Medical Drone Market Size, Share & Industry Analysis, By Type (Fixed Wing, Rotary-Wing, and Hybrid), By Technology (Fully Autonomous, Semi-Autonomous, and Remotely Operated), By Package Size (Less than 2 Kg, 2-5Kg, and More than 5 Kg), By Application (Emergency Blood Logistics, Medical Drug & Vaccine, Emergency Organ Logistics, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

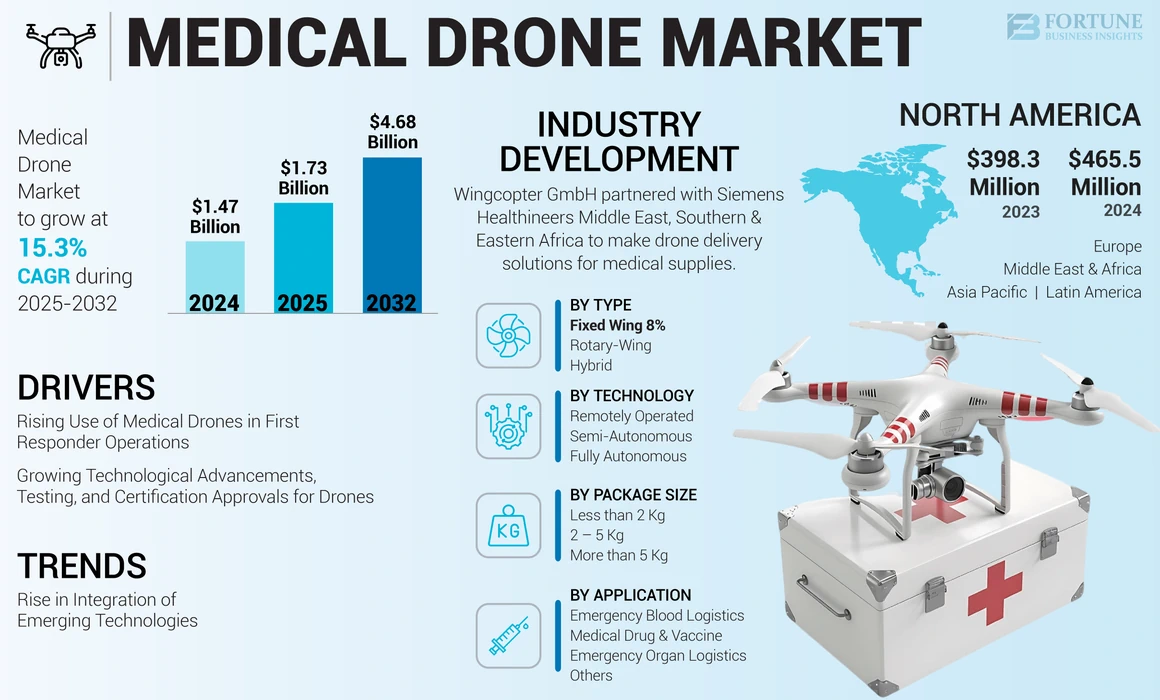

The global medical drone market size was valued at USD 1.47 billion in 2024. The market is projected to grow from USD 1.73 billion in 2025 to USD 4.68 billion by 2032, exhibiting a CAGR of 15.3% during the forecast period. North America dominated the medical drone market with a market share of 31.67% in 2024.

A medical drone is an unmanned system used for transportation and can carry a large load of healthcare-related items and essential supplies. During the COVID-19 pandemic, the market registered tremendous growth due to the high demand for medical drones to transport healthcare equipment. Nations around the world have established appropriate infrastructure and facilities to enable the contactless delivery of essential medical supplies and avoid the further spread of coronavirus.

The rise in demand for medical supplies, medicines, organs, and first aid kits to help first responders and carry out search and rescue operations is expected to drive the market during the forecast period.

Medical Drone Market Snapshot & Highlights

Market Size & Forecast:

- 2024 Market Size: USD 1.47 billion

- 2025 Market Size: USD 1.73 billion

- 2032 Forecast Market Size: USD 4.68 billion

- CAGR: 15.3% from 2025–2032

Market Share:

- North America dominated the medical drone market with the largest share in 2024, driven by strong demand for UAV-based medical logistics, presence of major OEMs, and adoption of drone technology during the COVID-19 pandemic for contactless delivery of essential healthcare supplies.

