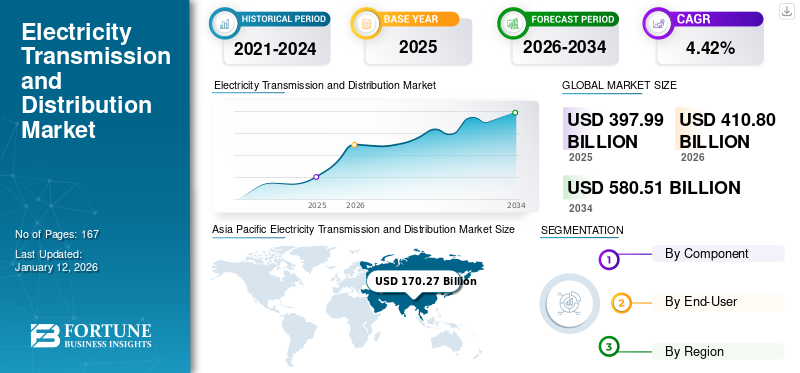

Electricity Transmission and Distribution Market Size, Share & Industry Analysis, By Component (Equipment and Services), By End-user (Electric Utility, Industrial, and Renewables) and Regional Forecast, 2026-2034

Electricity Transmission and Distribution Market Size and Future Outlook

The global electricity transmission and distribution market size was valued at USD 397.99 billion in 2025 and is projected to be worth USD 410.8 billion in 2026 and reach USD 580.51 billion by 2034, exhibiting a CAGR of 4.42% during the forecast period. Asia Pacific dominated the electricity transmission and distribution industry with a market share of 42.78% in 2025.

Electricity Transmission and Distribution (T&D) encompasses the critical infrastructure and processes that deliver electrical energy from power generation sites to end-users. Effective T&D systems are essential for maintaining grid reliability, optimizing energy efficiency, and ensuring safe, consistent access to electricity across various sectors.

The transition to renewable energy and its integration into a grid system is fueling investments in the transmission & distribution sector. Moreover, increasing demand for electrification across industries is expected to fuel the growth of the electricity transmission and distribution market.

State Grid Corporation of China (SGCC) is one of the leading players in the market. SGCC has been a pioneer in the development and implementation of Ultra-High Voltage (UHV) transmission technology, which enables the transmission of large amounts of electricity over long distances with minimal losses. The company has built several UHV transmission projects in China, including the world's first UHV Direct Current (DC) transmission project, which has a transmission capacity of 6.4 GW and a length of 2,000 kilometers.

MARKET DYNAMICS

MARKET DRIVERS

Transition to Renewable Energy and its Integration with Grid System

The global transition to renewable energy is transforming the electricity transmission and distribution sector. The integration of renewable energy sources, such as wind and solar, into the grid is accelerating. This shift requires significant upgrades to the T&D infrastructure to handle the variable nature of renewable generation and to facilitate efficient energy distribution.

According to IRENA’s Renewables 2023 report, global renewable energy capacity reached an estimated 507 GW in 2023, which is almost 50% higher than that in 2022. This growth is driven by continuous policy support in more than 130 countries, marking a significant change in the global electricity sector.

As the global demand for clean energy increases, investments in renewable generation capacity are also surging. For instance, the European Green Deal aims to achieve climate neutrality by 2050, with significant investments in grid infrastructure to support renewable energy generation. Germany and Spain are focusing on increasing investment to enhance their transmission networks to link remote wind and solar farms with urban areas that have high energy demands.

For the transition, some of the key components required include upgraded high-voltage transmission lines, and other technologies such as Flexible AC Transmission Systems (FACTS). FACTs improve grid controllability and stability, enabling more effective power flow management to address changing renewable energy outputs and impacting the overall market growth.

Increasing Demand for Electrification in all the Sectors

The global push toward electrification, including the adoption of Electric Vehicles (EVs) and the proliferation of data centers, is driving up electricity demand. This surge necessitates the expansion and modernization of T&D infrastructure to ensure reliable power delivery.

