Managed Detection and Response (MDR) Market Size, Share & Industry Analysis, By Type (Managed Endpoint Detection and Response (MEDR), Managed Network Detection and Response (MNDR), Cloud Detection and Response (CDR), and Others), By Deployment Mode (Cloud-based MDR and On-premises MDR), By Enterprise Type (Small and Medium-sized Enterprises and Large Enterprises), By Industry (BFSI, Healthcare & Life Sciences, IT & Telecom, Manufacturing, Retail & E-commerce, Government, and Others) and Regional Forecast, 2026-2034

Managed Detection and Response (MDR) Market Size

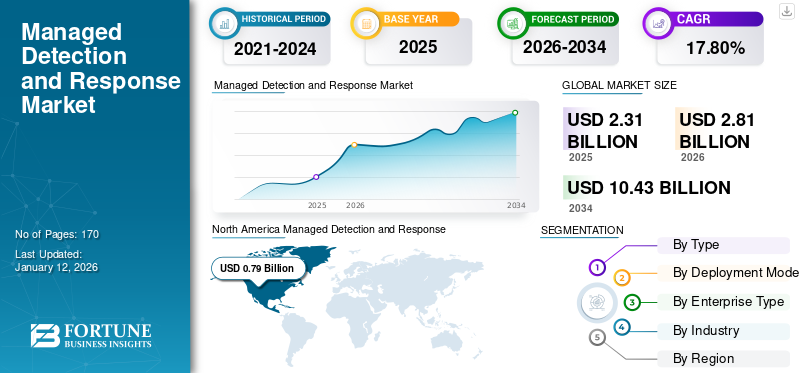

The global Managed Detection and Response (MDR) market size was valued at USD 2.31 billion in 2025. The market is projected to grow from USD 2.81 billion in 2026 to USD 10.43 billion by 2034, exhibiting a CAGR of 17.80% during the forecast period. North America dominated the global market with a share of 40.90% in 2025.

Managed Detection and Response (MDR) is a combination of human expertise, deep threat analytics, various endpoints, cloud based environments, and network detection technologies to help businesses lessen the risk and costs associated with cyberattacks and data breaches. MDR services enable 24/7, year-round coverage and expertise for threat identification, forensic investigation, and incident response.

The rapid growth of the MDR market is majorly attributed to the increasing cybersecurity threats, shortage of cybersecurity talent, increased adoption of cloud computing, and proliferation of the Internet of Things (IoT). Cyberattacks are rising at a rapid pace across the world. More than 30,000 websites are hacked daily worldwide. In addition, the average number of cyber threats, as well as data breaches, rose by 15.1% in 2021 compared to 2020. Due to all such increasing threats, businesses are investing significantly in robust detection and response services capabilities to identify and respond to cyberattacks. Moreover, the COVID-19 pandemic also highlighted the necessity for robust MDR capabilities to overcome uncertain business dynamics. To reduce the risks and costs associated with the impact of a cyberattack, companies enhanced their endpoint security measures and invested significantly in cyberattack detection, response, and recovery capabilities.

Key MDR providers are increasingly launching sophisticated MDR services to help organizations reduce the risk of cyberattacks. For instance,

- In October 2023, IBM launched an MDR service powered by AI. The launch enabled continuous assessment and auto-recommendation of effective detection rules, aiding firms to improve their speed response times and alert quality.

Managed Detection and Response (MDR) Market Trends

Integration of Artificial Intelligence (AI) and Machine Learning (ML) Aids Market Growth

In the past few years, cyberattacks have skyrocketed due to various factors, including the rapid digital transformation worldwide. In the ever-changing landscape of cybersecurity, Artificial Intelligence (AI) and Machine Learning (ML) have become crucial for enabling fast identification of potential cyber threats. AI and ML algorithms can analyze vast amounts of data in real time, helping in pattern recognition, process automation, and predictions. Many MDR providers are leveraging the power of AI and ML to offer complete cybersecurity solutions to enterprises that lack specialized AI and ML expertise. For instance,

- In July 2023, CyberCatch Holdings, Inc., a cybersecurity company offering an AI-enabled platform solution, and Proficio, an MDR services provider, collaborated to deliver an AI-enabled solution for businesses globally. The combined solution aided organizations with continuous compliance, protecting them from cyber threats.

