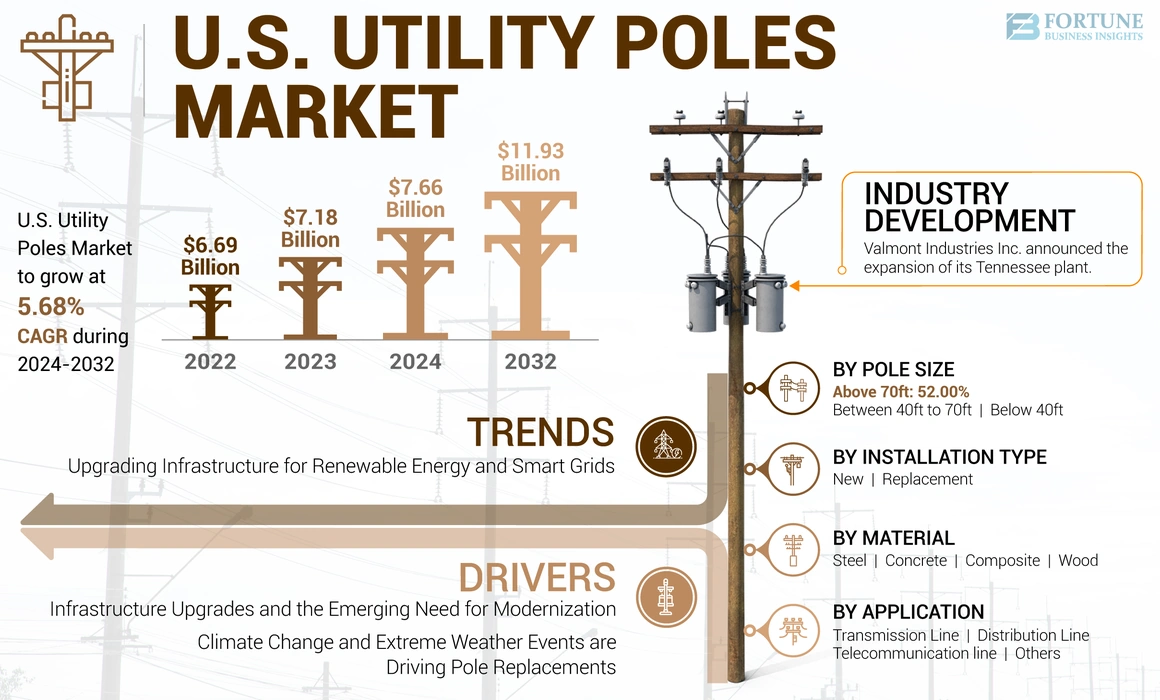

U.S. Utility Poles Market Size, Share & Industry Analysis, By Installation Type (New and Replacement), By Pole Size (Below 40ft, Between 40ft-70ft, and Above 70ft), By Material (Steel, Concrete, Composite, and Wood), By Application (Transmission Line, Distribution Line, Telecommunication Line, and Others), and Country Forecast, 2024-2032

KEY MARKET INSIGHTS

The U.S. utility poles market size was valued at USD 7.18 billion in 2023. The market is projected to be worth USD 7.66 billion in 2024 and reach USD 11.93 billion by 2032, exhibiting a CAGR of 5.68% during the forecast period.

The U.S. utility poles market is experiencing steady growth driven by increasing infrastructure investments, urbanization, and the modernization of power grids. Significant investments are being made in upgrading and expanding the power grid to support growing energy demands and integrate renewable energy sources. This includes the replacement of aging poles and the installation of new infrastructure to support advanced technologies. Thus, the market is witnessing a period of dynamic transformation driven by technological advancements, increasing sustainability demands, and significant infrastructural development investments.

