U.S. & U.K. Aerospace and Defense PCB Market Size, Share & Industry Analysis, By Type (Single-sided, Double-sided, and Multilayer), By Design (Rigid, Flexible, Rigid-Flex, High-Density Interconnect (HDI), and Others), By Material (Metal and Non-metal), By Platform (Airborne, Ground, Naval, and Space), By Application (Navigation, Communication, Lighting, Weapon System, Power Supply, Command and Control Systems, and Others), and Country-level Forecast, 2025-2032

KEY MARKET INSIGHTS

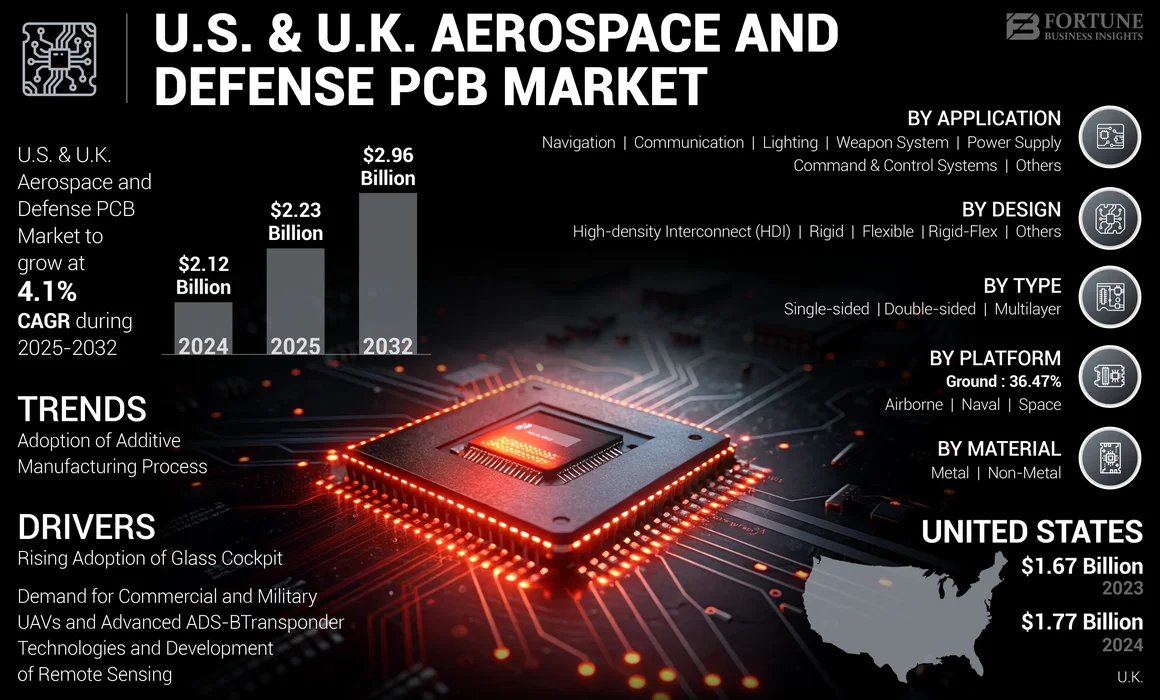

The U.S. & U.K. aerospace and defense PCB market size was valued at USD 2.12 billion in 2024. The market is projected to grow from USD 2.23 billion in 2025 to USD 2.96 billion by 2032, exhibiting a CAGR of 4.1% during the forecast period. Based on our analysis, the market exhibited an increase of 6.97% in 2024 as compared to 2023.

The global COVID-19 pandemic has been unprecedented and staggering, with U.S. & U.K. aerospace and defense PCB experiencing higher-than-anticipated demand across all regions compared to pre-pandemic levels.

