Vital Sign Monitoring Devices Market Size, Share & Industry Analysis, By Type (Pulse Oximeters {Fingertip Oximeters, Hand-held Oximeters, Table-top Oximeters, and Others}, Temperature Monitors {Analog Temperature Monitoring Devices, and Digital Temperature Monitoring Devices}, and Blood Pressure Monitors {Devices [Sphygmomanometer, Digital BP Monitors, and Ambulatory BP Monitors], and Accessories [Blood Pressure Cuffs, Transducers, and Others]}), By End User (Hospitals & ASCs, Clinics, Homecare Settings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

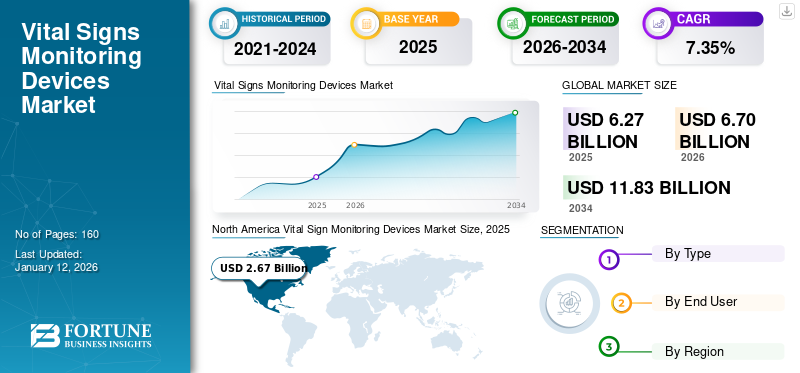

The global vital sign monitoring devices market size was valued at USD 6.27 billion in 2025. The market is projected to grow from USD 6.7 billion in 2026 to USD 11.83 billion by 2034, exhibiting a CAGR of 7.35% during the forecast period. North America dominated the vital signs monitoring devices market with a market share of 42.67% in 2025.

Vital signs are a significant component of patient care. They are used to decide which treatment protocols to follow, confirm feedback on treatments performed, and provide critical information needed to make life-saving decisions. The growing rate of chronic disorders, such as hypertension, respiratory conditions, and a few others across the globe is one of the major factors set to augment the vital signs monitoring devices market during the forecast period.

- According to a 2023 report published by the World Health Organization, one in three adults globally suffers from hypertension. Also, the number of people living with hypertension doubled between 1990 and 2019, from 650 million to 1.3 billion.

The COVID-19 pandemic positively impacted the global market owing to the increased demand for vital sign monitoring devices, including pulse oximeters, thermometers, and blood pressure monitors. The strict COVID-19 guidelines and regulations to control the spread of the infection led to increased temperature testing of the patients and individuals visiting various healthcare facilities, including hospitals, clinics, and others. These factors resulted in a significant increase in the demand for these devices, with the major players operating in the market witnessing a massive growth in their revenues during the pandemic.

- In March 2020, the U.S. Food and Drug Administration (FDA) issued a new guideline that allows the producers of certain vital sign monitoring devices to increase their production so that medical professionals can use them to monitor patients remotely. These include devices that measure respiratory rate, body temperature, heart rate, and blood pressure.

Global Vital Sign Monitoring Devices Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 6.27 billion

- 2026 Market Size: USD 6.7 billion

- 2034 Forecast Market Size: USD 11.83 billion

- CAGR: 7.35% (2026–2034)

Market Share Analysis:

- North America dominated the global vital sign monitoring devices market with a 42.67% share in 2025, driven by rising chronic diseases, advanced healthcare infrastructure, and widespread adoption of monitoring technologies.

- By Type, the Pulse Oximeters segment led the market owing to increasing respiratory and cardiovascular disease prevalence, followed by rapid advancements in device technology.

Key Country Highlights:

- United States: Largest market globally, fueled by high healthcare expenditure, increasing chronic disease burden, and supportive regulatory policies enabling remote monitoring.

- China & India: Fastest-growing markets in Asia Pacific, driven by rising healthcare awareness, rapid infrastructure development, and a surge in chronic conditions.

- Europe (Germany, U.K., France): Strong market presence due to rising lifestyle-related diseases and increasing product launches from regional manufacturers.

- Latin America & Middle East & Africa: Emerging markets with growing initiatives to raise awareness and increase healthcare access, though challenged by affordability issues.

Vital Sign Monitoring Devices Market Trends

Rising Technological Advancements in Monitoring Devices

The growing demand for monitoring vital signs of patients suffering from various chronic conditions is emphasizing the need for technologically advanced monitoring devices to overcome the challenges of traditional devices.

The continuous monitoring of vital signs in patients through traditional methods often results in frequent disruptions to patients’ sleep. Also, the manual recording of data is time-consuming and prone to errors, which can lead to inaccurate diagnoses and delayed treatment. These challenges emphasize the need for innovative products to overcome the challenges of traditional devices.

Several research studies are being conducted through collaborations among major players and academic & research institutes to develop and introduce vital sign monitoring devices with the latest technology.

