Portable Ultrasound Market Size, Share & COVID-19 Impact Analysis, By Type (Built-in-console, and Touchscreen), By End User (Hospitals, and Clinics), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

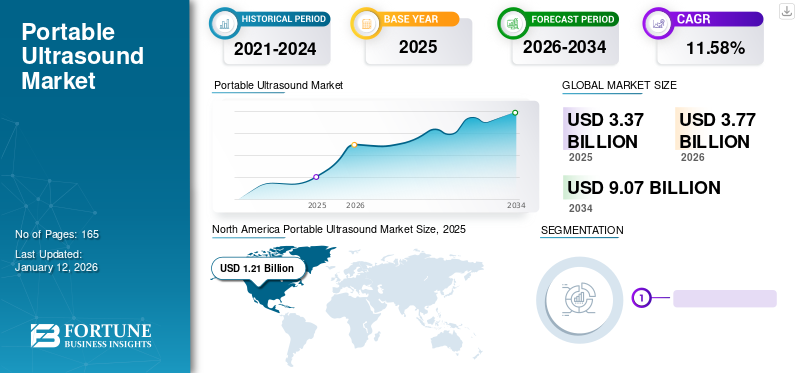

The global portable ultrasound market size was valued at USD 3.37 billion in 2025 The market is projected to grow from USD 3.77 billion in 2026 to USD 9.07 billion in 2034, exhibiting a CAGR of 11.58% during the forecast period. North America dominated the portable ultrasound market with a market share of 36.04%in 2025.

Based on our analysis, the market will exhibit a lower growth of 0.5% in 2020 compared to the average year-on-year growth during 2016-2019. The global impact of COVID-19 has been unprecedented and staggering, with portable ultrasound witnessing a negative impact on demand across all regions amid the pandemic. The rise in CAGR is attributable to this market’s demand and growth, returning to pre-pandemic levels once the pandemic is over.

In the present scenario, there has been a sustained and intense need for accurate medical imaging for a wide range of serious diseases, including cardiovascular ailments and also a wide range of cancers. This demand has further increased due to the rising transition to outpatient care from inpatient care in developed and emerging regions. Furthermore, the robust introduction of technologically advanced products is expected to surge the market growth in the forecast period. This trend of new product launches, coupled with the increasing need for point-of-care medical imaging in diverse end-user settings, is expected to strongly boost the growth of the global market during the forecast period.

COVID-19 Pandemic to Impact Market Negatively Stoked by Cancellation of Procedures

In terms of the medical devices market, the COVID-19 pandemic has had a mixed impact, with some markets witnessing an adverse impact to a few exhibiting a positive surge. However, lockdowns imposed by numerous governments in the initial days of the pandemic had severely limited the normal healthcare procedures to be conducted. This led to a significant decline in hospital visits, which further resulted in the cancellation of a substantial number of diagnostic procedures, such as ultrasound scans. Hence, the global market suffered from a negative impact as the flow of patients for diagnostics and treatment reduced substantially.

Supply chain hindrances, manufacturing challenges, and increased focus of the workforce towards the manufacturing of essential medical equipment are some of the factors that have impacted the portable ultrasound market growth. Manufacturers of ultrasound equipment have witnessed a decline in sales due to the pandemic. In the same instance, there was a slight positive effect in certain cases. These imaging systems were sometimes used for the diagnosis of COVID-19. Hence, the global market has showcased a negative impact.

Global Portable Ultrasound Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 3.37 billion

- 2026 Market Size: USD 3.37 billion

- 2034 Forecast Market Size: USD 9.07 billion

- CAGR: 11.58% (2026–2034)

Market Share Analysis:

- North America led the global portable ultrasound market with a 36.04% share in 2025, driven by high demand for advanced medical imaging, increasing outpatient care, and the presence of key players.

- By Type, the Built-in Console segment dominated the market, owing to high adoption in hospital settings, while the Touchscreen segment is projected to register the fastest CAGR due to increasing regulatory approvals and technological advancements.

