Electronic Data Interchange (EDI) Software Market Size, Share & Industry Analysis, By Type (In-house, Outsourcing, and Hybrid), By Deployment (Cloud and On-premises), By Industry (Healthcare, Automotive, Financial Services, High Tech/Manufacturing, Retail, Logistics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

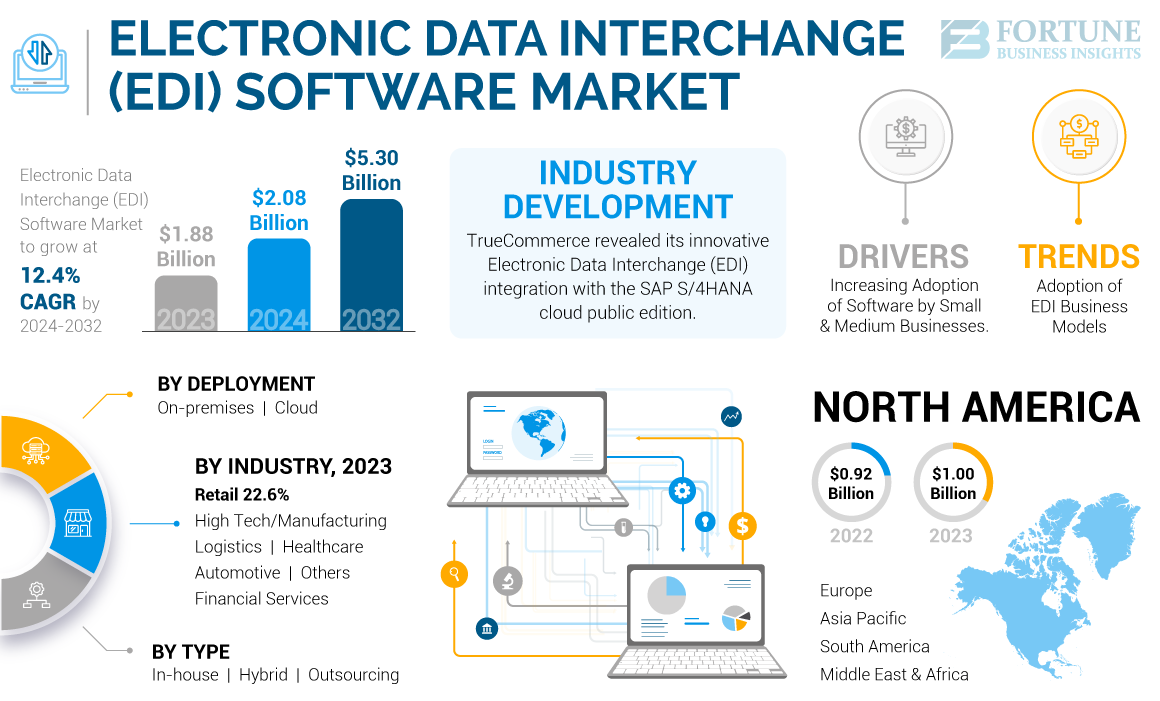

The global Electronic Data Interchange (EDI) software market size was valued at USD 2.08 billion in 2024. The market is projected to grow from USD 2.31 billion in 2025 to USD 5.30 billion by 2032, exhibiting a CAGR of 12.6% during the forecast period. North America dominated the global electronic data interchange software market with a share of 52.4% in 2024.

The Electronic Data Interchange (EDI) software considered in the scope includes Boomi B2B EDI, TrueCommerce EDI, Epicor EDI, and more. The growth of the market is primarily driven by the rising preference of large organizations toward in-house processing and digital transformation & process automation. In addition, the rising adoption of electronic data transactions across various industries is expected to drive market growth during the forecast period. The major software providers are focusing on adopting various marketing strategies, including mergers & acquisitions, joint ventures, and others to strengthen their position.

The COVID-19 pandemic significantly impacted the market during 2020-2021. Several business functions across verticals have been adversely affected, including the electronic data interchange process. Logistics, retail, manufacturing, and healthcare industries witnessed drastic changes in their ways of operations and customer management amid the pandemic. However, the significant changes and growing demand for smoother supply chain processes are anticipated to surge the demand for the Electronic Data Interchange (EDI) software market.