Increasing demand for electrification across various sectors, primarily in transportation, industrial, and heating processes, is significantly driving the electricity transmission and distribution market growth. This trend aligns with global efforts to decarbonize the energy sector, improve efficiency, and enhance energy accessibility.

The transportation sector is undergoing a transformative shift driven by the electrification of vehicles, propelled by a combination of technological advancements, environmental concerns, and supportive government policies. According to the International Energy Agency (IEA), global sales of electric cars reached around 14 million in 2023, accounting for 18% of all cars sold, up from 14% in 2022. Electric car sales in 2023 were 3.5 million higher than in 2022, a 35% year-on-year increase.

Moreover, the Electric Vehicle (EV) market is projected to reach over 30% of global car sales by 2030, leading to a corresponding increase in electricity demand, necessitating upgrades to existing T&D systems. Governments are implementing supportive policies, such as subsidies and infrastructure investment, to accelerate the transition to electric mobility. This includes expanding charging networks, which directly impacts the T&D market by requiring enhanced capacity and reliability.

In industrial sectors, electrification is driven by the need for energy efficiency and reduced carbon emissions. Industries are increasingly adopting electric machinery and processes, further fueling electricity demand. A report by the World Economic Forum highlights that transitioning to electrified industrial processes could cut global CO2 emissions by 70% by 2050, underscoring the urgent need for upgraded T&D systems.

MARKET RESTRAINTS

High Cost of Infrastructure Upgrades and Maintenance to Hamper Market Growth

Many regions are grappling with outdated T&D infrastructure that requires significant investment for upgrades and modernization to meet current and future energy demands. Infrastructure upgrades and maintenance of the T&D sector costs high, which hampers the market. Many existing T&D systems are aging, and their upgradation and modernization require significant investment to expand. For instance, a report by the U.S. Department of Energy says that more than 45-50% of the nation’s transmission lines and transformers are over 25 years old, leading to a higher risk of outages and inefficiencies.

The financial burden associated with the upgradation of aging infrastructure, modernization with new technologies such as smart grids, and expanding capacity to meet increasing electricity demand is substantial. Utilities often face budget constraints, making it struggle to secure funding, which delays some of the critical projects.

For instance, the U.S. alone will need to invest over USD 2 trillion in its electricity infrastructure by 2030 to enhance reliability and meet future demand. This situation is further exacerbated in developing regions where financial resources and technical expertise may be limited, hindering the overall growth and efficiency of the T&D market globally.

Moreover, complex regulatory frameworks and lengthy permitting processes create further delay in the development and expansion of T&D projects, hindering timely infrastructure improvements.

MARKET OPPORTUNITIES

Growing Demand for Smart Grid Technologies Drives Global Investment and Market Expansion in Electricity Distribution

The electricity Transmission and Distribution (T&D) market is a critical component of the global energy infrastructure, responsible for delivering electricity from generation facilities to end-users. This sector encompasses high-voltage transmission for long distance electricity transport and lower-voltage distribution networks that deliver power to consumers. As of 2024, the T&D market is experiencing significant transformations driven by technological advancements, policy shifts, and evolving energy demands. Advancements in technologies such as energy storage systems, advanced metering infrastructure, and grid automation are transforming the T&D landscape, enhancing grid flexibility, efficiency, and resilience.

The global electricity transmission and distribution market is witnessing increasing demand for smart grid technologies to enhance the reliability, efficiency, and sustainability of electricity systems, and this represents a significant growth opportunity for the market. A smart grid, which is an advanced systems that leverages cutting-edge technologies, including automation, real-time data analytics, and enhanced communication networks, to optimize electricity flow, improve grid resilience, and facilitate the integration of renewable energy sources.

Governments across the world are making notable progress in deploying smart grids; for instance, in 2022, the European Commission announced the EU action plan called Digitalisation of the Energy System. The Commission expects about USD 633 billion of investments in the European electricity grid by the end of 2030, of which USD 184 billion is focused on the digitalization of the grid system.