- By type, the rotary-wing segment is expected to retain the largest market share in 2025 due to its vertical lift capability and higher load-carrying efficiency for emergency medical logistics and organ transport.

Key Country Highlights:

- United States: Adoption is fueled by federal initiatives like the FAA’s drone registration programs and integration of AI-enabled drone networks for organ and vaccine delivery. Companies like Zipline and UPS are expanding medical drone logistics in emergency response and rural healthcare.

- China: High government support for drone innovation under the Belt and Road Initiative has boosted adoption of drones for blood, vaccine, and organ delivery in remote provinces. China’s UAV production capabilities further strengthen market growth.

- India: The government’s BVLOS drone testing initiatives for vaccine and medicinal deliveries in rural areas and partnerships with private companies such as Dunzo have accelerated deployment in emergency healthcare services.

- Rwanda (Africa): Pioneering large-scale use of drones for blood delivery and critical medical supplies to remote areas, setting an example for other nations in Sub-Saharan Africa.

- Europe (U.K., France, Germany): Growth supported by EU-funded projects for disaster response drones and strict sustainability and operational efficiency standards in medical logistics.

Medical Drone Market Trends

Rise in Integration of Emerging Technologies such as Artificial Intelligence to Act as a Major Market Trend

Original Equipment Manufacturers (OEMs) and service providers have started using Artificial Intelligence and other emerging technologies, such as AR, VR, XR, and IoT, in the delivery of medical materials via drones. The integration of these technologies is beneficial for the service providers and OEMs since they reduce errors, enable advanced operations, and provide assistance to healthcare providers. Artificial Intelligence (AI) provides critical data analysis and an aerial view of the situation, helping responders make informed decisions. For instance,

- North America witnessed medical drone market growth from USD 398.3 Million in 2023 to USD 465.5 Million in 2024.

- In January 2024, The Mayo Clinic, a Minnesota-based not-for-profit medical center, announced a partnership with Cerebras Systems, a Silicon Valley startup, to develop AI-based models for the healthcare industry.

Download Free sample to learn more about this report.

Medical Drone Market Growth Factors

Rising Use of Medical Drones in First Responder Operations to Support Market Growth

There has been a notable surge in the use of drones to aid operations related to first support, search & rescue, and disaster management in recent years. Such wide applications of drones have proliferated the demand for medical drones. The unmanned system is capable of transporting essential medicines, first aid, rescue materials, vital organs, and humans to places that could be dangerous for first responders to access. Additionally, this system facilitates the delivery of life-saving supplies, such as defibrillators, emergency supplements, and other critical resources to the location of emergency or accident before the regular transport vehicles, thereby avoiding traffic. Therefore, a growth in the usage of drones in SAR, emergency medical services, and blood bank operations is expected to boost the overall medical drone market growth during the forecast period.

- For instance, in March 2023, researchers funded by the European Union developed a drone-based technology that provides situational awareness in a moment of distress and disaster to aid first responders with appropriate information to save lives.

Growing Technological Advancements, Testing, and Certification Approvals for Drones to Drive Market Growth

The pandemic accelerated the adoption and initiation of regulations, approvals, experimentations, and test flights by governments and OEMs for medical applications. Therefore, many countries started experimenting with and testing the UAV’s efficiency. As a result, in 2021, the Federal Aviation Administration (FAA) registered around 900,000 drones, which may be deployed for varying applications. India as well, in May 2021, initiated a wider testing of drones for vaccine and medicinal deliveries to Beyond Visual Line of Sight (BVLOS) destinations.

- For instance, in February 2024, Scandron Pvt. Ltd., an Indian UAV manufacturer, received a certification from the Director General of Civil Aviation (DGCA) in India to enable efficient and timely delivery of products for companies using unmanned aircraft vehicles in their supply chain. The launch of a DGCA-type approved logistics drone will facilitate critical medical deliveries to remote regions, streamline e-commerce logistics, and enhance mid and last-mile delivery.

