Network Engineering Services Market Size, Share & Industry Analysis, By Service Type (Network Design, Network Deployment, and Network Assessment), By Connectivity (Wired and Wireless), By Enterprise Type (SMEs and Large Enterprises), By Industry (BFSI, IT & Telecommunication, Government, Education, Healthcare, Manufacturing, Media & Entertainment, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

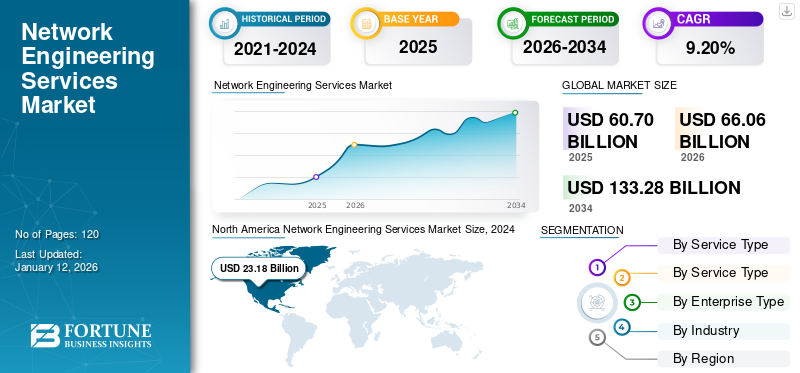

The global network engineering services market size was valued at USD 60.7 billion in 2025. The market is projected to grow from USD 66.06 billion in 2026 to USD 133.28 billion by 2034, exhibiting a CAGR of 9.20% during the forecast period. North America dominated the global market with a share of 38.20% in 2025.

Network engineering services consist of various services such as deployment, design, management, and optimization of computer networks. These services are important to confirm that networks operate securely, efficiently, and reliably to match the requirements of businesses and institutes across various industries. Network engineers manage network operations, including device provisioning, software updates, configuration management, and access control. This involves the adoption of network management tools, maintaining inventories, creating documentation, and implementing network policies for smooth and efficient network administration. As a result of these factors, network engineering services are increasingly adopted in various organizations which drives network engineering services market growth.

Global Network Engineering Services Market Overview

Market Size:

- 2025 Value: USD 60.7 billion

- 2026 Value: USD 66.06 billion

- 2034 Forecast Value: USD 133.28 billion

- CAGR (2026–2034): 9.20%

Market Share:

- Regional Leader: North America accounted for 38.20% share in 2025.

- Fastest-Growing Region: Asia Pacific is expected to record the highest CAGR during the forecast period.

Industry Trends:

- Network design services accounted for the largest share in 2024.

- Wired connectivity dominated the market, while wireless connectivity is projected to grow at a significant pace.

- Large enterprises were the leading adopters, whereas SMEs are expected to expand adoption rapidly.

- BFSI, IT & telecom, government, healthcare, manufacturing, and education are major end-use sectors.

Driving Factors:

- Rising adoption of cloud computing, IoT, and 5G networks is fueling demand for advanced network engineering solutions.

- Increasing complexity of enterprise network infrastructures is boosting the need for professional network design and deployment services.

- Growing focus on secure, high-performance, and scalable network architectures is driving market growth.

During the COVID-19 pandemic, many organizations adopted remote work culture and virtual collaboration. It fueled the demand for network engineering services to support virtual private networks (VPNs), remote access, secure communication platforms, and cloud-based applications. Network engineers were assigned to ensure that remote workers have secure and reliable connections with corporate networks and resources, which fueled demand for remote work services.

In the scope of work, we have included solutions offered by Calsoft Inc., Datavision, Inc., Movate, Cyient, Advance Digital Systems, Inc., Juniper Networks, Inc., Infosys Limited, and others.

