Medical Billing Outsourcing Market Size, Share & Industry Analysis, By Service (Front-End, Middle-End, and Back-End), By End-user (Hospitals, Physicians’ Office, and Others), and Regional Forecast, 2026-2034

Medical Billing Outsourcing Market Size

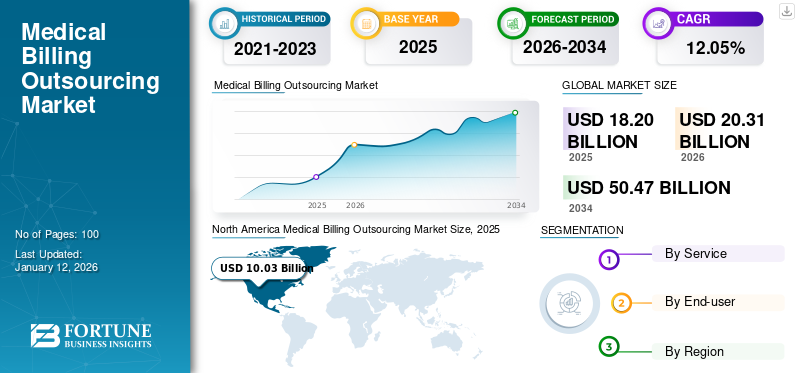

The global medical billing outsourcing market size was estimated at USD 18.20 billion in 2025. It is projected to grow from USD 20.31 billion in 2026 to USD 50.47 billion by 2034, exhibiting a CAGR of 12.05% during the forecast period. North America dominated the medical billing outsourcing market with a market share of 55.12% in 2025.

Medical billing outsourcing refers to managing the medical billing of healthcare facilities, such as hospitals, specialty clinics, radiology departments, and private clinics through third-party companies. These outsourced medical billing services are required for the complex and evolving healthcare industry, regulatory compliance & risk management, and easing the billing burden on healthcare practitioners and providers. The various benefits associated with it, including an increased focus on patient care, reduced billing errors, and cost-effectiveness, have increased healthcare providers' adoption of these services.

GLOBAL MEDICAL BILLING OUTSOURCING MARKET OVERVIEW

Market Size:

- 2025 Value: USD 18.20 billion

- 2026 Value: USD 20.31 billion

- 2034 Forecast Value (with CAGR): USD 50.47 billion (CAGR of 12.05%)

Market Share:

- Regional Leader: North America (55.12% in 2025)

- Fastest-Growing Region: Asia Pacific

- End-User Leader: Hospitals Segment

Industry Trends:

- Integration of AI & ML for Efficient Medical Billing

- Growing Use of Telehealth Billing Integration

- Partnerships with Tech Giants like Microsoft to Improve RCM Systems

Driving Factors:

- Shortage of Skilled Staff & Difficulty in Maintaining Profitability

- Increasing Patient Burden from Chronic Disease Prevalence

- Rising Demand for Compliance & Error-Free Billing

- Growing Number of Hospital Admissions & Patient Visits

- Cost-Effectiveness & Reduced Billing Errors: Enhancing Adoption

The rising number of patient visits and hospital admissions will positively influence the global medical billing outsourcing market growth. Furthermore, the growing demand for billing compliance and the rising number of hospitals adopting such services are expected to boost the market growth over 2025-2032.

Additionally, the global COVID-19 outbreak increased the demand for remote patient care and virtual consultations, which further boosted the adoption of medical bill outsourcing services. This adoption is anticipated to grow continuously in the coming years.

Medical Billing Outsourcing Market Trends

Integration of Technology to Increase Adoption of Medical Billing Outsourcing Services in Healthcare Facilities

The market is continuously evolving with the advent of advanced software and services provided by third-party players. The need to focus on patient care and cost-effective billing solutions has allowed for higher adoption of outsourcing medical billing services. The market players are focusing on developing innovative and technologically advanced software for medical billings to enhance their billing quality and attract a wider customer base of healthcare providers by offering improved, fast, error-free, and cost-effective billing facilities.