The COVID-19 pandemic had a significant impact on the U.S. utility poles market, primarily influencing supply chains and construction timelines. During the height of the pandemic, lockdowns and restrictions disrupted manufacturing and transportation, leading to shortages in raw materials, such as wood and steel, which are essential for utility pole production. Additionally, the implementation of social distancing measures slowed down construction and maintenance projects, causing delays in both new installations and repairs. As a result, utility companies faced increased costs and project delays, which impacted their operational efficiency and budget allocations.

U.S. Utility Poles Market Trends

Upgrading Infrastructure for Renewable Energy and Smart Grids Creating Major Opportunities

The transition toward renewable energy sources and the modernization of the electrical grid present significant opportunities for the market. As the U.S. moves to integrate more renewable energy sources, such as solar and wind, into the grid, there is a growing need for infrastructure that can support these changes. Additionally, the development of a smart grid, which uses digital technology to monitor and manage the demand for electricity, requires upgraded utility poles and related infrastructure to support new technologies and improve grid reliability.

For instance, California's ambitious renewable energy targets are driving the need for upgraded utility infrastructure. The state's commitment to 100% clean energy by 2045 is pushing utilities to enhance their grids and increase the capacity of utility poles to handle new types of power generation and distribution. As of August 2023, California's Public Utilities Commission (CPUC) is actively investing in grid modernization to support these goals. This includes the installation of new utility poles and equipment to accommodate increased solar and wind energy.

Download Free sample to learn more about this report.

U.S. Utility Poles Market Growth Factors

Infrastructure Upgrades and the Emerging Need for Modernization are Driving Market Growth

The U.S. continues to invest in modernizing its aging infrastructure, and there's a significant push to replace outdated utility poles with more durable and efficient options. This includes transitioning from traditional wood poles to advanced materials, such as concrete or composite material poles. This shift not only enhances the reliability and safety of power distribution but also helps integrate renewable energy sources, street lighting, and grid technologies. Many utility poles in the U.S. are decades old and were installed during periods of rapid infrastructure expansion in the mid-20th century. As these poles age, they become more prone to failures, necessitating their replacement or upgrading to modern standards.

Moreover, the U.S. is investing heavily in smart grid technologies to improve grid efficiency and reliability, which requires infrastructure upgrades, including utility poles that can support new technologies such as sensors, communication devices, and automated control systems.

In 2023, the Grid Resilience and Innovation Partnerships (GRIP) Program, which is managed by DOE’s Grid Deployment Office (GDO), funded various activities to modernize the electric grid to reduce the impacts of natural disasters and extreme weather worsened by climate change. It announced over USD 3.46 billion, which is the first round of selections under the broader USD 10.5 billion GRIP Program.

Climate Change and Extreme Weather Events are Driving Pole Replacements in the U.S.

The increasing frequency and severity of extreme weather events, such as hurricanes, wildfires, and heavy storms, have underscored the need for more resilient utility poles. Utilities are focusing on upgrading their infrastructure to withstand these conditions better. This involves using poles designed to be more resistant to environmental stresses, thereby reducing the risk of outages and maintenance costs associated with weather-related damage.

Around the U.S., dealing with the vulnerability of overhead power lines is one of many problems that only get worse as the climate deteriorates. According to the Energy Department and other utility sector experts in the U.S., the overall electrical outages in heavy power lines areas caused by bad weather cost the U.S. economy more than USD 33 billion in an average year and higher in an especially bad weather year.

The NOAA National Centers for Environmental Information (NCEI) released its 2022 billion-dollar disaster report confirming another year of costly disasters and extremes throughout the U.S. In 2022, the U.S. experienced 18 different weather and climate disasters costing over USD 1 billion; that puts 2022 into a three-way tie with 2017 and 2011 for the third-highest number of billion-dollar disasters in a year, behind the 22 events in 2020 and the 20 events in 2021.

