Veterinary Drugs Market Size, Share & Industry Analysis, By Product (Anti-infectives, Anti-inflammatory, Parasiticides, and Others), By Animal Type (Companion {Feline, Canine, Avian, and Others} and Livestock {Poultry, Porcine, Bovine, and Others}), By Route of Administration (Oral, Parenteral, Topical, and Aerosol), By Distribution Channel (Veterinary Hospitals, Veterinary Clinics, Pharmacies & Drug Stores, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

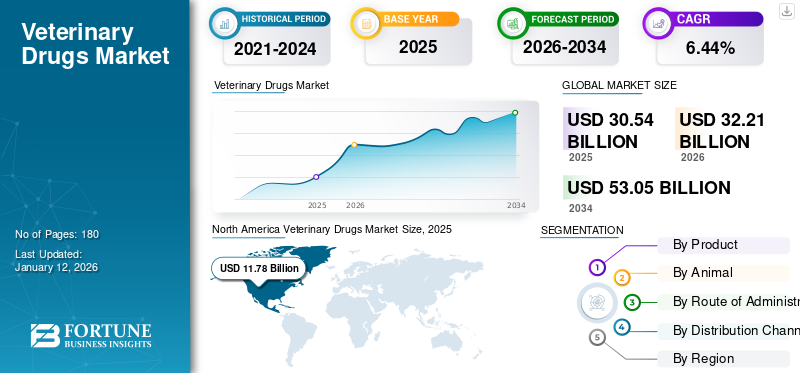

The global veterinary drugs market size was valued at USD 30.54 billion in 2025. The market is projected to grow from USD 32.20 billion in 2026 to USD 53.05 billion by 2034, exhibiting a CAGR of 6.44% during the forecast period. North America dominated the Veterinary Drugs market with a market share of 38.57% in 2025.

Veterinary drugs are administered to cure, mitigate, treat, or prevent diseases in animals. These drugs regulate the physiology of animals and are designed to restore or maintain their optimal health status. The main application of these drugs is to treat diseases and infections. Widespread diseases in cattle, such as bovine respiratory diseases, foot and mouth diseases, avian influenza, and others, are treated with drugs such as anti-infectives, parasiticides, anti-inflammatory and pain medications. Rising incidences of zoonotic diseases, increasing pet ownership, and the growing demand for animal protein across the globe are a few factors supporting the demand for efficient products.

- For example, in October 2024, Veterinary World published an article titled “Spatial and temporal distribution of foot-and-mouth disease outbreaks in Algeria from 2014 to 2022”, which reported 22,690 Foot-and-Mouth Disease (FMD) cases and 1,141 outbreaks in Algeria between 2014 and 2022. The prevalence of FMD extended to 91.6% of the districts of the country of Algeria, particularly in the north (center) and eastern regions. Such a high number of cases associated with chronic animal diseases is expected to drive market growth.

Moreover, the presence of influential players in the market, such as Zoetis Services LLC, Elanco, and Virbac, with strong research and development initiatives, strategic activities, and robust product offerings, boosts the market offerings and propels the market growth.

Veterinary Drugs Market Snapshot & Highlights

Market Size & Forecast

- 2025 Market Size: USD 30.54 billion

- 2026 Market Size: USD 32.20 billion

- 2034 Forecast Market Size: USD 53.05 billion

- CAGR: 6.44% from 2026–2034

Market Share

- Region: North America dominated the global veterinary drugs market with a 38.5% share in 2025, driven by increasing pet ownership, rising awareness of animal health, and a robust presence of key market players offering innovative treatment solutions.

- By Product Type: Parasiticides held the largest market share in 2024, fueled by growing incidences of parasitic infections in livestock and companion animals, increased use of internal and external parasite control products, and a strong focus on novel product approvals by key players.

Key Country Highlights

- United States: The U.S. leads the North American market, driven by widespread pet ownership (66% of households), strong veterinary healthcare infrastructure, and significant R&D investments by companies like Zoetis and Elanco. Recent innovations, such as Zoetis’s Librela monoclonal antibody treatment for osteoarthritis in dogs, exemplify the country’s leadership in advancing veterinary therapeutics.