Artificial Intelligence (AI) and machine learning algorithms are being integrated into medical billing systems to enhance the efficiency and accuracy of coding and claims submission. These technologies can analyze large datasets to identify patterns and trends, ensuring that the codes are correctly assigned and claims are less likely to be denied. Consequently, rising partnerships among the key market players for AI integration is promoting the adoption of medical billing services in hospitals and clinics.

- For instance, in November 2023, R1 RCM Inc. collaborated with Microsoft to accelerate the incorporation of Azure OpenAI Service into its revenue cycle management platform.

Furthermore, with the increased adoption of telehealth services, billing outsourcing companies are integrating telehealth billing into their offerings. They utilize telehealth-specific billing software to handle claims related to virtual consultations and other remote services. This ensures that healthcare facilities can efficiently bill for telehealth visits while maintaining compliance with the evolving regulations.

Download Free sample to learn more about this report.

Medical Billing Outsourcing Market Growth Factors

Shortage of Skilled Staff and Difficulty in Maintaining Profitability to Boost Market Growth

The market is anticipated to experience significant growth in the coming years due to the rising demand for fast and accurate medical bills for healthcare providers. There has been an increase in the adoption of billing services provided by third parties due to the increasing burden on hospital staff and shortage of skilled workforce for billings and record maintenance. The increasing complexity of healthcare regulations & coding requirements and rising operational costs increase the complications of the medical billing process.

- For instance, according to a study published by QWAY Healthcare in December 2021, the U.S. could face a labor shortage of around 3.2 million people for healthcare billing services by 2026.

Hospitals and private clinics are also hiring more staff for their patients' billing and administrative tasks and maintenance. Such an increase in workforce exerts pressure on healthcare providers of extra expenses, thereby increasing the demand for outsourcing medical bills. Adopting outsourcing services to increase profitability and reduce financial burden is expected to drive market progress.

- For instance, in April 2023, according to an article published by Capline Healthcare Management, medical practices adopting outsourcing services noticed a 16.9% decrease in their billing-related costs. According to the same report, healthcare practices saw an average increase in their revenue of 11.6% due to outsourcing their medical bills.

Therefore, discrepancies associated with in-house billings are expected to drive the growth of the market in the coming years.

Increasing Patient Burden to Boost Demand for Medical Billing Outsourcing

Healthcare providers face unique challenges while managing their patients’ bills and tracking policies, primarily due to the growing burden of the patient population. The increasing burden of persistent diseases, such as arthritis, asthma, lung infections, diabetes, heart diseases, and hypertension is the leading cause of the growing number of patient visits in hospitals and private clinics worldwide.

- For instance, in January 2020, according to a report published by The Commonwealth Fund, adults in the U.S. had the highest chronic disease burden - about 28% across the globe. Also, according to the same report, the U.S. has the highest rate of obesity - about 40% of the total population.

Such a high prevalence of diseases has increased the patient burden on hospitals and radiology clinics. Also, limited adoption of the latest billing software by healthcare providers is expected to drive the demand for medical billing outsourcing services to streamline their operations, reduce administrative burden, and improve revenue cycle efficiency.

The rise in patient visits to radiology and surgical centers is also driving the adoption of these services in the market. Moreover, the need to be updated on coding and billing changes, documentation requirements, mitigating the risk of billing errors, reduction in claim denials, and balance of financial health in ASCs and hospitals are factors anticipated to drive the medical billing outsourcing market forecast.

RESTRAINING FACTORS

Concerns Associated with Data Privacy and Breaches to Hinder Market Growth

In emerging countries, there has been an increase in the adoption of billing outsourcing services by healthcare providers. However, several factors, such as lack of awareness, risk to patient data privacy, and increased threat of breaches related to medical data and bills are expected to impede the market growth. Additionally, internal and external healthcare data breaches affect many patients, clients, stakeholders, and hospitals.

Furthermore, the increased frequency of such attacks and breaches has resulted in unauthorized internal disclosures, financial losses, and a high magnitude of exposed records.

- For instance, according to an article published by the NCBI in April 2020, from 2015 to 2019, 157.4 million individuals were affected by data breaching. Also, the average cost of a healthcare data breach in the U.S. is USD 15 million. According to the same article, from 2014 to 2019, the average data breach cost increased by 12% globally.

Additionally, in response to the data privacy concerns, companies may need to invest in additional security measures and protocols to control data breaches. This can further increase operational and service costs.

Hence, factors, such as risk to medical data privacy and data breaches are responsible for the lower adoption rate of billing outsourcing services.

Medical Billing Outsourcing Market Segmentation Analysis

By Service Analysis

Middle-End Services to Gain Momentum Due to Growing Awareness among Healthcare Professionals

Based on service, the market is segregated into front-end, middle-end, and back-end. The middle-end services segment will expand at the highest CAGR during the forecast timeframe. This segment’s growth is due to the growing number of hospitals and surgical centers coupled with rising awareness among healthcare facilities about middle-end services. Furthermore, the market players are focusing on various strategies to expand such services for easy and errorless medical billing, thereby increasing the segment’s growth during the forecast period.

The front-end segment captured the highest medical billing outsourcing market share 43.41% in 2026 and is estimated to record a significant CAGR over 2026-2034. The rising demand for managing patient schedules, verification of insurance eligibility, and pre-authorization, especially among hospitals in developing countries, is expected to boost the segment’s growth during the forecast period.

The back-end segment accounted for a significant share of the market. The rising pressure on hospital administrative branches for managing claims denials & credit balance, remittance processing, and provider enrollment & credentialing is expected to drive the segment’s growth in the coming years.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Hospitals Segment to be Major End-User Due to Growing Number of Patient Visits

Based on end-user, the market is segregated into hospitals, physicians’ office, and others. In 2026, the hospital segment dominated the market share 50.11% is projected to register a notable CAGR during 2026-2034. The segment’s higher share is attributed to increasing patient visits and higher adoption of electronic health record systems to retrieve and organize information of patient health and also assist in billing.

- For instance, according to a report published by MGMA (Medical Group Management Association), 55% of medical practices reported that their patient visit volumes in 2022 were above those in 2021.

The physicians' office segment is expected to grow significantly over 2025-2032. The segment’s growth is due to a growing number of physicians and surgeons opening their independent clinics and radiological centers, and boosting their focus on outsourcing medical bills to third parties. The others segment includes radiology centers, surgical centers, and pain management centers. This segment is expected to record a higher CAGR during the forecast timeframe owing to higher adoption of these billing outsourcing services.

REGIONAL INSIGHTS

North America Medical Billing Outsourcing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The market in North America generated a revenue of USD 8.99 billion in 2024. The region is anticipated to dominate the global market share owing to the surge in the presence and expansion of various key players providing medical billing services in the region. Moreover, growing developments and expenditures in medical infrastructures, a large population base visiting hospitals & private clinics, and increase in patient admissions for their treatment will foster the regional market outlook. The U.S. market is projected to reach USD 10.36 billion by 2026.

Europe

Europe captured a substantial market share in 2024 and is predicted to record a notable CAGR during the forecast period of 2024-2032. The change in healthcare regulations and rising need for managing medical policies are expected to drive the demand for billing outsourcing services. Furthermore, established market players are anticipated to propel the regional market growth during the forecast period. The UK market is projected to reach USD 0.98 billion by 2026, while the Germany market is projected to reach USD 1.08 billion by 2026.

Asia Pacific

Asia Pacific is anticipated to register the highest CAGR from 2025 to 2032. The high CAGR of the regional market is attributed to the increasing demand for medical billing outsourcing services in hospitals and radiology clinics, coupled with the growing patient population across the region. Moreover, growing investments by regional companies are expected to drive the regional market growth. The Japan market is projected to reach USD 0.86 billion by 2026, the China market is projected to reach USD 1.2 billion by 2026, and the India market is projected to reach USD 0.7 billion by 2026.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa are anticipated to witness growth prospects during the forecast period. The growing percentage of the population suffering from chronic and infectious diseases, rising healthcare investments, and increased focus by key players on providing billing services in these regions are expected to propel the market expansion during the forecast period.

List of Key Companies in Medical Billing Outsourcing Market

R1 RCM Inc. and CareCloud Inc. to Hold Key Market Share with Front-End Services in Their Portfolios

R1 RCM Inc., CareCloud Inc., Veradigm LLC, and Experian Information Solutions Inc. are considered some of the leading players in the market. The dominance of these companies is attributable to their strong direct and indirect presence across the world and the vast portfolio of services they provide. These market players are focused on entering merger and acquisition agreements to penetrate new markets.