Japan announced a funding program of USD 155 billion in 2022 to promote investments in smart power grids. Similarly, India launched a USD 38 billion scheme to support power distribution companies and improve distribution infrastructure, thus promoting and integrating smart grid systems in power grids.

MARKET CHALLENGES

Higher Technical Complexity Level to Certain Grid Modification to Pose Challenges

The integration of renewable energy sources into the grid system and other electricity sectors increases operational complexity. For instance, integrating Distributed Energy Resources (DERs) such as rooftop solar panels necessitates modifications to the existing T&D infrastructure. Additionally, utilities need to upgrade transmission lines and substations to handle bi-directional power flows, which complicates system design and operation and leads to increased engineering, regulatory, and implementation costs, thus hampering market growth. Furthermore, the increasing digitalization of T&D systems introduces vulnerabilities to cyberattacks, necessitating robust cybersecurity measures to protect critical infrastructure.

ELECTRICITY TRANSMISSION AND DISTRIBUTION MARKET TRENDS

Growing Investments in Development of Power Grids, Especially in Emerging Regions

Access to electricity has substantially increased from 83% in 2010 to 91% in 2020, with Asia achieving significant progress during this period. However, Africa is yet to improve its electrification rates. As a result, several organizations and respective governments are investing heavily in developing power grids to either accelerate electrification rates or modernize the existing grid to adopt advanced technologies. In April 2024, the World Bank Group announced plans to ram up their electrification targets. World Bank Group has partnered with the African Development Bank to provide electricity access to more than 300 million people in Africa by 2030.

The electricity transmission and distribution market is poised for continued growth, driven by the global transition toward renewable energy, increasing electricity demand, and the need for grid modernization. Addressing the challenges of aging infrastructure, regulatory hurdles, and cybersecurity risks is essential to ensure a reliable and efficient electricity supply.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic significantly impacted the electricity Transmission and Distribution (T&D) sector. Lockdowns and health protocols led to workforce shortages, causing delays in essential maintenance and construction projects. Many utilities, as reported by the Edison Electric Institute (EEI), postponed necessary inspections and repairs, raising concerns about the long-term reliability of the electrical grid.

Moreover, the pandemic caused drastic shifts in electricity demand patterns. According to the U.S. Energy Information Administration (EIA), residential energy consumption surged by approximately 6% in 2020, driven by widespread remote work, and commercial and industrial demand fell sharply by about 10%. These disruptions in load distribution forced utilities to adapt quickly to maintain grid stability, further straining already challenged systems.

SEGMENTATION ANALYSIS

By Component

Services Segment Dominate Due to Growing Demand for EPC Services in Construction and Power Infrastructure

Based on component the market is segmented into equipment and services. Based on equipment the market is further sub-segmented into transformer, switchgear, electric meter, wires & cables, capacitor, and others. Based on services, the market is further segmented into Engineering Procurement and Construction (EPC), consulting, and others.

The EPC segment leads the services segment of global electricity transmission and distribution, due to its critical role in the actual construction and implementation of power infrastructure projects. This segment's significance lies in its ability to execute large-scale, complex projects, ensuring that transmission and distribution networks are built efficiently, reliably, and in accordance with relevant standards and regulations.

Consulting services also play a significant role, focusing on regulatory compliance, project feasibility studies, and strategic planning. The increasing complexity of energy systems, the need for efficient grid management, and the growing emphasis on sustainability are driving the demand for consulting services.

The equipment segment is expected to capture 46.47% of the market share in 2025.

The services segment is likely to grow with a considerable CAGR of 3.88% during the forecast period (2025-2032).

By End-User

Electric Utility Plays Dominates due to its Pivotal Role in Transmission & Distribution

Based on end-user global market is segmented into electric utility, industrial, and renewables.

Electric utility dominates the market and also holds the largest electricity and distribution market share due to its foundational role in energy delivery. It is essential for maintaining grid stability and meeting the increasing demand for electricity due to population growth and urbanization. The segment captured 48.96% of the market share in 2024.