Healthcare, retail, and other industrial sectors have started adopting cloud-based data exchange software to offer lifetime access to the data. Globally, government bodies, along with organizations, are focused on enrolling recovery actions for the post-COVID-19 impact. According to the World Economic Forum (WEF), in April 2020, contactless digital payment means, such as Quick Response (QR) codes, facial recognition, and Near-Field Communications (NFC), helped various countries to cope with the pandemic crisis, thus propelling the use of paperless transactions. Various companies are opting for innovative contact-less solutions to avoid the spread of coronavirus. Thus, the demand for Electronic Data Interchange (EDI) software is expected to grow significantly to offer an efficient customer experience in the coming years.

Electronic Data Interchange (EDI) Software Market Trends

Adoption of EDI Business Models Transforms Value Chain in Healthcare, Thereby Creating Numerous Market Opportunities

Electronic Data Interchange (EDI) software in the healthcare sector is favorable for developing transaction process regulations, government support for HCIT (Healthcare IT) implementation, and the need to curtail healthcare costs. The Global Language of Business (GS1) has deployed a Healthcare EDI implementation kit to introduce the GS1 EDI standards for global healthcare guidelines.

Also, the growing government initiatives and investments across various countries for digital capacities and high-tech mechanisms in the healthcare sector create lucrative opportunities for the implementation of EDI in healthcare. For instance,

- In February 2024, the New Digital Europe Programme announced an investment of over USD 190.5 million (EUR 176 million) in digital capacities and tech in Europe. USD 80.1 million (EUR 74 million) will be capitalized in data and data-associated operations under the Digital Programme of Europe. It would also focus on AI-driven healthcare, with projects aiding work in paths for AI in healthcare.

EDI ensures accurate communication about the products ordered, shipped, received, and utilized through the healthcare supply chain, offering several market opportunities.

Therefore, due to the above mentioned factors, the demand for EDI software is increasing fueling the Electronic Data Interchange (EDI) software market growth.

Download Free sample to learn more about this report.

Electronic Data Interchange (EDI) Software Market Growth Factors

Increasing Adoption of Software by Small & Medium Businesses to Drive EDI Software Market Growth

The Electronic Data Interchange (EDI) software aids small and medium organizations in automating several transactions with other companies that occur frequently, including exchanging invoices, orders, and advanced shipping notices. The inventory software solution also aids in managing various solutions, creating fully integrated, end-to-end, and automated Electronic Data Interchange (EDI) software solutions. This significantly increases the productivity, efficiency, and profitability of smaller and mid-sized businesses by enabling fully automated transaction processing.

The software enables small organizations to enhance customer satisfaction and brand loyalty by offering online recommendations. It also helps small organizations to seamlessly transact with large organizations across the globe by solving technical and business connection requirements productively and efficiently. The software aided in fastening transactions, delivery, payment, and invoicing and improved the visibility of goods in the supply chain.

RESTRAINING FACTORS

Technical Complexity and Interoperability Issues can Limit Usage of EDI Software among Enterprises

Electronic Data Interchange (EDI) software systems can be precisely complex, demanding specialized data and the ability to implement and maintain them. This intricacy can result in assimilation challenges, predominantly when incorporating third-party applications or existing systems. EDI standards, including EDIFACT or ANSI X12, can vary across different countries or sectors, causing interoperability issues. It can result in issues when switching data between enterprises using various versions or standards.

Electronic Data Interchange (EDI) Software Market Segmentation Analysis

By Type Analysis

Companies Investing in Hybrid Electronic Data Interchange (EDI) software to Drive Segment Growth

By type, the market is segmented into in-house, outsourcing and hybrid.

The hybrid segment is expected to grow with the highest CAGR during the forecast period as hybrid EDI enables B2B transactions with much less infrastructural limitation than conventional EDI, and businesses that invest in hybrid integration platforms gain automation through enhanced visibility.

The outsourcing dominated the market in 2023 as companies chose to outsource EDI save costs, focus on core business activities, and have the flexibility to scale up or down their EDI capabilities as needed without incurring the cost of maintaining an in-house EDI system.

By Deployment Analysis

Higher Scalability Offered by Cloud-based EDI to Boost Market Expansion

By deployment, the market is categorized into cloud and on-premises.

Amongst these, the cloud segment dominated the market in 2023 and is expected to grow at the highest CAGR in the coming years. This is owing to its characteristics of providing newfound flexibility for enterprises and the ability to save time and operation costs by improving scalability and agility. The adoption of cloud-based platforms is increasing across companies, especially among those who have a wide presence across different geographies or are planning for aggressive expansion. These platforms allow the end-users to connect with customers, partners, and other businesses with minimal effort. In addition, the cloud computing features allow the user instant provisioning of any software or application and eliminate time spent on installation and configuration.