IMPACT OF GENERATIVE AI

Growing Demand for Automated Network Design is Expected to Boost Market Growth

In a world where technology is evolving at a rapid pace, the IT sector is constantly in change. Traditional IT infrastructure and operations are facing substantial transformation. Generative AI technology introduces optimization, automation, and intelligence into network engineering processes. Also, this technology can automate the process of network design by analyzing requirements, constraints, and performance objectives to generate ideal network configurations. This automation reduces manual efforts, streamlines the design process, and accelerates time-to-deployment for network infrastructure. In addition, multiple companies are engaged in incorporating gen AI technologies into their digital solution offerings and enhancing networking solutions. For instance,

Infosys is progressing its AI footprint with generative AI technologies at the 2024 Australian Open for player performance, fan engagement, and digital content creation.

- In January 2024, Juniper Networks launched its First AI-Native Networking Platform. This platform provides lower operational costs, end-to-end operator support, and enhanced end-user experience.

Network Engineering Services Market Trends

Increasing Focus on Technological Evolution Fuels Market Growth

Growing emphasis on innovative technologies such as 5G, artificial intelligence (AI), Internet of Things (IoT), network virtualization, machine learning (ML), and software defined networking (SDN) are transforming the networking landscape. Network engineering service providers are significantly adopting these technologies into their offerings to meet the requirements of businesses. Organizations across industries are adopting innovative technologies to modernize their operations and enhance customer experiences. This results in growing demand for network infrastructures that are flexible, scalable, and agile. With the growing importance of digital experiences, there is an increased focus on enhancing network reliability, performance, and quality of service. Thus, these factors play an important role in increasing the adoption of innovative technologies among network service providers and fuel the network engineering services market growth during the forecast period.

Download Free sample to learn more about this report.

Network Engineering Services Market Growth Factors

Increasing Adoption of Cloud Computing Services in Organizations Aids Market Growth

Organizations globally are increasingly adopting cloud computing services to migrate their data, applications, and workloads to cloud infrastructure. Cloud computing allows network engineers to scale resources up or down based on demand. It is beneficial for network infrastructure experiencing fluctuating workloads. In addition, cloud deployment eliminates the need for organizations to invest in hardware infrastructure and maintain them. It reduces capital expenditure and enhances operational costs.

Further, cloud computing providers are capable of operating data centers globally and enable network engineers to deliver services globally. This global reach allows businesses to expand their network infrastructure in multiple regions with minimal downtime. For instance,

- In February 2024, Movate expanded its operation by launching a new delivery center in the Philippines. This site will help the company to strengthen its regional presence and utilize a highly skilled local workforce with multilingual capabilities to enhance its customer experience.

RESTRAINING FACTORS

Complexity of Network Infrastructure and Cybersecurity Threats May Hinder Market Growth

Modern networks are becoming more complex, with the inclusion of multiple protocols, wired and wireless connectivity, and diverse devices. Augmenting and managing such complex infrastructure can be challenging for network engineers. Furthermore, the increase in cyber threats such as phishing attacks, malware, data breaches, and ransomware creates a major challenge for network engineers. Owing to this, network engineers are required to constantly detect, monitor, and mitigate security vulnerabilities to protect networks and data against cyber-attacks.

Network Engineering Services Market Segmentation Analysis

By Service Type Analysis

Growing Need of Optimized Performance and Scalability Drives Demand for Network Design

Based on service type, the market is classified into network design, network deployment, and network assessment.

The network design service segment is projected to dominate the market with a share of 43.71% in 2026, as it ensures network resource allocation to meet performance requirements. For factors such as latency, bandwidth, and throughput, network designers can generate designs that deliver consistent network service levels to users and optimize network performance. Also, well-designed networks are scalable, enabling them to accommodate growth and evolving business needs.

Network deployment is expected to grow at the highest CAGR during the forecast period, as it assures effective implementation of network designs. This includes configuration of software, installation of hardware components, and deployment of network protocols according to design specifications. Additionally, it ensures that network components are configured and optimized to provide enhanced performance.

