Utility Poles Market Size, Share & Industry Analysis, By Material (Steel, Concrete, Composite, and Wood), By Pole Size (Below 40 ft, Between 40 ft and 70 ft, and Above 70 ft), By Application (Transmission Line, Distribution Line, Telecommunication, and Others), and Regional Forecast, 2026-2034

Utility Poles Market Size

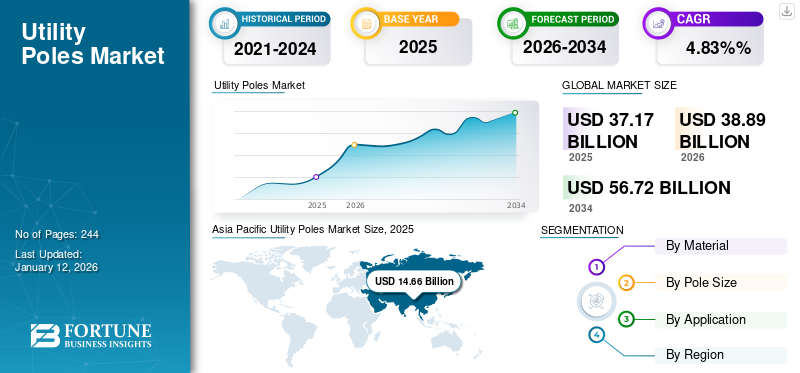

The global utility poles market size was valued at USD 37.17 billion in 2025. The market is projected to grow from USD 38.89 billion in 2026 to USD 56.72 billion by 2034, exhibiting a CAGR of 4.83% during the forecast period. Asia Pacific dominated the global market with a share of 39.44% in 2025. The Utility Poles Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 11.28 billion by 2032.

Utility poles are structures similar to columns that are meant to support public utility and service setups such as wires, cables, and power lines. The poles are utilized in supporting distribution cables, hydro poles, and transmission cables. They can be used for various applications. Based on the requirement and the available sources, the size of these poles and the type of material used make them vary. Utility poles do not involve a sign pole less than 15ft in height above ground.

These poles are in direct contact with soil and are exposed to a high decay threat even though they deliver 40 or more years of reliable service. Due to this hazard, most utilities use either pressure-treated, less durable woods with preservatives or naturally durable wood species such as western red cedar.

The coronavirus pandemic had a damaging impact on the development of the global utility poles market. The poles are mainly used to provide support to the overhead power lines and several other public utilities. For instance, in April 2020, Egypt’s interconnection electricity project with Saudi Arabia was halted due to the coronavirus pandemic. The (EETC) Egyptian Electricity Transmission Company postponed the acceptance of bids for the construction of the power line project for a few months to open the tender for the project later, inviting seven companies to participate.

Utility Poles Market Trends

Advancements in Smart Pole Technology is Driving the Product Demand

Smart poles are big poles with all types of technology such as sensors, cameras, charging stations and more attached to different parts of the pole, resulting in a great solution with high visual impact and efficiency. Companies are coming up with the technology of smart lamp posts powered by wind and solar with incorporated battery storage. It transforms a regular street light into a smart infrastructure capable of multiple functions such as LTE small cell, security camera, public Wi-fi, IoT sensors, EV charging, and even integrated audio for public communication. Moreover, they have the added benefit of being a robust solution that can still provide surveillance, lighting, and other functionality during grid outages through the inbuilt battery storage. Existing poles can also be used in most cases due to the services that are integrated inside the top protective shell. Therefore, the transformation is much more economical, avoiding time-consuming and expensive civil works for transforming a simple old light into a smart pole by only changing the head of the unit.

Download Free sample to learn more about this report.

Utility Poles Market Growth Factors

Increasing Global Energy Demand to Support the Installation of Utility Poles

The demand for energy is continuously increasing across the world. Electricity providers are regularly growing their electricity generation capabilities. The electricity market is at the front of a transformation, especially driven by a growing energy demand for utility poles. One of the most significant advancements in power distribution is the implementation of smart grids. A smart grid incorporates advanced communication and control systems, sensors, and automation to provide real-time information and foster interactive management of electricity. Trends such as urbanization, population growth, and electrification of rural areas as increasing attention on environmental protection are affecting the current pillars of the industry. In the macro scenario, recent technological advancements and investments in research and development are playing a crucial role, heading the main sector changes such as the growth of distributed power generation, energy efficiency, increasing usage of renewable energy, smart grids, and demand side management to have a huge impact on the power business.