PCBs are printed circuit boards that demand high technical performance with tolerance to extreme environmental conditions while performing complex and reliable functions. They are embedded within aerospace and defense equipment, weapon systems, and critical systems and subsystems. Thus, it should strictly comply with and be certified by the stringent military PCB performance standards such as MIL-PRF-31032, MIL-PRF-38535, MIL-PRF-19500, MIL-PRF-55342, MIL-PRF-123, and MIL-PRF-55681. Furthermore, these PCBs should comply with military PCB testing standards such as MIL-STD-202G, MIL-STD-750-2, and MIL-STD-883. Moreover, these PCBs need to be registered under International Traffic in Arms Regulations (ITAR), aerospace approved, Joint Certification Program (JCP), and Underwriter Laboratories (UL). In addition, they have to comply with certifications such as AS9100D, ISO9001, and IPC-6012 Class 2/3A.

Traditional PCB manufacturing relies on energy-intensive and high-emission processes that involve copper, epoxy resin, glass fiber, and water. With the high adoption rate of aerospace and defense PCBs for various applications amid high demand for process automation, the future aerospace and defense operational requirements require highly complex, reliable, and high-performance and advanced multilayered PCB solutions for applications such as engine control systems and other aerospace & defense applications. Armed forces worldwide are working with domestic and U.S. & U.K. aerospace and defense PCB manufacturers to design, develop, manufacture, and facilitate PCBs qualified under stringent certification set by armed forces. This standard aims to yield high performance, failure risk reduction, and high reliability.

However, the market faces some challenges, such as an increase in labor and material costs. Key players such as Epec Engineered Technologies LLC, Amitron Corporation, TechnoTronix Inc., and others are focused on research and development to improve aerospace and defense PCB technologies and actively innovating solutions to address these challenges, enhance system efficiency, and expand their global presence.

MARKET DYNAMICS

Market Drivers

Increasing Demand for Commercial and Military UAVs and Advanced ADS-B Transponder Technologies and Development of Remote Sensing to Propel Market Growth

Growing adoption of small-unmanned aerial vehicles for commercial and military applications such as aerial photography, situation awareness, law & enforcement, disaster management, relief & rescue operation, and research & development is expected to fuel market growth. Drones are well suited for quasi-static positioning of advanced sensors in 3D space with high precision. Even in windy conditions, drones enable precise flight operations and control in messy environments owing to their ability to fly at low speeds and maneuverability. There is a growing interest in deploying drones for military and commercial applications that are based on remote sensing tasks.

ADS-B uses a Trig transponder, combined with a GPS, to transmit highly accurate positional information to other drones and ground-based controllers. This transmission is known as ADS-B Out, and its accuracy is greater than using conventional radar surveillance. This factor gives air traffic controllers the potential to reduce the required separation distance between ADS-B drones. High Eye Airboxer is a long-range Unmanned Aerial Vehicle (UAV) powered by an air-cooled boxer engine with fuel injection. With a payload capacity of 5kg, sensors, multiple payloads, and other hardware are integrated into UAVs, making it a highly flexible platform suitable for warfare.

The UAV, as with Space/Satellites and Avionics, is a small device that requires low weight and offers minimal space to design. Moreover, the drone requires very high-quality printed circuit boards with high durability as these drones need to be performed in outer space.

For instance, in November 2021, ModalAI, Inc. introduced the VOXL CAM™ perception engine and the Seeker micro-development drone, the world’s first micro-development drone optimized for indoor and outdoor autonomous navigation development. Built on the foundation of the VOXL Flight Deck, the VOXL CAM is a single Printed Circuit Board (PCB) that easily attaches to robots, drones, or IoT devices to activate autonomy for a breadth of applications.

Increasing Demand for PCB Due to Rising Adoption of Glass Cockpit to Propel Market Growth

A glass cockpit is an aircraft cockpit that features electronic flight instrument displays, typically large LCD screens, rather than the traditional style of analog dials and gauges. These LCD screens are fitted with PCB-connected different data computers in the aircraft to provide real-time data with more precision and accuracy and eliminate errors. Monitoring the aircraft's functionality both onboard and from the ground is essential to its proper functioning and survival. This monitoring equipment depends on reliable and rugged printed circuit boards to provide the crew with reliable data from various sensors in the engines, cockpits, and other important parts of the aircraft.