- For instance, in January 2024, R1 RCM Inc. acquired Acclara from Providence. The acquisition strengthened R1 RCM Inc.’s revenue cycle management and expanded its ability to deploy new technology solutions to improve patient and healthcare provider outcomes.

Other companies operating in the market include Billing Paradise, 3Gen Consulting, AdvancedMD Inc., NOVAmedtek, Neolytix LLC, CureMD Healthcare, and other small & medium-sized players. These companies are focusing on strategic developments, such as partnerships, collaborations, and regional expansions. Furthermore, the growing focus on introducing new and advanced services in the untapped markets is expected to boost their share in the market.

LIST OF KEY COMPANIES PROFILED:

- CareCloud Inc. (U.S.)

- R1 RCM, Inc. (U.S.)

- Experian Information Solutions, Inc. (U.S.)

- Veradigm LLC (U.S.)

- Billing Paradise (U.S.)

- 3Gen Consulting (U.S.)

- Altera Digital Health Inc. (U.K.)

- eClinicalWorks (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- Decemebr 2023 - Experian Information Solutions, Inc. launched Ascend Ops and Retro On Demand on its cloud-based platform for integrated decision-making, customer acquisition, and revenue cycle management.

- October 2023 - EClinicalWorks launched an AI-powered clinical documentation solution, Sunoh.ai. The tool works within the EHR software of the company to increase the healthcare efficiency and outcome.

- February 2023 - GeBBS Healthcare Solutions announced the acquisition of CPa Medical Billing, a provider of Revenue Cycle Management (RCM) services to federally qualified health centers and other multi-specialty physician groups.

- April 2022 - Omega Healthcare acquired ApexonHealth, an AI and automation-based revenue cycle management and payor solutions provider. ApexonHealth provides services, such as medical billing, coding, and collections processes, and offers virtual nursing services.

- March 2022 – Omega Healthcare announced the acquisition of Reventics, a U.S.-based company, to expand its Revenue Cycle Management (RCM) services by leveraging cloud-native platforms - RevCDI and RevMAX for improvement in clinical documentation and revenue cycle management.

- October 2022- National Medical Billing Services acquired MedTek, LLC. It is a leading provider of revenue cycle management solutions to hospitals, clinics, and ASCs.

- May 2021- R1 RCM Inc. announced a definitive agreement to acquire VisitPay, a digital payment solution, for approximately USD 300 million, further transforming the payment service and driving patient satisfaction and higher collection yield of payment,

- April 2021- Cerner Corporation announced the acquisition of Kantar Health, a division of Kantar Group, to accelerate innovation and advance patient care services worldwide.

REPORT COVERAGE

An Infographic Representation of Medical Billing Outsourcing Market

To get information on various segments, share your queries with us

The market research report provides a detailed competitive landscape. It provides an overview of the market and its dynamics, such as drivers, restraints, opportunities, and trends. Besides this, the report provides information related to key industry developments, such as mergers & acquisitions and regional expansions in the market. In addition, the impact of COVID-19 and the industry overview during the pandemic are covered in the report.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.05% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation

|

By Service

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the medical billing outsourcing market is a significant industry, currently estimated at USD 20.31 billion in 2026 and projected to reach USD 50.47 billion by 2034.

North America dominated the medical billing outsourcing market with a market share of 55.12% in 2025.

The medical billing outsourcing market is projected to experience significant growth, with a CAGR of 12.05% during the forecast period (2026-2034).

Outsourcing medical billing allows healthcare providers to focus more on patient care, reduces billing errors, ensures regulatory compliance, and is cost-effective.

Key factors include the shortage of skilled staff, difficulty in maintaining profitability, rising management costs, regulatory changes, and increasing patient burden.

Leading companies include CareCloud Inc., R1 RCM Inc., Experian Information Solutions, Inc., and Veradigm LLC.

AI technologies revolutionize medical billing processes by streamlining tasks, reducing manual errors, improving efficiency, and enabling quicker reimbursements.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic