IT Operations Analytics Market Size, Share & Industry Analysis, By Type (Predictive Analytics, Visual Analytics, Root Cause Analytics, and Behavior Analytics), By Deployment Mode (On-Premises and Cloud), By Application (Asset Performance Management, Network Management, Security Management, Log Management, and Others), By End-User (BFSI, Retail and Consumer Goods, Healthcare, Manufacturing, Telecommunications, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

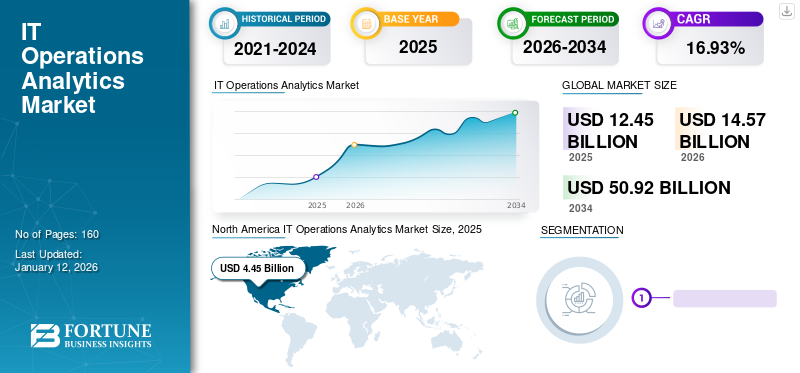

The global IT operations analytics market size was valued at USD 12.45 billion in 2025 and is projected to grow from USD 14.57 billion in 2026 to USD 50.92 billion by 2034, exhibiting a CAGR of 16.93% during the forecast period. North America dominated the global market with a share of 35.78% in 2025.

The market growth is expected to be driven by increasing business use of IT ops solutions and services to decrease operating costs, improve infrastructure, and expand IT operations. Due to the digital transformation of the industry and reduction of asset downtime, demand for the transformation of IT operations is increasing. Moreover, the rising number of data storage centers and cloud computing technologies, and the use of Artificial Intelligence (AI)-enabled analytics are driving the market’s share.

Global IT Operations Analytics Market Overview

Market Size:

- 2025 Value: USD 12.45 billion

- 2026 Value: USD 14.57 billion

- 2034 Forecast Value: USD 50.92 billion

- CAGR: 16.93% (2026–2034)

Market Share:

- Regional Leader: North America held the largest market share in 2025.

- Fastest-Growing Region: Asia Pacific is expected to grow at the highest rate during the forecast period.

Industry Trends:

- Asset Performance Management was the leading application segment in 2024.

- Increasing integration of AIOps and real-time root-cause analytics to enable predictive diagnostics and reduce IT complexity.

Driving Factors:

- Expanding IT environments and rising operational complexity across enterprises are fueling demand for analytics-driven solutions.

- Growing focus on automation, predictive insights, and operational efficiency through intelligent platforms.

IT operations analytics is a process of combining, storing, and contextualizing operational data to understand the strength of infrastructure, applications, and environments, and simplify daily operations. Using hypervisors, software agents, or network logs, this operational data can be gathered from live infrastructures. For precise real-time insight and faster incident management, it collects operational data to identify anomalies and patterns. According to the Digital Enterprise Journal in 2023, 55% of organizations are deploying modern IT operations technologies to improve customer satisfaction.

The COVID-19 pandemic underscored the importance of robust IT operation analysis in enabling organizations to adapt to rapidly changing circumstances and maintain operational resilience to drive innovation in a challenging environment.

IMPACT OF GENERATIVE AI

Advanced Capabilities of Generative AI for Creating High-quality Data-Driven Insights Fueled Market Growth

Generative AI is a crucial part of refining IT operations analytics as it automates data analysis, helps make predictions, and identify problems. This enables organizations to deal with issues in advance, make the most of their resources, and improve their overall IT operation effectiveness. According to an industry analyst in 2023, 40% of businesses expect to implement AI in IT Ops in the future.

Generative AI has created a highly positive impact on the market as it helps in providing high-quality data-driven insights. In addition, the market is on track to achieve its most significant level of transformative change as major language models have been developed that support generative AI.

IT Operations Analytics Market Trends

Rising Technological Advancements and Digital Transformation in IT Operations Industry to Emerge as Key Trend

With the exponential growth in volume, velocity, and variety of data generated by IT operations, there is still a need for effective analytical solutions to manage, analyze, or draw conclusions from this information. The demand for IT operations analytics solutions and services is further driven by the adoption of cloud computing, IoT, and digital transformation initiatives across different industries. These solutions allow organizations to keep a close eye on, repair, and optimize their IT infrastructure at regular intervals to ensure efficient operation and improve performance.

Analytics platforms that use AI technology to leverage historical data and patterns are capable of detecting anomalies, identifying data security threats, and automating routine tasks to increase productivity and reduce interruptions. Furthermore, better data interpretation and decision-making for information technology professionals can be facilitated through the use of sophisticated visualization techniques and language processing capabilities.

Download Free sample to learn more about this report.

IT Operations Analytics Market Growth Insights

Increasing Expansion of IT Operations to Aid Market Growth

A massive amount of operational data is generated daily due to the rapid change in and the growing complexity of the IT infrastructure. Useful data can help businesses achieve better performance, simplify their processes, and optimize their IT systems. One of the main benefits of IT operations analytics solutions is that it can identify the underlying cause of performance problems in an IT system quickly.

Organizations gain a complete understanding of their IT operations, spot trends & anomalies, and make data-driven decisions by incorporating data from diverse sources. This detailed study provides a basis for capacity planning, infrastructure management, and resource allocation optimization. The benefits of using these solutions are further enhanced by real-time analytical capabilities. Organizations can identify potential problems promptly, analyze operating data at the same time, and gain immediate insight into system efficiency. As a result, the market is expected to be driven by the massive expansion of IT operations.

RESTRAINING FACTORS

Complex Nature of IT Infrastructure to Hinder Market Expansion

The complexity of IT infrastructure, as it increases data integration, collection, and analysis challenges, is a barrier to the adoption of IT operations analytics solutions. Identifying relevant data sources and establishing consistent data flows is complicated by the composite network of hardware, software, and various components. Complexity may lead to incomplete or inaccurate information, making it difficult to detect problems, optimize performance, and make informed decisions. Thus, these factors are hindering the IT operations analytics market growth.

IT Operations Analytics Market Segmentation Analysis

By Type Insights

Implementation of Big Data and Massive Data Generation Fueled Predictive Analytics Segment Growth

Based on type, the market is segmented into predictive analytics, visual analytics, root cause analytics, and behavior analytics.

In terms of market share, the predictive analytics segment dominated the market with a share of 41.48% in 2026, due to the generation of large amounts of data and increasing implementation of big data solutions. Predictive analytics can predict system failures, network interruptions, and performance bottlenecks by analyzing past data and patterns. This proactive approach is a key tool for maintaining the IT infrastructure, delivering seamless services, reducing interruptions, enhancing operational efficiency, and decreasing costs.

The root cause analytics segment is anticipated to register the highest CAGR during the forecast period. It is an important component of IT operations analytics, which aims at ensuring smooth operations. Organizations can effectively deal with issues and reduce downtime if they identify the root cause of their problems. While addressing operational issues, the segment efficiently allocates resources into the software to eliminate time-consuming tasks. Furthermore, the adoption of other technologies, such as IoT and AI has led to an increase in the demand for advanced root cause analytics solutions.

By Deployment Mode Insights

Ease of Controllability and Accessibility Boosted Adoption of On-Premises IT Operations Analytics

Based on deployment mode, the market is divided into on-premises and cloud.

The on-premises segment held a dominant market with contribution of 56.04% globally in 2026 . The adoption of on-premises deployment is increasing due to the implementation of an on-premises strategy that enables customers to view their website from a desktop or any other system. More control and flexibility are offered by solutions deployed in an organization's data center or on-premises, but they require an initial investment in hardware and software.

The cloud segment is predicted to record the fastest CAGR in the coming years. Cloud-based solutions help organizations reduce physical infrastructure costs, monitor data effectively, and improve accessibility, which has become the standard in different sectors. The key factor driving the cloud deployment of IT operations analytics solutions is a reduction in total ownership costs.

By Application Insights

Asset Performance Monitoring Segment Dominated Market Owing to Growing Demand for Digital Solutions

Based on application, the market is categorized into asset performance management, network management, security management, log management, and others.

In terms of share, in 2024, the asset performance management segment dominated the market with a share of 32.61% in 2026. The use of analytics in asset performance management is growing significantly across several sectors due to the rising demand for digital solutions that allow asset performance monitoring and reduce operating expenditures of organizations. Use of asset performance management solutions can improve operational efficiency, reduce interruptions, and lower maintenance costs. According to a survey of industry leaders in 2022, digital changes, such as asset performance monitoring were among the top strategic priorities.

The security management segment is expected to record the highest CAGR during the forecast period. Security management enables IT teams to provide insight into the security, health, and compliance of systems and applications. Key data sources for security analytics, such as threat detection, intrusion detection, compliance, and others can also be detected.

By End-User Insights

To know how our report can help streamline your business, Speak to Analyst

BFSI Holds Leading Position Owing to Need for Accurate Data Insights to Reduce Complexities

Based on end-user, the market is categorized into BFSI, retail and consumer goods, healthcare, manufacturing, telecommunications, and others.

In terms of share in 2024, the BFSI segment dominated the market with contribution of 41.86% globally in 2026. The aim of the financial & banking sector to remain profitable, understand customer needs & preferences to reduce risks, and proactively improve network security of data can boost the growth of the BFSI end user segment. The IT operations analytics solution enables BFSI end-users to identify any service issues and bring them to the attention of a bank for resolution by offering preventive solutions.

The healthcare segment is anticipated to register the highest CAGR during the forecast period due to the increasing demand for value-based care, rising need to analyze the health data gathered, and growing awareness of medical standards and technology improvements. The desire to enhance the quality and efficiency of healthcare delivery while keeping costs under control has led to an increase in the demand for value-added healthcare. The focus on a patient's outcomes, containment of costs, management of long-term illnesses, advances in health technologies, and other factors will contribute to a growing demand for value-based care.

REGIONAL INSIGHTS

Based on geography, the market is fragmented into North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America IT Operations Analytics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Regional IT Operations Analytics Market Trends

North America

North America held a dominant IT operations analytics market share in 2026. North America dominated the global market in 2025, with a market size of USD 4.45 billion. This growth is attributed to the tremendous increase in the generation of IT data in various organizations and increasing adoption of cloud-based solutions. The growth of IT operations analytics in North America is also expected to be stimulated by the region’s advanced technological infrastructure. The U.S. market is projected to reach USD 2.90 billion by 2026.

Asia Pacific

Asia Pacific is anticipated to register the highest growth rate during the forecast period due to increased government spending, rising number of data centers, and improved infrastructure. The amount of data generated and collected daily by different organizations in the region is estimated to increase exponentially. The increasing use of mobile phones and social media, BYOD in enterprises, and adoption of IoT are among the main reasons for the strong growth of data in this region. The Japan market is projected to reach USD 0.51 billion by 2026, the China market is projected to reach USD 0.9 billion by 2026, and the India market is projected to reach USD 0.51 billion by 2026.

Middle East & Africa

The Middle East & Africa is expected to register the second-highest growth rate in the global market during the forecast period. This growth is attributed to a high mobile phone penetration rate, digital transformation, and rise in e-commerce platforms. The UK market is projected to reach USD 0.51 billion by 2026, and the Germany market is projected to reach USD 0.61 billion by 2026.

Key Industry Players

Market Players Use Various Business Strategies to Increase Reach of Business Operations

Major market players are providing enhanced IT operations analytics solutions to help end-users improve their business decision-making. Market players are prioritizing the acquisition of small-scale organizations to increase the reach of their business operations. Moreover, other strategies, such as leading investments, signing merger & acquisition agreements, and entering long-term partnerships will also increase the product demand.

List of Top IT Operations Analytics Companies:

- Open Text Corporation (Canada)

- BMC Software Inc. (U.S.)

- ExtraHop Networks (U.S.)

- Glassbeam Inc. (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- IBM Corporation (U.S.)

- Microsoft Corporation (U.S.)

- Oracle Corporation (U.S.)

- SAP SE (Germany)

- Splunk Inc. (U.S.)

RECENT INDUSTRY DEVELOPMENTS:

- April 2024: OpenText, an information technology company, announced Cloud Editions CE 24.2. OpenText IT Operations Aviator, a private-gen AI virtual assistant that is unified into OpenText SMAX. This advanced service management solution is now supporting service desk agents, which was previously exclusive to technology users.

- January 2024: ExtraHop Networks, a company specializing in IT Ops analytics and cloud-native network detection, announced that it had raised USD 100 million in growth capital from existing investors. This funding added cybersecurity veterans to the executive team to support the company’s continued growth.

- March 2023: Splunk Inc., a player in cyber security and observability, announced innovations in its unified platform of safety and observability to help build safer and more resilient digital enterprises. The latest innovations from Splunk included improvements to mission control and monitoring cloud, and the general availability of the Splunk Edge Processor. Organizations can unify, simplify, and modernize their processes and operations with the Splunk platform.

- January 2023: Microsoft launched a showcase of a cloud service called Smart Store Analytics in partnership with AiFi. This startup aims to make it cost-effective for retailers to deploy autonomous shopping technology. Smart Store Analytics is part of the Microsoft Cloud for Retail product suite, which provides retailers with AiFi’s technology and operational analytics for their Smart Store fleets.

- October 2021: Accenture and Splunk partnered to help clients maximize their data insights, with a particular focus on AI-powered IT operations, security automation, and intelligent supply chains. This partnership aimed to combine Accenture’s technical know-how with Splunk’s deep industry experience and software technology.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies and top end-users of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 16.93% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Deployment Mode

By Application

By End-User

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach a valuation of USD 50.92 billion by 2034.

In 2025, the market value stood at USD 12.45 billion.

The market is projected to record a CAGR of 16.93% during the forecast period.

In 2025, the asset performance management segment led the market.

Increasing expansion of IT operations is aiding the market growth.

Open Text Corporation, BMC Software Inc., ExtraHop Networks, Glassbeam Inc., Hewlett Packard Enterprise Development LP, IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, and Splunk Inc. are the top companies in the global market.

In 2025, North America held the largest market share.

Asia Pacific is expected to exhibit the highest growth rate during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us