Network Analytics Market Size, Share & Industry Analysis, By Component (Solution and Services), By Network Type ((Enterprise Network (Cloud, On-Premise, Hybrid) and Telecom Network)), By End User ((Organization, Enterprise, Businesses (SMEs, Large Enterprises), Telecom Companies, and Data Centers)), and Regional Forecast, 2026 - 2034

Network Analytics Market (2026-2034)

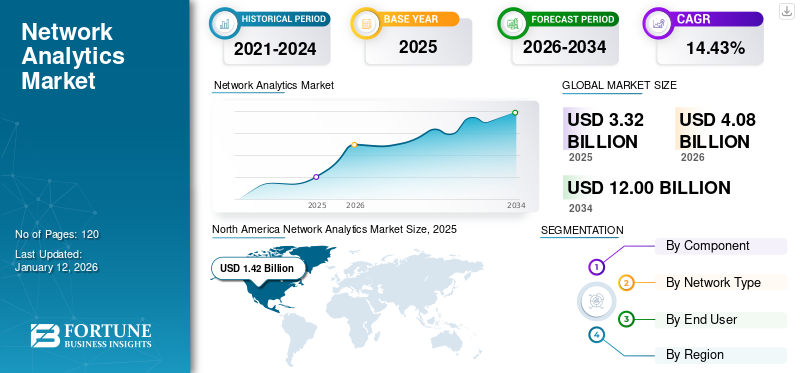

The global network analytics market size was valued at USD 3.32 billion in 2025 and is projected to be worth USD 4.08

billion in 2026 and reach USD 12 billion by 2034, exhibiting a CAGR of 14.43% during the forecast period. North America dominated the global network analytics market with a share of 41.96% in 2025.

In the scope of work, the report includes network analytics solutions offered by companies such as Cisco Systems, Inc., VMware, Inc., Juniper Networks, IBM Corporation, Plixer, LLC., Cynet, Subex, Nokia Corporation, and others.

Network analytics is a big data application and tool used to manage data network security. Network analysis controls all unwanted activities. Additionally, it provides information about the devices available on the network, such as their performance and communication status. It also provides insights into how the organization is using the network and how the network is performing within the organization.

During the COVID-19 pandemic, the demand for network and data analytics in IT companies experienced considerable growth due to the need to improve the data security network, perform forensic investigation, fine-tune performance, and perform predictive traffic.

Moreover, companies were focusing on adopting and implementing business intelligence strategies, including Artificial Intelligence (AI) systems, flexible risk management, and data analytics to help users make informed decisions and improve their commercial performance.

Network Analytics Market Trends

Advancement of Internet of Things (IoT) in Analytics Solutions Contributing to Business Growth

The Internet of Things plays a crucial role in network analytics by providing a wealth of data from connected devices. IoT devices generate vast amounts of data and network analytics leverages this information to optimize performance, enhance security, and improve overall efficiency. This involves analyzing data patterns, identifying anomalies, and making data-driven decisions to ensure the network operates seamlessly.

According to a report on IoT Analytics 2023, in 2022, the number of global IoT connections grew by 18% or 14.3 billion active IoT endpoints. The number of globally connected IoT devices is anticipated to grow by 16% or 16.7 billion active endpoints in 2023.

In addition, the implementation of network analytics solutions in IoT data provides organizations with data insights that are utilized to enhance customer experiences, identify & minimize operational risk, find & replace inefficiencies, and discover new opportunities. Thus, the advancements in and adoption of network analytics in IoT devices will create growth opportunity for the network analytics market.

Download Free sample to learn more about this report.

Network Analytics Market Growth Factors

Increased Adoption of Cloud Computing in Network Analytics by Major Companies to Boost the Market Growth

Network analytics in cloud computing involves examining and optimizing cloud-based network performance, security, and efficiency. It includes monitoring traffic, analyzing data patterns, and identifying potential issues to ensure seamless operation and resource utilization in the cloud environment. Analytics tools help monitor resource usage, providing efficient allocation, and utilization of cloud resources, which can lead to cost savings and improve scalability. In addition, cloud computing platforms are constantly evolving, allowing network analytics solutions to be deployed without the complexity and costs of managing and purchasing underlying solutions and services. Therefore, businesses are adopting cloud computing to provide flexibility in their networking, driving network analytics market growth.

