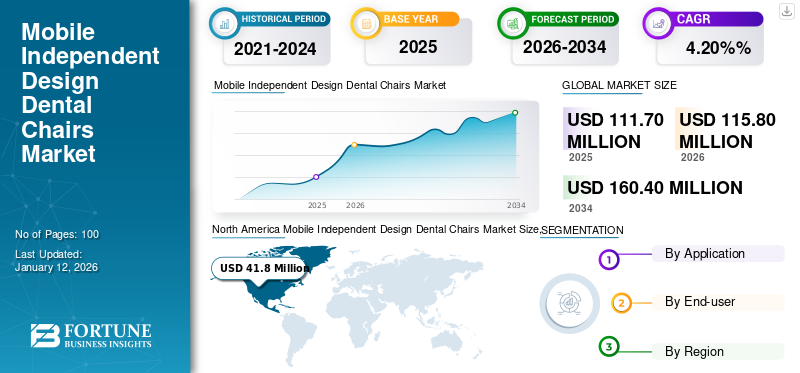

Mobile Independent Design Dental Chairs Market Size, Share & Industry Analysis, By Application (Examination, Oral Surgery, Orthodontics, Prosthetics, and Others), By End-user (Mobile Dental Clinics and Outreach Programs, Home Healthcare Services Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global mobile independent design dental chairs market size was valued at USD 111.7 million in 2025. The market is projected to grow from USD 115.8 million in 2026 to USD 160.4 million by 2034, exhibiting a CAGR of 4.20% during the forecast period. North American dominated the mobile independent design dental chairs market with a market share of 37.40% in 2025.

Mobile independent design dental chairs are revolutionizing dental practices by offering greater flexibility and efficiency. Unlike the traditional fixed units, these chairs are equipped with integrated power sources and water supplies, enabling greater mobility within the clinic. Their ergonomic design ensures patient comfort and ease of access for dentists. These chairs have features such as adjustable height and tilt, as they accommodate diverse treatment needs. The compact footprint saves space and allows for easy maneuverability. Overall, these chairs enhance the workflow and patient experience, making them a valuable asset in mobile dental clinics, home care services, and outreach programs.

The mobile independent design dental chairs market is driven by the growing demand for flexible and efficient dental equipment in modern clinics that fuels the adoption of these chairs. Additionally, the advancements in technology have led to the development of ergonomic chair designs that prioritize patient comfort and the ease of use for dentists. Furthermore, the trend toward mobile dentistry and the need for space-saving solutions contributes to the growth of the market.

The COVID-19 pandemic significantly affected the market as dental practices were closed temporarily due to the widespread lockdowns and restrictions on non-essential medical services, including routine dental care. This led to a decrease in the demand for dental chairs as fewer dental professionals were conducting field visits or providing services outside of their clinics. However, post pandemic, the market gained its pre-pandemic growth levels due to the normalization of the safety protocols and increased vaccination rates, dental practitioners regained confidence in offering mobile services.

Mobile Independent Design Dental Chairs Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 111.7 million

- 2026 Market Size: USD 115.8 million

- 2034 Forecast Market Size: USD 160.4 million

- CAGR: 4.20% from 2026–2034

Market Share:

- North America dominated the mobile independent design dental chairs market with a 37.40% share in 2025, driven by a strong dental infrastructure, patient-centric care models, and high adoption of mobile dental equipment.

- By application, the examination segment held the largest market share in 2024 and is expected to maintain its lead due to the rising prevalence of periodontal diseases and expanding community outreach dental programs.

Key Country Highlights:

- Japan: Demand is supported by a well-established mobile healthcare infrastructure and the country’s emphasis on elderly care. The use of mobile dental chairs is increasing in home healthcare services and outreach programs, particularly for the aging population.

- United States: The implementation of large-scale outreach initiatives and programs, along with funding support for community dental health, is encouraging the adoption of mobile dental clinics using independent design dental chairs. Programs under the Infrastructure Investment and Jobs Act and private-public collaborations are boosting demand.

- China: Growing government investments in public health infrastructure and rising awareness of oral hygiene have spurred mobile dental units and outreach services. Mobile independent chairs are gaining traction for their cost-effectiveness and adaptability in rural regions.

