Lead-acid Battery Recycling Market Size, Share & Industry Analysis, By Chemistry (Flooded Lead Acid Battery, Sealed Lead Acid Batteries, Deep Cycle Lead Acid Battery, and Others), By Source (Electronics, Automotive, Power Tools, and Others), By Process (Physical/Mechanical, Hydrometallurgical, and Pyrometallurgical), and Regional Forecast, 2026-2034

Lead-acid Battery Recycling Market Size

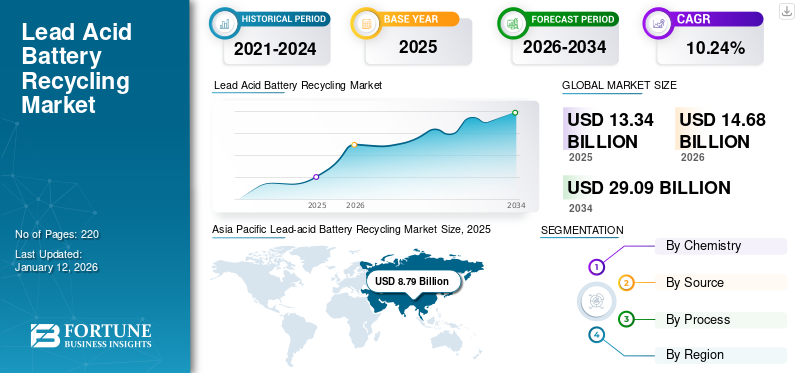

The global lead-acid battery recycling market size was valued at USD 13.34 billion in 2025. The market is projected to be worth USD 14.68 billion in 2026 and reach USD 29.09 billion by 2034, exhibiting a CAGR of 10.24% during the forecast period. Asia Pacific dominated the lead-acid battery recycling industry with a market share of 65.86% 2025. The Lead acid battery recycling market in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.58 billion by 2032.

A lead-acid battery is a rechargeable battery that covers two electrodes submerged in a sulfuric acid electrolyte. While the positive electrode is lead dioxide and the negative electrode is elastic lead, the chemical reaction between lead and sulfuric acid generates electricity. Used lead-acid batteries are collected from various sources, such as automotive repair shops, retailers, and industrial users. The collected batteries are transported to recycling facilities using specialized containers to prevent leaks and ensure safety.

The impact of the COVID-19 pandemic on the lead-acid battery recycling market was moderate. It hampered consumption in many end-use industries due to the supply chain disruption in services and technology sectors and hindrance in activities due to social distancing norms. Furthermore, China, the U.S., and India are significant countries processing and deploying lead-acid battery recycling technologies. These countries have undergone various regional and national level shutdowns of industrial operations to contain the spread of this viral infection, which led to a fall in demand for the recycling of lead-acid batteries.

Lead-acid Battery Recycling Market Trends

Favorable Government Policies to Boost Adoption of Low-carbon Technologies Will Aid Market Growth

An increasing inclination toward the deployment of cleaner power sources to provide efficient input to different applications is likely to accelerate the lithium-ion battery recycling market growth.

Countries have made significant investments and installed numerous batteries for large-scale energy storage and automotive. The increasing deployment is set to drive the replacement of long-standing batteries with low out-of-efficiency, generating waste for recycling opportunities.

According to the NREL report on Grid-Scale Battery Storage, the current market for grid-scale battery storage in the U.S. and globally is dominated by lithium-ion chemistries. Due to technological innovations and improved manufacturing capacity, lithium-ion chemistries have experienced a steep price decline of over 70%, and prices are projected to decline further.

The European Union (EU) and India launched expressions of interest for automotive (EV) battery recycling start-ups to participate in a matchmaking event. This initiative occurs under the India-EU Trade and Technology Council (TTC), which the India and European Commission announced. It aims to enhance the cooperation between European and Indian SMEs and start-ups in the clean and green technologies sector. The intended exchange of knowledge and expertise will be instrumental in advancing the circularity of rare materials and transitioning toward carbon neutrality in India and the EU.

Download Free sample to learn more about this report.

Lead-acid Battery Recycling Market Growth Factors

Rising Adoption of Battery-Powered Automobiles to Unlock New Potentials for Industry

Various emerging and developed economies have observed a paradigm shift toward a low-carbon generation transportation fleet to reduce their carbon footprint.

Over the years, the adoption of different types of Automotive, such as Battery Automotive (BEVs), Hybrid Automotive (HEVs), and Plug-in Hybrid Automotive (PHEVs) has resulted in large quantities of batteries reaching their end-of-life.

Policies, such as Extended Producer Responsibility (EPR) and battery waste management rules mandate manufacturers to take responsibility for battery end-of-life management, ensuring proper recycling and disposal. These regulations create a framework that incentivizes the recycling industry and promotes the circular economy for batteries.

