SOC as a Service Market Size, Share & Industry Analysis, By Service (Security Information and Event Management (SIEM), Intrusion Detection and Prevention Systems (IDPS), Vulnerability Management, Endpoint Security, and Others), By Offering (Fully Managed Service and Co-Managed Service), By Enterprise Type (SMEs and Large Enterprises), and By Industry (BFSI, IT & Telecom, Healthcare, Government & Public Sector, Retail & E-commerce, Manufacturing, and Others) and Regional Forecast, 2026–2034

SOC as a Service Market Size & Share

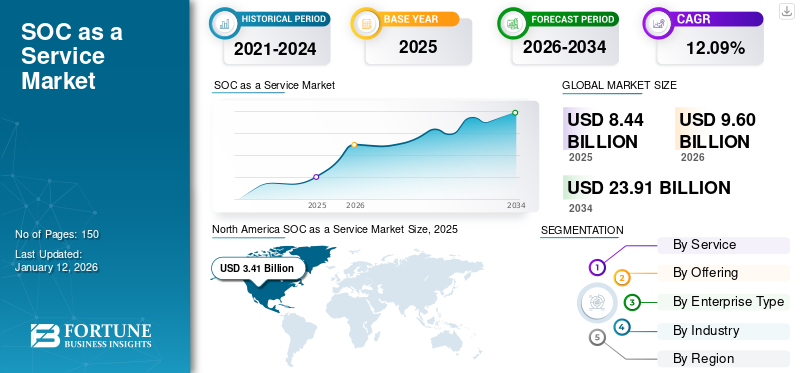

The global SOC as a Service market size was valued at USD 8.44 billion in 2025 and is projected to grow from USD 9.60 billion in 2026 to USD 23.91 billion by 2034, exhibiting a CAGR of 12.09% during the forecast period. North America dominated the SOC as a Service market with a market share of 40.40% in 2025.

SOC as a Service (SOCaaS) is a security framework where a third-party service provider operates and oversees a fully managed Security Operations Center (SOC) through a subscription model via the cloud. SOCaaS encompasses all security functions typically carried out by an internal SOC, such as network monitoring, threat detection & intelligence, log management, reporting, incident investigation & response, as well as risk and compliance activities.

Cyberthreats covered by SOCaaS include Denial of Service (DoS), ransomware, Distributed Denial of Service (DDoS), phishing, malware, insider threats, credential theft, smishing, zero days, and more. The vendor assumes responsibility for all the people, processes, and technologies required to deliver these services, offering 24/7 support.

The market is driven by the increasing number of cyber threats, stringent data protection regulations, remote workforce, and increased integration of advanced technologies. Moreover, with businesses increasingly emphasizing proactive cybersecurity measures, the demand for AI-driven SOC is expected to rise, further contributing to the SOC as a Service market growth. For instance,

In April 2022, Vectra AI, an AI-driven threat detection and response provider, launched an SOC as a Service solution in collaboration with Neutron Engineering. The partnership combined Vectra’s cyber detection tools with Neutron’s creative engineering and service delivery expertise.

Download Free sample to learn more about this report.

COVID-19 IMPACT

Increased Remote Workforce and Rapid Digital Shift Among Businesses Propelled the Market Growth

The COVID-19 pandemic had a positive influence on the market. The significant transition to remote work increased the vulnerabilities of various organizations, emphasizing the necessity for strong cybersecurity measures. According to a study by AAG IT Services in cybersecurity in 2020, malware attacks increased by 358% compared to 2019. Consequently, businesses sought SOC services more extensively to safeguard their distributed networks and ensure the security of sensitive data. In addition, Google stated that its systems detected around 18 million COVID-19-related malware and phishing Gmail messages per day, in addition to over 240 million daily spam messages related to the pandemic.

Furthermore, organizations sensed the potential of the market and adopted many corporate strategies to expand their business. For instance,

In January 2020, Pax8 partnered with RocketCyber to enable Managed Service Providers (MSPs) to provide customers with continuous cybersecurity incident detection and response. The partnership offered 24/7 Managed SOC as a Service to RocketCyber’s customers, thereby increasing client protection and MSPs’ profitability.