RESTRAINING FACTORS

Lack of Skilled Pilots and Appropriate Infrastructure to Limit Market Growth

Irrespective of multiple applications and attractive qualities of a drone, lack of appropriate infrastructure and skilled pilots can hinder the growth of the market. Additionally, lack of unified air traffic management operations to increase flight safety in controlled airspace for all airborne platforms causes a major hindrance. Minimizing the operational challenges and drone-related accidents faced by BVLOS flights is a major problem. Furthermore, the use of remotely operated drones for medical delivery applications has been challenged by the lack of skilled pilots for BVLOS flight operations, further restraining the market.

Medical Drone Market Segmentation Analysis

By Type Analysis

Rotary-Wing Segment to Dominate Market Owing to its Vertical Lift Capability

Based on type, the market is categorized into fixed wing, rotary-wing, and hybrid.

The rotary-wing segment accounted for the largest market share in 2023 and is expected to record the highest CAGR owing to its vertical lift capabilities and micro turbine equipment that increases its load carrying capacity and eases operation. The rotary wing segment is expected to experience high growth due to pertaining usability and high demand created in the market. This high demand is due to their vertical

- The fixed wing segment is expected to hold a 8% share in 2024.

The hybrid segment is anticipated to record a significant CAGR owing to several technological advancements and applications. Since hybrid drones can be used for long-haul and SAR applications, the market is expected to witness a steady growth during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Technology Analysis

Remotely Operated Drones to Dominate Market Due to their High Adoption in Medical Applications

By technology, the market is classified into remotely operated, semi-autonomous, and fully autonomous.

The remotely operated segment is anticipated to be the largest segment owing to the high adoption rate of these systems for various medical applications. The segment is also expected to emerge as the fastest growing segment.

- For instance, in June 2021, Dunzo, a hyperlocal delivery service provider, announced that it was working with a consortium of industry experts to create a remotely operated drone-based medicinal and healthcare logistics in Telangana, India in partnership with the Government of Telangana.

However, the semi-autonomous segment is expected to record a significant CAGR during the forecast period. This growth can be attributed to the rising demand for drones that can fit small spaces and be used for compact medical operations, such as disinfection.

By Package Size Analysis

2-5 Kg Segment Dominates Market Owing to Growing Preference for Medium Capacity Drones

Based on package size, the market is divided into less than 2 kg, 2 – 5 kg, and more than 5 kg.

The 2-5 kg segment accounted for the largest medical drone market share in 2023 and is expected to maintain the dominance by recording the highest CAGR during the forecast period. This is owing to a high demand for medium payload drones for medical equipment delivery and wide availability of 2-5Kg drones.

The less than 2 kg segment is anticipated to register a significant CAGR from 2024-2032 owing to rising experimental and operational approvals granted to the less than 2 kg category for unmanned logistics as government initiatives worldwide.

- For instance, in August 2021, the Indian Ministry of Civil Aviation launched a successful test flight of BVLOS drone to deliver medicines in Bengaluru, India.

By Application Analysis

Emergency Blood Logistics to Dominate Market Owing to High Demand for Emergency Blood Samples

The market is bifurcated by application into emergency blood logistics, medical drug and vaccine logistics, emergency organ logistics, and others.

The emergency blood logistics segment accounted for the largest market share in 2023 owing to high demand for emergency blood in case of accidents and to supply blood and pathological samples. Additionally, countries in Asia Pacific and Africa have initiated blood delivery from collection centers to medical centers via drones.

- For instance, in April 2022, Rwanda, an East African country, successfully initiated the blood delivery process using air shuttle, which is said to be faster than driving.

The medical drug and vaccine segment is expected to display the highest CAGR during the forecast period owing to the aftermath of the pandemic, which led to a surge in the demand for on-time delivery of medicines and vaccines.

REGIONAL INSIGHTS

Based on region, the global market is analyzed across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

North America Medical Drone Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The North America market was valued at USD 465.5 million in 2024 and is expected to dominate the global market due to the presence of top OEMs and a growing demand for medical drones. During the pandemic, the U.S. was one of the first countries to come up with technologically advanced solutions such as disinfecting spray drones for public spaces.