- Europe: Supportive government policies such as the NHS Dental Recovery Plan (February 2024) are promoting preventive care services via mobile dental solutions. High demand is driven by increased dental awareness, initiatives for equitable access to oral care, and widespread use of portable dental setups by both public and private dental providers.

Mobile Independent Design Dental Chairs Market Trends

Growing Dental Expenditure in Emerging Countries to Increase the Adoption of Portable Dental Chairs

The rise in oral diseases globally has compelled governments, particularly in emerging countries, to increase their dental expenditures. Owing to the escalating prevalence of oral health conditions such as dental caries, periodontal diseases, and oral cancers, there is a growing recognition of the importance of oral preventive care. The governments are allocating more resources toward oral healthcare programs, infrastructure development, and treatment subsidies to address this growing public health concern.

Furthermore, as the government expenditure on dental healthcare increases, it is expected to impact the market for these portable dental chairs. The expenditure is expected to increase the outreach programs to provide dental care in the untapped regions. The large number of camps will propel the demand for portable chairs. These chairs, known for their flexibility and mobility, are particularly relevant in the context of expanding dental services to the underserved populations, remote areas, and outreach programs.

Download Free sample to learn more about this report.

Mobile Independent Design Dental Chairs Market Growth Factors

Cost-effectiveness and Convenience Propels Demand for Independent Dental Chairs

The demand for mobile independent design dental chairs is being propelled by their cost-effectiveness and convenience, which are significant market drivers. These chairs offer dentists, a versatile and an efficient solution that minimizes the initial investment costs compared to traditional fixed units.

Furthermore, the mobility of these chairs eliminates the need for the expensive infrastructure modifications, such as plumbing and electrical work, resulting in a lower installation and operational expenses for dental practices. Additionally, their compact and space-saving design maximizes the clinic floor space utilization, making them particularly appealing for practices with a limited square footage.

For instance, according to various articles, the average retail cost of these chairs is approximately USD 300.0 – USD 600.0 in India, which is inexpensive compared to other types of chairs available in the market.

Moreover, the convenience of the aspect of mobility allows for easy maneuverability within the clinic, enhancing the workflow efficiency and patient throughput. Overall, the cost-effectiveness and convenience offered by the mobile independent design dental chairs make them an attractive investment for dentists looking to optimize their practice operations while providing high-quality patient care.

Expansion of Dental Services to Underserved Areas Drives the Demand for Portable Dental Chairs

Dentists provide dental care through oral outreach programs, offering preventive, diagnostic, and treatment services to patients. These programs aim to improve access to oral healthcare, especially in underserved communities, by delivering services such as cleanings, screenings, fillings, and extractions.

These oral services programs are provided to underserved locations, which lack traditional dental clinics. To conduct these services, the portable dental chairs are considered as an invaluable option for dentists due to the various benefits associated with these chairs. Their portability allows dentists to reach the underserved communities and remote areas where traditional dental services may be lacking or limited.

- For instance, in December 2022, the Spanish government approved legislation that provides free preventive dental care to children aged 0 to 14, as well as other population groups, via the country's public healthcare system.

Furthermore, these chairs facilitate the quick setup of temporary clinics in various locations, enabling the dentists to deliver a wide range of services directly to the patients in need. Additionally, their compact design and ease of transportation make them ideal for community outreach missions and mobile dental clinics.

As a result, the demand for these chairs is increasing as more dental professionals recognize their value in expanding access to care, driving the growth of the dental equipment sector.

RESTRAINING FACTORS

Shortcomings of Mobile Independent Design Dental Chairs Compared to its Alternatives May Limit Market Growth

These portable chairs, lacking reliance on the external power sources, offer unparalleled flexibility but are constrained by their inability to provide certain advanced dental chairs functionalities that are otherwise available in powered alternatives. While the mobile independent chairs facilitate on-the-go dental services, they often compromise on features, such as automated adjustments, integrated instruments, and an advanced ergonomic support.

