentation Analysis

By Product Analysis

Digital Pathology Hardware to Witness Robust Adoption Owing to Strong Demand for Timely Pathology Outcomes

Based on product, the market is segmented into hardware, software, and storage systems. The hardware segment is projected to dominate the market with a share of 58.10% in 2026. Rise in the number of laboratories performing in-vitro tests and increasing need for timely outcomes are responsible for the growing demand for hardware products, which is anticipated to drive the segment’s growth.

The hardware segment is further sub-segmented into scanners, tissue microarrayer, and others. The growing demand for digital databases to store specimens across the globe is anticipated to boost the segment’s growth during the forecast period. The scanner segment is expected to register the fastest growth rate during the forecast timeline due to increasing collaborations between industry players for launches and distribution.

- For instance, in March 2023, Agilent Technologies Inc. partnered with Hamamatsu Photonics K.K. to incorporate Hamamatsu’s slide scanner system into Agilent’s digital pathology solution.

- Also, in April 2021, OptraSCAN launched the OS-Ultra 320. It is the world’s first-ever affordable high-speed digital pathology scanner. The scanner scans tissues/cells with an area size of 15x15 mm at 40x magnification in less than 60 seconds to reduce workflow errors and scale up pathology laboratory operations.

The software segment is anticipated to grow steadily during the forecast period due to increasing demand for Artificial Intelligence (AI)-based algorithms in the market owing to their rising applications in pathology data processing and assisted analysis. The software segment is further sub-segmented into pathology management, digital microscopy viewers, image analyzers, and others. The increasing prevalence of infectious diseases has fueled the demand for in-vitro diagnostic tests, resulting in a higher workload for pathologists. Software, such as microscopy viewers, image analyzers, and others can assist pathologists in disease diagnosis, thereby reducing workload and enhancing the quality of diagnosis.

Furthermore, the growing number of regulatory approvals and the launch of these products by key players are some of the factors propelling the segment growth.

- For instance, in November 2023, 4D Medical announced the U.S. FDA clearance of CT-based ventilation products (CT LVAS). This software scans and analyzes CT images, providing high-quality data on lung function. It also provides quantitative perfusion (blood flow) data and visualizations to be extracted from CT scans.

The storage systems segment is anticipated to grow at a steady pace throughout the forecast period due to the high demand for storing key data to share and analyze it in the future and access the data remotely in an instant. Furthermore, the introduction of novel digital tools by leading companies is fueling the product adoption in the market.

- The Software segment is expected to hold a 35.2% share in 2024.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Drug Discovery Segment’s Growth Attributed to Due to Strong Demand for Potential Pipeline Drugs

Based on application, the market is segmented into disease diagnosis, drug discovery, and others. The drug discovery segment is anticipated to record the highest CAGR during the forecast period owing to the increasing demand for potential pipeline drugs for treating life-threatening diseases. Moreover, several applications of pathology tools are emerging in drug discovery, such as high-throughput screening.

The disease diagnosis segment is expected to account for 54.96% of the market share in 2026 owing to the increasing burden of pathological tests among the patient population and rising awareness of early diagnosis to anticipate the risk of a disease and take preventive action. Moreover, growing collaborations among companies to improve the diagnosis of life-threatening diseases is also supporting the growth of the market.

- For instance, in May 2021, Quest Diagnostics collaborated with Paige AI, Inc. to integrate Artificial Intelligence into its pathology workflow to improve cancer detection.

In addition, several companies are launching software to address challenges with manual molecular testing workflows, with the aim of helping streamline routine diagnostics testing for standardization and faster results.

- For instance, in June 2022, F. Hoffmann-La Roche Ltd launched a new BenchMark ULTRA PLUS system for cancer diagnosis. It is the newest advanced tissue staining platform that enables quick and accurate test results for clinicians to make timely decisions regarding a patient’s care journey.

Therefore, the rising applications of digital tools in drug discovery and disease diagnosis, such as high throughput screening, deep learning, and cancer diagnostics, among others, are anticipated to drive the growth of the segment.

By End-user Analysis

Hospitals & Clinics Segment Leads Due to Wide Adoption of Digital Pathology Services and Rising Patient Admissions

Based on end-user, the global market is segmented into hospitals & clinics, clinical laboratories, and others.

The hospitals & clinics segment is anticipated to hold a dominant market share of 62.18% in 2026. The dominance of the segment is attributed to the increasing number of patient admissions and pathology services offered by major hospitals. Moreover, initiatives to introduce advanced products through partnerships with key hospitals and higher adoption of digital tools due to increased patient footfall are anticipated to drive the segment's growth. Leading hospitals in the U.S., the U.K., and other developed countries have installed pathology tools and systems to enhance the workflow, which has been pivotal in attracting a large patient pool.