RESTRAINING FACTORS

Lack of Awareness among Companies and Skill Shortage Can Hamper the Market Growth

As many companies migrate to the cloud, many of them lack a clear understanding of the number of cloud resources in use and the process for aligning them. There is still a lack of understanding among businesses about key identity-related security controls. Lack of understanding of the general security liability model contributes to cyberattacks that can hinder the market growth. In addition, the field of analytics requires specialized skills. Organizations may face challenges in securing staff with necessary expertise for the effective deployment and management of network analytics solutions. This skill gap can make it difficult to exploit the full potential of these tools.

Network Analytics Market Segmentation Analysis

By Component Analysis

Rising Need for Sophisticated Analytics Solutions for Enhanced Network Experience to Drive Market Growth

Based on component, the network analytics market is bifurcated into solutions and services.

The network analytics solutions segment is anticipated to hold a dominant market share of 85.69% in 2026, as networks became more intricate and dynamic in the cloud environment. The need for sophisticated analytics solutions has risen, helping organizations manage and optimize these complex infrastructures efficiently. Owing to this characteristic, it will likely continue its growth during the forecast period.

Services segment is expected to grow at a considerable CAGR during the forecast period. System integration service providers offer consistent services to end users, effectively deploying and integrating these analytics into their existing network and IT infrastructure systems. The demand for these services in the market is likely to proliferate as organizations need to comply with varying network and radiation regulations worldwide.

By Network Type Analysis

High Volume of Data in Telecom Firms to Foster Market Growth

Based on the network type, the network analytics market is classified as enterprise and telecom network.

Telecom network segment is anticipated to hold a dominant market share of 58.14% in 2026. Telecommunications companies generate vast volumes of data every day. Applying analytics in the telecommunications industry helps businesses to handle this enormous amount of information. Analytics enables telecom operators to make informed decisions based on actionable insights from their vast data sets, contributing to the growth of the segment.

Moreover, with 5G enablement and 5G-related data in the network, it allows the industries to consume, fuse, and visualize data for faster analysis, thereby making timely decisions and delivering a level of service assurance. For instance,

- In August 2023, SK Telecom Co. introduced an analytics solution and simulator designed for Urban Air Mobility (UAM) communication networks. The system engages drones to simulate the real-time communication of UAM vehicles.

Enterprise networks segment is predicted to grow at the highest CAGR during the forecast period. Enterprise networks utilize analytics to monitor, manage, and optimize their infrastructure. This involves collecting and analyzing data to gain insights into network performance, security, and user behavior. Enterprise networks are further categorized into cloud, on-premise, and hybrid. Cloud holds a significant network analytics market share and is growing at the highest CAGR owing to the global development of cloud computing solutions.

By End User Analysis

Rising Awareness About Network Security and Reliability Propel the Adoption of Analytics in Data Centers

By end user, the network analytics market is categorized into organizations, enterprises, businesses, telecom companies, and data centers.

Data centers segment is anticipated to hold a dominant market share of 39.49% in 2026. Analytics in data centers enhanced the reliability, security, and cost-effectiveness of the infrastructure. This support enables the delivery of services and solutions with high performance and availability. It involves the analysis of data gathered from network devices, servers, applications, and other components within the data center environment.

Organizations, enterprises, and businesses segment is anticipated to grow at the highest CAGR during the forecast period. Analyzing network data helps to detect anomalies and potential security threats. It aids in identifying and responding to cyber-attacks, ensuring the integrity and confidentiality of sensitive business information. Thus, the demand for these analytics will drive the network analytics market growth in the upcoming years. Organizations, enterprises, and businesses are further categorized into SMEs and large enterprises. The SMEs sub-segment will grow at the highest CAGR during the forecast period due to the adoption of cloud solutions. This adoption is driving the network analytics market growth, as SMEs are increasingly moving to the cloud to reduce costs and improve operational efficiency.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

By region, the network analytics market has been analyzed across five major regions namely North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America Network Analytics Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America

North America holds a major share of the network analytics market. The increasing availability of technology and infrastructure in the region is expected to contribute to market growth. This is combined with increased cyber malware attacks in the region and growing technology adoption rates. North America is also home to the world's largest telecommunications companies, such as Verizon and AT&T, which use network analytics capabilities extensively. The U.S. market is valued at USD 0.89 billion by 2026.