The renewables segment is rapidly gaining traction as the world shifts toward sustainable energy sources. The increasing demand for cleaner energy and government incentives significantly drive investments in renewable projects for upgrading infrastructure for effective energy distributions.

To know how our report can help streamline your business, Speak to Analyst

ELECTRICITY TRANSMISSION AND DISTRIBUTION MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

Asia Pacific Electricity Transmission and Distribution Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Rising Demand for Renewable Energy Sources is Fostering Market Growth

North America is the second largest market anticipated to gain USD 118.59 Billion in 2026, exhibiting a CAGR of 3.07% during the forecast period (2026-2034). The electricity Transmission and Distribution (T&D) market in North America is the second leading region, as it is experiencing substantial changes, influenced by infrastructure demands, regulatory shifts, and a rising integration of renewable energy. Moreover, the growth is largely attributed to the urgent need to upgrade aging infrastructure, which the American Society of Civil Engineers (ASCE) has rated as a D+, highlighting critical investment requirements. The electricity T&D market in the U.S. and Canada are undergoing significant transformation as both countries prioritize the integration of renewable energy sources and the modernization of infrastructure.

U.S.

Expanding Renewable Energy Installation is driving Investments in T&D Sector

The U.S. is likely to dominate the regional market in 2024 due to the surge in renewable energy expansion. Under federal and state initiatives aimed at reducing greenhouse gas emissions, the U.S. has set a goal of achieving a 50-52% reduction by 2030. This transition necessitates enhanced T&D systems to accommodate variable energy sources such as wind and solar. The Infrastructure Investment and Jobs Act (IIJA) has allocated significant funding for grid resilience and modernization efforts, further supporting this transition. The U.S. market is predicted to grow with a value of USD 102.99 billion in 2026.

Europe

Favorable Government Initiatives Drive Growth of the Market

Europe is the third largest market estimated to be worth USD 69.89 billion in 2026. The electricity Transmission and Distribution (T&D) market in Europe is evolving rapidly due to various factors including regulatory frameworks, technological advancements, and sustainability goals. The EU has been active in creating regulations to enhance energy security and market integration. The Clean Energy for All Europeans package, which was implemented in 2019, sets a framework for a more integrated energy market and emphasizes the importance of T&D systems. The U.K. market continues to expand, projected to reach a market value of USD 5.76 billion in 2026.

Significant investments are being made to modernize infrastructure for renewable energy sources. The European Commission estimates that up to USD 550 billion will be needed by 2030 to meet climate goals. The EU Recovery Plan has allocated funds specifically for enhancing electricity grids, aiming to improve resilience and integrate more renewable energy.

European countries are investing in upgrading their T&D infrastructure to support renewable energy integration and enhance grid reliability. For example, France's RTE signed more than a billion USD contract with European suppliers for the supply and installation of underground cables to support projects by 2028. Germany is poised to be valued at USD 13.94 billion in 2026, while France is projected to reach USD 6.92 billion in 2025.

Asia Pacific

Presence of Major Countries Such as China, Australia, India, and Japan to Drive Market Growth

Asia Pacific dominated the market with a valuation of USD 170.27 billion in 2025 and USD 177.88 billion in 2026, which is influenced by a combination of rapid urbanization, diverse energy policies, and technological advancements to meet regional needs. Investments in T&D infrastructure are being made to meet growing energy demands and integrate renewable energy sources.

The electricity T&D market in Australia is experiencing a distinct shift toward decentralization, driven by the rise of community energy projects. In September 2023, a USD 200 million investment was announced for the local solar and battery initiatives, allowing communities to generate and share their energy. This grassroots approach empowers local consumers and supports grid stability by reducing peak load pressures, highlighting the region’s adaptability to diverse energy demands.