The increasing adoption of battery-powered EVs is spurring innovation in battery technologies and recycling processes. Companies, such as Evonik Industries are developing advanced recycling methods, such as electrochemical processes with ceramic membranes, to improve the efficiency of lithium recycling from EV batteries. These technological advancements will enhance the sustainability of battery production, thereby driving the growth of the market.

RESTRAINING FACTORS

High Cost and Investment Can Hamper the Lead-Acid Battery Recycling Market Growth

The construction of new recycling facilities requires high capital expenditures and dedicated collection and supply chains, limiting the lithium-ion battery recycling market growth. Additionally, the absence of proper regulatory frameworks in various developing nations to extract battery materials, coupled with the increasing recycling of other chemistries, such as lead-acid batteries, may pose a problem for lead-acid battery recycling market growth.

Establishing a lead-acid battery recycling facility demands substantial investment compared to lead-acid plants. The operational expenses for lithium-ion recycling units are significantly higher, reflecting challenges in cost-effectiveness. The high initial investments required for setting up advanced recycling infrastructure and technologies act as a barrier for new entrants and existing players in the market. This financial burden can deter potential investors and hinder the expansion of recycling facilities, limiting the market's growth potential.

Lead-acid Battery Recycling Market Segmentation Analysis

By Chemistry Analysis

Flooded Lead Acid Battery is Dominating Market Due to its Cost-efficient and Wide Availability

The market is segmented based on type into flooded lead acid battery, sealed lead acid batteries, deep cycle lead acid battery, and others.

The flooded lead acid battery emerged as the largest sub-segment, accounting for 67.20% market share in 2026 due to its cost-effectiveness, reliability, and widespread availability. These batteries have a well-established manufacturing process and supply chain, making them cheaper to produce than other types of batteries. They are also highly durable and can withstand overcharging, which is advantageous for various applications such as automotive, industrial, and backup power systems.

The sealed lead acid batteries segment holds the second major share in the global market as they have a maintenance-free design, safety features, and versatility. Unlike flooded lead acid batteries, SLAs are sealed and do not require regular water replenishment, making them more convenient for users. They are spill-proof and can operate in various positions, enhancing their suitability for different applications, including emergency lighting, Uninterruptible Power Supplies (UPS), and medical equipment.

To know how our report can help streamline your business, Speak to Analyst

By Source Analysis

Increasing Consumption of Electronic Devices to Dominate Market

Based on source, the market is segmented into electronics, automotive, power tools, and others.

Electronics are anticipated to lead the market during the projected period. The production and consumption of electronic devices, such as smartphones, laptops, tablets, and other portable gadgets is increasing rapidly, which has led to a substantial amount of end-of-life batteries needing recycling. These devices primarily use lithium-ion batteries, which are currently a major focus for recycling efforts, due to their valuable materials and environmental impact.

The growing adoption of automobiles is significantly increasing the number of automotive batteries entering the recycling stream. EV batteries are similar to those used in electronics but on a much larger scale.

By Process Analysis

Improved Efficiency and Better Metal Recoverability to Propel Adoption of Hydrometallurgical Process

Based on process, the market is segmented into physical/mechanical, hydrometallurgical, and pyrometallurgical.

The hydrometallurgical process segment dominates the market with a market size of USD 12.24 billion in 2026, accounting for 83.37% market share by using aqueous chemistry to recover metals from spent batteries. This method efficiently extracts valuable metals, such as lithium, cobalt, nickel, and manganese, which are key components in lithium-ion batteries. The high recovery rates make it an economically viable option. The materials recovered through hydrometallurgical processes are often of high purity.

The physical/mechanical process is used as the initial stage of battery recycling. These methods involve the mechanical shredding and sorting of battery components. The primary goal is to separate the different materials (metals, plastics, and other elements) to prepare them for further processing, such as hydrometallurgical treatment.

REGIONAL INSIGHTS

The market has been studied geographically across four main regions: North America, Europe, Asia Pacific, and the rest of the world.

Asia Pacific Lead-acid Battery Recycling Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

The Asia Pacific market is valued at USD 9.74 billion by 2026. Asia Pacific dominates the market globally and accounts for most lead-acid battery recycling processes. Asia Pacific is leading the lithium-ion and lead-acid recycling battery market as China is experiencing growth in industrial automation and electronics manufacturing. These sectors heavily rely on advanced equipment for powering various devices. A Chinese manufacturing and automotive unit factory utilizes a multitude of battery recycling to provide precise devices for soldering components, functionality, and charging devices during assembly. The China market is valued at USD 6.42 billion by 2026, and the Japan market is valued at USD 0.73 billion by 2026.