Increasing Development of Composite Materials in the Utility Pole Market to Boost the Growth

The importance of composite materials is increasing rapidly throughout the globe and the poles created from these materials display bigger properties, which further increase the installation of such poles. This material is cost effective and extremely profitable to use in the utility industry. These poles are reliable and lightweight when compared with the rest. It has been over a decade that electric utility and communication companies broadly use composite poles. Additionally, these poles solve many issues affecting steel, wood, and concrete poles. Composite poles replace wood poles given that, on average, these poles survive for around 40 years.

However, there are some installations where a wood pole can only last a fraction of that time and then it needs replacement. Woodpeckers and pests are responsible for most of the yearly damage to wood poles. Compared to the traditional materials such as wood, concrete, and steel used in overhead line construction, FRP composite components such as poles, cross arms and cross braces have distinctive and, when applied correctly, beneficial high-performance characteristics resulting in cost savings, resiliency, and security, over the entire life cycle of the pole.

RESTRAINING FACTORS

Rising Inclination toward Underground Connection May Hamper the Market Growth

Earlier, underground cables were used where the utility poles could turn out to be difficult or dangerous. However, various developed and developing nations such as India, Germany, China, and others are switching toward underground connections. This is due to the several advantages of underground connections such as increased reliability for the grid and the mandatory right of way for the transmission corridor. Furthermore, disruption in weather also cannot damage such connections. However, the maintenance cost of underground cables is higher compared to overhead cables. Besides this fact, countries are adopting underground connections due to the benefits they offer.

The cables in the underground infrastructure have become the backbone of the utilities sector, allowing the effective delivery of services. Underground cables experience significantly less interference, resulting in a more stable and reliable power supply with reduced voltage fluctuations and fewer power surges. Moreover, Underground power systems require less maintenance as they are less exposed to weather-related damages, reducing the need for frequent repairs and replacements. In recent years, the utility sector has observed a flow of ground-breaking innovations that are transforming underground infrastructure, making it more dependable, cost-effective, and sustainable.

Utility Poles Market Segmentation Analysis

By Pole Size Analysis

Between 40 ft and 70 ft Segment Dominates the Market Due to its Usage in Various Applications

Based on pole size, the market is segmented into below 40ft, between 40ft and 70ft, and above 70ft.

The between 40ft and 70ft segment is contributing 44.72% globally in 2026, the market due to its application in transmission lines, distribution lines, telecommunication lines, and others. The transmission and distribution sector has seen major growth in the last few years, which can be recognized due to budgetary allocations, huge investments, and initiatives by the government. In addition to this, the government is placing a solid emphasis on this sector by creating a favorable environment through steps such as providing incentives for investments and easing regulations. Due to several supporting factors, the number of projects in the power distribution and transmission sector is increasing.

To know how our report can help streamline your business, Speak to Analyst

By Material Analysis

Wood Segment owing to its characteristic as a renewable resource is Dominating the Global Market

Based on material, the market is segmented into steel, concrete, wood, and composite.

The wood segment dominates the market share of 63.39% in 2026, due to its characteristics that provides flexibility and strength, making it the better option for utility poles. Wooden poles are the pillar of the U.S. electric grid. In the era of green technology, companies need to come up with environmentally friendly technologies. Even though it may not seem like the most environmentally friendly choice, the use of wooden poles is an optimistic step toward dropping the carbon footprint. Sustainably managed forests are the source of wooden utility poles. In these forests, on average, three trees are planted for each harvested tree. In addition, the wood used to manufacture utility poles is renewable and the waste rate is comparatively low. In situations of natural calamities such as lightning and thunderstorms, wooden poles are easier to access as they reduce power arcs.

By Application Analysis

Increasing Electricity Demand In Urban Areas Expanded The Growth Of Distribution Line Segment

Based on application, the market is divided into transmission lines, distribution lines, telecommunication lines, and others.

The distribution lines segment dominates the market due to the expansion in urban areas and population growth, accounting for 42.01% market share in 2026. These factors generate the demand for electricity, which then requires the development of infrastructure for power distribution. Electricity is first created at power stations and then transmitted through transmission lines to substations near consuming areas. Then, it is finally delivered to the end-users via power lines called distribution lines. The distribution section of the electric grid involves lower voltage power lines that provide electricity to end-users. Distribution networks are inclined to span shorter distances and involve the delivery of electricity that has voltages common to end-user needs. The increased relocation of people from rural to urban areas and workplaces continues to drive the higher demand for power distribution systems.

REGIONAL INSIGHTS

By geography, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Utility Poles Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific market is expected to dominate the market throughout the forecast period, owing to the increasing installation of such poles through the rural and urban areas of the region. The demand for electricity is growing with each passing day. The governments in various developing countries such as Vietnam, India, Malaysia, China, Indonesia, and others are working broadly to provide constant electricity in rural as well as disaster-prone areas, due to which the installation of such poles is increasing. The Japan market is forecast to reach USD 0.65 billion by 2026, the China market is set to reach USD 6.99 billion by 2026, and the India market is likely to reach USD 4.23 billion by 2026.

