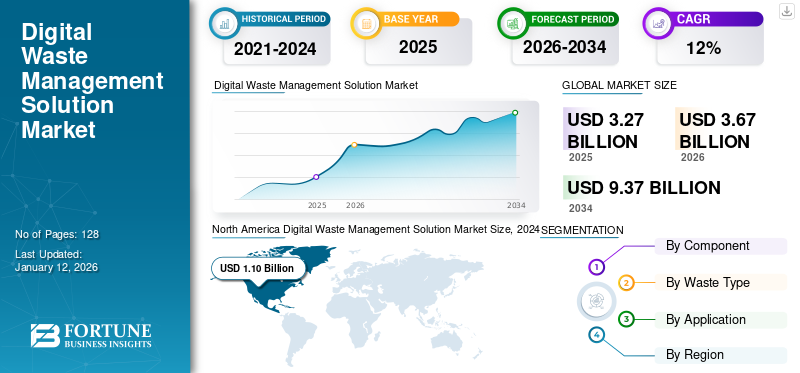

Digital Waste Management Solution Market Size, Share & Industry Analysis, By Component (Hardware and Software and Services), By Waste Type (Recyclable, Non-recyclable, and Hazardous), By Application (Smart Cities, Commercial Establishments, and Private Organizations), and Regional Forecast 2026–2034

KEY MARKET INSIGHTS

The global digital waste management solution market size was valued at USD 3.27 billion in 2025. The market is projected to grow from USD 3.67 billion in 2026 to USD 9.37 billion by 2034, exhibiting a CAGR of 12.40% during the forecast period. North America dominated the global digital waste management solution market with a share of 37.40% in 2025.

Digital, or smart, waste management solutions represent a paradigm shift in the waste collection industry. These solutions leverage the latest technologies to create a more efficient, cost-effective, and environmentally friendly ecosystem for managing waste materials. A key driving factor in this market is the increasing emphasis on sustainability and reducing the environmental impact of traditional waste management practices. Moreover, the adoption of the Internet of Things (IoT) and advanced analytics enables real-time monitoring and optimization of waste collection routes, leading to significant cost savings for municipalities and waste management companies.

Core Technology Stack:

- Sensor-equipped Bins – These bins provide real-time data on fill levels, enabling route optimization and improved scheduling.

- RFID Tags – For enhanced granularity, Radio Frequency Identification (RFID) tags can be used to track individual bins and specific waste streams and even grant residents access to designated bins.

- Data Analytics Platform – Collected data is analyzed using sophisticated software to identify trends, optimize collection routes, and inform strategic decision-making.

- Internet of Things (IoT) Integration – The network collects bins, trucks, processing facilities, and other components, facilitating real-time data exchange and communication.

Digital waste management systems offer personalized solutions through route optimization, reducing fuel consumption and operational costs. They also contribute to the circular economy by enhancing resource recovery through AI-powered sorting systems. Additionally, these systems also support deposit schemes, encouraging responsible disposal practices and waste reduction.

Download Free sample to learn more about this report.

IMPACT of GENERATIVE AI

Leveraging Generative AI for Optimizing Waste Management Processes and Driving Sustainability Driving Market Expansion

Integrating Artificial Intelligence (AI) into digital waste management solutions has revolutionized the waste management industry by optimizing processes, enhancing efficiency, and reducing environmental impact. AI-powered systems leverage advanced algorithms to analyze vast amounts of data, enabling predictive modeling and real-time monitoring of waste generation, collection, and disposal processes.

This proactive approach allows waste management companies to optimize their routes, schedules, and resource allocation, thereby minimizing operational costs and reducing greenhouse gas emissions and carbon emissions. For instance,

- In August 2023, BEEAH's waste collection and city cleaning division, Tandeef, introduced "Al City Vision" to enhance urban cleanliness. The initiative enables the use of 360-degree external cameras, which accurately assess waste bin status, overflow, and road cleanliness, promising to transform city maintenance and waste management. This AI-driven technology optimizes waste management processes, saving time and improving asset management.

Thus, integrating AI technologies into digital waste management solutions has brought transformative changes in the industry, enabling proactive, data-driven decision-making, optimizing resource utilization, and driving sustainability efforts.