- Japan: Japan’s veterinary drug demand is supported by increasing focus on companion animal care, government-backed initiatives for zoonotic disease control, and rising pet healthcare expenditures. Demand for oral and parenteral formulations is increasing, particularly among aging pet populations in urban centers.

- China: As one of the largest livestock producers globally, China is witnessing robust demand for veterinary drugs due to its expanding animal protein sector and enhanced government initiatives promoting animal health. Efforts under the Livestock and Health Disease Control Programme are increasing access to veterinary medicines in rural and semi-urban regions.

- Europe: The region’s growth is supported by a rise in pet adoption, increasing consumer spending on animal healthcare, and stringent regulations promoting responsible drug usage. Approximately 90 million European households own companion animals, driving high consumption of veterinary drugs across clinics, hospitals, and pharmacies.

MARKET DYNAMICS

MARKET DRIVERS

Rising Prevalence of Veterinary Diseases to Propel Market Growth

The principal factor influencing the global market growth is the rising prevalence of key veterinary diseases such as bovine respiratory disease, infectious diseases, skin infections, parasite infections, mastitis, foot and mouth diseases, and others. With the rising number of diseases and increasing advancements in animal healthcare, treatment for such diseases is becoming more accessible, leading to the growing adoption of veterinary drugs. This has significantly driven the global veterinary drugs market growth.

To capture the growing market demands, key players in the market carry out constant research initiatives to provide innovative treatment methods that treat companion and livestock animals. These research initiatives have led to a surge in new product launches to fight against the diseases and are expected to surge market growth.

- For instance, in February 2020, Forte Healthcare Limited launched PROCAPEN Injector 3g. It is a narrow-spectrum antibiotic drug used for the treatment of mastitis that targets udder infections in lactating cattle. Such development boosts the growth of the market.

Additionally, the rise in government initiatives to protect against zoonotic diseases and increased awareness about animal health create favorable effects on the adoption of these products.

MARKET RESTRAINTS

Presence of Illegal Veterinary Medicines is a Significant Factor Restraining Market Growth

Illegal veterinary medicines comprise counterfeit, falsified, and unregistered products and unapproved parallel imports. These counterfeit, falsified, and unregistered products harm animals and decrease food safety while increasing the risk of zoonotic disease transmission and antimicrobial resistance.

- For instance, in December 2024, the Veterinary Medicines Directorate seized over 13,000 unauthorized horse medicines sold without permission, which the company Abler marketed. The active ingredients in the confiscated drugs were Omeprazole and Sucralfate, contained within the products of AbPrazole and Absucralfate, respectively. These illegal and unauthorized drugs would have adversely affected the authorized medications if sold.

Additionally, these counterfeits and illegal drugs not only pose risks to the consumer but also harm the reputation of the original companies, creating doubts regarding the efficiency of the company’s original product.

MARKET OPPORTUNITIES

Increasing Pet Ownerships to Propel the Demand for Drugs, Generating Profitable Opportunity for Market Growth

With the rise in disposable income, the number of people adopting pets for emotional support has increased. The American Veterinary Medical Association (AVMA) discovered over 60.0% of pet owners perceive their pets as family members. This emotional attachment influences their willingness to invest more in advanced care.

- For instance, in October 2024, Mars Incorporated, a leader in pet care products and services, revealed in the results of their pet parent study that more than one-third (37.0%) of dog and cat owners consider their pets as the most important part of their lives. The percentage is even higher amongst Generation Z (Gen Z) (45.0%) and Millennials (40.0%).

Additionally, the key market has evolved with increasing disposable income and rising awareness about pet care, including the administration of routine medications, vaccinations, and grooming. Such factors are expected to offer lucrative opportunities for the growth of the market.

MARKET CHALLENGES

Antimicrobial Resistance in Companion Animals to Hamper Product Adoption

Antimicrobial Resistance (AMR) refers to the ability of microorganisms to create resistance against the drugs, limiting their efficiency. Limited information accompanied by instances of self-medication and economic limitations has led to unsupervised and ubiquitous use of antibiotics. Such incidences have led to the rise of Antimicrobial Resistance (AMR) in companion animals. The overuse of these antibiotics results in serious consequences, particularly in the form of AMR, which poses a threat to animal as well as human health to create further requirements for stronger antibiotics.