Latin America

The Latin America region is also projected to grow rigorously in the coming years owing to increasing investment in infrastructure expansion. The government is working to offer smooth networks and electricity to its people. Additionally, advancements and replacement work are also going on within the country. This increases the growth of the market in the Latin America region.

Middle East & Africa

The Middle East & Africa region contributes to growth in the global utility poles market size with substantial progress in the coming years. The region comprises rural areas where infrastructure expansion is in progress. Furthermore, the work offering electricity in such areas is going on at a quick pace, which further increases the installation in the region.The U.S. market is expected to reach USD 8.18 billion by 2026.

Key Industry Players

Key Participants are Intent on Expanding their Product Capabilities and New Product Development

The global market comprises a few global players and numerous small and medium-scale players. New product development has been the major market strategy adopted by key players. For instance, Stella-Jones Inc. has been developing, manufacturing, designing, and installing utility poles throughout the world. They are offering smart pole services and products all over the world, aiming at various industries, which include transmission and distribution, telecommunication, and other applications.

Major players include El Sewedy Electric Company, Valmont Industries Inc., Skipper Ltd, Nippon Concrete Industries Co., Ltd, Hill & Smith Holdings Plc, and others. The major companies have more than half of the market share, and many regional and local players for various applications dominate the remaining market.

List of Top Utility Poles Companies:

- El Sewedy Electric Company (Egypt)

- Valmont Industries Inc. (U.S.)

- Skipper Ltd. (India)

- Nippon Concrete Industries Co., Ltd. (Japan)

- Hill & Smith Holdings Plc (U.K.)

- Stella-Jones Inc. (Canada)

- Fuchs Europoles GmbH (Germany)

- Strongwell Corp (U.S.)

- Omega Factory (Saudi Arabia)

- KEC International (India)

- Pelco Products, Inc. (U.S.)

- Stella-Jones (Canada)

- NOV (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- August 2023- KEC International Ltd., a worldwide infrastructure EPC major, an RPG Group Company, received new orders worth USD 13.54 million across several businesses. The company received orders for T&D projects in Africa, India, and the Americas. These included 400/220 kV AIS Substation order in India, from a leading private developer; 400 kV Transmission line and GIS Substation order in India, from a subsidiary of a renowned PSU in renewable power generation segment; supply of poles, towers, and hardware in Americas, secured by subsidiary, SAE Towers; and supply of towers in Africa.

- July 2023 - VMI broadcasted the opening of a concrete utility pole manufacturing facility in Bristol, Indiana. The company accomplished an industry first by manufacturing utility transmission and distribution poles at scale with lower greenhouse gas emissions. This was achieved by reducing cement usage, which is considered a significant contributor to global CO2 emissions.

- May 2023 - The U.S. government shared intent to give green light to a proposed multibillion-dollar transmission line that would send mainly wind-generated power from the rural grasslands of New Mexico to big cities in the West. The Internal Department declared its record of conclusion for the SunZia project. This came around a year after an environmental evaluation was finished as part of a wider effort by the Biden administration to clear the way for main transmission projects as it looks to encounter climate goals and shore up the nation's power grid.

- September 2022 - Stella-Jones Inc. entered a complete agreement to purchase all of the assets active in the wood utility pole manufacturing industry of Texas Electric Cooperatives, Inc. (“TEC”). The assets would be purchased for an entire purchase price of USD 28 million along with inventories of approximately USD 4 million.

- February 2021 - Egypt's National Authority for Military Production and El-Sewedy Electric signed a memorandum of understanding to establish a plant to manufacture electric panels and lighting poles, as well as extend and install power grids. The plant would be established in one of the companies affiliated with the country's military production ministry as part of its plan to be integrated with different local and international companies.

REPORT COVERAGE

The market research report provides a complete industry assessment by proposing valuable insights, facts, industry-related information, competitive landscape, and past data. Various methodologies and approaches are deployed to make assumptions and views to formulate the global utility poles market analysis.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.83% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

|

|

By Pole Size

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights shows that the global market was USD 37.17 billion in 2025.

The global market is set to grow at a CAGR of 4.83% during the forecast period.

The Asia Pacific market size stood at USD 14.66 billion in 2025.

Based on material, the wood segment holds the dominating share in the global market.

The global market size is expected to reach USD 56.72 billion by 2034.

The key market driver is the increasing development of composite materials in utility poles.

The top players in the market are El Sewedy Electric Company, Valmont Industries Inc., Nippon Concrete Industries Co Ltd, and Stella-Jones, among others.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us