SOC as a Service Market Trends

Rising Integration of Artificial Intelligence and Machine Learning Technologies to Enhance SOCaaS Solutions

Integration of Artificial Intelligence (AI) and Machine Learning (ML) in SOC as a Service (SOCaaS) solutions enhances the capabilities of threat detection, incident response, and other cyber security technologies. These technologies provide businesses with advanced threat detection, anomaly detection, behavioral analysis, automated incident response, threat intelligence integration, user & entity behavior analytics, continuous learning, predictive analytics, phishing detection, and many more features.

AI algorithms analyze vast datasets in real-time to identify patterns indicative of sophisticated cyber threats, such as zero-day attacks or polymorphic malware. In comparison, ML models can predict potential security incidents by analyzing historical data and identifying patterns that precede common types of attacks. For instance,

In September 2023, Symantec, a Broadcom Inc. company, partnered with Google Cloud to insert generative AI into the Symantec Security platform. With Google Cloud Security AI Workbench, Symantec provided customers with a technical edge for understanding, detecting, and remediating cyberattacks.

Thus, the integration of AI and ML in SOCaaS not only enhances the efficiency of security operations, but also enables a more adaptive and proactive approach to cybersecurity.

SOC as a Service Market Growth Factors

Growing Number of Cybercrimes to Fuel Demand for SOCaas Solutions

The market is driven by the increasing sophistication of cyber threats, including malware, ransomware, and phishing attacks. In a study by AAG IT Services, the company stated that around 236.1 million ransomware attacks occurred globally in the first half of 2022. Organizations are seeking advanced security solutions to protect their databases against evolving threats and tackle the complexity of managing security operations in-house.

Many businesses, especially SMEs, are shifting toward cloud-based solutions to deliver cost-effective solutions to customers. SOCaaS allows these companies to access advanced security capabilities without the need for heavy investments in infrastructure and expertise. Moreover, the integration of innovative technologies, such as AI and ML enhances the features of SOC as a Service. These technologies enable more accurate threat detection and help identify patterns indicative of potential security incidents. For instance,

In April 2023, BlackBerry Limited and Solutions Granted collaborated to deliver cybersecurity services to small and medium-sized businesses (SMBs). The partnership enabled MSSPs and Managed Service Providers (MSPs) to offer security services as a SOCaaS solution.

RESTRAINING FACTORS

Data Privacy and Compliance Issues to Impede the Market Growth

The adoption of SOCaaS solutions can be hindered by concerns about data privacy and compliance, especially in regions with strict regulations as organizations navigate complex legal frameworks. Different regions and industries have varying data protection regulations, such as the General Data Protection Regulation (GDPR) in the European Union and the Health Insurance Portability and Accountability (HIPPA) in healthcare. Companies offering SOC as a Service solutions must comply with these regulations. Many organizations may worry about trusting external providers with their sensitive data and critical cybersecurity functions.

Also, integrating SOCaaS solutions seamlessly with the existing IT infrastructure can be complex and may pose challenges for enterprises, thereby causing reluctance to adopt them.

SOC as a Service Market Segmentation Analysis

By Service Analysis

Growing Need to Protect Endpoint Devices for Better System Functionality to Bolster Demand for Endpoint Security

Based on service, the market is divided into Security Information and Event Management (SIEM), Intrusion Detection and Prevention Systems (IDPS), vulnerability management, endpoint security, and others.

The endpoint security segment emerged as the largest sub-segment, accounting for 54.41% of the market share in 2026 owing to its growing applications in various endpoint devices, such as computers, mobile devices, and servers that form the common entry points for cyber threats. The increasing volume of remote workforce, along with the rising number of connected devices, augments the importance of securing endpoints.