Different regulatory bodies are implementing stricter guidelines and enhancing their surveillance capabilities. These measures aim to address AMR challenges that may hinder the availability of these drugs in the market for therapeutic purposes.

- For instance, in November 2024, The Food and Agriculture Organization of the United Nations (FAO), which has been instrumental in establishing the India Network for Fisheries and Animal Antimicrobial Resistance (INFAAR), marked a pioneering effort to create a structured surveillance network aimed at addressing AMR in the country’s fisheries and livestock sectors.

Additionally, growing awareness programs associated with limited use of antibiotics to avoid drug-resistant infections are leading to decreased adoption of antibiotics and thus hindering the market growth.

- For instance, in September 2023, according to the World Organization for Animal Health (WOAH), global antimicrobial use in animals has declined by 13.0% in the last 3 years, marking the decreased adoption and misuse of antibiotics, thus challenging the growth of the market.

VETERINARY DRUGS MARKET TRENDS

Emergence of New Therapies for Revolutionizing Veterinary Healthcare is a Prominent Trend

Veterinary healthcare has observed the commencement of various new technologies that revolutionize the veterinary market. Novel treatment technologies such as gene therapy and monoclonal antibody therapy are gaining momentum as research is being carried out. These methodologies provide personalized treatment options for complex diseases. This shift toward customized medicine reduces the risk of adverse immunological reactions in animals.

Leading companies are investing highly in research and development for programs to bring forth biotech innovations such as novel treatment methodologies with minimal risk of side effects. These factors are accelerating market growth as they commercialize novel therapies such as gene therapy and cell therapy.

- For example, in July 2024, Protect Animal Health Inc. and DotBio announced a collaboration to develop innovative therapeutic antibody discovery platform technologies and a therapeutic antibody pipeline to develop advanced therapies and technologies for canine and feline health.

Other Trends

Rising Adoption of Sustainable Drugs for Veterinary Use Boosts Market Growth

Another trend observed in the global market is the need for sustainable and environmentally friendly veterinary practices. Certain veterinary drugs, particularly parasiticides such as fipronil and imidacloprid, have raised environmental concerns due to their impact on wildlife and water resources.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic exhibited a slightly positive impact on the market, while key companies redirected their research efforts toward human health and faced supply chain challenges. The issue of COVID-related loneliness gave rise to pet ownership and acted as a significant driver in the global market.

Moreover, the rise of telemedicine in veterinary practices facilitated remote consultations, allowing for ongoing access to veterinary care and prescriptions. This ensured that pet owners could still receive veterinary expertise during the pandemic. As the impact of COVID-19 has diminished, the market is returning to its previous state. The growing prevalence of veterinary diseases is expected to boost market growth further during the forecast period.

SEGMENTATION ANALYSIS

By Product

Rising adoption of Livestock Farming and Companion Pets has Contributed Toward the Dominance of Parasiticides

On the basis of product, the global market is segmented into anti-infectives, anti-inflammatory, parasiticides, and others.

The parasiticides segment dominated with the highest global veterinary drugs market share of 42.92% in 2025. Parasiticides are used to control parasites such as fleas, ticks, and worms in animals. The market share of the segment is majorly driven by the increasing focus of key companies on novel treatments, followed by various approvals for clinical trials.

- For instance, in July 2023, Boehringer Ingelheim International GmbH. received U.S. FDA approval for its Parasiticides ‘NexGard Plus’ (afoxolaner, moxidectin, and pyrantel tablets). This drug is a combination type and protects animals against internal and external parasites.

The anti-inflammatory drugs held the second-largest share of the global market in 2024. These are administered to manage the pain caused by fever, injuries, surgeries, and conditions such as osteoarthritis in animals. The growth of anti-inflammatory drugs is a reason for the continuous advancement of treatment methodologies. The segment is expected to grow during the forecast period as a result of various new product launches.