Europe

The European network analytics market is influenced by increased digital transformation across industries, the adoption of advanced technologies such as 5G, and the growing volume of data traffic. These factors are contributing to the demand for network analytics in the region. European organizations are leveraging these tools to optimize network performance, enhance security, and gain valuable insights into user behavior. The UK market is valued at USD 0.19 billion by 2026, and the Germany market is valued at USD 0.20 billion by 2026.

Asia Pacific

The Asia Pacific region is witnessing the gradual adoption of network analytics solutions. This is owing to the increased adoption of digital technologies, rising demand for network optimization, growing awareness of cybersecurity threats, and the need for efficient network management solutions. Additionally, the proliferation of IoT devices and the expansion of the 5G network are likely to contribute to regional growth during the forecast period. The Japan market is valued at USD 0.21 billion by 2026, the China market is valued at USD 0.25 billion by 2026, and the India market is valued at USD 0.13 billion by 2026.

The South American and Middle East & African markets are influenced by increased technology adoption, rising smartphone penetration, investment in infrastructure, and a large-scale acceptance of cloud computing.

Key Industry Players

Market Players Are Focusing On Various Strategies to Expand their Analytics Solutions Worldwide

Leading companies are working to expand their geographic presence globally by introducing industry-specific network analytics solutions. These companies strategically collaborate with local partners to gain strong regional influence. Additionally, major companies in the market are launching new products to attract and retain their customers. Furthermore, continuous investments in product research and development are aligning with the growth of the global network analytics market. Therefore, by adopting such strategies, companies can sustain and maintain their competitiveness in the network analytics market.

List of Top Network Analytics Companies:

- Nokia Corporation (Finland)

- Cisco Systems, Inc. (U.S.)

- VMware, Inc. (U.S.)

- Juniper Networks (U.S.)

- IBM Corporation (U.S.)

- Vehere, Inc. (U.S.)

- Plixer, LLC. (U.S.)

- Subex (India)

- Aruta Networks (U.S.)

- Cynet (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2023 – Ericsson expanded its Ericsson Expert Analytics product, which offered advanced troubleshooting features. Advanced troubleshooting utilized AI and machine learning tools to evaluate telecommunications network data in present and identify the root cause of any issues for troubleshooting purposes.

- August 2023 - TPG Telecom partnered with Ericsson to provide a cloud-native and Artificial Intelligence (AI) analytics tool to improve the network performance. Through this partnership, TPG Telecom will gain insights from its fixed wireless access, 4G & 5G mobile, and Internet of Things (IoT) subscribers using enhanced data collection with embedded intelligence.

- April 2023 – Google Cloud and Accenture announced a partnership to help businesses in improving critical assets protection and increase security against persistent cyber threats. The two companies collaborated to improve their businesses by leveraging Google Cloud's advanced technology in data analytics, machine learning (ML), artificial intelligence (AI), and cybersecurity to build more robust digital cores.

- February 2023 – Cisco announced that it is partnering with V.tal to surge the volume of its neutral, multi-tenant fiber network in Brazil to accelerate 5G services. This expansion aimed to support the future of the Internet and enhance nationwide connectivity.

- February 2023 – Oracle Corporation launched its Director of Network Analytics Data. This would allow operators to adaptably integrate 5G core capabilities into their existing operational tools, even for network functions.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 14.43% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Component, Network Type, End User, and Region |

|

Segmentation |

By Component

By Network Type

By End User

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market value is projected to reach USD 12 billion by 2034.

In 2025, the market value stood at USD 3.32 billion.

The market is projected to record a CAGR of 14.43% during the forecast period.

By network type, telecom network led the market in 2025.

Increased adoption of cloud computing in network analytics by major companies is a key factor augment the market growth.

Cisco Systems, Inc., VMware, Inc., Juniper Networks, IBM Corporation, and Plixer, LLC. are the top players in the market.

North America region is expected to hold the highest market share.

By end user, organizations, enterprises, businesses segment is expected to grow with the highest CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us