Digital Waste Management Solution Market Trends

Integration of Deposit Return Schemes and Focus on ESG Goals to Enhance Sustainability and Circular Economy Initiatives

The integration of Deposit Return Schemes (DRS) into sustainability and circular economy initiatives represents a significant step forward in waste management strategies. DRS involves consumers paying a small deposit on beverage containers, which is refunded when the empty container is returned for recycling. This system incentivizes consumers to recycle and reduces the amount of waste that ends up in landfills or polluting the environment. By integrating DRS into broader sustainability and circular economy goals, governments and businesses can significantly enhance their waste management practices and contribute to a more sustainable future.

One of the key benefits of integrating DRS into sustainability and circular economy initiatives is the reduction of waste and litter. Beverage containers are a significant source of litter in many urban and natural environments. By implementing DRS, governments and businesses can encourage consumers to return these containers for recycling, thereby reducing litter and the environmental impact of these materials. This not only helps to create a cleaner and more pleasant environment but also reduces the resources needed to clean up and dispose of litter, contributing to overall waste reduction goals.

- In January 2024, Poland made changes to its waste management system, which is aligned with EU directives, focusing on sustainability and circular economy goals. These changes included implementing the SUP Directive to reduce the impact of certain plastic products, introducing Extended Producer Responsibility (EPR) for packaging waste, and establishing a deposit system for beverage containers.

Digital Waste Management Solution Market Growth Factors

Government Aids and Regulations to Incentivize the Adoption of Digital Waste Management Technologies

The global governments are increasingly recognizing the importance of waste reduction and recycling technology in addressing environmental challenges. To promote these goals, many governments are implementing aids and regulations that incentivize the adoption of digital waste management solutions. These aids can take various forms, such as financial incentives, tax breaks, or subsidies, aimed at making it more cost-effective for businesses and individuals to invest in these technologies. Additionally, regulations are being put in place to mandate the use of digital waste management technologies in certain industries or regions, ensuring widespread adoption and adherence to best practices.

One of the key ways governments are supporting waste reduction and recycling is through financial aid and grants. These aids help businesses and municipalities offset the initial costs of implementing digital waste management solutions, making them more accessible to a wider range of stakeholders. Additionally, tax breaks or incentives further encourage adoption by reducing the ongoing costs associated with these technologies, such as maintenance and operation expenses. By providing financial support, governments effectively lower the barrier to entry for adopting digital waste management solutions, leading to increased uptake and improved waste management practices. For instance,

- In June 2023, The Development Bank of the Philippines (DBP) provided USD 1.2 million in funding to Pacific Mactan Renewable Environmental Systems, Inc. for the construction of a fully integrated waste treatment and disposal facility in Cebu. This funding, part of the Sustainable Waste Management for Enhanced Environmental Protection Financing Program (SWEEP), aimed to establish an energy recovery system and digital waste management for over 200 firms in the Mactan Economic Zone I (MEZ) area.

RESTRAINING FACTORS

Integration with Existing Systems and Vulnerable Smart Bins to Disrupt Data Collection and Cause Logistical Issues

Challenges while integration with existing systems often arises due to differences in data formats, protocols, or interfaces between the new smart bin technology and legacy systems. These challenges hinder the seamless flow of data and communication between smart bins and other systems, leading to inefficiencies and data silos. Additionally, the vulnerability of smart bins to vandalism and theft poses a significant risk to their functionality and reliability. Instances of vandalism or theft can disrupt the operation of smart bins, leading to potential gaps in data collection and logistical difficulties in managing waste collection and disposal.

- According to FNDC, in August 2022, a stainless steel Wi-Fi smart bin installed at Ōpononi had its door ripped off shortly after installation, funded through the government’s Tourism Infrastructure Fund. The damage was caused by someone trying to retrieve a USD 40 mobile phone top-up card, which resulted in repairs costing over USD 1000.

Digital Waste Management Solution Market Segmentation Analysis

By Component Analysis

Software and Services Segment to Thrive with Surging Demand for Cloud-based Scalable Software

By component, the market is segmented into hardware and software and services.

Software and services are projected to experience the highest growth rate as they offer data-driven optimization, scalability through cloud-based solutions. They enable the transition toward a circular economy through advanced analytics and IoT integration. As organizations prioritize digitalization and data-driven decision-making, the demand for software and services in the digital waste management sector is expected to surge.

The Hardware solutions segment led the market accounting for 68.97% market share in 2026, due to their tangibility and ease of integration with existing infrastructure.

By Waste Type Analysis

Circular Economy Initiatives to Fuel the Adoption of Recyclable Waste Technology

By waste type, the market is segmented into recyclable waste, non-recyclable waste, and hazardous waste.