RESTRAINING FACTORS

Environmental Regulations and Sustainability Concerns in the U.S. is a Major Restraint

The increasing environmental regulations and sustainability concerns in the U.S. are one of the major restraints for the U.S. utility poles market share. As environmental regulations become more stringent, there is growing pressure on the utility pole industry to adopt more sustainable and cost-effective solutions and materials. For instance, the use of traditional materials, such as treated wood, is being scrutinized due to concerns about chemical preservatives and their impact on ecosystems. Utility poles, especially those treated with preservatives, such as creosote, pose challenges when it comes to disposal and recycling. Regulations may require safe disposal methods or recycling processes that are costly and complex.

For instance, the disposal of creosote-treated poles involves specialized handling and disposal procedures to prevent environmental contamination, increasing the overall cost of pole management. Utilities and manufacturers face higher costs to manage the disposal of these poles and to switch to alternative treatments or materials that comply with new regulations.

Additionally, there is a push for the development and adoption of more environmentally friendly materials, such as composite or recycled materials, which can involve higher costs and technological challenges. This shift can create financial and logistical hurdles for manufacturers and utility companies, potentially slowing down market growth and increasing operational costs. Overall, the increasing regulatory and environmental compliance costs can hinder the U.S. utility poles market growth.

U.S. Utility Poles Market Segmentation Analysis

By Installation Type Analysis

Replacement Type Dominates the Market Due to Aging Infrastructure and Increasing Modernization

Based on installation type, the market is segmented into new and replacement.

The replacement segment dominates the market due to aging infrastructure and demand for modernization. The replacement of existing poles is primarily motivated by aging infrastructure, which requires upgrades to meet current safety standards and technological demands. Many poles, especially wooden ones, are being replaced with more durable materials, such as steel and composite, to improve longevity and resilience.

New pole installations are driven by infrastructure expansion, particularly in growing urban and suburban areas where demand for enhanced power distribution and telecommunications services is rising. This segment is also bolstered by initiatives aimed at modernizing the grid to support renewable energy sources and smart grid technologies.

By Pole Size Analysis

Above 70ft Poles Size Accounts for a Major Share due to its Varied Application in the Utility Sector

Based on pole size, the market is divided into below 40ft, between 40ft-70ft, and above 70ft.

Above 70ft pole size is dominating the market as they are typically employed in high-voltage transmission poles, distribution poles, and large-scale infrastructure projects. The demand for these tall poles is primarily driven by the need to support long-distance power transmission, the expansion of energy grids, and the reinforcement of infrastructure to handle increased electrical loads.

For poles below 40 feet, which are often used in residential and small commercial areas, the market is influenced by local infrastructure development and maintenance needs. These shorter poles are frequently installed in areas with existing utility networks that require updates or expansions to accommodate new technology or increased load demands.

Poles between 40 and 70 feet cater to a broad range of applications, including medium-sized commercial and industrial zones as well as suburban areas. The driving factors here include urban expansion, infrastructure modernization, and the integration of renewable energy sources, which often necessitate the installation of poles to support new distribution lines or upgrades to existing ones.

To know how our report can help streamline your business, Speak to Analyst

By Material Analysis

Wood Dominates Market Due to Easy Transportation and Low Installation

Based on material, the market is segmented into steel, concrete, composite, and wood, where wood dominates the market due to its characteristic of easy transportation and installation, which is a considerable factor. Wood poles are predominantly used in rural and less-developed areas. However, the market for wood poles is increasingly challenged by concerns about their lifespan, maintenance, and susceptibility to environmental damage. There is also growing regulatory pressure to replace aging wood poles with more durable alternatives to ensure reliability and safety.

Steel poles are increasingly popular due to their durability, strength, and low maintenance requirements. They are often chosen for high-voltage transmission lines and areas prone to severe weather conditions. The market for steel poles is driven by the need for robust infrastructure capable of supporting modern, high-capacity power and communication systems.

By Application Analysis

Distribution Lines Dominate Application Segments Due to Increasing Electricity Demand In Urban Areas of the U.S.

Based on application, the market is segmented into transmission line, distribution line, telecommunication line, and others.

Distribution lines account for a major share of the market, which is increasingly incorporating smart grid technologies. Moreover, increased consumer demand for reliable, high-quality power and the ability to manage their energy consumption through smart technologies are driving innovations and demand in distribution poles.

