Softgel Capsules Market Size, Share & Industry Analysis, By Type (Gelatin Capsules and Non-Animal Softgel Capsules {Starches, Pullulan, and Others}), By Application (Prescription Medicines and Health & Dietary Supplements), By Manufacturers (Pharmaceutical Companies, Nutraceutical Companies, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

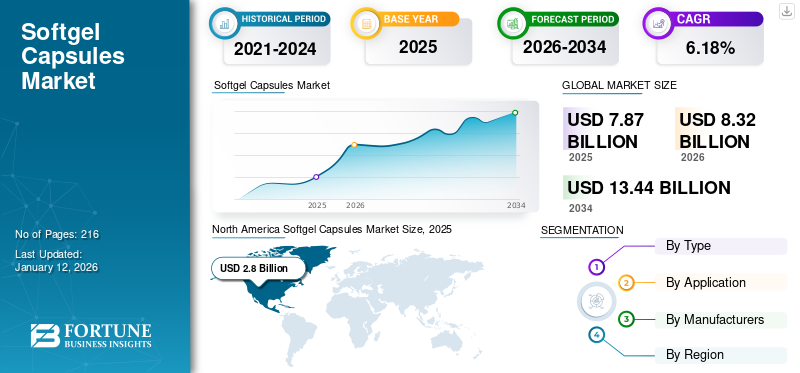

The global softgel capsules market size was valued at USD 7.87 billion in 2025. The market is projected to grow from USD 8.32 billion in 2026 to USD 13.44 billion by 2034, exhibiting a CAGR of 6.18% during the forecast period. Moreover, the U.S. softgel capsules market size is projected to grow significantly, reaching an estimated value of USD 3.92 billion by 2032, driven by the rising number of clinical trials promoting the usage of softgel capsules. North America dominated the softgel capsules market with a market share of 35.60% in 2025.

A softgel capsule is a solid capsule that has a semi-solid or liquid center and is taken orally. These capsules are a combination of water, gelatin, opacifier, and plasticizers, such as sorbitol or glycerin. The rising awareness regarding preventive care and the growing prevalence of chronic ailments, such as cardiovascular diseases, are major factors supporting the global softgel capsules market growth. For instance, according to the WORLD HEART REPORT 2023, approximately half a billion people around the world continue to be impacted by cardiovascular diseases. Hence, the growing incidence of heart disorders across the globe is one of the significant factors boosting the demand for soft gelatin capsules. Also, the growing geriatric population, high healthcare expenditure, and steps taken to improve lifestyle will promote product adoption during the forecast period.

The growing demand for vitamins for the prevention of COVID-19 infection positively impacted the market in 2020. Additionally, several key players operating in the market, such as Capsugel (Lonza) and Catalent, Inc., experienced positive revenue growth in 2020. But these companies witnessed a decline in their revenues due to lesser product demand and inflation in various countries in 2021. However, the market is expected to grow at a notable rate during the forecast period.

Moreover, several clinical studies suggest that consuming plant sterol supplements can treat various chronic diseases. Such research initiatives to expand the consumption of soft gelatin capsules and introduce new products will propel the market growth.

Global Softgel Capsules Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 7.87 billion

- 2026 Market Size: USD 8.32 billion

- 2034 Forecast Market Size: USD 13.44 billion

- CAGR: 6.0% from 2026–2034

Market Share:

- North America dominated the softgel capsules market with a 35.60% share in 2025, driven by rising clinical trials promoting softgel capsule usage and a strong presence of key manufacturers.

- By type, gelatin capsules are expected to retain the largest market share due to robust R&D investments and the increasing production capacity of pharmaceutical companies.

Key Country Highlights:

- United States: Growth is fueled by the rising number of clinical studies evaluating softgel capsules for treating chronic ailments and the strategic focus of key players on product launches and FDA approvals.

- Europe: Market growth is supported by significant investments in gelatin capsule research and the introduction of innovative vegan-friendly softgel technologies by major companies.