- For instance, in October 2023, Zoetis Services LLC launched two U.S. FDA-approved drugs in the U.S. This prescription drug was the first monoclonal antibody (mAb) that the FDA has approved for use in dogs. These medications help with the pruritus associated with the allergic reaction.

On the other hand, anti-infectives exhibit potential growth, with key companies expanding their product portfolio with innovative and technologically advanced product launches to increase the lifespan of animals.

- For instance, in February 2025, Zoetis Services LLC acquired marketing rights for Loncor 300 (florfenicol) from Elanco. This acquisition led to the expansion of the company’s anti-infective portfolio for cattle. This drug is a broad-spectrum antibiotic active against many Gram-negative and Gram-positive bacteria that cause bovine respiratory disease and foot rot.

They are widely used for the prevention of diseases such as mastitis in cattle, respiratory and urinary tract infections, streptococcal infections in fish, and various other infections in livestock and companion animals. Moreover, the production of higher-quality products has contributed to the high growth of the anti-infective veterinary drug segment. Such benefits bolster the segment’s growth during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Animal Type

Companion Animal Segment Dominated Owing to Increased Disposable Incomes

In reference to animal type, the market is segmented into companion and livestock.

The companion animals segment held the largest global market share in 2024. This segment is further divided into feline, canine, avian classes, and others. The growth of this segment is compelled by increasing pet ownership and their augmenting disposable incomes. Also, growing awareness of veterinary diseases assists in the development of the segment. The segment is expected to capture 51.71% of the market share in 2026.

- For instance, in January 2025, Forbes published an article that reported that the number of pet owners in the U.S. has jumped over the past decades. As of 2024, 66.0% of U.S. households are home to companion animals who are considered as family, as compared to 56.0% in 1988.

The livestock segment also held a substantial key market share with a narrow difference. This segment is further classified into poultry, porcine, bovine, and other livestock categories. The growth potential of the livestock segment is owed to the increasing demand for animal proteins and animal-derived products such as meat, milk, and many more. The food derived from these livestock animals should be free of infection and diseases. The use of drugs also maximizes the output from the livestock animals. This segment is anticipated to grow with a considerable CAGR of 5.49% during the forecast period (2025-2032).

- For example, the arm of the United Nations for Food and Agriculture (FAO) estimated that by 2050, the demand for food will surge by 60.0%. It is also estimated that during 2010 and 2050, production of animal proteins will grow by around 1.7% per year, with meat production on the rise by nearly 70.0%, aquaculture by 90.0%, and dairy by 55.0%.

Additionally, an increase in the demand for meat and animal-based products is estimated to provide for the rise in segmental growth during the forecast years.

The companion animals segment held the largest global market share in 2024. This segment is further divided into feline, canine, avian classes, and others. The growth of this segment is compelled by increasing pet ownership and their augmenting disposable incomes. Also, growing awareness of veterinary diseases assists in the development of the segment.

- For instance, in January 2025, Forbes published an article that reported that the number of pet owners in the U.S. has jumped over the past decades. As of 2024, 66.0% of U.S. households are home to companion animals who are considered as family, as compared to 56.0% in 1988.

The livestock segment also held a substantial key market share with a narrow difference. This segment is further classified into poultry, porcine, bovine, and other livestock categories. The growth potential of the livestock segment is owed to the increasing demand for animal proteins and animal-derived products such as meat, milk, and many more. The food derived from these livestock animals should be free of infection and diseases. The use of drugs also maximizes the output from the livestock animals.

- For example, the arm of the United Nations for Food and Agriculture (FAO) estimated that by 2050, the demand for food will surge by 60.0%. It is also estimated that during 2010 and 2050, production of animal proteins will grow by around 1.7% per year, with meat production on the rise by nearly 70.0%, aquaculture by 90.0%, and dairy by 55.0%.

Additionally, an increase in the demand for meat and animal-based products is estimated to provide for the rise in segmental growth during the forecast years.

By Route of Administration

Ease of Administration Enables Oral Segment to Hold Market Dominance

On the basis of route of administration, the global market is segmented into oral, parenteral, topical, and aerosol.

The oral segment held the major market share of the global market in 2024. This is accredited to its effortless administration and ease of availability and access. Moreover, the key players in the market are focusing on investing in research and development, thus propelling the launch of various new products that cater to the needs of pet owners and livestock breeders. This segment is estimated to hold 48.50% of the market share in 2026.

- For example, in August 2024, Norbrook, a leading veterinary manufacturer, announced the launch of Felanorm (methimazole) oral solution, which is utilized to treat Feline Hyperthyroidism, providing an effective alternative to veterinarians.

Parenteral is the second largest segment and is expected to grow with a significant CAGR of 6.05% over the forecast period. The growth of this particular segment is attributed to its efficiency and speedy results, which are demonstrated when compared to other routes. This segment includes injecting the drugs directly into the animal’s body, which can be done via subcutaneous, epicutaneous, intradermal, transdermal, and intramuscular administration, respectively. Additionally, increasing research and development activities for innovative drugs and product launches of new parenteral vaccines also promoted the growth of the segment.

- For instance, in February 2025, Elanco launched Pradalex, an injectable antibiotic to treat Bovine respiratory diseases and Swine Respiratory diseases. A bovine respiratory disorder commonly known as “shipping fever” that largely affects cattle and is one of the most frequent and costly stockers can be treated with the help of Pradalex.

On the other hand, the topical segment comprises a fair market share in the global veterinary drug market. Topical veterinary drug treatments are localized, easy to apply, and are majorly used for activity against fungal and bacterial skin infections.

- For instance, in October 2024, Orkla Wound Care AB launched its first product, Snögg BactiDefend Dressing, in Europe, that utilized American antimicrobial technology for animal wound care. It is a topical application that helps in fungal and microbial infections.

Furthermore, the aerosol segment currently possesses the least market growth. The segment comprises the drugs that are directed to the respiratory tract through oral or nasal routes. Anesthetics make up for the majority of the aerosol segment. The usage of anesthetics is limited, resulting in stunted growth in this particular segment.

- For instance, in August 2024, Virbac launched Cortotic, a diester glucocorticosteroid to reduce inflammation as a symptomatic treatment for the clinical signs associated with canine otitis externa, without an antimicrobial.

By Distribution Channel

Veterinary Hospital Segment to Hold Largest Share Owing to Comprehensive Care Provided for Long Procedures

Based on distribution channel, the global market is divided into veterinary hospitals, veterinary clinics, pharmacies & drug stores, and others.

The veterinary hospital segment is anticipated to have a dominant share during the forecast period. To cater to the growing need for comprehensive care and treatment options, veterinary hospitals have equipped themselves with state-of-the-art facilities and a diverse, specialized team of professionals. Major procedures in livestock animals, such as breeding along with gestation and many more, along with procedures including castration in companion animals, have to proceed in the hands of licensed medical professionals. After-procedure care also contributes to the growth of the segment. This segment is foreseen to capture 45.14% of the market share in 2026.

- For instance, in March 2025, a primary care veterinary hospital named Elm City Vet officially opened exclusively for companion animals. The hospital provides high-quality, compassionate care to the pets and families of veterinary patients.

Clinics are the second largest segment, followed by hospitals. They provide a wide range of services, including routine checkups, vaccinations, dental care, and emergency care. Ease of accessibility and assistance of veterinary professionals, support the segment’s market share. These developments have influenced many companies to expand their reach. This segment is likely to grow at a CAGR of 6.25% during the forecast period (2025-2032).

- For instance, in February 2025, Mars Inc., the biggest owner of veterinary clinics in the world, expanded its practice footprint into India by acquiring a minority stake in Crown Veterinary Services, a Mumbai-based group of eight practices in the country, according to a press release issued by Crown in December.

The pharmacies and drug stores are expected to maintain a strong position during the forecast period. Routine drugs are provided at the convenience of the customers. The vast availability of generic drugs and easy accessibility propels the market growth for the pharmacy and drug stores. The segment is to witness various collaborations to bridge the gap in the distribution channel.