To know how our report can help streamline your business, Speak to Analyst

By Connectivity Analysis

Growing Demand for Higher Bandwidth and Security Fuels Growth for Wired Segment

Based on connectivity, the market is divided into wired and wireless.

The wired connectivity segment is expected to lead the market, accounting for 56.98% of the total market share in 2026, as it offers higher bandwidth compared to wireless connections, allowing greater throughput and faster data transfer. High bandwidth helps network infrastructures for bandwidth intensive applications, such as multimedia streaming and large file transfers. In addition, wire connections are more secure than wireless connections as it prohibits unauthorized access. This enhanced security is important for confidential communications and sensitive data transmission.

Wireless connectivity is expected to grow at the highest compound annual growth rate during the forecast period, as it enables users to access network services and resources from any location within the premises. This mobility enhances flexibility, scalability, and productivity for users compared to wired networks. This flexibility allows for easy deployment of new access points and expansion of coverage areas.

By Enterprise Type Analysis

Increasing Demand of Networking Service in Complex IT Environment Fuels the Adoption of Networking Solution in Large Enterprises

Based on enterprise type, the market is bifurcated into SMEs and large enterprises.

The large enterprises segment is anticipated to hold a dominant market share of 70.77% in 2026, as large enterprises have complex network infrastructures, multiple data centers, office locations, and cloud environments. Networking services help large enterprises manage, deploy, and design these network infrastructures to ensure high security, reliability, and performance.

SMEs are expected to grow at the highest CAGR over the projected period as many SMEs are experiencing cyber-attacks, including ransomware, malware, and phishing attacks. Network engineering services help SMEs implement robust security measures such as intrusion detection systems, fireballs, and encryption protocols to protect their data and networks from unauthorized access and cyber-attacks.

By Industry Analysis

Surge in Demand for High Speed Connectivity Propel the Adoption of Network Services in IT & Telecommunication

Based on industry, the market is categorized into BFSI, IT & telecommunication, government, education, healthcare, manufacturing, media & entertainment, and others (energy & utility).

IT & telecommunication held the largest network engineering services market share in 2024, as these companies require high speed connectivity to deliver their services, such as voice communications, internet access, cloud computing, and video streaming. Network engineering services help to enhance traffic management, network configurations, and quality of services to provide the high speed and bandwidth required for these services.

BFSI is anticipated to showcase the highest CAGR during the forecast period, owing to the growing focus on the adoption of digital services in the banking sector. Baking organizations handle sensitive personal and financial data, which makes security a top priority. These services assist BFSI institutes in implementing robust security measures such as intrusion detection systems, firewalls, encryption, and access control to protect against cyber-attacks.

REGIONAL INSIGHTS

By region, the market has been analyzed across five major regions, namely North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America Network Engineering Services Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America held the largest revenue share in 2025, as organizations are increasingly focusing on digital transformation initiatives to improve efficiency, modernize their operations, and enhance customer experiences. Network engineering services play an important role in deploying, designing, and managing the network infrastructures to support IoT, cloud computing, big data analytics, and other digital initiatives. Further, the presence of a large number of market players in the region plays a vital role in fueling market growth. The U.S. market is projected to reach USD 17.57 billion by 2026.

Asia Pacific

Asia Pacific is expected to grow at the highest CAGR during the forecast period. The region is experiencing significant growth in telecommunication infrastructure, including the deployment of submarine cables, 5G mobile networks, and broadband networks. Network engineering services support the expansion of telecommunication infrastructure by designing and enhancing network architectures that provide low latency, high speed connectivity, and reliable communication services to customers and businesses. Thus, the region’s growing focus on telecommunication expansion, digital transformation, IoT deployment, cloud computing adoption, smart city initiatives, and data center expansion plays an important role in fueling market growth in the region. The Japan market is projected to reach USD 3.42 billion by 2026, the China market is projected to reach USD 3.82 billion by 2026, and the India market is projected to reach USD 2.77 billion by 2026.