- For instance, in May 2022, Sectra announced an agreement with UniHA, a cooperative of French public hospitals. The agreement will enable hospitals associated with UniHA to procure Sectra's solutions on pre-decided terms and conditions. The partnership allowed the hospital network to manage its workflow, thereby supporting the segment's growth.

The clinical laboratories segment is also anticipated to grow during the analysis period due to the increasing number of laboratories developing databases by digitizing slides using digital tools. Moreover, key digital solution providers are collaborating with each other to expand their product portfolios by offering customized solutions. These factors are estimated to foster the growth of the segment.

- For instance, in March 2022, F. Hoffmann-La Roche Ltd. announced a collaboration with Bristol Myers Squibb to support the advancement and deployment of two new pathology algorithms. The two assay methods developed would be used in clinical trials. The collaboration aimed to create an AI-based image analysis algorithm to aid pathologists in interpreting VENTANA PD-L1 (SP142) Assay. Such collaborations focused on providing key solutions to cater to the increasing product demand among clinical laboratories are anticipated to drive the segment's growth.

Some of the key industry players are also introducing novel digital pathology solutions to enhance workflows for clinical laboratories.

- For instance, in December 2023, Thermo Fisher Scientific Inc. launched the Thermo Scientific KingFisher Apex Dx, an automated nucleic acid purification instrument, and Applied Biosystems MagMAX Dx Viral/Pathogen NA Isolation Kit for the isolation and purification of viral and bacterial pathogens from respiratory biological specimens. This system allows laboratories to obtain the highest degree of consistency, reproducibility, and reliability in obtaining quality nucleic acids for specific downstream applications.

Furthermore, higher adoption of telepathology during the pandemic for remote diagnostics also provided an opportunity to clinical laboratories for improving awareness of such products among key consumers.

REGIONAL INSIGHTS

Geographically the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Digital Pathology Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America market value stood at USD 0.42 billion billion in the global market in 2024. The growing incidence of chronic diseases, such as cardio-diabetic disorders and increasing geriatric population, which is at a higher risk of developing such disorders, are expected to increase the demand for pathology tests. The growing burden of tests, coupled with the rising demand for streamlining workload, is anticipated to improve the adoption of digital tools among pathologists in the region. The U.S. market is projected to reach USD 0.5 billion by 2026.

- According to an article published by the Journal of the American Medical Association Network in 2021, the total number of adults suffering from diabetes in the U.S. was estimated to be 13%, and 34.5% of people met the criteria of pre-diabetes. The prevalence of pre-diabetes and diabetes was found to be higher in older adults. The increasing prevalence of chronic diseases among the aging population is anticipated to support the demand for routine tests and drive the regional market growth.

Moreover, market players are increasing their emphasis on inorganic growth strategies, such as partnerships and collaborations to launch innovative digital tools to manage workflow and cater to the rising demand for customized solutions. These are the major factors responsible for driving the growth of the North American market.

- For instance, in January 2022, Vital Signs Solutions Ltd. announced the launch of the PocDoc test, a smartphone-based at-home test for cardiovascular diseases. The test covers a full five marker lipid panel, which is considered the gold standard in cardiovascular assessment, under six minutes.

Europe

Europe holds the second position in terms of market share. Surge in the number of patients preferring digital tools over traditional pathology and strategic developments, such as patenting of proprietary technology by key industry players is boosting the regional market growth. Moreover, the growing adoption of technologically advanced products in the region, increasing regulatory approvals, and product launches are some of the factors driving the market expansion. The UK market is projected to reach USD 0.05 billion by 2026, while the Germany market is projected to reach USD 0.11 billion by 2026.

- For instance, in June 2022, F. Hoffmann-La Roche Ltd launched the VENTANA DP 600 slide scanner for digital pathology. This scanner provides enhanced patient care with precision diagnostics.

- In September 2021, Visiopharm announced that it had been granted the European patent for a novel method developed by the company for labeling histopathological images and training deep learning models. The patent provided the company with a proprietary advantage in the pathology industry and is expected to drive the market’s growth.

Asia Pacific

Asia Pacific digital pathology market is expected to register the highest growth rate during the forecast period. Rising number of healthcare chains partnering with key companies to manage the increasing volume of tests in diagnostic laboratories is estimated to augment the regional market growth. Moreover, increasing investments by public and private institutions along with a growing healthcare infrastructure is accelerating the adoption of digital tools and solutions among key stakeholders. Moreover, the increasing patient population is driving the market growth in Asian countries. The Japan market is projected to reach USD 0.09 billion by 2026, the China market is projected to reach USD 0.07 billion by 2026, and the India market is projected to reach USD 0.05 billion by 2026.

- For instance, in February 2022, Siriraj Hospital of Mahidol University, based in Thailand, announced its extended partnership with DB Results, an Australian digital business consultant. The agreement involved the utilization of DB's Outsystems for building Siriraj’s digital applications, such as the Pathology App. Such initiatives and the rising demand for pathology services are anticipated to drive the regional market's growth.