- For example, in December 2022, the University of Illinois Veterinary Teaching Hospital, Chicago, collaborated with the UIC College of Pharmacy to welcome their first official resident in veterinary pharmacy, marking a new intercampus, interprofessional collaboration.

Furthermore, various collaborations between veterinary clinics and hospitals create unprecedented opportunities for growth. Integration of online pharmacies is also likely to bolster the segment’s expansion.

VETERINARY DRUGS MARKET REGIONAL OUTLOOK

Geographically, the market is segmented into North America, Asia Pacific, Europe, the Middle East & Africa and Latin America.

North America

North America Veterinary Drugs Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America’s veterinary drugs market size was at USD 11.77 billion in 2025. It is expected to grow remarkably over the market forecast period. The growth of the region is expected to advance quickly due to the increasing pet ownership, continuous research and development in veterinary medicine, growing demand for animal protein, and increasing number of state-of-the-art treatment facilities in the region.

Additionally, to cater to the growing need to access quality veterinary healthcare, various companies are forming strategic collaborations, fostering the expansion of the segment.

- For instance, in June 2024, Boehringer Ingelheim International GmbH. & Trupanion announced an exclusive collaboration to increase access to pet care. This collaboration allowed them to strengthen their expertise and provide early detection of risk factors and better management of the disease.

These relentless research and development initiatives provide better treatment alternatives and aid in novel technologies being developed across the region, which will support its growth.

U.S.

The U.S. is estimated to dominate the North American region during the study period. Increasing pet ownership, continuous research, and development in treatment methodologies are anticipated to support the country’s market growth. Additionally, the presence of key players and the increasing number of research and development activities in the country for the development of drugs bolster the country’s economic growth. The U.S market is estimated to reach a valuation of USD 12.01 billion in 2026.

- For instance, in February 2025, Zoetis announced U.S. label update for Librela (bedinvetmab injection), a once-monthly injectable monoclonal antibody for the control of pain associated with Osteoarthritis (OA) in dogs.

Europe

Europe is the second largest market anticipated to be valued at USD 8.04 billion in 2026, exhibiting a CAGR of 5.27% during the forecast period (2025-2032), driven by an increase in demand for animal-based proteins, rising animal husbandry, and increasing disposable income of pet owners, which has, in turn, increased the demand for veterinary drugs. Furthermore, with an increase in the population of companion animals, the demand for its affiliated products, medications, and other services also bolsters market growth. The U.K. market is foreseen to reach USD 2.58 billion in 2026.

- In June 2022, European Pet Food Industry Federation (FEDIAF) published its annual facts & figures related to the pet population and pet food market in Europe. The data confirmed the rise in pet ownership in Europe. They reported that 90.0 million European households, which is around 46.0%, owned companion animals, which resulted in over USD 21.65 billion worth of related services and products, including veterinary drugs. Such a large number of revenue generation associated with companion animals leads to the growth of the market in the region.

Germany is poised to be valued at USD 1.13 billion in 2026, while France is projected to reach a market value of USD 1.26 billion in the same year.

Asia Pacific

Asia Pacific is the third largest market expected to gain USD 5.99 billion in 2026. The region is expected to grow with a significantly higher CAGR during the forecast period. The region has witnessed a notable increase in disposable income, which has resulted in an increased number of pet parents. Pet and livestock owners in developing countries such as China, India, Japan, and other parts of Asia Pacific are increasingly focusing on preventive care available for both companion and livestock animals. China is expected to hit USD 2.18 billion in 2026.

Additionally, various government initiatives are available to animal owners that aim to optimize animal output to cope with the augmenting demand. These factors influence the expansion of the market in the region.

- For example, in March 2025, The Indian Union Cabinet approved the revision of the Livestock and Health Disease Control Programme (LHDCP). The scheme focuses on improving the accessibility of generic veterinary medicine –Pashu Aushadi through an intricate network of PM Kishan Samriddhi Kendra and Co-operative societies that are available throughout the country.

India is set to be worth USD 0.90 billion in 2026, while Japan is estimated to grow with a valuation of USD 1.17 billion in the same year.