Recyclable waste is projected to dominate the digital waste management solution market growth while also showcasing the highest growth rate during the forecast period. Recyclable waste consists of materials that can be processed and reused in manufacturing processes, reducing the need for virgin resources and contributing to a circular economy. A driving factor behind the dominance of recyclable waste is the increasing awareness and regulations surrounding waste reduction and resource conservation. Governments and organizations are actively promoting recycling initiatives, which has led to a surge in demand for efficient sorting and collection of recyclable materials through digital waste management solutions.

Non-recyclable waste comprises materials that cannot be economically or technically recycled, often requiring landfilling or incineration as disposal methods. Hazardous waste includes materials that pose a risk to human health or the environment due to their chemical, biological, or physical properties, requiring special handling and disposal methods.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Optimized Waste Collection Routes and Efficiency to Enhance Deployments in Smart Cities

By application, the market is segregated into smart cities, commercial establishments, and private organizations.

Commercial segment dominated the market accounting for 50.17% market share in 2026. In commercial establishments, digital waste bins equipped with fill-level sensors and RFID technology enable smart monitoring and waste collection. The applications consist of hospitals, food service, airports, and office complexes, among others. Private organizations benefit from digital waste management solutions that integrate with existing systems, providing analytical insights and scalability. The applications consist of waste collectors, universities, theme parks, and zoos, among others. A key driving factor behind the dominance of commercial establishments is the high volume of waste generated by these facilities, which include shopping malls, large office buildings, and hospitality venues, among others. Implementation of digital waste management solutions in these settings leads to substantial cost savings through optimized collection routes and reduced transportation expenses. Additionally, the need for efficient waste management to maintain cleanliness and comply with environmental regulations further drives the adoption of these solutions in commercial establishments.

Smart cities showcase the highest growth rate during the forecasted period. Smart cities leverage IoT sensors and data analytics to optimize waste collection routes, minimize operational costs, and enhance efficiency. The applications consist of cleaner spaces, public space recycling, municipalities, and transit, among others.

REGIONAL INSIGHTS

By geography, the market is studied across North America, South America, Europe, the Middle East and Africa, and Asia Pacific. These regions are further categorized into several dominating countries.

North America Digital Waste Management Solution Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 1.22 billion in 2025 and USD 1.37 billion in 2026. North America holds the highest share in the digital waste management solution market as the region benefits from rapid technological advancements, infrastructure, and a mature IoT ecosystem, which enables the seamless integration of digital waste management systems into existing urban infrastructure. Additionally, the region has a strong regulatory framework and stringent environmental policies that mandate adopting sustainable waste management practices, driving the demand for digital waste solutions. Additionally, the growing trend toward smart city initiatives and sustainable urban development projects in North America has driven the deployment of digital waste management solutions. Cities across the region are investing in smart infrastructure and IoT-enabled systems to enhance the efficiency of waste collection, improve public health, and promote environmental conservation.

The U.S. market is expected to reach USD 0.9 billion by 2026.

For instance,

- In February 2024, Mayor of New York City Eric Adams and Department of Sanitation (DSNY) Commissioner Jessica Tisch unveiled two significant initiatives to remove all trash from the city's streets and into secure containers. These include introducing automated side-loading garbage trucks and a data-driven containerization strategy. This marks a pivotal moment in New York City's quest to become the cleanest major city in the U.S.

Europe holds a significant share of the market. The region benefits from stringent environmental regulations and waste management policies prioritizing sustainability and resource conservation. These regulations drive the adoption of advanced waste management technologies, including digital waste solutions, to optimize waste collection, sorting, recycling, and disposal processes. The UK market is expected to reach USD 0.18 billion by 2026, while the Germany market is expected to reach USD 0.22 billion by 2026.

Asia Pacific is anticipated to experience the highest CAGR in the digital waste management solution market share. The rapid urbanization and industrialization in countries across the region are leading to increased waste generation, necessitating the adoption of advanced waste management technologies to address the growing environmental challenges. Additionally, rising population densities in urban areas are driving the demand for efficient waste collection, recycling, and disposal solutions to maintain public health and hygiene standards. The UK market is expected to reach USD 0.18 billion by 2026, while the Germany market is expected to reach USD 0.22 billion by 2026.