North America

North America is the second-leading region in the lead-acid battery recycling market. The region has a strong presence of leading technology companies and research institutions. This raises innovation in technology, leading to more advanced and efficient products. The U.S.-based companies are constantly investing in high-efficiency battery devices to optimize power consumption and reduce operational costs within the facilities. The North America market is valued at USD 1.37 billion by 2026. The United States market is valued at USD 0.99 billion by 2026.

Europe

The Europe market is valued at USD 2.91 billion by 2026. Europe has witnessed a substantial increasing demand for electric vehicles, focused on energy storage system demand, which has led to a growing need for lead-acid battery recycling. Increasing research and development efforts in battery recycling to promote a sustainable energy model. Large companies are investing and developing in the battery recycling industry. For instance, Mercedes-Benz is building a battery recycling factory in Kuppenheim, Germany, cutting resource consumption and establishing closed-loop recycling of battery raw materials. The United Kingdom market is valued at USD 0.33 billion by 2026, and the Germany market is valued at USD 0.85 billion by 2026.

KEY INDUSTRY PLAYERS

Established Organizations are Offering Wide Range of Technology at Domestic and International Levels

The global lead-acid battery recycling market is highly fragmented, with key players and some medium-scale regional players delivering a wide range of recycling technology across the value chain at local and national levels. Numerous companies are actively operating across different countries to cater to the customers' specific demands.

Call2Recycle Canada partnered with electronics recycler Electronic Distributors International Inc. (EDI) to unveil a new battery sorting technology that could significantly increase Ontario’s capacity to sort and recycle end-of-life batteries. This investment by Call2Recycle and EDI is part of their strategy to enhance battery recycling infrastructure, boost efficiency, improve safety, and help the province achieve its waste diversion goals.

List of Top Lead-acid Battery Recycling Companies:

- SNAM (France)

- Umicore (Belgium)

- Exide (India)

- Cirba Solutions (U.S.)

- Gravita India Ltd (India)

- Call2Recycle, Inc (U.S.)

- Glencore (Switzerland)

- Battery Solutions (U.S.)

- Aqua Metals (U.S.)

- EnerSys (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Fortum Battery Recycling and Hydrovolt signed an agreement to deliver black mass to Fortum’s battery material recycling plant in Finland. The collaboration involves a cross-Nordic process, where Hydrovolt first mechanically recycles EV batteries at its industrial plant in Fredrikstad, Norway.

- December 2023: Cirba Solutions assisted Toyota in expanding its battery recycling network to a nationwide program. The agreement with Cirba Solutions includes battery collection, storage, testing, and processing to support the growing EV market. This initiative is expected to reduce Toyota’s overall end-of-life battery transportation and logistics costs by 70% and decrease transportation-related emissions.

- September 2023: Fortum Battery Recycling, Europe’s leading battery recycler, received a USD 4.5 million grant from Business Finland to develop its recycling facility in Ikaalinen, Finland. Fortum Battery Recycling aimed to expand this plant's mechanical processing capacity, enhancing its hydrometallurgical plant's operations in Harjavalta.

- August 2023: Exide Industries’ subsidiary, Chloride Metals, launched commercial production at its fourth lead battery recycling plant in India. The plant, built on a greenfield site spanning more than 15 acres in the Supa-Parner Industrial Park, has an initial capacity of 96,000 metric tons per annum (MTPA), which will increase to 120,000 MTPA.

- February 2023: Gravita India announced that its step-down subsidiary, Gravita Netherlands BV (GNBV), has executed a Memorandum of Understanding (MOU) to establish a recycling plant in Oman. This will be Gravita's first recycling facility in the Middle Eastern market. GNBV will hold 50% of the equity and have management control of the project, while other partners based in Oman will hold the remaining equity. In Phase 1, the battery recycling plant will be established with a capacity of 6,000 MTPA.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service process, and leading source of the battery. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.24% from 2026 to 2034 |

|

Unit |

Volume (Kilo Tons) and Value (USD Billion) |

|

Segmentation |

By Chemistry, Source, Process, and Region |

|

Segmentation |

By Chemistry

|

|

By Source

|

|

|

By Process

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 14.68 billion in 2026.

The market is likely to record a CAGR of 10.24% during the forecast period of 2026-2034.

The flooded lead acid battery segment is expected to drive the market due to the global development of lead-acid battery recycling technology.

The market size of Asia Pacific stood at USD 8.79 billion in 2025.

Favorable government policies to boost the adoption of low-carbon technologies and the rising adoption of battery-powered automobiles are the key factors driving market growth.

Some of the top players in the market are Umicore, Fortum, and BASF SE.

The global market size is expected to record a valuation of USD 26.45 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us