These flight displays require high-quality printed circuit boards and services, high precision, and durability. The PCBs fitted inside the cockpit are designed to face tremendous amounts of turbulence, vibration, and temperature variations. The rapid adoption of these glass cockpits in older and new-generation aircraft fitted with LED and LCDs is one of the major reasons for the market growth. These PCBs can contain various sensors, from GPS gyroscope, barometer, temperature, ultrasonic, and more. It has many ways of transmitting data from one data station to another. Moreover, the growing trend of touchscreen flight displays is one of the driving factors of the PCB market.

Touchscreen technology offers flight crews a completely new way of interacting with the aircraft and its systems, opening up huge opportunities for pilots to access information more intuitively and interact with the content in ways that are more meaningful. Thus, higher growth numbers are expected during the forecast period. For instance, in December 2019, Airbus announced that it started delivering the first A350 XWBs equipped with modern touchscreen cockpit displays combined with Thales Group. Specially developed displays offer enhanced operational efficiencies, greater crew interaction, cockpit symmetry, and smoother information management.

Market Restraints

Increase in Labor and Material Costs to Hinder the U.S. & U.K. Market Growth

Labor cost is around 40-45% of the total PCB production cost in the U.S. and the U.K. The key players worldwide report that material costs are rising, with an additional four-fifths reporting rising labor costs. Manufacturers are hiking prices to minimize the damage done to their bottom lines by various snags throughout the global supply chain. Labor, in particular, has been a major asset to companies and companies' supply chains as they attempt to meet the growing demand. Employers are trying to entice potential workers with higher wages and sign-on bonuses while investing further in automation to boost productivity. Thus, other laborers are demanding more wages according to industry standards, which is not economical for the small players or major companies with high team members or labor count. Thus, high labor and material costs will be a major threat to market growth.

Moreover, the worldwide shortage of semiconductors has disrupted entire parts of the global supply chain for the aerospace & defense industry. The electronic segment in aerospace and defense depends on semiconductors for major applications. The global semiconductor shortage is caused by the global trade conflicts between China and the U.S., inclement weather in some world regions, fires at semiconductor facilities, and general increases in the prices of raw materials. The players involved in the avionics market are now facing a shortage of these semiconductor devices. These devices are fitted with PCBs for different monitoring and communication parts and equipment. Thus, this shortage will hinder the market growth during the forecast period.

Around two million tons of printed circuit boards goes to waste, further creating environmental problems and threats to human health. The key players involved in the market are now developing environmentally friendly printed circuit boards made of bio-based material to resolve waste issues in the electronics industry.

Market Opportunities

Increasing Demand for High-Performance Electronics are Creating New Market Opportunities

Globally, nations are heavily investing in advanced military technology, including PCB, and are looking to improve their defensive skills and modernize their military resources. This results in an increasing focus on the integration of advanced electronics that improve operational efficiency, accuracy, and overall performance. This trend not only benefits defense companies but also opens up the possibilities of suppliers of innovative components, software, and specialized manufacturing processes, resulting in fueling the U.S. & U.K. aerospace and defense PCB market growth.

Moreover, the increasing adoption of UAVs and unmanned vehicles and the integration of machine learning and artificial intelligence in advanced military technology will provide the aerospace and defense PCB market with further growth opportunities. Military operations are increasingly adopting these advanced technologies for surveillance, education, and operational efficiency, and the demand for high-performance PCBs that can withstand hard environments and provide reliable functions will continue to grow. This innovation not only improves battlefield skills, but also increases the need for solutions for special circuit boards tailored to the complex requirements of modern defense systems.

For Instance, in August 2023, The Washington Post reported that Russia is preparing, with the help of Iran, to produce more than 6,000 attack drones by 2025.

U.S. & U.K. Aerospace and Defense PCB Market Trends

Adoption of Additive Manufacturing Process for PCB to Drive the U.S. & U.K. Aerospace and Defense PCB Market Growth

Additive PCB printing processes using 3D printed electronics, conformal electronics, aerosol, inkjet, LaserJet printing, and direct wire production are new trends dominating PCB manufacturing. Moreover, additive manufacturing can occur as either a single-build process or a post-production process that builds electronic circuits separate from producing the entire device. Manufacturers use 100% solid conductive inks and toners loaded with charged particles that do not contain Volatile Organic Compounds (VOCs) or need etch resists.