However, the Intrusion Detection and Prevention Systems (IDPS) segment is expected to record the highest CAGR during the forecast period. IDPS plays a vital role in identifying and mitigating security incidents in real-time, compelling organizations to invest in robust security solutions.

By Offering Analysis

Co-Managed Services to Gain Immense Popularity Owing to Their Ability to Leverage Internal Expertise with External Professionals

Based on offering, the market is divided into fully managed service and co-managed service.

The co-managed service segment holds the largest part in the SOC as a Service market share as this offering allows businesses to leverage their internal expertise while benefitting from the knowledge and resources of external security professionals.

The fully managed service segment is forecasted to record the highest CAGR owing to the growing awareness of the benefits of outsourcing security operations to third-party providers. Managed service providers bring expertise and dedicated resources, which many organizations may lack internally.

By Enterprise Type Analysis

Better Protection of Complex and Extensive IT Infrastructures Boosts Product Use in Large Enterprises

Based on enterprise type, the market is bifurcated into SMEs and large enterprises.

The large enterprise segment accounted for 58.45% of the market share in 2026 due to the complex and extensive IT infrastructure of these enterprises, which makes them more prone to cyberattacks. Advanced security measures, such as SOC as a Service can help them mitigate associated security risks and maintain compliance.

The SME segment is forecasted to register the highest CAGR owing to the cost-effective services offered by SOCaaS vendors. Outsourcing SOC services assists SMEs in accessing advanced cybersecurity measures without the need for significant upfront investments.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Growing Need for Securing Sensitive Financial Data Drives Service Adoption in BFSI Industry

Based on industry, the market is segmented into BFSI, IT & telecom, healthcare, government & public sector, retail & e-commerce, manufacturing, and others.

The BFSI segment holds the highest share of the global market. The BFSI industry is involved in handling sensitive financial information, making it a prime target for cyber threats. As a result, there is more emphasis on implementing robust cybersecurity measures. Also, the increasing adoption of digital banking, online transactions, and mobile financial services necessitates the use of advanced security solutions, such as SOCaaS.

The healthcare segment is expected to account for 29.49% of the market in 2026. The increasing frequency and sophistication of cyberattacks have prompted healthcare organizations to invest in SOC as a Service solutions.

REGIONAL INSIGHTS

The market is being studied across North America, South America, Europe, Asia Pacific, and the Middle East.

North America SOC as a Service Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America accounted for USD 3.41 billion in 2025 owing to the rising instances of major security breaches, fueling the need for cloud-based security solutions throughout the region. The regional market’s growth is further propelled by the rising presence of e-commerce platforms, particularly in countries, such as the U.S. and Canada. Additionally, the governments are adopting advanced network security protocols to provide efficient security measures for enterprises.

In August 2023, The U.S. Government Accountability Office stated that the ransomware attacks in public elementary and secondary schools resulted in monetary losses of around USD 1 million to each school, as well as weeks of lost learning.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is expected to record the highest CAGR owing to the rising number of cloud infrastructures in the region. The region’s cloud infrastructures, including public, private, and hybrid models, are the greatest source of cyber threats. Moreover, online transactions and e-commerce activities are more prone to potential cyber threats. SOCaaS enables organizations to strengthen their cyber security with cutting-edge technology and robust infrastructure. The Japan market reaching USD 0.47 billion by 2026, the China market reaching USD 0.52 billion by 2026, and the India market reaching USD 1.02 billion by 2026.

In September 2023, the United Nations, in its latest report on online scam violations in South Asia, stated that many people in Asia were forced and trafficked to work for online scams. Cybercriminal gangs are exploiting online businesses and e-commerce platforms across the world by using online gambling and cryptocurrencies scams.

Europe

Europe's market is driven by factors, such as the rapid adoption of cloud-based solutions by SMEs due to their cost-effective nature and growing awareness of the importance of robust security measures. Moreover, the adoption of advanced technologies, such as Artificial Intelligence (AI) and Machine Learning (ML) in cybersecurity and need for proactive threat detection across vital industries will contribute to the market’s growth. Also, the European Union has set new rules to ensure a high level of cybersecurity across the Union’s countries, responding to the evolving threat landscape and taking into account the digital transformation, which the COVID-19 pandemic has accelerated. The UK market reaching USD 0.81 billion by 2026 and the Germany market reaching USD 0.58 billion by 2026.