Key Country Highlights:

- United States: Leading contributor globally, driven by high demand for diagnostic imaging in emergency care, increasing prevalence of chronic diseases, and rapid adoption of AI-integrated portable ultrasound devices.

- Germany & U.K.: Strong demand for point-of-care imaging systems and robust healthcare spending, with active new product launches enhancing market penetration.

- China & India: Fast-growing markets due to a large patient base, improving healthcare infrastructure, and rising investments by domestic players like Mindray and Chison.

- Latin America & Middle East & Africa: Emerging markets with significant opportunities due to infrastructure upgrades and growing awareness of portable imaging benefits.

LATEST TRENDS

Download Free sample to learn more about this report.

Incorporation of Advanced Technologies in These Systems is a Prominent Trend

One of the most critical trends witnessed in the global market is the increased incorporation of cutting-edge technologies such as artificial intelligence (AI) in these imaging systems. These advanced technologies are also being established for ultrasound-based quantification. Ultrasound-based imaging analysis software is being used to integrate deep learning techniques for measurements. Hence, an increasing number of medical professionals are adopting these devices owing to the diverse range of medical applications associated with the system.

For instance, ultrasound scans are considered the gold standard for most diagnostics of cardiovascular, obstetrics, traumatic, and orthopedic medical specialties. This is attributable to the fact that these systems offer quick and correct diagnoses, thereby enabling medical professionals to make an efficient and accurate analysis of any ailment. This is expected to result in more sales of these medical imaging systems. Furthermore, with the introduction of handheld ultrasound devices, several areas of medicine that did not formerly use this technology are likely to do so in the near future. This is expected to grow and lead to significant market growth in the future.

DRIVING FACTORS

Extensive Adoption of These Systems in Emergency Departments to Drive the Global Market

One of the foremost drivers influencing the global market's growth is the extensive adoption of these imaging systems in emergency care. Emergency care departments are considered the first point of care for many patients requiring urgent medical intervention. The rapidity of patient care depends on a multitude of factors such as the technology and medical equipment present in the emergency department. Among the medical imaging equipment used, the portable ultrasound machine is one of the most sensitive and essential technologies utilized by emergency departments. It can provide real-time images and is an important diagnostic tool due to its non-invasive approach.

Such factors have led several companies to focus on the development of portable medical imaging systems. For instance, newer models have been introduced, such as the Philips Lumify, which was added to the versatility and functionality of portable ultrasound machines, hence, benefitting emergency departments and other areas where this can be a useful tool. Therefore, such strong adoption trends are projected to boost the market growth in the forecast period.

Increasing Product Introductions to Aid Market Growth

One of the critical factors expected to drive market growth during the forecast period is new product launches in the market. These new product introductions are projected to positively impact the market as they are expected to lead to the greater adoption of these systems. This market has witnessed a number of new product introductions over the past few years due to the greater acceptance of these systems among a wide group of physicians. For instance, in January 2020, Siemens Healthineers India announced the launch of the ACUSON Redwood Ultrasound System at the annual conference of the Indian Radiological & Imaging Association (IRIA) 2020. Hence, such steady introductions are projected to impact the market during the forecast period positively.

RESTRAINING FACTORS

Concerns Associated with Regulatory Overhaul coupled with Limited Reimbursement to Hinder Market Growth

Certain restraining factors that are expected to limit the global market's growth in the forecast period include the limited reimbursement for medical imaging. For instance, the reimbursement for portable ultrasound procedures is only provided if the usage meets all requirements by that particular payer. Furthermore, in some cases, as medical ultrasound is an emerging technology, it is considered investigational and is not provided under the CPT code list. Also, a significant rise in unnecessary imaging and misdiagnosis could lead to regulatory overhaul, limiting adoption in the future. Hence, these factors are expected to restrain the market growth in the forecast period.

SEGMENTATION

By Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Touchscreen Segment to Grow at Faster Pace during 2020-2026

Based on type, the market can be segmented into built-in-console and touchscreen segments. The built-in-console segment accounted for the largest portable ultrasound market share of 77.10% in 2026. The dominance is due to the significant launches of product offerings in this segment and the greater transition from the traditional ultrasound systems to these built-in-console systems.