Japan is focusing on enhancing energy security through Microgrid developments, particularly in areas prone to natural disasters. In 2023, the Japanese government introduced the Resilience Strategy, which promotes the establishment of localized microgrids that can operate independently during emergencies. This strategy is crucial for ensuring a reliable power supply while integrating renewable Japan’s commitment to building more resilient energy infrastructure. India is set to be worth USD 28.88 billion in 2026, while Japan is predicted to reach USD 14.92 billion in the same year.

China

Rising High Voltage Projects to Drive Market Growth

China is likely to grow with a value of USD 110.14 billion in 2026. China is a lucrative market for electricity transmission and distribution services. China continues to dominate the region with its ambitious Ultra High Voltage (UHV) transmission projects. The country’s focus on UHV technology enables the efficient transport of electricity over long distances, facilitating the connection of remote renewable resources, particularly in the western regions, to major urban centers in the east. In 2023, the completion of a new UHV line aimed at integrating 50GW of renewable energy underscores this unique capability, positioning China as a leader in advanced transmission technology.

Latin America

Growing Renewable Energy Integration and a Strong Commitment to Upgrading Aging Infrastructure to Fuel Market Growth in Latin America

The electricity Transmission and Distribution (T&D) market in Latin America is experiencing a significant shift, characterized by a rapid increase in renewable energy integration and a strong commitment to upgrading aging infrastructure. As of 2022, renewable sources accounted for almost 20-23% of the region's electricity generation, with Brazil and Chile at the forefront of this transition. In 2023, Brazil announced plans to invest over USD 2 billion in T&D upgrades, targeting improvements in grid resilience and capacity. Brazil is also set to enhance its clean energy capacity by approximately 1,500 MW through the launch of over 30 new solar plants anticipated to go live by 2024, demonstrating the country’s proactive efforts to expand its renewable energy portfolio.

Moreover, other countries such as Chile have committed to a USD 1.2 billion investment plan aimed at expanding its T&D network, aligning with its goal of achieving carbon neutrality by 2050. This initiative underscores the necessity of upgrading infrastructure to connect more renewable energy projects effectively.

Middle East & Africa

Growing Electricity Demand is Expected to Offer Considerable Growth Opportunities for the Middle East

The Middle East & Africa is the fourth largest market likely to hit USD 21.47 billion in 2026. The MEA region is experiencing one of the highest electricity demand growth globally. According to the International Energy Agency (IEA), electricity demand in the region is expected to increase by over 50% by 2040, necessitating substantial investments in T&D infrastructure.

Countries across the MEA region are making concerted efforts to diversify their energy mix. There is a strong regional push toward integrating renewable energy sources. For example, the UAE has a target for 50% of its energy to come from renewable sources by 2050. Saudi Arabia's Vision 2030 emphasizes diversification, aiming to achieve 58.7 GW of renewable energy by 2030.

According to World Bank, the region faces an estimated funding gap of USD 25 billion annually to meet its energy needs, and this investment is crucial for modernizing existing T&D infrastructure, which is often outdated and inefficient. The GCC market is estimated to hold USD 7.14 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Market Leaders Focus on Providing Exceptional Support and Service to Gain Leading Share

Globally, Power Construction Corporation of China, Kiewit Corporation, Fluor Corporation, Larsen & Toubro, and Duke Energy among others, are some of the dominating players in the market. The electricity transmission and distribution market is commoditized, wherein market players offer similar products with identical designs, efficiencies, and durability. However, competition is based on price, ability to handle large projects, geographical presence, customized solutions, and compatibility with local regulatory norms. The market's primary differentiators are service and support.

List of Key Electricity Transmission and Distribution Companies Profiled:

- Duke Energy Corporation (U.S.)

- National Grid plc (U.K.)

- Enel SpA (Italy)

- E.ON SE (Germany)

- NextEra Energy Inc (U.S.)

- Dominion Energy Inc (U.S.)

- Tokyo Electric Power Company Holdings (Japan)

- American Electric Power Company Inc (U.S.)