Moreover, the growing awareness of environmental sustainability and the need to minimize the ecological footprint drive governments and organizations to invest in digital waste management solutions. For instance,

- In February 2024, Nakadai Holdings and SATO Holdings Corporation plan to conduct a proof of concept at Japan's Nakadai's Komagata plant. The aim is to develop a traceability system that visualizes the entire process, from waste collection and treatment to producing recycled raw materials. The trial aims to improve waste treatment and recycling methods, ensuring a stable supply of high-quality recycled materials as a domestic resource and contributing to establishing a circular economy.

The Middle East & Africa is expected to grow at the second-highest CAGR in the market due to rapid urbanization and population growth in urban areas across the region. This factor has led to increased waste generation, necessitating the adoption of advanced waste management technologies to address growing environmental concerns and regulatory requirements.

South America is expected to grow at an average rate in the market due to several factors, primarily rapid urbanization and industrialization, leading to increased waste generation from urban centers and industrial facilities. This trend necessitates the adoption of advanced waste management technologies to address growing environmental concerns and regulatory requirements.

List of Key Companies in Digital Waste Management Solution Market

Key players are Collaborating with Regional Governing Bodies to Deploy Extensive Digital Waste Management Solutions

Key players in various industries are strategically partnering and collaborating with the respective governing bodies to enhance their waste management systems and drive efficiency. This trend is driven by the recognition of the circular economy and the cost efficiency surrounding digital waste management tools. By leveraging AI, these solutions have offered automated sorting systems, collection efficiency, and route efficiency, among others.

- For Instance, in March 2023, Rubicon Technologies Inc., a provider of waste and recycling management software, broadened its smart technology for government fleets to 11 cities across the U.S., primarily focusing on solid waste collection operations. The expansion includes cities such as Surprise, Arizona; Rochester, New York; Dubuque, Iowa; High Point, North Carolina; Rockville, Maryland; Newton, Massachusetts; Galveston, Texas; North Platte, Nebraska; Cleveland Heights, Ohio; and Winchester, Virginia.

List of Key Companies Profiled:

- Schneider Electric (France)

- Rubicon Technologies, Inc. (U.S.)

- Veolia (France)

- c-trace GmbH (Germany)

- AMCS Group (Ireland)

- Waste Harmonics (U.S.)

- ISB Global (U.K.)

- SENSONEO (Slovakia)

- Big Belly Solar, LLC. (U.S.)

- Evreka (Turkey)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: George Mason University implemented 23 BigBelly zero waste stations on its Fairfax and Mason Square campuses, featuring solar-powered computing, recycling, and trash bins. These stations supported Mason’s sustainability goals through user-friendly design, technology upgrades, and capacity-based alerts, with five composting bins at outdoor patio sites to improve waste diversion rates.

- February 2024: Veolia partnered with the Professional Pickleball Association (PPA Tour) for a three-year collaboration aimed at promoting environmental sustainability. This partnership focused on improving recycling rates and waste collection, providing sustainable waste refill stations, and enhancing the environmental performance of the PPA Tour.

- February 2024: ZenRobotics launched its fourth-generation waste sorting robots, ZenRobotics 4.0, with upgraded AI and new features to enhance sorting efficiency. The robots automated waste management processes, replacing outdated manual sorting methods and helping companies meet modern recycling requirements.

- October 2023: AMCS acquired FigBytes, a Sustainability Platform provider, to enhance its EHSQ and ESG solutions globally. This move underscored the company’s commitment to investing in the environmental services industries and enabled them to offer powerful cloud-based SaaS solutions to aid clients in achieving their sustainability goals and managing regulatory reporting.

- September 2023: c-trace launched c-gap, a new system for automatically detecting improperly placed containers aimed at improving water disposal efficiency. It was developed to reduce costs and environmental impact, as it minimizes late collection trips caused by incorrectly provisioned containers.

- September 2023: Rubicon Technologies partnered with the City of Phoenix in a five-year collaboration to digitize and enhance efficiency for the city's solid waste collection programs. Phoenix's Public Works Department implemented Rubicon's smart city software for waste and recycling collection.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.40% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Waste Type

By Application

By Region

|

Frequently Asked Questions

The global market is projected to reach USD 9.37 billion by 2034.

In 2025, the global market was valued at USD 3.27 billion.

The market is projected to grow at a CAGR of 12.40% during the forecast period.

By waste type, the recyclable waste led the market in 2025.

Government aid and regulations will incentivize the adoption of digital waste management technologies.

Schneider Electric, Rubicon Technologies, Inc., c-trace GmbH, AMCS Group, Waste Harmonics, ISB Global, Sensoneo, and Veolia are the top players operating in the market.

North America held the highest market share in 2025.

By component, the software and services are expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us