The key players in this business have also developed printed circuit boards made from natural cellulose fibers extracted from agricultural wastes and coproducts, in contrast to non-biodegradable glass fiber and epoxy boards. 3D printing for electronic circuits uses a base conductive material to apply to the circuitry. By combining these materials, manufacturers develop a 3D print product with a complete electronic circuit, including the board, traces, and components as a single, continuous part. This technique allows printing PCBs with different shapes or designs to match product requirements. In addition, 3D printing for circuits allows a design team to customize a printed circuit according to customer needs. Thus, considering the above factors and process, higher growth numbers are projected in the near future.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Type

Multilayer Segment to Dominate Due to Rising Demand for High Performance and Reliability PCB for Aerospace and Defense Applications

The market is divided into single-sided, double-sided, and multilayer, based on type.

The multilayer segment was the largest segment in 2024, and it is projected to be the fastest-growing segment by 2032. The increasing demand for multilayered PCBs for military applications, owing to their high reliability under extreme conditions, is expected to fuel the market growth. Increased demand for high-performance and reliable multilayer PCBs due to the growing adoption rate of complex circuits, nanotechnology, and miniaturization is anticipated to fuel the market growth. The growth is attributed to the rising demand for highly complex circuit boards for high-performance mission-critical military hardware and the adoption of unmanned vehicles for combat, ISR, and combat support applications.

The single-sided segment held the second-largest market share in 2024. The growth is attributed to the increased demand and adoption rate of single-sided PCBs in surveillance applications, military-grade radio equipment, and imaging systems. The increasing use of imaging systems, surveillance equipment, and military radio communication systems due to increased demand for next-generation aircraft is a major reason for the segment's growth during the forecast period.

The double-sided segment is expected to grow at the highest CAGR throughout the projected period. This growth is attributed to the increasing modernization of aerospace and defense communication systems, military phone systems, and critical military components. The growing procurement of double-sided PCBs is expected to propel the segment's development. Moreover, the increased popularity of the armed forces' secure and encrypted communication networks is expected to support market growth.

By Design

High-Density Interconnect Segment to Record Fastest Growth Rate Owing to High Adoption Rate of PCBs in Hypersonic Missiles and Unmanned Systems

The market is classified into rigid, flexible, rigid-flex, high-density interconnect, and others, based on design.

The High-Density Interconnects (HDI) segment is projected to grow at the highest CAGR throughout the forecast period. The segment's growth is attributed to the high adoption of high-density interconnect PCBs in missiles, defense systems, and military communications devices. The segment's growth is attributed to the increasing demand for High-Density Interconnect PCBs for hypersonic missiles, artificial intelligence, and unmanned vehicles.

The rigid segment held the largest share in 2024. Growing demand for rigid PCBs for transmission sensors, electronic computer units, military robotic systems, and power distribution junctions is anticipated to propel the segmental market growth during the forecast period. The high utility of ruggedized computers for battlefield operations surges the demand for rigid PCBs.

The flexible segment held the second-largest market share in 2024. The segment's growth is attributed to the increasing demand for flexible PCBs for helmet-mounted displays (Heads-Up Display (HUD)) in military aircraft and rotorcraft. Also, the growing advantages of flex PCB in space launch vehicles are expected to support market growth. In addition, augmented reality and virtual reality in aerospace and defense for training applications are anticipated to drive market growth during the forecast period.

The rigid-flex segment held the third-largest market share in 2024 and is anticipated to grow at a significant CAGR during the projection period. The high demand and adoption rate of rigid-flex PCBs for high-temperature and extreme environment applications, such as military and space, are anticipated to drive market growth during the projection period. The high demand for rigid-flex PCBs in commercial and military satellite systems and the high adoption rate in small commercial satellites drive the market growth during the forecast period

By Material

Non-metal Segment Dominates Owing to High Demand for Polymer-core PCBs for Commercial, Defense, and Space Applications

Based on material, the market is classified into metal and non-metal.