Latin America and the Middle East & Africa regions are developing steadily in the global market. The increasing influx of patients owing to growing medical tourism and rising adoption of digitization are estimated to drive the regional market’s growth. Moreover, factors, such as increasing spending on healthcare by patients and rising applications of digital tools, such as remote review of cases, virtual education, decreased response time, and improved workflow are some key reasons expected to enhance the market growth in these regions.

List of Key Companies in Digital Pathology Market

Broad Product Portfolios and Rising Inorganic Business Activities by Key Players Will Spur Market Competition

F. Hoffmann-La Roche Ltd., Koninklijke Philips N.V., Leica Biosystems Nussloch GmbH, and 3DHISTECH Ltd. accounted for the highest market share in 2023. The dominance of these companies is attributed to their strong portfolio of digital tools and rising research & development investments to launch technologically advanced tools. Moreover, strategic collaborations with key service providers and a well-established distribution channel are the other key factors driving the market. The prominent companies operating in the market are focused on introducing technologically advanced products to gain a competitive advantage over other firms.

- For instance, in January 2022, Aiforia announced its collaboration with Mayo Clinic to establish an AI-powered pathology research center at the clinic. The collaboration is focused on leveraging Aiforia’s expertise in digital platforms and deep learning to enable faster results and scalable studies in translational research. This development will further drive the global market share of the company in the competitive landscape.

Moreover, several companies, such as PaigeAI, Inc, PathAi, Aiforia, and others are focusing on providing customized solutions in the market to integrate and analyze data from various devices.

- In August 2021, Xybion Corporation announced the launch of Pristima XD Digital Pathology, offering full integration of preclinical laboratory information systems into the pathology workflows.

LIST OF KEY COMPANIES PROFILED:

- Thermo Fisher Scientific Inc. (U.S.)

- Hoffmann-La Roche Ltd. (Switzerland)

- Hamamatsu Photonics K.K. (Japan)

- 3DHISTECH Ltd. (Hungary)

- Koninklijke Philips N.V. (Netherland)

- Apollo Enterprise Imaging Corp (U.S.)

- Sectra AB (Sweden)

- Huron Technologies International Inc. (Canada)

KEY INDUSTRY DEVELOPMENTS:

- February 2024 – F. Hoffmann-La Roche Ltd announced a partnership with PathAI to develop artificial intelligence (AI) digital pathology algorithms for Roche’s Tissue Diagnostics business.

- October 2023 – F. Hoffmann-La Roche Ltd announced a partnership with Ibex and Amazon Web Services to enhance the adoption of AI-enabled digital pathology solutions. This AI-enabled solution helps in the diagnosis of breast and prostate cancer.

- August 2023 – PathAI announced the commercial launch of its product “AISight Digital Pathology Image Management System”.

- October 2022 – Hamamatsu Photonics K.K. and Indica Labs entered into a partnership to provide optimized digital workflow.

- April 2022 – 3DHISTECH Ltd. announced an agreement with the Catalan Health Institute (ICS) to deploy digital tools for pathology across a network of 8 hospitals, over 168 pathologists, and more than 1 million slides each year as part of its DigiPatICS project. The development promoted the company's brand image in the industry with a key focus on establishing its market presence.

- March 2022 – Thermo Fisher Scientific, Inc. launched CE-IVD marked Ion Torrent Genexus Dx Integrated Sequencer, an automated, Next-Generation Sequencing (NGS) platform for use in clinical laboratories and to perform both diagnostic and clinical research.

- January 2022 - Leica Biosystems Nussloch GmbH announced its partnership with Leap Therapeutics, a biotechnology company, to develop a companion diagnostic to detect Dickkopfrelated protein 1 (DKK1). The development of this assay was aimed at the clinical development of Leap Therapeutics’ anti-DKK1 cancer therapy, DKN-01, currently being studied in clinical trials.

- October 2021 - F. Hoffmann-La Roche Ltd. collaborated with PathAI, a global leader in AI-powered technology, to develop AI-based applications for improved patient care.

REPORT COVERAGE

The global market research report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, products, applications, and end-users. Additionally, it offers insights into the latest digital pathology market trends and highlights key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market's growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 18.56% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product

|

|

By Application

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 1.3 billion in 2025 and is projected to reach USD 5.75 billion by 2034.

In 2025, the market size in North America stood at USD 0.48 billion.

The market is set to record a CAGR of 18.56% during the forecast period.

By product, the hardware segment will lead the market.

Increasing prevalence of chronic diseases and rising applications of digital tools in diagnostics are the key factors driving the market.

F. Hoffmann La Roche Ltd, Koninklijke Philips N.V., Leica Biosystems Nussloch GmbH, and 3DHISTECH Ltd. are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us