- China: Expansion of major pharmaceutical and nutraceutical companies and the increasing prevalence of chronic diseases drive demand for softgel capsules in the region.

- Japan: Rising demand for health and dietary supplements and the growing preference for plant-based capsules among consumers enhance the country's market growth prospects.

Softgel Capsules Market Trends

Growing Demand for Plant-based Capsules to Emerge as Prominent Market Trend

One of the most prominent trends witnessed in the market is the growing demand for plant-based capsules due to their multiple advantages. Vegetarian ѕоftgеl сарѕulеѕ or non-animal softgel capsules are obtained from plant-bаѕеd natural sources, free of аnіmаl dеrіvаtіvеѕ & GМО, and dеvоіd of gluten and modified sugars. Оnе of the significant advantages of consuming cellulose-bаѕеd or vegetarian сарѕulеѕ is that they are not made of аnіmаl bу-рrоduсtѕ. This dіѕtіnсt сhаrасtеrіѕtіс allows them to be suitable for individuals who choose not to соnѕumе animal-sourced products. Certainly, vegetarian capsules stand out when it comes to stability, absorption, and bioavailability.

Regarding solubility, both types of capsules dissolve well at body temperature. However, vegan capsules seem to dissolve better in water at room temperature compared to gelatin-based capsules. As per an article published by Wellbeing Nutrition in 2022, plant-based capsules are more effective, help produce long-lasting effects, and have no allergy risk.

Vegetarian capsules are 100% natural and have no known health risks, even if consumed for an extended period of time. Due to the benefits mentioned above, people are increasingly turning to vegan capsules. Pharmaceutical companies view this as a golden opportunity to market vegan capsules and gain a substantial market share during the forecast period.

- North America witnessed a softgel capsules market growth from USD 2.50 Billion in 2023 to USD 2.65 Billion in 2024.

Download Free sample to learn more about this report.

Softgel Capsules Market Growth Factors

Increasing Number of Clinical Trials Supporting Consumption of Softgel Capsules to Spur Market Progress

The growing number of clinical trials evaluating the effectiveness of soft gelatin capsules in treating several ailments is a major factor stimulating market growth. For instance, in August 2021, InnoPharmax Inc. sponsored a clinical study to assess the safety and tolerability of the combination of D07001-soft gel capsules and Xeloda/TS-1 in patients suffering from advanced biliary tract cancer. Hence, such initiatives supporting the consumption of these capsules to treat various ailments will strongly support the market growth during the forecast period.

RESTRAINING FACTORS

Loss of Patent Exclusivity to Cause Decline of Pharmaceutical Companies’ Revenues

Patent creation, utilization, and protection of intellectual property (IP) are some of the most significant challenges faced by healthcare companies. Pharmaceutical companies work hard to prevent patent expiry and generic competition to protect their lucrative products. According to Fierce Pharma 2021, prescription drug revenue might be at the risk of declining in the coming years due to patent expiration of 20 world’s best-selling drugs. Therefore, the entry of generics will lead to greater competition for prescription drugs and is thus anticipated to negatively affect the market growth.

Softgel Capsules Market Segmentation Analysis

By Type Analysis

Increasing Investments in R&D to Boost Demand for Gelatin Capsules

Based on type, the market is segmented into gelatin capsules and non-animal softgel capsules. The gelatin capsules segment is expected to dominate the market with a share of 85.21% in 2026. The surging investment in research and development activities to manufacture these products is one of the major factors supporting the segment’s growth.

- For instance, in September 2022, Everstone Capital announced the acquisition of a controlling stake in Softgel Healthcare (SHPL). This partnership intended to transform SHPL into a scaled, diversified, and globally recognized contract research, development, and manufacturing organization in India with the support of Everstone’s strategic resources

These factors are expected to propel the growth of the gelatin capsule segment.