Download Free sample to learn more about this report.

Managed Detection and Response (MDR) Market Growth Factors

Stringent Regulatory Compliance Requirements to Fuel Market Growth

Governments across the globe are increasingly directing stringent data protection regulations such as the General Data Protection Regulation (GDPR) to safeguard personally identifiable information from cyberattacks and other security incidents. Non-compliance to these regulations can cause legal penalties and fines and may damage the reputation of organizations. For instance, non-compliance with GDPR can lead to fines of up to 4% of the company’s annual revenue. However, fulfilling such compliance is a demanding task for organizations as industry standards and requirements can overlap. Hence, to address strict compliance needs, many organizations are opting for MDR services to identify security threats while fulfilling regulatory mandates. MDR services offer real-time, 24/7 threat detection technologies, helping organizations detect and respond to suspicious activities and data breaches on time and meet regulatory compliance. For instance, in November 2023, Vectra AI, Inc., an investigation, hybrid attack detection, and response provider, announced improvements to the Vectra AI Platform by launching Cloud Detection and Response for AWS. The new launch empowered Security Operations Center (SOC) teams with real-time, integrated attack signals for hybrid attacks in cloud, network, and identity domains.

RESTRAINING FACTORS

Data Security Concerns Coupled with High Cost May Hinder Market Growth

Organizations often share sensitive information with MDR providers. Hence, data privacy, as well as managed security services, becomes a major concern, limiting market growth. Another major concern is the increasingly intricate and rapidly changing cyber threat landscape. Cybercriminals are employing more sophisticated and new strategies to target organizations. This, in turn, requires continuous advancement of threat detection strategies, vigilant monitoring, and prompt incident response.

Moreover, the high cost, especially for small enterprises, also poses a significant challenge for widespread adoption. The cost of procurement and maintenance of the tools and technologies, as well as the expense of hiring and retaining cybersecurity experts, is significantly high. In today’s highly competitive business environment, organizations that operate on tight budgets may find it challenging to allocate enough resources for implementing 24/7/365 cyber threat monitoring and response service.

Managed Detection and Response (MDR) Market Segmentation Analysis

By Type Analysis

MEDR Segment to Dominate Due to Simplification of Endpoint Management Process

Based on type, the market is divided into Managed Endpoint Detection and Response (MEDR), Managed Network Detection and Response (MNDR), Cloud Detection and Response (CDR), and others. The Managed Endpoint Detection and Response (MEDR) segment is expected to account for 56.87% of the market in 2026. MEDR is typically used for detecting and remediating suspicious activity at various endpoint servers, mobile devices, laptops, desktop PCs, and others. It offers real-time threat detection, monitoring, and responses to malicious activities. It also simplifies the endpoint management process by enabling threat detection and response via one central platform.

The Cloud Detection and Response (CDR) segment is poised to show the highest growth rate during the forecast period owing to increased cloud adoption and data breach issues. Enterprises are increasingly migrating to cloud environments, augmenting the need for cloud security solutions such as MDR.

By Deployment Mode Analysis

Cloud-based MDR Segment to Dominate Owing to Better Accessibility

Based on deployment mode, the market is divided into cloud-based MDR and on-premises MDR. The Cloud-based MDR segment will account for 78.20% market share in 2026, owing to its numerous advantages compared to on-premises deployment. Cloud-based MDR enables enterprises to easily adjust their resources to cater to their requirements. Moreover, cloud deployment facilitates accessibility to remote teams in any part of the globe with an active internet connection. In addition, cloud-based MDR can be updated rapidly in an ever-changing cyber threat landscape.