Asia Pacific is anticipated to register the highest CAGR during the forecast period due to growing number of OEMs in the region. The region is witnessing large quantities of drones being exported to service providers in North America and Europe. Additionally, customization and refurbishment of regular commercial drones that are converted to medical drones is expected to drive the market in the region.

Europe accounted for the second-largest market share in 2023. This is due to increased demand for drones from developed countries in the region, such as France, the U.K., Italy, and Germany. Additionally, the pandemic accelerated the technological advancements in drones to facilitate effective and on-time delivery of life-saving materials and medication.

The Middle East & Africa region is expected to gain traction in the coming years owing to the region’s budding healthcare sector. Additionally, numerous countries in the African sub-continent, such as Ghana are a major contributor to the market’s growth. In African countries, medicinal aid and various vaccines are transported via drones to reach remote areas.

Latin America is a growing market for medical drones. For instance, in March 2023, Speedbird Aero, a Brazil-based drone delivery company, unveiled its plans to expand in the U.S. market.

List of Key Companies in Medical Drone Market

Key Market Players are Focused on Providing Different Services to Seal Market Position

The market is highly fragmented, with several global and regional players operating in this industry. It is observed that key market players have a vast variety of products and are focused on providing the best possible drone for faster delivery. The top players in the industry are Bell Flight – Textron, Vayu Inc., and others.

Other prominent players involved in the market include Aquiline Drones, Avy, Zipline Inc., UPS, and others. These companies are highly involved in new product launches and partnerships and acquisitions to sustain their market positions.

List of Key Companies Profiled:

- Aquiline Drones (U.S.)

- Avy (Netherlands)

- Bell Flight – Textron (U.S.)

- Draganfly Innovations (Canada)

- Drone Delivery Canada Corp. (Canada)

- Freefly Systems (U.S.)

- Aether Global Innovations Corporation (Formerly, Plymouth Rock Technologies Inc.) (U.S.)

- Skyports Ltd. (U.K.)

- Vayu Inc. (U.S.)

- Workhorse Group (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2021 – Avy BV, a Dutch UAV manufacturer, announced its partnership with Robotic Skies Inc., a global drone maintenance service provider. The partnership would enable the development of an in-field fleet support program for Avy's growing fleet of autonomous long-range life-saving UAVs to maintain the large operational fleet for critical medical and humanitarian flight operations across the world.

- April 2023 – The Virginia Institute for Spaceflight & Autonomy (VISA) initiated the delivery of medicines to patients suffering from hypertension in remote locations. The service was announced as a partnership with DroneUp, Riverside Health System, and Virginia Innovation Partnership Corporation.

- April 2023 – Michigan Medicine, a healthcare provider, unveiled its plans to double the in-house pharmacy numbers using Zipline Inc., a global drone services provider. The operation is said to benefit over a thousand patients around the county and will be able to make 10 mile flights in record 10 minutes.

- May 2023 – RigiTech, a Swiss UAV medical drone delivery specialist, announced a strategic partnership with Spright, a U.S.-based healthcare transport company. The partnership was initiated to aid expansion across Europe and the world.

- June 2023 – Wingcopter GmbH, a Germany-based drone services provider, partnered with Siemens Healthineers Middle East, Southern & Eastern Africa to make drone delivery solutions for medical supplies. The partnership will aid delivery of medical materials in the African subcontinent.

REPORT COVERAGE

The global market research report provides detailed information on the market and focuses on leading companies, product types, and key product applications. It also offers insights into the latest market trends and competition and highlights key industry developments. In addition to the above factors, it covers several factors that have contributed to the market’s growth in recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 15.3% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Type

|

|

By Technology

|

|

|

By Package Size

|

|

|

By Application

|

|

|

By Country

|

Frequently Asked Questions

Fortune Business Insights stated that the global market size was valued at USD 1.47 billion in 2024 and is projected to reach USD 4.68 billion by 2032.

Registering a CAGR of 15.3%, the market will exhibit rapid growth during the forecast period of 2025-2032.

The rotary-wing segment will dominate this market during the forecast period.

UPS, Zipline Inc., and Textron are the leading players in the global market.

North America dominated the market in terms of share in 2023.

The U.S. dominated the market in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us