Middle East & Africa and South America

Similarly, the Middle East & Africa and South America are forecasted to grow at a steady pace over the years. The growing awareness of the importance of cyber security among businesses will drive the market. Cyber threats and attacks have significant reputational and financial impacts on businesses, leading to the rising demand for cybersecurity solutions to protect against them.

Competitive Landscape

Collaborations & Partnerships among Vendors to Propel Market Growth

Key players in the SOC as a Service market are collaborating with similar companies to bring significant financial gains to both the parties. Partnerships aid businesses in increasing their sales and cutting down costs by sharing or combining resources. For instance,

In August 2023, Trend Micro launched a Service Provider Module of Vision One Cybersecurity Platform. It is designed to help Managed Service Partners (MSPs), Managed Security Service Providers (MSSPs), and pure-play Managed Detection and Response (MDR) companies develop, launch, and expand their SOC/SOCaaS capabilities.

List of Top SOC as a Service Companies

- Fortinet, Inc. (U.S.)

- NTT DATA Group Corporation (Japan)

- Check Point Software Technologies Ltd. (Israel)

- Teceze (U.K.)

- Clearnetwork, Inc. (U.S.)

- ConnectWise, LLC. (U.S.)

- CyberNX Technologies Pvt. Ltd. (India)

- Thales (France)

- Arctic Wolf Networks Inc. (U.S.)

- Cloudflare, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- November 2023: SonicWall acquired Solutions Granted, Inc. to expand its product portfolio and provide new services globally. The acquisition added key technologies to the SonicWall portfolio, including Security Operations Center as a Service (SOCaaS), Managed Detection & Response (MDR), and other managed services.

- October 2023: Stairwell and 360 SOC partnered with each other to provide customers with innovative security solutions at competitive rates. The partnership combined Stairwell's AI-powered threat detection capabilities with 360 SOC's Security Operations Center as a Service (SOCaaS) offering. It offers cost-effective, scalable, and highly automated security solutions for businesses of all types and sizes.

- October 2023: Check Point Software Technologies Ltd. made additions to its Check Point Infinity Global Services portfolio. The new services include managed network security service (Network Operations Center (NOC) and Security Operation Center (SOC) as a service), managed cloud security service, and extended Managed Detection and Response (MDR) capabilities.

- July 2023: NTT Data launched an outsourcing service for its MDR security service to prevent cyber threats and reduce damage when these incidents occur. The company leveraged its SOCaaS offering with log analysis to provide and support threat analysis through the log monitoring platform.

- January 2023: Fortinet launched Security Operations Center (SOC) expansion services aimed to strengthen an organization’s cyber structure and support smaller teams. The additions include SOC-as-a-Service (SOCaaS), outbreak detection service, and Incident Response and Readiness (IR&R) services. In addition, the Fortinet Training Institute added many initiatives in its programs to increase accessibility to its training and certifications.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading applications of the product. Besides, it offers insights into the latest market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.09% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service

By Offering

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

The market is projected to reach USD 23.91 billion by 2034.

In 2025, the market was valued at USD 8.44 billion.

The market is projected to record a CAGR of 12.09% during the forecast period.

BFSI is the leading industry in the market.

The growing number of cybercrimes is fueling the demand for SOCaaS solutions, thus driving the market growth.

Fortinet, Inc., NTT DATA Group Corporation, Check Point Software Technologies Ltd., Teceze, Clearnetwork, Inc., ConnectWise, LLC., CyberNX Technologies Pvt. Ltd., Thales, Arctic Wolf Networks Inc., and Cloudflare, Inc. are the top players in the market.

In 2025, North America is held the highest market share.

By service, the Intrusion Detection and Prevention Systems (IDPS) segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us