- In February 2024, NTT DOCOMO, INC. (DOCOMO), a Japan-based mobile operator, selected AWS to commercially deploy its nationwide 5G Open Radio Access Network (RAN) in Japan. This collaboration will speed-up the deployment of 5G mobile networks across the country.

Europe

Europe is anticipated to grow at a prominent CAGR in the coming years and is a leader in IoT adoption across various industries, including smart cities, healthcare, manufacturing, and transportation. Network engineering services help businesses deploy IoT-ready networks capable of supporting data transmission, connectivity, and real time analytics requirements of IoT devices and applications. Further, many European cities are investing significantly in smart city projects to enhance urban infrastructure and promote citizen engagement. The UK market is projected to reach USD 2.94 billion by 2026, while the Germany market is projected to reach USD 2.8 billion by 2026.

- In September 2023, The U.K. government announced USD 90 million R&D investment in 19 5G Open Network Projects across the U.K. These projects are expected to deliver optimized connectivity across the U.K.

These services play a vital role in designing and deploying smart city networks, which propel market growth in the region.

The Middle East & Africa is expected to showcase noteworthy growth during the forecast period. Governments and private sector businesses in the region are investing significantly in infrastructure development, including data centers and telecommunication networks. Network engineering services are important to support these initiatives and ensure reliable connectivity.

Moreover, the adoption of these services is expected to grow significantly in South America, owing to the expansion of telecommunications networks. Governments and telecom companies are heavily investing in the deployment of 5G mobile networks and fiber optic networks to provide high speed internet services across the region.

Key Industry Players

Market Leaders are Focused on Acquisition and Collaborations to Expand Their Analytics Services

Key players are focused on expanding their market reach globally by presenting industry-specific services. Major players are focusing on mergers and acquisitions with regional players strategically to maintain dominance across regions. Top market participants are launching new solutions to increase the customer pool. Rising research & development investments to design novel solutions enhance market share. Moreover, market leaders deploy strategies at a quick pace to reinforce their position in a competitive market.

List of Top Network Engineering Services Companies

- Calsoft Inc. (U.S.)

- Datavision, Inc. (U.S.)

- Movate (U.S.)

- Juniper Networks, Inc. (U.S.)

- Sincera Technologies (U.S.)

- Cyient (India)

- Advance Digital Systems, Inc. (U.S.)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Aviat Networks (U.S.)

- Infosys Limited (India)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Aviat Networks, Inc. collaborated with PT Smartfren Telecom Tbk. With this collaboration, the company aims to deliver private wireless indoor and outdoor networks, ultra-reliable, high speed wireless connectivity, and automation services to private network customers across Indonesia.

- February 2023: Calsoft Inc. launched a new 5G lab. This lab offers solutions for deploying 5G service in a public cloud such as AWS. It will help companies looking to leverage AWS solutions for 5G services.

- November 2022: Juniper Networks participated in and powered SuperComputing 2022, the international conference for high performance computing, storage, networking, and analysis. It brings various experts from private companies, government agencies, and universities.

- August 2022: Ericsson and SkyMax Network Limited signed a Memorandum of Understanding (MoU) for two years to develop a 5G broadband network across sub-Saharan Africa for corporate businesses.

- April 2022: Accenture acquired AFD.TECH, a network services provider company. Through this acquisition, the company aims to obtain expertise across design, engineering, deployment, and operation of next-gen networks, such as fiber optics and 5G.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 9.20% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service Type

By Connectivity

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

The market is projected to reach USD 133.28 billion by 2034.

In 2024, the market was valued at USD 60.7 billion.

The market is projected to grow at a CAGR of 9.20% during the forecast period.

By service type, the network design was the leading segment in the market.

The surge in digital transformation initiatives and focus on providing enhanced customer experience aids market growth.

Calsoft Inc., Datavision, Inc., Movate, Cyient, Advance Digital Systems, Inc., Juniper Networks, Inc., and Infosys Limited are the top players in the market.

North America held the highest market share in 2025.

By industry, the BFSI segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us