Latin America and the Middle East & Africa

Latin America is the fourth largest market poised to grow with a valuation of USD 3.47 billion in 2026. The Middle East & Africa and Latin America markets are expected to grow at a stable pace during the forecast period. The region is largely dependent on livestock farming for its meat requirements and accounts for approximately 43% of the nation’s agricultural GDP. The major poultry companies in the region are investing in their expansion and capacity production.

- For instance, in February 2025, Saudi Arabia’s poultry company, Balady and Tanmiah Food, as Entaj announced their expansion plan and were ready to list themselves on the Saudi stock exchange. These investment plans have been carried out for production expansion.

The increasing demand for animal protein and veterinary products and services required for maintaining optimum health conditions of livestock is the significant driver propelling the growth of the market in the region. The GCC market is expanding and is set to be valued at USD 1.02 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Strong Global Presence and Robust Product Offerings by Influential Players such as Elanco, Inc., and Others Strengthen their Positions

In terms of the competitive landscape, the global market is consolidated by few key players with a stronghold due to their diverse product portfolio and strategic collaborations and acquisitions. Some of the notable players in the market are Zoetis Services LLC, Merck Animal Health, and Elanco. The relentless research initiatives and product launches accompanied by a strong geographical presence over the globe are expected to propel the company’s share in the market.

- For instance, in April 2024, Virbac Corporation completed the acquisition of Sasaeah. This strategic acquisition brought the organization top leadership in the farm animal vaccines market in Japan, particularly in the cattle segment, and a large portfolio of pharmaceutical products for all the major species.

Other prominent players, such as Ceva, Virbac, and Dechra Pharmaceuticals Limited, are also expected to hold a substantial share of the market. Owing to the presence of a robust product portfolio with expanded investment in research and development and emphasis on strategic activities to offer advanced products in the market.

LIST OF KEY VETERINARY DRUGS COMPANIES PROFILED

- Zoetis Services LLC (U.S.)

- Merck & Co., Inc. (U.S.)

- Elanco Animal Health Incorporated (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Ceva (France)

- Vetoquinol (France)

- Dechra Pharmaceuticals Limited (U.K.)

- Virbac Corporation (France)

KEY INDUSTRY DEVELOPMENTS

- July 2024: Humane Society International/Mexico launched a pilot program to improve companion animal welfare and increase access to care in rural and low-income households in Aguascalientes.

- June 2024: Cocrystal Pharma, Inc.’s novel, broad-spectrum antiviral, which is in a Phase 2a clinical trial, inhibits activity in the highly pathogenic avian influenza A (H5N1) PB2 protein recently identified in infected dairy cattle.

- December 2023: Merck animal health receives positive CVMP opinion for an injectable formulation of Bravecto (fluralaner) for use in dogs.

- September 2022: Zoetis completed the acquisition of Jurox which operates in providing livestock and companion animal products.

- May 2021: Anivive announced a collaboration with MWI Animal Health in an attempt to provide veterinarians with the newest lymphoma treatment for dogs.

REPORT COVERAGE

The global veterinary drugs market research report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, products, animals, route of administration, and distribution channels. Besides this, it offers insights into the market trends, the impact of COVID-19, and the prevalence of diseases, among other key insights. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.44% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Animal Type

|

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market is projected to reach USD 53.05 billion by 2034.

In 2025, the market stood at USD 30.54 billion.

By registering a CAGR of 6.447%, the market will exhibit steady growth during the forecast period (2026-2034).

In terms of product, the parasiticides are expected to lead the market during the forecast period.

The rising prevalence of key veterinary diseases increased veterinary healthcare awareness, and the rise in pet ownership will drive the growth of the market.

Zoetis, Elanco, Inc., and Merck Animal Health are the top players in the market.

North America is expected to hold the largest share of the market.

Increased awareness about animal health, various product launches, a rise in the prevalence of veterinary diseases, and surging animal ownership would drive the adoption of veterinary drugs.

The current market trends are the adoption of novel treatment therapies, stringent regulatory norms with respect to livestock animals, and increased awareness among owners.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us