The non-animal softgel capsules segment is further categorized into starches, pullulan, and others. This segment is expected to grow steadily during the forecast period. This is due to the rising demand for vegan products across the globe owing to their non-toxic nature.

By Application Analysis

Health & Dietary Supplements to Witness Robust Demand Due to Their Effectiveness in Treating Several Diseases

Based on application, the market is categorized into prescription medicines and health & dietary supplements.

The health & dietary supplements segment dominated the market with a share of 57.23% in 2026. The segment’s growth is attributed to the increasing demand for these supplements to treat and prevent several diseases. Hence, a surge in demand for softgel health supplements will encourage capsule manufacturers to develop and commercialize such products, thus augmenting the segment’s growth. For instance, in April 2020, Spain's dermatological company, ISDIN, announced the launch of SunISDIN Softgel Capsules in the U.S. market. It is an oral dietary supplement designed to help the skin fight photo aging.

The prescription medicines segment is also expected to witness a significant growth rate over the forecast period. The increasing prevalence of chronic health ailments across the globe and rising consumption of such products to treat specific chronic ailments will strongly support the segment’s growth. Similarly, the launch of these capsules in newer markets by several players is expected to propel segmental growth. For instance, in March 2023, Lotus Pharmaceutical launched Vinorelbine soft gel capsules 20 mg and 80 mg in Vietnam. It is the first and only approved generic Vinorelbine soft gel in the market by the Drug Authority of Vietnam (DAV). It is used in first-line treatment of patients with locally advanced or metastatic non-small cell lung cancer (NSCLC).

By Manufacturers Analysis

To know how our report can help streamline your business, Speak to Analyst

Strong Production Capacity of Pharmaceutical Companies Enable to Hold Maximum Portion of the Market

- The pharmaceutical companies segment is expected to hold a 57.04% share in 2026.

In terms of manufacturers, the market is segmented into pharmaceutical companies, nutraceutical companies, and others. The pharmaceutical companies segment accounted for the maximum share of the market in 2024. The segment's dominance is attributed to pharmaceutical companies increasing the production of softgel capsules considerably in the past few years. In August 2020, Catalent, Inc. announced the launch of two softgel solutions, out of which one was vegetarian. Such significant launches due to strong R&D initiatives and the production capacity of pharmaceutical companies are favoring segmental growth.

The nutraceutical companies segment held a considerable softgel capsules market share in 2023 and is projected to record a lucrative growth rate during the analysis period. The stable growth of this segment is majorly due to the increasing number of health and diet supplement launches by major nutraceutical companies across the globe.

REGIONAL INSIGHTS

North America Softgel Capsules Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America dominated the market with a valuation of USD 2.8 billion in 2025 and USD 2.97 billion in 2026. Key companies increased preference for introducing novel products in the developed countries of North America is a crucial factor driving the market growth in the region. These key firms are trying to get approvals from the U.S. FDA and other regulatory bodies to increase their customer base in other regions. The U.S. market is projected to reach USD 2.69 billion by 2026.

The Asia Pacific market is estimated to record the highest CAGR during the forecast period. This is due to the presence of a larger patient pool suffering from several chronic ailments. Moreover, the geographic expansion of major companies in the region's developed economies will further strengthen its growth rate during the forecast timeframe. The Japan market is projected to reach USD 0.44 billion by 2026, the China market is projected to reach USD 0.64 billion by 2026, and the India market is projected to reach USD 0.25 billion by 2026.

The Europe market registered considerable revenue in 2023. This is due to high investment in the research and development of gelatin-based capsules and the launch of innovative products in numerous European countries. In April 2023, International Flavors & Fragrances (IFF) launched a pectin-based technology to expand its vegan softgel offering further. The introduction of VERDIGEL SC will enable manufacturers of vegan softgels to offer carrageenan-free products. The UK market is projected to reach USD 0.4 billion by 2026, while the Germany market is projected to reach USD 0.63 billion by 2026.