Furthermore, dental practitioners may find their utility limited in terms of complex procedures or specialized treatments, impacting their adoption and market penetration. Moreover, the preference for the powered chairs amongst the established dental practices seeking easy accessibility and flawless operation further constrains the market potential for mobile independent design dental chairs.

This disparity in the capabilities may deter some dentists, particularly those with high volume of dental procedures or specialized requirements, thereby impeding the widespread adoption and the expansion of the portable dental chair solutions market.

Mobile Independent Design Dental Chairs Market Segmentation Analysis

By Application Analysis

Examination Segment Held a Major Share Due to the Growing Burden of Periodontal Disease

Based on application, the market is segmented into examination, oral surgery, orthodontics, prosthetics, and others.

The examination segment held the highest mobile independent design dental chairs market with a share of 39.72% in 2026 and is expected to expand at a substantial CAGR during the forecast period. These portable chairs enable the dental professionals to perform the comprehensive dental examinations, conveniently in diverse settings, including remote areas and community outreach programs. In addition, growing primary oral services, which include the oral examinations in the dental programs held in the underserved population, are expected to propel the segment’s growth.

The others segment is projected to expand at the highest CAGR during the forecast period. The others segment includes pediatric dentistry, implantology, and endodontics. Mobile independent design dental chairs facilitate pediatric dental care in various settings, including schools, day-care centers, and community events, where the presence of traditional dental equipment may be impractical. These chairs offer adjustable settings and reassuring features that help alleviate children's anxiety and promote a positive dental experience.

- For instance, in December 2019, Indian UNIFIL peacekeepers held a dental health and oral hygiene awareness camp for children with disabilities in their jurisdiction in southeastern Lebanon.

In 2024, the oral surgery segment accounted for a moderate share of the market due to growing cases of impacted teeth, jaw misalignment, oral infections, and trauma-related injuries.

The orthodontics segment held a considerable share of the market. The segment’s growth is credited to the growing number of orthodontists across the globe and rising awareness regarding the treatment misalignment and crooked teeth.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Mobile Dental Clinics and Outreach Programs to Continue Dominance Due to Increasing Dental Outreach Programs

Based on end-user, the market is segmented into mobile dental clinics and outreach programs, home healthcare services practices, and others.

In 2026, the mobile dental clinics and outreach programs segment held the highest share contributing 71.07% globally in 2026 and is expected to expand at a substantial CAGR during the forecast period. The segment’s growth is attributed to the introduction of mobile dental clinics across the globe. These clinics, often serving remote or underserved communities, rely heavily on mobile independent dental chairs for their flexibility and accessibility. Equipped with these chairs, mobile dental clinics can deliver comprehensive dental services outside of traditional healthcare settings, reaching populations with limited access to dental care.

- For instance, in April 2023, Emirates Health Services (EHS) announced the launch of a mobile, foldable dental clinic to provide at-home services for patients when in-person visits are off-limits due to certain physical and medical conditions. The foldable clinic includes various dental units including a dental chair, which is expected to be a portable dental chair.

In 2024, the home healthcare services segment held a significant share of the market due to the flexibility and cost-effectiveness offered by mobile dental chairs. For individual practitioners operating at-home, the chairs offer the convenience of portability without the need for extensive infrastructure.

The others segment includes academic research institutes, clinics, and nursing homes. The segmental growth is due to the increasing usage of these chairs in nursing homes for geriatric population.

REGIONAL INSIGHTS

Based on region, the market for mobile independent design dental chairs has been studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Mobile Independent Design Dental Chairs Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 41.8 million in 2025 and USD 43.1 million in 2026. and is expected to continue its dominance during the forecast period. The region’s growth is attributed to its robust healthcare infrastructure and growing dental camps that contribute to the widespread adoption of mobile independent chairs. In addition, due to the growing focus on a patient-centric care and accessibility, North America continues to drive its market growth. The U.S. market is valued at USD 39.5 million by 2026.