By Enterprise Type Analysis

Large Enterprises Segment to Dominate Due to Growing Spending on Cybersecurity

Based on enterprise type, the market is divided into large enterprises and small and medium-sized enterprises. The large enterprises segment is anticipated to hold a dominant market share of 67.53% in 2026, as large enterprises typically spend more on cybersecurity due to the higher value of their data as well as assets. Stricter compliance requirements also cause large enterprises to increase their cybersecurity budget. This, in turn, augments the managed detection and response market growth.

The small and medium sized enterprises segment is expected to experience rapid growth during the forecast period. The rapid shift to remote as well as hybrid working, accelerated by the pandemic, has raised the cybersecurity stakes significantly for SMEs. Hence, safeguarding the security of remote access and devices has become crucial. For instance, in January 2024, ESET launched ESET MDR, a solution created to address the current cybersecurity challenges faced by small and medium-sized businesses. The launch expanded ESET’s security service offerings with another MDR solution.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

BFSI Segment Leads and Embraces MDR for Enhanced Protection

Based on industry, the market is divided into BFSI, healthcare & life sciences, IT & telecom, manufacturing, retail & e-commerce, government, and others. The BFSI segment is forecast to represent 23.80% of total market share in 2026. The BFSI sector is the most targeted sector by cyber criminals and involves the highest cost of data breaches. Due to this, investments in digital infrastructure and cybersecurity are critical for the BFSI industry. In addition, this sector is rapidly adopting cloud solutions to process data in real time. Hence, more and more financial institutions are anticipated to adopt MDR to safeguard against cyber threats.

The IT & telecom segment is anticipated to experience rapid growth during the forecast period owing to its heavy dependency on technology and increasing exposure to cyber-attacks. Many IT and telecom enterprises have a global presence, requiring robust cybersecurity.

REGIONAL INSIGHTS

Geographically, the market share is fragmented into five major regions, including North America, South America, Europe, the Middle East & Africa, and the Asia Pacific. They are further categorized into countries.

North America Managed Detection and Response (MDR) Market Size, 2024

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 0.94 billion in 2025 and USD 1.14 billion in 2026, due to the stringent regulatory landscape, increased cloud computing adoption, robust cybersecurity spending, rapid developments in digitization, and technological developments in this region. Moreover, the U.S. has maintained its leadership in the North America region on account of the presence of key players. Acquisitions, product launches, collaborations, and partnerships by key players in the region further contribute to the regional growth. The U.S. market is projected to reach USD 0.87 billion by 2026. For instance,

- In March 2023, Trustwave partnered with Trellix to provide security teams with more precise detection and response capabilities, and superior visibility to defend themselves against cyber threats.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific market for managed detection and response is expected to show the highest growth rate during the forecast period due to the presence of the world’s fastest-growing economies, such as India, South Korea, and Singapore, growing cloud adoption, and increasing cyber threats. For instance, in July 2023, NTT Japan launched an outsourcing MDR service to prevent threat instances and reduce damage when cyberattacks occur. The Japan market is projected to reach USD 0.11 billion by 2026, the China market is projected to reach USD 0.20 billion by 2026, and the India market is projected to reach USD 0.13 billion by 2026.

Europe market for managed detection and response is driven by government initiatives to bolster cybersecurity, growing emphasis on cybersecurity, and rapid digital transformation. These factors are expected to augment the regional growth during the forecast period. The U.K. market is projected to reach USD 0.12 billion by 2026, while the Germany market is projected to reach USD 0.12 billion by 2026.

The growth of the South America market for managed detection and response is being propelled by the cloud computing expansion and growth of various industries, such as BFSI and e-commerce. Brazil is anticipated to dominate the market in this region on account of more awareness regarding cybersecurity in this country.

The Middle East & Africa (MEA) market for managed detection and response shows significant growth as major financial institutions are spending significantly on cybersecurity.

Key Industry Players

Key Players Are Focused on Strengthening their Market Position with Continuous Developments

Leading players such as CrowdStrike, Secureworks, Inc., Arctic Wolf Networks Inc., Palo Alto Networks, Rapid7, WithSecure, Atos SE, Accenture, TATA Consultancy Services Limited, Sophos Ltd., and others consolidate the global market. These key players are expanding their operations by adopting strategies such as mergers, acquisitions, product launches, collaborations, and partnerships. For instance,

- In April 2023, CrowdStrike, a cybersecurity technology company, extended its existing MDR offerings with Managed Extended Detection and Response (MXDR) service. The MXDR combines Artificial Intelligence (AI) and threat intelligence with human intelligence to cater to organizations’ threat detection and response needs.

List of Top Managed Detection and Response (MDR) Companies:

- CrowdStrike (U.S.)

- Secureworks, Inc. (U.S.)

- Arctic Wolf Networks Inc. (U.S.)

- Palo Alto Networks (U.S.)

- Rapid7 (U.S.)

- WithSecure (Finland)

- Atos SE (France)

- Accenture (Ireland)

- TATA Consultancy Services Limited (India)

- Sophos Ltd. (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Sophos added a new offering, Partner Care, which is a team of Sophos experts dedicated to handling non-sales-related questions and offering operational support. The new launch will speed up the response times for Managed Service Providers (MSPs) and Sophos partners.

- November 2023: SonicWall acquired Solutions Granted, Inc. (SGI) to add several advanced technologies to the SonicWall portfolio, including Security Operations Center as a Service (SOCaaS), Managed Detection and Response (MDR), and other managed services.

- October 2023: Blackpoint Cyber launched a Cloud Response feature, named Identity Response for Azure AD to expand cloud security. This MDR for Single Sign-On (SSO) increases the security of Microsoft environments and offers protection to third-party applications interrelated via the Azure SSO authentication.

- October 2023: Rapid7, a cybersecurity company, improved its MDR services with amplified endpoint prevention capabilities enabled by its insight agent, helping enterprises with advanced cyber threats.

- July 2023: Sophos Ltd., an enterprise security software company, unveiled MDR for Microsoft Defender for organizations using Microsoft Security. This solution enables 24/7 security across the Microsoft security suite of endpoints, cloud, and others to defend against data breaches.

REPORT COVERAGE

The managed detection and response market research report offers qualitative and quantitative insights into the market and a detailed analysis of the size & growth rate for all possible segments in the market. It also provides an elaborative analysis of market dynamics, emerging trends, and the competitive landscape. The report also offers key insights, such as the implementation of automation in specific market segments, recent industry developments such as partnerships, mergers, funding, acquisitions, consolidated SWOT analysis of key players, business strategies of leading market players, macro and micro-economic indicators, and major industry trends. This detailed analysis provides a comprehensive view of the market and its potential for growth and development.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021 - 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 – 2034 |

|

Historical Period |

2021 - 2024 |

|

Growth Rate |

CAGR of 17.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, Deployment Mode, Enterprise Type, Industry, and Region |

|

Segmentation |

By Type

By Deployment Mode

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global MDR market value is predicted to reach USD 10.43 billion by 2034.

In 2025, the market value stood at USD 2.31 billion.

The market is projected to record a CAGR of 17.80% during the forecast period of 2026– 2034.

Based on deployment mode, the cloud-based MDR segment is anticipated to dominate the market during the forecast period.

The increasing cloud-computing adoption coupled with a surge in the number of cyberattacks aids market growth.

Some of the top players in the market are CrowdStrike, Secureworks, Inc., Arctic Wolf Networks Inc., Palo Alto Networks, and others.

North America is expected to dominate the market during the forecast period due to the presence of major market players in this region.

By industry, the IT & Telecom segment is expected to adopt the solution at a higher rate during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us