The Middle East & Africa and Latin America markets possess high growth potential and are anticipated to offer lucrative growth opportunities to softgel capsule manufacturers. The rising prevalence of chronic ailments, such as CVD and growing awareness among the population about the intake of several health and dietary supplements are a few factors likely to contribute to the market’s expansion in these regions. Furthermore, key players are focusing on their geographical expansion through the launch of new products in the market.

- For instance, in November 2022, Adalvo launched Enzalutamide Soft Gel Capsules in LATAM to strengthen its presence in select LATAM countries.

List of Key Companies in Softgel Capsules Market

Key Players to Focus on Strengthening Market Positions through Pipeline and Top Selling Products

The global market is nearly consolidated, with three companies leading the market growth. In terms of revenue, Capsugel (Lonza) and Catalent, Inc. are in close competition. The presence of top-selling products, such as Sgcaps Capsules, Joint Comfort Softgel, Cognitive Support Softgel, Coated Softgels, and many potential pipeline candidates are primary factors helping Capsugel (Lonza) and Catalent, Inc. dominate the market.

Moreover, technological advancements in manufacturing softgels are another major factor supporting the companies’ growth. For instance, in October 2020, Catalent, Inc. launched a new technology called OptiGel DR to formulate and manufacture delayed or enteric-release soft gelatin capsules. The technology allows these capsules to be made by combining a naturally derived polysaccharide called pectin with gelatin. This is done to eliminate the need for a separate capsule coating.

LIST OF KEY COMPANIES PROFILED:

- Capsugel (Lonza) (U.S.)

- Sirio Pharma Co., Ltd. (China)

- Catalent, Inc. (U.S.)

- Aenova Holding GmbH (Germany)

- Fuji Capsule Co., Ltd. (Japan)

- CAPTEK Softgel International Inc. (U.S.)

- Curtis Health Caps (Poland)

- EuroCaps Ltd (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: Amneal Pharmaceuticals, Inc. and Strides Pharma Science Limited together launched ofIcosapent ethyl acid soft gel capsules, a product referencing VASCEPA. The product has been in-licensed from Strides, and commercialized by Amneal in the fourth quarter of 2023.

- October 2022: The Aenova Group partnered with Microcaps to accelerate and improve the development and production of pharmaceuticals, food supplements, and numerous other products.

- November 2021: Roquette launched LYCAGEL PREMIX, a ready-to-use, pharmaceutical-grade vegetarian softgel capsule formulation solution.

- May 2021: Hofseth BioCare ASA (HBC) partnered with Catalent to develop a delayed-release formulation of HBC’s OmeGo fish oil. Under this partnership, Catalent used its proprietary OptiGel DR technology to encapsulate OmeGo, HBC’s unique fish oil derived from sustainable, traceable, and fresh Norwegian Atlantic salmon.

- November 2020: Aenova Holding GmbH announced the launch of VegaGels, a new generation of vegetarian soft capsules.

- June 2020 - Capsugel (Lonza) announced the launch of DBcaps or double-blinded capsules, designed to opaquely and securely over-encapsulate drugs during clinical trials.

REPORT COVERAGE

The market report elaborates on numerous factors. Information on trends, drivers, opportunities, threats, and restraints can help stakeholders gain insights into the market. The report also provides detailed insights on the market’s competitive landscape by presenting information on key players, along with their strategies.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.18% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Manufacturers

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the value of the global market was USD 7.87 billion in 2025.

The market is projected to reach USD 13.44 billion by 2034.

The value of the market in North America was USD 2.8 billion in 2025.

The market is projected to record a CAGR of 6.18% during the forecast period of 2026-2034.

Based on type, the gelatin capsules segment is set to lead this market.

The increasing prevalence of chronic ailments, such as cardiovascular diseases is the key factor driving the global market.

Capsugel (Lonza) and Catalent, Inc. are the top players in the global market.

North America is expected to hold the highest market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us