The non-metal segment held the largest share in 2024. A wide range of PCBs utilized in various applications, such as commercial aviation, defense, and space, are polymer-based, such as FR-4, ceramics, and others. The high demand and adoption rate of polymeric-core PCBs is anticipated to drive segmental market growth during the forecast period. The high demand for polymer-core PCBs, such as rigid-flex and high-density interconnect in commercial and military satellites, is anticipated to drive the market growth during the forecast period.

The metal segment is estimated to show remarkable growth with a CAGR of 3.7% during the forecast period. High demand for various satellite and missile applications is driving market growth during the forecast period. The growing utility of ruggedized computers and communication equipment is expected to drive segmental market growth during the forecast period.

By Application

Communication Application Dominates with High Demand for Communication Network in Next-Generation Aircraft

The market is segmented into navigation, communication, lighting, weapon system, power supply, command and control systems, and others based on application.

The communication segment held the largest market share in 2024 and is anticipated to grow with the highest CAGR during the forecast period. The rising demand for advanced next-generation aircraft from emerging countries, such as India, China, and others, is expected to support the market's growth during the forecast period. Moreover, innovation in communication systems fitted with modern electronic equipment is expected to fuel the market growth. The rise in the need for battlefield communications enhancement and the high demand for military communication networks for various command and control operations are projected to drive segmental growth during the forecast period.

The navigation segment held the second-largest market share in 2024. The segment's growth is attributed to the increasing utility of navigation systems on various platforms, including airborne, naval, ground, and space. Technological advancements in GPS PCB designing and the high utility of navigation systems in various aerospace and defense applications, such as detection systems, are anticipated to drive market growth during the projection period.

By Platform

Airborne Platform Leads with PCBs High Demand from Airborne Systems and Subsystems

The market is divided by platform into airborne, ground, naval, and space.

The airborne segment comprises commercial aircraft, Unmanned Aerial Vehicles (UAVs), and military aircraft. The ground segment is further segmented into communication stations, vetronics, Unmanned Ground Vehicles (UGV), and others. The naval segment is classified into naval vessels and unmanned underwater vehicles. The space segment is segmented into satellite and launch systems.

The airborne segment was the largest in 2024. The high utility rate in heads-up displays, flight control systems, weapon systems, and commercial and military aircraft power supplies is expected to drive the market during the forecast period. The growth is attributed to PCBs' high demand and adoption rate in various airborne systems and subsystems, such as unmanned aerial systems, rotorcraft, and aircraft.

The ground segment held the second segment in the U.S. & U.K. aerospace and defense PCB market share in 2024. Increased demand for defense-specific PCBs for various applications, such as UGVs, artillery and mortars, ruggedized computers, and electronic warfare systems, is anticipated to drive market growth during the forecast period. The growing demand for printed circuit boards in artillery, radar equipment, ground vehicles, and military-grade computing systems is projected to propel the market growth during the forecast period.

The naval segment is projected to grow at the highest CAGR of 5.5% during the forecast period. This growth can be attributed to an increased investment in progressive ocean technology, increased demand for increased maritime security, and a strong emphasis on modernizing ocean heads. As the country focuses on strengthening naval qualifications, this segment hopes to determine robust expansion driven by shipbuilding, defense systems innovation, and the integration of national integration in naval operations.

To know how our report can help streamline your business, Speak to Analyst

U.S. & U.K. Aerospace and Defense PCB Regional Insights

Based on country, the market is segmented into the U.S. and the U.K.

In 2024, the U.S. dominated the market. The U.S. market size stood at USD 1.77 billion in 2024 and is projected to grow at a significant CAGR during the forecast period. For instance, in March 2022, TTM Technologies Inc. announced that it would be launching a new, highly automated, state-of-the-art PCB manufacturing facility in Penang, Malaysia. The decision is in response to the growing concern of supply chain resiliency and market penetration in lower-cost regions for advanced multilayer PCBs for aerospace and defense sectors.

The U.K. market is expected to grow at the maximum CAGR over the forecast period. For instance, in February 2019, Corintech Ltd. acquired Kurtz Ersa SMARTFLOW 2020, the next-generation and industry-leading PCB manufacturing equipment. SMARTFLOW 2020 is a compact selective-soldering system that facilitates high-speed solder joints of through-hole PCB components.