Asia Pacific is expected to expand at the highest CAGR during the forecast period. The mobile independent design dental chairs market growth across the region is attributed to its vast population, increasing healthcare expenditure, and expanding dental infrastructure. The region's diverse healthcare landscape, including urban centers and remote rural areas, necessitates flexible and portable dental solutions such as mobile independent chairs. Furthermore, rising awareness of oral health and a growing number of dental practices have led to a heightened demand for innovative dental equipment in Asia Pacific. The Japan market is valued at USD 7.9 million by 2026, the China market is valued at USD 9.3 million by 2026, and the India market is valued at USD 3.4 million by 2026.

Europe held the second-highest market share in 2024 and is anticipated to expand at a moderate growth rate during the forecast period. The regional growth is due to its advanced healthcare infrastructure and a strong emphasis on dental care accessibility. The UK market is valued at USD 4.1 million by 2026, and the Germany market is valued at USD 9.2 million by 2026.

- For instance, in February 2024, the government unveiled its long-awaited NHS Dental Recovery Plan, to reshape the landscape of oral healthcare across the U.K.

Furthermore, the presence of a large number of dental practices, including the solo practitioners and mobile clinics, in the region demonstrates a high demand for flexible and innovative dental equipment such as mobile independent chairs.

Latin America and the Middle East & Africa are expected to expand at a comparatively lower CAGR during the forecast period. The growth is attributed to the increasing utilization of mobile independent design dental chairs among the dental professionals. Mobile independent chairs offer mobility, versatility, and cost-effectiveness, making them essential tools for dental practitioners across the region. Additionally, government initiatives and collaborations with non-profit organizations further drive the adoption and prominence of mobile independent dental chairs in Latin America.

KEY INDUSTRY PLAYERS

DHM-dental BV and Aseptico Inc. with Diversified Product Portfolio to Maintain Market Position

The mobile independent design dental chairs market is fragmented due to the presence of prominent players, such as DHM-dental BV, Aseptico Inc., and BPR Swiss GmbH with significant market share. These prominent companies are focusing on partnerships with hospitals and dental companies to provide their dental chairs for oral services programs. Safari Dental and other companies hold a substantial market share supported by increasing R&D activities and rise in product launches.

LIST OF TOP MOBILE INDEPENDENT DESIGN DENTAL CHAIRS COMPANIES:

- DHM-dental BV (Netherlands)

- BPR Swiss GmbH (Switzerland)

- Aseptico Inc. (U.S.)

- Safari Dental (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- November 2022 – GlaxoSmithKline Asia launched vans under the corporate social responsibility initiative “Smile on Wheels Mobile Dental Vans”, in partnership with Smile Foundation. The launch of mobile dental clinics is expected to install portable dental chairs.

- August 2023 – The department of public health dentistry at Manipal College of Dental Sciences (MCODS), Manipal, India inaugurated state-of-the-art Mobile Dental Clinic in its college.

- January 2019 – The Minister of Health of South Africa launched mobile dental clinics to promote school children’s health in the country. This clinic launched to further reduce the dental caries among school-aged children and boost the oral and dental health behaviors.

REPORT COVERAGE

An Infographic Representation of Mobile Independent Design Dental Chairs Market

To get information on various segments, share your queries with us

The report covers market forecast and a detailed analysis of segments, which include application, and end-user. It focuses on key aspects such as the competitive landscape, major companies, the impact of the COVID-19 pandemic on industry growth, and insights into the market trends. Additionally, the report includes several factors that have supported the market’s growth in recent years. Furthermore, the report provides the data of active dentists in key countries along with the major oral diseases in key countries/region and the oral awareness campaigns held globally.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Million) |

|

Growth Rate |

CAGR of 4.20% from 2026-2034 |

|

Segmentation |

By Application

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size stood at USD 111.7 million in 2025 and is projected to reach USD 160.4 million by 2034.

The market is expected to exhibit a CAGR of 4.20% during the forecast period (2026-2034).

In 2025, North America’s market value stood at USD 41.8 million.

By application, the examination segment is the leading segment as it held a dominant market share in 2025.

North America dominated the market in 2025 by holding the largest market share.

The rising cases of periodontal diseases and growing dental services in emerging countries are expected to drive the market growth.

DHM-dental BV, Aseptico Inc., and BPR Swiss GmbH are the top players in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic