Optical Sorter Market Size, Share & Industry Analysis, By Type (Camera Sorter, Lasers Sorter, Near Infrared (NIR) Sorter, Hyperspectral Cameras & Combined Sorter, and Others), By End-user (Food and Beverages, Waste Recycling, Mining, Pharmaceutical, and Others), and Regional Forecasts, 2026-2034

Global Optical Sorter Market Analysis

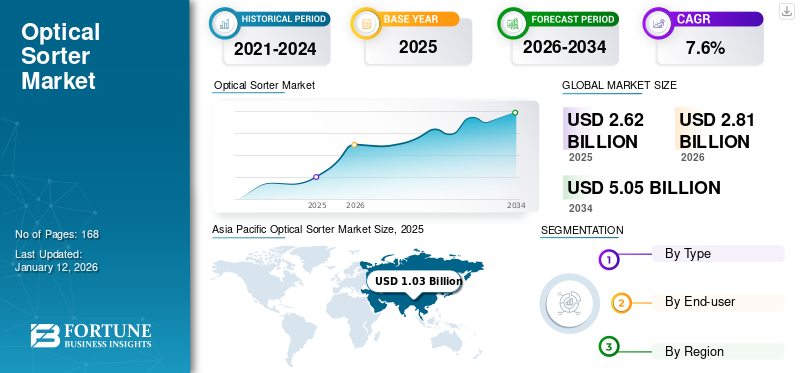

The global optical sorter market size was valued at USD 2.62 billion in 2025 and is projected to grow from USD 2.81 billion in 2026 to USD 5.05 billion by 2034, exhibiting a CAGR of 7.6% during the forecast period. Asia Pacific led the optical sorter market in 2025, accounting for a 39.2% market share.

Optical sorters, also known as visual sorting machines, are devices used in various industries to automatically sort objects based on their optical properties such as color, shape, size, and texture. It utilizes advanced imaging technology, usually in the form of cameras or sensors, to analyze the characteristics of objects as they pass through a conveyor belt. The global market has been experiencing steady growth driven by the increasing demand for automation in various industries such as food and beverage, pharmaceuticals, recycling, and mining. Continuous advancements in optical sorting technology have led to improved accuracy, efficiency, and speed of sorting processes. These advancements include high-resolution cameras, advanced sensors, and sophisticated sorting algorithms.

With increasing environmental concerns and emphasis on sustainability, the recycling industry has been a significant contributor to the market’s growth. These machines are used to efficiently sort and separate recyclable materials such as plastics, glass, and metals. The market’s increased share can be attributed to rapid industrialization, urbanization, and increasing investments in infrastructure development. The global market is characterized by the presence of several key players as they are continuously innovating and expanding their product portfolios to maintain their competitive edge in the market. Several players offer advanced technology-based optical sorters for cleaning food grains, seeds, grains, and industrial products. These sorters utilize reflected lights for analyzing products that need segregation.

Optical sorting machines use a wide range of technologies such as cameras, lighting, and machine learning software for segregating items. It helps to remove defective products and foreign materials by shape, color, and texture. Rising adoption and development of the advanced technology-based sorter by the top players aids market growth. This is primarily attributed to the surge in adoption across the end-use industries, including pharmaceuticals, recycling, food & beverage industries, and others.

The COVID-19 pandemic reflected the downfall of the market growth due to restrictions on the movement of goods and disruptions in supply chain activities. However, post pandemic the market is supposed to show steady growth during the forecast period.

Optical Sorter Market Trends

Advance Vision Systems Integration to Process Equipment is Shaping New Technology Trends

The optical sorter market growth is primarily driven by the advancements in technology that shape the demand for optical sorters in the food processing lines. The increasing trend for automation and rising awareness regarding food safety and quality have paved the path for AI capabilities in machines. Companies are re-designing their product strategies with more advanced imaging and vision technology that enables the detection and sorting of foreign substances in a wider range of materials with higher precision. For instance, in June 2022, Buhler AG, a prominent leader in optical sorting technology announced the launch of its next-level sorter utilizing advanced spectra vision technology offering three major key benefits including enhanced connectivity, ease of use, and high-performance, contributing to increased sustainability. Optical sorter manufacturers benefit from these redesigned product strategies and integration of advanced vision systems, shaping new technology trends in the market.

Download Free sample to learn more about this report.

Optical Sorter Market Growth Factors

Growing Emphasis on Quality Assurance and Expansion of Production Capacities to Boost Market Growth

The global food industry landscape has grown drastically in the past few years, leading manufacturers to increase revenues from consumer goods and food products. Packaged food manufacturers are proactively responding to changing consumer demands by integrating eco-friendly and biodegradable packaging solutions. This proactive approach, combined with advancements in packaging and sorting facilities, aims to enhance product's quality and foster customer trust. Nowadays, packaged food manufacturers at all levels i.e. small, medium, or large enterprises are expanding their production capacities which are getting fulfilled by the processing equipment manufacturers through automation and advancements. The upgrade keeps their products free from foreign materials and ensures efficient supply chain management and product quality control. For instance, in November 2023, Buhler announced the latest Spark Pro and advanced upgrade to the old model Spark that provides food safety for small and medium enterprises at an affordable price. Increasing automation with advanced process lines is driving the adoption of optical sorters across food industry verticals.

RESTRAINING FACTORS

Disturbed Supply Chain and Consumer Health Concerns Hamper Market Growth

Consumers becoming aware and conscious about their health and monitoring their diet on a usual basis is becoming a key restraint for the manufacturers to hack through the post pandemic period. To remain competitive, companies must devise innovative strategies. Additionally, the plastic dilemma is a major concern impacting the food processing and retail market, as consumers prioritize environmentally friendly and healthy products. For instance, according to the Annova Consumer Survey 2020, global consumers are highly looking for food and beverage products that support their immune health and are free from plastics and foreign materials. Supply bottlenecks in process lines will most likely affect the market for a longer period.

Optical Sorter Market Segmentation Analysis

By Type Analysis

Rising Hyperspectral Sorter Demand Across the Food Processing Industry to Drive Segment Growth

Based on type, the market is categorized into camera sorter, laser sorter, Near Infrared (NIR) sorter, hyperspectral cameras & combined sorter, and others. The hyperspectral cameras & combined sorters is touted to capture the largest revenue share of the global market, primarily attributed to the rising adoption of these machines across the food processing industries. The Camera Sorter segment is projected to dominate the market with a share of 41.64% in 2026. Additionally, hyperspectral-based optical sensors facilitate the highest accuracy in sorting out food grains, coffee beans, corn, peanuts, dry fruits, and others, detecting defective pieces to keep the processing well without waste.

The Near Infrared (NIR) sorter segment is expected to grow with the highest CAGR owing to the rising demand for advanced technology-based sorters for recycling and food processing units.

To know how our report can help streamline your business, Speak to Analyst

By End-User Analysis

Food and Beverages Segment Leads due to Increasing Global Production and Consumption of Cereals

Based on end-user, the market is classified into food and beverages, waste recycling, mining, pharmaceutical, and others (logistics and nutraceuticals). The food and beverages sector dominates by holding the largest market share of 35.59% in 2026, owing to the leading players' advancements in food grain sorting technology. The rising cereal production and consumption around the globe aid the demand for sorter machines, used to remove unwanted cereal grains and avoid contamination. According to the Food and Agriculture Organization of the United Nations Report, in 2021, the world cereal production reached around 927 million tons, increasing productivity by almost 5% compared to 2020. This increase in cereals and food grain production has created a massive demand for the product.

The pharmaceutical segment is expected to grow with the highest CAGR during the forecast period. This is primarily owing to rising demand during the COVID-19 pandemic for sorting essential pharmaceutical drugs and devices. For instance, in July 2020, ECOPACK, an optical sorter manufacturer, launched an optical sorting machine capable of detecting masks and gloves. This sorter helps to fight against the pandemic and to meet the global demand for the manufacturing of disposable products such as gloves and masks.

REGIONAL INSIGHTS

Based on region, the market is studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Optical Sorter Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 1.03 billion in 2025 and USD 1.12 billion in 2026. Asia Pacific dominates the optical sorter market share, accounting for over two-thirds of the total revenue, largely due to rapid industrialization and urbanization. This growth fosters increased demand for automation and advanced sorting technologies across various industries. As industries in the region expand and modernize, there is a growing need for efficient sorting solutions to enhance productivity, quality control, and product consistency. The food and beverage industry is a major contributor to the demand for optical sorters in the region. With the region's large population and rising disposable incomes, there is a growing demand for processed food and beverages. Optical sorting technology helps ensure food safety, quality assurance, and compliance with regulatory standards, driving its adoption in the industry. Moreover, the presence of several food processing manufacturers in the region, supported by a large population, drives market growth.

China's rapid modernization efforts have led to increased demand for automation and advanced sorting technologies across various industries. As industries evolve and expand, there is a growing need for efficient sorting solutions to improve productivity, enhance quality control, and meet consumer demands. The country’s vibrant technology and innovation ecosystem, with companies investing heavily in research and development to develop innovative sorting solutions tailored to the needs of different industries. The Japan market is valued at USD 0.11 billion by 2026, the China market is valued at USD 0.52 billion by 2026, and the India market is valued at USD 0.24 billion by 2026.

In industries such as food processing, pharmaceuticals, and manufacturing, optical sorters are used to ensure product quality, consistency, and compliance with strict standards. Optical sorting technology aligns well with this focus, enabling high-precision sorting of materials based on color, shape, size, and other characteristics.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe has been at the forefront of sustainability initiatives, fostering a growing demand for recycling solutions. The adoption of optical sorting technology has been growing across various industries in Europe, including food and beverage, recycling, mining, pharmaceuticals, and agricultural products. Industries are leveraging optical sorters to enhance productivity, improve quality control, and ensure compliance with stringent regulatory standards. These sorting systems are used in various industries, including food processing, recycling, mining, and pharmaceuticals, to automate sorting processes based on visual characteristics such as color, shape, and size. The UK market is valued at USD 0.19 billion by 2026, while the Germany market is valued at USD 0.17 billion by 2026.

North America

North America has been experiencing substantial growth, driven by factors such as increasing industrial automation, stringent quality standards, and growing demand for processed food and recycled materials. The market size has been expanding, with noteworthy contributions from industries such as recycling, mining, food and beverage, and pharmaceuticals. Optical sorter are used to separate and sort various recyclable materials, thereby contributing to waste management and environmental sustainability efforts. The U.S. market is valued at USD 0.49 billion by 2026.

Infrastructure development projects in South America, including those related to mining, construction, and transportation, are driving demand for optical sorters for material sorting and quality control purposes. Optical sorting technology is used in mining operations to separate valuable ores from waste materials, thereby improving resource efficiency and reducing production costs.

The market in the Middle East & Africa is poised for growth driven by increasing industrialization, infrastructure development, and the adoption of advanced sorting technologies across various sectors. Continued investments in technology, supportive government policies, and rising awareness about the benefits of optical sorting technology are expected to fuel market growth in the region.

KEY INDUSTRY PLAYERS

Partnerships and Development of Advanced Product Line-up to Strengthen Market Presence for Key Players

Prominent players have addressed the market revival with a lot of product and market penetration strategies. Several players in order to sustain their market position are focusing on collaborations, establishing partnerships, mergers, and acquisitions, and making innovations in the existing product. Manufacturers are setting up a new joint venture, or developing a more advanced product for the production line-up that would further expand their consumer base in the present untouched sorter market across all regions. Growing investments in technology research advancements such as object identification, multi-vision, and artificial intelligence to enhance the performance of foreign object detection have bolstered the demand in the food and other industries in the long term.

Cimbria strategizes the launch of a product line up to strengthen its market presence.

- In May 2022, Cimbria announced the launch of a new series of optical sorters with a unified multispectral vision solution, enabling users to classify the right order of materials through production with the finest definition.

List of Top Optical Sorter Companies

- Binder+Co (Austria)

- Bühler (Switzerland)

- TOMRA Systems ASA (Germany)

- Körber AG (Germany)

- Hitachi Zosen Corporation (Japan)

- CFT S.p.A. (ATS Corp.) (Italy)

- Cimbria (AGCO) (Denmark)

- SATAKE CORPORATION (Japan)

- Key Technology (U.S.)

- Sesotec GmbH (Germany)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Forever Plast S.p.A introduced a project to transform the purification and sorting procedure of PP flakes and HDPE with the help of Cimbria's optical sorting mechanism. The new optical sorting product line comprises a blend of 7 Cimbria SEA optical sorting machinery that proficiently chooses both colors and polymers in the same handling line.

- November 2023: TOMRA announced the launch of INNOSORT FLAKE to enhance the high-throughput distillation of plastic flakes and improve flake sorting performance. Its advanced features allow simultaneous flake categorization by polymer, transparency, and color, achieving better quality even from extremely contaminated inputs.

- November 2023: Pro-Environmental Limited selected the AUTOSORT technology of TOMRA for its plastic packaging categorization plant in Nottinghamshire. Pro Environmental Ltd invested in Recycling Sorting's innovative equipment of TOMRA for their new EUR 15M plastic sorting facility.

- October 2023: Cimbria announced a partnership with OFI Weigh and Inspection Solutions for the SEA product line of Optical Sorter in Australia. Inspection Solutions and OFI Weigh manufactures, designs, and services product inspection tools for several sectors, such as packaging food, logistics, and pharmaceuticals.

- May 2023: Bühler expanded its product line with optical sorters powered for nut processing. The SORTEX optical sorter helps enterprises combat aflatoxin, upsurge yields, and offers flexible nut processors. With SORTEX, consumers can expect consistent nuts in shape and size, with no insect pieces or other cosmetic injuries.

- February 2024: Cimbria unveiled the new AI-driven software BRAIN to its top-range optical sorters. Artificial intelligence enables users to experience simple and easy management of optical sorter while functioning at a highly progressive level.

- January 2024: Key Technology introduced optical sorters, VERYX, and COMPASS optical sorters for processed protein foods. These optical sorters identify the size, color, shape, and structural characteristics of every object to locate and eliminate various product flaws and foreign materials. They help to elevate product quality while enhancing yield and minimizing labor costs.

REPORT COVERAGE

The report provides detailed information regarding various insights into the market. Some of them are growth drivers, restraints, competitive landscape, regional insights, and challenges. It further offers an analytical depiction of the market, current trends, and estimations to illustrate the forthcoming investment pockets. The market is quantitatively analyzed from 2023 to 2032 to provide the financial competency of the market. The information gathered in this report has been taken from several primary and secondary sources.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021 – 2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026 – 2034 |

|

Historical Period |

2021 – 2024 |

|

Growth Rate |

CAGR of 7.6% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By End-User

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market stood at USD 2.62 billion in 2025.

Fortune Business Insights says that the market will reach USD 5.05 billion by 2034.

Growing at a CAGR of 7.6%, the market will exhibit strong growth during the forecast period.

Food capacity and product advancements are key factors up surging the market valuation.

The top companies in the market are Satake Corporation, Sesotec, Binder +Co., Key Technologies Inc., and Korber Group.

Asia Pacific leads the market followed by Europe as a result of increasing industrial automation, stringent quality standards, and growing demand for processed food and recycled materials.

Hyperspectral cameras & combined sorters are projected to experience the largest share of the market.

The food and beverages segment captures the largest market revenue share during the forecast period.

Advance vision systems integration are highly preferred due to increasing demand for automation across industries. BT-Wolfgang, Binder, Bühler Sortex, Satake Corporation, and others.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us