COMPETITIVE LANDSCAPE

Key Industry Players

Technological Developments Executed by Major Players to Boost Market Growth Over the Forecast Period

The latest trends in the U.S. and U.K. aerospace and defense PCB market include technologically innovative PCB solutions, deployment of advanced technology equipment, and the development of new aerospace and defense PCB enhancements. Major players such as TTM Technologies, Amphenol Printed Circuits Inc., and Sanmina Corporation adopt strategies such as agreements, partnerships, and mergers and acquisitions to grow. Moreover, key players invest in the research and development of electronic components and new PCB solutions to maintain their market position. Innovative concepts and a diversified product portfolio are the major factors boosting the market.

LIST OF KEY AEROSPACE AND DEFENSE PCB COMPANIES U.S AND U.K.

- Epec Engineered Technologies LLC (U.S.)

- Amitron Corporation (U.S.)

- TechnoTronix Inc. (U.S.)

- Advanced Circuits Inc.(U.S.)

- Corintech Ltd. (U.K.)

- Delta Circuits Inc. (U.S.)

- SMTC Corporation (Canada)

- Sanmina Corporation (U.S.)

- IEC Electronics Corporation (U.S.)

- Firan Technology Group Corporation (Canada)

- Amphenol Printed Circuits Inc. (U.S.)

- TTM Technologies Inc. (U.S.)

- APCT Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- March 2022 – Sanmina Corporation and Reliance Strategic Business Ventures Ltd. (RSBVL), a subsidiary of Reliance Industries Ltd., India’s largest privately-held company, announced that they have signed an agreement for the creation of a joint venture through Sanmina SCI India Pvt. Ltd. The joint venture will focus on high technology hardware for various markets such as communication networking, medical and healthcare systems, industrial and clean-tech, aerospace, and defense.

- October 2021 – IEC Electronics Corporation and Creation Technologies Inc. announced that CTI Acquisition Corporation had completed the tender offer.

- September 2021 – FTG Corporation was awarded a CAD after-market contract worth USD 3.7 million by the U.S. Department of Defense’s Defense Logistics Agency to support airborne radar systems.

- March 2024 – The Department of Defense disclosed that it has awarded USD 11.7 million through the Defense Production Act Investment (DPAI) Program to Ensign-Bickford Aerospace & Defense (EBAD), which will enhance the Printed Circuit Board Assembly (PCBA) production capacity at their facility in Simsbury, CT. EBAD plans to boost its current capacity and improve manufacturing processes to lower costs and speed up PCBA production.

- August 2023 – TTM Technologies, Inc., a top manufacturer of solutions such as mission systems, Radio Frequency (RF) components, RF microwave/microelectronic assemblies, and Printed Circuit Boards (PCBs), has been awarded a multi-year contract for the AN/UPR-4(V) Passive Detection & Reporting System (PDRS) by the U.S. Army to aid in their Air Missile Defense Planning and Control System (ADMPCS) and Integrated Battle Command System (IBCS).

REPORT COVERAGE

The research report provides an in-depth technical analysis of the market. It focuses on key aspects such as leading market players, the COVID-19 effect on the market, applications, and the research ideology. Besides this, the report offers insights into the market trends and highlights key industry developments and trends. In addition to the factors mentioned earlier, it provides multiple factors that will contribute to the market's growth during the forecast period.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.1% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Design

|

|

|

By Material

|

|

|

By Application

|

|

|

By Platform

|

|

|

By Country

|

Frequently Asked Questions

Fortune Business Insights says that the market size was USD 2.12 billion in 2024 and is projected to reach USD 2.96 billion by 2032.

The market will register a CAGR of 4.1% and exhibit steady growth in the forecast period (2025-2032).

In 2024, the U.S. market value stood at USD 1.77 billion.

Airborne is expected to lead this market during the forecast period.

Increasing demand for commercial and military UAVs, the development of remote sensing, and advanced ADS-B transponder technologies drive market growth.

TTM Technologies Inc., Amphenol Printed Circuits Inc., and Sanmina Corporation are the major players in the global market.

The U.S. dominated the market in terms of share in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us