- According to a 2021 article published by St. Olav's Hospital, the hospital had partnered with Vitalthings AS and DNV Imatis to develop a new contactless technology to measure vital signs continuously and automatically among patients at an early stage. The technology was developed under the project Autoscore, which is supported by Innovation Norway.

Also, the integration of artificial intelligence in these devices by companies and institutes is another major factor leading to rising technological advancements in these monitoring devices, including wireless vital sign monitoring devices.

- According to a 2022 article published by the Stevens Institute of Technology, the institute is working with Autonomous Healthcare to develop a NASA-supported technology that monitors heartbeat and breathing with radar, cameras, and algorithms.

Therefore, the growing demand for vital sign monitoring devices with new technology among healthcare facilities is increasing the focus of companies and research institutes on integrating technologies, including artificial intelligence, machine learning, and others, in their devices.

Download Free sample to learn more about this report.

Vital Sign Monitoring Devices Market Growth Factors

Increasing Prevalence of Lifestyle-associated Chronic Disorders to Propel Product Demand

The growing prevalence of chronic conditions and non-communicable diseases associated with a sedentary lifestyle, poor diet, and other factors is leading to an increasing number of people suffering from cardiovascular disorders, respiratory disorders, diabetes, and other conditions. The increasing adoption of sedentary lifestyle that includes binge eating and lack of physical activities have resulted in the growing prevalence of hypertension, diabetes, dyslipidemia, obesity, and other chronic diseases.

- According to a 2023 WHO report, Non-Communicable Diseases (NCDs) kill 41 million people each year, accounting for 74% of all deaths globally. Among these, cardiovascular diseases account for most of the NCD deaths, followed by chronic respiratory diseases and diabetes.

Moreover, increasing awareness among the population regarding disease treatment and management options available in the market is expected to surge the product demand and fuel the global vital sign monitoring devices market growth during the forecast period.

RESTRAINING FACTORS

High Price Associated With Certain Products to Limit Adoption in Emerging Countries

Continuous vital sign monitoring is a crucial parameter in terms of specialized care in developed countries, such as the U.S., Germany, the U.K., Japan, and others. There are several positive outcomes associated with continuous monitoring, including early detection of complications, lower complication rates, and shorter length of stay in hospitals.

However, despite these benefits, the high cost associated with conventional patient monitors and the difficulty in maintaining the complex equipment are anticipated to hamper the adoption of these devices in healthcare settings in low and middle-income countries.

Also, the growing technological advancements in vital sign monitoring devices by companies to cater to the rising demand among patients is another important factor leading to the high cost of these devices.

- For instance, according to the Africa Medical Supplies Platform, the average cost of patient monitors ranges from USD 550 to USD 4,000, depending on the type of product, technology involved, and various other features.

Thus, high costs, along with limited technical knowledge among healthcare professionals in emerging countries, are expected to hinder the global vital sign monitoring devices market growth.

Vital Sign Monitoring Devices Market Segmentation Analysis

By Type Analysis

Pulse Oximeter Segment Dominated Market Owing to Rising Prevalence of Respiratory Diseases

Based on type, the vital sign monitoring devices market is segmented into pulse oximeters, temperature monitors, and blood pressure monitors. The pulse oximeters are further segmented into fingertip oximeters, hand-held oximeters, table-top oximeters, and others. Temperature monitors are further bifurcated into analog temperature monitoring devices and digital temperature monitoring devices. Blood pressure monitors are further segmented into devices and accessories.

The pulse oximeter segment dominated the global vital sign monitoring devices market share of 38.61% in 2026. The rising prevalence of respiratory and cardiovascular conditions among the population, increasing patient visits to healthcare facilities, and growing focus of companies on developing and launching more innovative products are some of the major factors contributing to the growth of the segment.

- In February 2024, Masimo received the U.S. FDA approval for its MightySat Medical, the world’s first OTC fingertip pulse oximeter. The company aims to increase the penetration of the device among patients with the approval of the product.

The temperature monitors segment is expected to record a significant CAGR during the forecast period. The rising prevalence of viral diseases, such as COVID-19 and others is leading to increasing adoption of these devices for temperature monitoring among patients. Moreover, growing technological advancements in these devices by the market players is another crucial factor favoring the growth of the segment.

The blood pressure monitors segment is projected to register the highest CAGR as compared to other segments during the forecast period. The rising prevalence of cardiovascular conditions, such as hypertension and growing awareness regarding regular monitoring of the vitals to avoid major risks and complications are a few of the major factors contributing to the growth of the segment. The growing number of product launches by major players to enable easy and convenient use of these devices at healthcare facilities and homes is another significant factor contributing to the growth of the segment.

To know how our report can help streamline your business, Speak to Analyst

By End User Analysis

Homecare Settings Segment Dominated Due to Increasing Geriatric Population

On the basis of end user, the vital sign monitoring devices market is segmented into hospitals & ASCs, clinics, homecare settings, and others.

The homecare settings segment dominated the market with a share of 39.94% in 2026 and is expected to record a significant CAGR during the forecast period. The increasing shift toward home care services among people, especially the geriatric population, is one of the major factors supporting the dominance of the segment. The growing geriatric population in countries, such as Japan, China, and others is expected to increase the patient pool suffering from various chronic conditions.