The touchscreen segment is anticipated to register a higher CAGR in the forecast period. This is primarily due to the recent regulatory approvals being awarded to the products in the touchscreen segment. For instance, in May 2017, Chison Medical Imaging received U.S. FDA approval for its Site-Rite Halcyon Diagnostic Ultrasound System, which is indicated for general-purpose ultrasound imaging.

By End User Analysis

Hospitals Segment Accounted for the Highest Market Share in 2024

Based on the market segmentation by the end user, it is divided into hospitals and clinics. The hospitals segment is projected to account for the largest market share of 64.97% in 2026, because of the greater availability of trained healthcare professionals and the higher adoption of these technologically advanced devices in the application end user settings. Hence, this type of end user would maintain its dominance over the global portable ultrasound market. The clinics segment accounted for a lower share of the global market and is expected to register a comparatively higher CAGR due to a gradual rise in the emergence of specialty clinics, especially in developed countries which are aiming to reduce the flow of patients towards hospital settings and divert the examinations and diagnostic tests in specialized outpatient clinics.

REGIONAL INSIGHTS

North America Portable Ultrasound Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 1.21 billion in 2025 and USD 1.34 billion in 2026. The region is projected to become the largest market in the forecast period. The contributive factor for the dominant share includes the higher adoption of the technologically advanced portable ultrasound. Other critical factors include the high and sustained demand for accurate medical imaging due to the increased prevalence of critical illnesses such as cancers. For instance, according to the Global Cancer Observatory (GLOBOCAN), in 2020, it was estimated that the United States would record approximately 2,281,658 new cases of cancer in 2020. The U.S. market is projected to reach USD 1.31 billion by 2026.

Europe

Europe is estimated to be the second-largest market in the forecast period. Some of the reasons for the region’s significant market share include a higher medical expenditure in the region’s major countries, coupled with new product launches. For instance, in April 2020, Mindray Medical announced the launch of its new portable ultrasound, ME series, for the enhancement of clinical confidence during critical and emergency COVID-19 cases in Europe. The UK market is projected to reach USD 0.19 billion by 2026, and the Germany market is projected to reach USD 0.27 billion by 2026.

Asia Pacific

The Asia Pacific region is projected to record the highest CAGR in the forecast period due to factors such as the increased demand for effective medical imaging, strong potential patient base, and improving healthcare expenditure. The Japan market is projected to reach USD 0.57 billion by 2026, the China market is projected to reach USD 0.45 billion by 2026, and the India market is projected to reach USD 0.09 billion by 2026.

Latin America and the Middle East & Africa

Developing regions of Latin America and the Middle East & Africa recorded a comparatively lower market share in the forecast period but are projected to witness strong growth prospects in the upcoming years due to the significant improvement in the healthcare infrastructure of these emerging regions, coupled with the increasing adoption of technologically advanced imaging systems.

KEY INDUSTRY PLAYERS

Strong Medical Imaging Portfolio of GE Healthcare and Koninklijke Philips N.V. to Help Them Lead the Market

In terms of the global market's competitive landscape, the scenario depicts the presence of a multitude of companies of various sizes. This includes the presence of established medical imaging players at the international level and also emerging companies at the domestic level. The most dominant industry players of this market are GE Healthcare and Koninklijke Philips N.V. Collectively, these key players account for a dominant proportion of the global market owing to their robust and technologically advanced product portfolio for portable ultrasound devices.

Furthermore, these prominent companies are involved in cutting-edge R&D initiatives to launch technologically advanced product offerings. For instance, in May 2020, Koninklijke Philips N.V. received the U.S. FDA approval for the usage of its ultrasound portfolio for the management of COVID-19-related lung and cardiac complications. Furthermore, many of the global market's upcoming players are based in China and include Shenzhen Mindray Bio-Medical Electronics Co., Ltd. and CHISON Medical Technologies. These companies’ strategic expansion initiatives are expected to contribute to their efforts to expand their market revenue share in the forecast period.