The transmission line is the second leading application segment. Enhancing the resilience of the transmission network to extreme weather events and cyber threats is becoming increasingly important, which is the major factor for the growth of this segment.

For the telecommunication sector, the growth in smart grid technologies and the need for real-time data processing drive demand for robust telecommunications infrastructure. The Internet of Things (IoT) and increasing connectivity requirements for smart devices and sensors in the grid drive advancements in telecommunications networks are driving demand for these poles.

KEY INDUSTRY PLAYERS

Intense Competition and Price Pressures Drive Consolidation in the Power Utility Sector

The power utility industry has been continuously consolidating, giving rise to a large number of small players. Hence, the market is highly competitive. Key players in the market compete with a broad spectrum of companies that manufacture, distribute, and market utility poles and related products. The market is restricted by fierce price competition among manufacturers and the absence of distinct product features. However, companies are focusing on expanding further in the market to gain higher market shares. For instance, in September 2022 and August 2023, Stella-Jones Inc. entered into a complete agreement to purchase all of the assets of Texas Electric Cooperatives, Inc. and Baldwin Pole and Piling Company, Inc., respectively.

List of Top U.S. Utility Poles Companies:

- Valmont Industries, Inc (U.S.)

- Pelco Structural, LLC (U.S.)

- Stella-Jones (Canada)

- Bell Lumber & Pole (U.S.)

- Nello Corporation (U.S.)

- Sabre Industries, Inc. (U.S.)

- Creative Composites Group (U.S.)

- StressCrete Group (Canada)

- Koppers (U.S.)

- NOV Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2024: Valmont Industries Inc. announced the expansion of its Tennessee plant to enhance the production of the company’s engineered steel structures for the utility and transportation sector. Valmont is investing over USD 6 million in its plant over the next five years to boost its production capacities.

- August 2023: Stella-Jones Inc. acquired all the assets of the wood utility pole manufacturing business of Baldwin Pole and Piling Company, Inc. at USD 47.41 million. Baldwin is a Southern Yellow Pine pole treating company with facilities in Alabama, Bay Minette, and Wiggins, Mississippi.

- March 2023: Valmont signed a partnership with ClearWorld, a leading provider of solar LED lighting and smart pole solutions. The partnership will allow Valmont Utility to serve its customers better while conserving resources and improving life. It will also expand ClearWorld's infrastructure solutions to make a conscious and lasting impact on communities' resilience and serve a wide range of clients.

- September 2022: Bell Lumber & Pole Company acquired the assets of The Oeser Company, which is a utility pole producer and supplier in Bellingham, Wash. The acquisition also enables the firm to further establish itself as a leading supplier of utility poles in North America, advancing its presence in the Pacific Northwest.

- March 2022: Sabre Industries Inc. planned to begin a USD 25 million expansion that will include a galvanizing plant. The plant will enable Sabre to galvanize utility poles in Sioux City, a process that includes dipping the large structures in large vats of acids and chemicals, giving them a silver finish and protection against corrosion.

REPORT COVERAGE

The U.S. utility poles market research report provides a detailed analysis of the market. It focuses on key aspects such as major key players, product types, and leading applications of the product. Besides, the report offers insights into the competition landscape for market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 5.68% from 2024 to 2032 |

|

Unit |

Value (USD Billion & K Units) |

|

Segmentation |

By Installation Type

|

|

By Pole Size

|

|

|

By Material

|

|

|

By Application

|

|

|

By State

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 7.18 billion in 2023.

The market is likely to grow at a CAGR of 5.68% over the forecast period (2024-2032).

The distribution line of the application segment is expected to lead the market.

Infrastructure upgrades and the emerging need for modernization in the U.S. are the key factors driving the market growth.

Some of the top players in the market are Koppers, Stella-Jones, and Valmont Industries, Inc.

The U.S. market size is expected to reach USD 11.93 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us