The hospitals & ASCs segment is expected to showcase lucrative growth rate during the forecast period. This is due to the increasing number of partnerships among hospitals and market players to increase the adoption of vital sign monitoring devices.

- In January 2024, Apollo Hospitals partnered with LifeSigns, one of the leading AI-powered health monitoring technology companies in India, to empower the remote patient monitoring system and deliver better care and quality of service.

The clinics and other segments are also projected to witness considerable growth during the forecast period. The rising patient visits to clinics for various procedures, along with the increasing focus of research institutes on developing vital sign monitoring devices equipped with advanced technologies, are some of the major factors anticipated to spur the growth of these segments.

REGIONAL INSIGHTS

Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Vital Sign Monitoring Devices Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market in 2025 with a value of USD 2.67 billion. The dominance is due to the increasing prevalence of lifestyle-related chronic disorders across the region. For instance, according to a study published by the International Diabetes Federation, in 2019, around 48 million people in the U.S. were suffering from diabetes. The U.S. market is projected to reach USD 2.6 billion by 2026.

Asia Pacific

Asia Pacific is expected to record the highest growth rate during the forecast period. The growing healthcare infrastructure and expenditure among the population and increasing shift toward a healthy lifestyle are some of the major factors leading to rising number of patient visits to healthcare facilities for the treatment of various chronic conditions. These factors are leading to increased demand for and adoption of these monitoring devices in countries, such as China, India, and others, further promoting market growth in the region. The Japan market is projected to reach USD 0.39 billion by 2026, the China market is projected to reach USD 0.42 billion by 2026, and the India market is projected to reach USD 0.22 billion by 2026.

Europe

Europe held the second-highest market share in 2024. The market’s growth in the region can be attributed to several factors, such as the growing prevalence of chronic conditions in countries, including the U.K., Germany, France, and others, and increasing number of product launches by market players to increase the penetration of these devices among the population. The UK market is projected to reach USD 0.3 billion by 2026, while the Germany market is projected to reach USD 0.39 billion by 2026.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa accounted for a comparatively lower share of the market owing to the presence of a huge underpenetrated market. However, the rising initiatives by government organizations and market players to increase awareness regarding the importance of vital sign monitoring are expected to spur market growth in these regions.

KEY INDUSTRY PLAYERS

Masimo and Medtronic to Lead Market Due to Increasing Product Launches

The market is consolidated, with a few major players accounting for a majority of the market share. Masimo, Medtronic, and OMRON HEALTHCARE Cos., Ltd. are the prominent players in the market. The rising focus of these companies on strengthening their product portfolio and their remarkable distribution network in the developed and emerging countries are some of the major factors contributing to their growing market shares. Along with this, the rising merger and acquisition contracts executed by these players to expand their product portfolio is another crucial factor supporting their market positions.

- In April 2024, Omron Healthcare acquired Luscii Healthtech, one of the leading digital health and remote consultation service platforms, to expand its product portfolio and geographical presence.

Nihon Kohden Corporation, GE Healthcare, Koninklijke Philips N.V., and others are a few players operating in the market. The robust efforts by these companies to merge and collaborate with other organizations to develop and introduce technologically advanced products in the market are expected to fuel their market positions.

List of Top Vital Sign Monitoring Devices Companies:

- Masimo (U.S.)

- OMRON HEALTHCARE Co., Ltd. (Japan)

- Medtronic (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- GE Healthcare (U.S.)

- Contec Medical Systems Co. Ltd. (China)

- Nonin (U.S.)

- SunTech Medical, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2024 – GE Healthcare received the U.S. FDA approval for its Portrait VSM vital signs monitor that can provide clinicians with an accurate view of a patient’s vital signs to support timely clinical decisions.

- November 2023 – DuPont collaborated with STMicroelectronics to develop a new wearable device concept for remote biosignal-monitoring.

- September 2023 – Masimo expanded its partnership with Koninklijke Philips N.V. to improve telehealth applications and home healthcare services for patients and clinicians around the world.

- June 2023 – OMRON HEALTHCARE Co., Ltd. announced its plan to establish a manufacturing facility in India. The establishment of the factory is aimed at increasing its manufacturing capacity and penetration in the Indian market.

- March 2021 – Nonin launched its two new disposable products, a single-use wristband and a sensor for its WristOx2 3150 pulse oximeters.

- June 2020 – Hillrom announced the launch of the Hillrom Extended Care Solution, a new, connected remote vital signs monitoring device that allows clinicians to shift care closer to home.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, types, and end users. Besides this, it offers insights into the market trends and highlights key industry developments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.35% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 11.83 billion in 2034.

In 2025, the North American market value stood at USD 2.67 billion.

Recording a CAGR of 7.35%, the market will exhibit steady growth during the forecast period.

The pulse oximeters segment is the leading segment in this market.

The increasing prevalence of lifestyle-related chronic disorders across the globe is driving the growth of the market.

Medtronic and OMRON HEALTHCARE Co., Ltd. are the major players in the global market.

North America dominated the vital signs monitoring devices market with a market share of 42.67% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us