LIST OF KEY COMPANIES PROFILED:

- GE Healthcare (Chicago, U.S.)

- Koninklijke Philips N.V. (Amsterdam, The Netherlands)

- FUJIFILM Sonosite, Inc. (Bothell, U.S.)

- ALPINION MEDICAL SYSTEMS Co., Ltd. (Seoul, South Korea)

- Hitachi Ltd. (Tokyo, Japan)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (Shenzhen, China)

- EDAN Instruments (Shenzhen, China)

- Terason Corporation (Burlington, U.S.)

- CHISON Medical Technologies (Jiangsu, China)

- Healcerion (Seoul, South Korea)

- Butterfly Network, Inc. (Guilford, U.S.)

- Bard Access Systems Inc. (Becton, Dickinson and Company) (Salt Lake City, U.S.)

- Teknova Medical Systems Co., Ltd. (Beijing, China)

- Advanced Instrumentations (Miami, Florida)

- DRE Medical (Kentucky, U.S.)

- DRAMIŃSKI S. A. (Olsztyn, Poland)

- Landwind Medical (Shenzhen, China)

- Shenzhen AnaSonic Bio-Medical Technology Co., Ltd. (University Town of Shenzhen, China)

- Accutome Inc. (Philadelphia, U.S.)

- Zimmer MedizinSysteme GmbH (Neu-Ulm, Germany)

- Other Players

KEY INDUSTRY DEVELOPMENTS:

- March 2021 - G.E. Healthcare, worldwide medical technology and digital solutions innovator announced the launch of Vscan Air, a wireless compact ultrasound that provides crystal clear image quality and whole-body scanning capabilities.

- October 2020 - Clarius Mobile Health announced the rising adoption of its Clarius L7 H.D. handheld ultrasound scanner by pain management specialists worldwide. It tends to quality ultrasound imaging of anatomy under the skin for more reliable and precise placement of pain medication.

- August 2020 - PulseNmore announced the launch of tele-ultrasound device to reduce prenatal office visits during the pandemic and ahead that to assist pregnant women in performing at-home ultrasound scans and limiting trips to hospitals or clinics. The company signed an agreement with Clalit Health Services to provide tens of thousands of its pregnant members with PulseNmore's product.

- May 2020 - Philips received approval for ultrasound solutions to manage COVID-19-related lung and cardiac complications from the U.S. Food and Drug Administration (FDA). The portfolio includes ultrasound systems including the EPIQ series, Affiniti series, Lumify, CX50, and Sparq diagnostic ultrasound systems.

REPORT COVERAGE

The global market research report provides a detailed analysis of the market. It focuses on key aspects such as disease burden – cancer and incidence of prostate cancer – by key region, healthcare overview – particular countries, COVID-19 impact on the portable ultrasound value chain, sales channels analysis, an overview of medical ultrasound equipment customers, key trends – emerging markets to drive growth, and key mergers, acquisitions & partnerships. Besides this, it offers insights into the market trends and highlights vital market dynamics. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the global market over recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.58% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By End User

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 3.37 billion in 2025 and is projected to reach USD 9.07 billion by 2034.

In 2025, the North America market value stood at USD 1.21 billion.

Registering a CAGR of 11.58%, the market will exhibit steady growth in the forecast period (2026-2034).

The built-in-console segment is expected to lead this market during the forecast period.

The increasing demand for portable ultrasound imaging, rising technological advancements in this portable type of ultrasound, and new product launches are some of the major factors driving the markets growth.

GE Healthcare and Koninklijke Philips N.V. are some of the major players in the global market.

North America dominated the portable ultrasound market with a market share of 36.04%in 2025.

An expanding customer base due to the low cost of handheld ultrasound scanners, increased adoption of these products for early-stage disease diagnosis, and a strong prevalence of chronic diseases would necessitate effective imaging. These factors are expected to drive the adoption of these products in the global market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us