- Power Grid Corporation of India (India)

- State Grid Corporation of China (China)

KEY INDUSTRY DEVELOPMENTS:

- August 2024: Power Grid Corporation of India Ltd acquired Rajasthan IV E Power Transmission Ltd (RIVEPTL) for 2.2 million following its selection as the successful bidder under Tariff-Based Competitive Bidding. The acquisition aligns with POWERGRID's power transmission business and supports the company's objective to strengthen the national grid infrastructure, particularly for renewable energy zones. With this acquisition, the company aims to establish a new 765 kV substation at Rishabhdeo in Rajasthan, along with the development of 765 kV D/C transmission lines and associated bay extensions at existing substations in Rajasthan and Madhya Pradesh.

- May 2024: Dominion Energy announced a 500 kV, 36.5-mile-long transmission line, starting from Fauquier County through Prince William and connecting to Loudoun’s Wishing Star substation. The project aimed at addressing the growing demand for power in the region.

- July 2023: SSEN Transmission signed a joint venture with National Grid Electricity Transmission for subsea electricity superhighway- Eastern Green Link 2, the single largest electricity transmission project in the U.K. The joint venture aimed to create 525kW, 2GW High Voltage Direct Current (HVDC) subsea transmission cable from Peterhead in Scotland to Drax in England.

- March 2023: Tata Power collaborated with Enel Group to automate and digitalize the distribution system in India. According to the contract, the Gridspertise of the Enel Group is to collaborate with Tata Power Delhi Distribution Ltd (TPDDL), which serves 1.9 million customers in North Delhi on the completion of the project. In the first project, Tata Power will focus on speeding up the automation and digitalization of secondary substations. The second project will use Gridspertise’ metering technology in Delhi’s electricity distribution system to test and assess the new hybrid smart metering technology.

- September 2020: NextEra Energy Transmission, a subsidiary of NextEra Energy, Inc., signed an agreement to acquire GridLiance Holdco, LP and GridLiance GP, LLC (GridLiance) for over USD 660 million. GridLiance owns around 700 miles of high-voltage transmission lines and related equipment with utility rates set by the Federal Energy Regulatory Commission (FERC). Its assets span three regional transmission organizations and six states.

Investment Analysis and Opportunities

- Enel Group announced an investment for the period 2024-2026 to increase grid investments and renewable energy. It plans to invest USD 38.96 billion by 2026, and from this, 49% will be invested in Italy, 25% in Iberia, 19% in Latin America and 7% in North America. The majority of this overall investment will be utilized for a power grid system focused on new connections, improving quality, resilience, and digitalization of the grid system.

- Governments across the world are investing in grid infrastructure. For example, in November 2023, the U.S. Department of Energy announced USD 3.46 billion in funding for 58 projects across 44 states to strengthen the nation's power grid. This includes investments in advanced sensors, grid management software, and new transmission lines, aiming to enhance grid reliability and resilience.

- Similarly, the European Union is pushing forward with its "TEN-E" regulation, driving cross-border transmission projects such as the 'Baltic Loop' which will connect the grid infrastructure in multiple countries. These large-scale investments and projects highlight the significant opportunities for market growth in technologies supporting grid modernization, such as energy storage systems, Advanced Metering Infrastructure (AMI), and digital grid management solutions.

REPORT COVERAGE

The global report delivers a detailed insight into the market and focuses on key aspects such as leading companies in electricity transmission and distribution. Besides, the report offers insights into the market trends and technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.42% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component, End-user, and Region |

|

Segmentation |

By Component

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market was valued at USD 397.99 billion in 2025.

The market is likely to grow at a CAGR of 4.42% over the forecast period (2026-2034).

The electric utility segment dominated the global electricity transmission and distribution market.

The market size of Asia Pacific stood at USD 170.27 billion in 2025.

Rising efforts to reduce the effects of high Carbon emissions are the key factors driving market growth.

Some of the top players in the market are National Grid plc, Enel SpA, E.ON SE, NextEra Energy Inc, Dominion Energy Inc, and others.

The global market is expected to reach USD 580.51 billion by 2034.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us