The on-premises segment is anticipated to grow at a considerable rate. On-premises data exchange solutions can allow enterprises to maintain a level of control.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Adoption of EDI is Increasing in Healthcare Due to Need to Improve Data Quality and Cut Down Costs for Processing Documents

By industry, the market is categorized into healthcare, financial services, automotive, retail, high-tech/manufacturing, logistics, and others.

Healthcare is projected to register the highest CAGR during the forecast period. Integration of EDI in healthcare has helped improve the data quality and cut down the cost for processing documents, as most of the data is digitized. The Workgroup for Electronic Data Interchange estimates that adoption of EDI helps healthcare organizations save USD 1 per claim for health plans, USD 0.86 for hospitals, and USD 1.49 for physicians.

The retail segment dominated the market as Electronic Data Interchange (EDI) software technology enhances the accuracy and efficiency of retail operations by reducing processing errors, eliminating manual data entry, and speeding up information exchange. EDI helps retailers to streamline the procurement process and enhance their inventory management.

REGIONAL INSIGHTS

The global market scope is classified across five regions, North America, South America, Europe, Middle East & Africa, and Asia Pacific.

North America Electronic Data Interchange (EDI) Software Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is expected to gain maximum revenue share with a market size of USD 1.09 billion in 2024. The expanding manufacturing, healthcare, automobile, and retail industries are boosting the demand for data interchange solutions across the region. The U.S. is likely to gain maximum Electronic Data Interchange (EDI) software market share during the forecast period owing to increasing digital business-to-business transactions. For instance, in December 2021, Yamato Transport U.S.A., Inc. announced the implementation of EDI for its logistics systems.

Asia Pacific is expected to grow at the highest CAGR during the forecast period. The growth is attributable to the increasing supply chain efficiencies between retailers & suppliers and the rise of the e-commerce industry, particularly in developing countries, such as India, China, and others. In addition, rising government initiatives and growing manufacturing facilities in this region are expected to increase the demand for Electronic Data Interchange (EDI) software among enterprises.

Europe is expected to grow at a substantial CAGR owing to the presence of a considerable number of data exchange solutions and tool manufacturers. The United Nations Commission for Europe introduced an electronic data transfer standard, ISO 9735 to regularize and comply with electronic data interchange operations.

The Middle East & Africa and South America are expected to experience a gradual CAGR during the forecast period owing to the rising e-commerce and distribution stores and facilities, the emergence of SMEs engaged in third-party logistics businesses, growing healthcare and manufacturing infrastructure, and others. Similarly, South America showcases steady growth owing to the increasing digital transitions. The software is helping to offer continuous connections between small and large enterprises across the industries in the region.

KEY INDUSTRY PLAYERS

Major Players Focus on Global Expansion with Innovative Solutions to Boost Market Share

Major players such as Dell Boomi, SPS Commerce, Inc., MuleSoft LLC, and others are proactively strengthening their market position by upgrading their existing product lines to cater to various end-use applications. These key players are now integrating EDI systems with advanced technologies such as IoT, Machine Learning (ML), blockchain, cloud, and others to enhance their product portfolio and deliver enhanced solutions. Further, the major players in the market are focusing on the expansion and development of existing solutions in terms of upgrading and integration of technology.

List of Top Electronic Data Interchange (EDI) Software Companies:

- Boomi Inc. (Dell Boomi) (U.S.)

- SPS Commerce, Inc. (U.S.)

- Software AG (Germany)

- MuleSoft LLC (U.S.)

- Epicor Software Corporation (U.S.)

- TrueCommerce Inc. (U.S.)

- Rocket Software, Inc. (U.S.)

- Open Text Corporation (Canada)

- Babelway (Belgium)

- Comarch SA (Poland)

KEY INDUSTRY DEVELOPMENTS:

- May 2024: TrueCommerce revealed its innovative Electronic Data Interchange (EDI) integration with the SAP S/4HANA cloud public edition. The integration will support the on-premises and private cloud versions of SAP S/4HANA.

- April 2024: Software AG introduced webMethods.io B2B 11, a cloud platform that improves partner onboarding, data governance, self-service, archival, and secure file transfer, thereby enhancing B2B collaboration and integration.

- April 2024: MuleSoft launched a MuleSoft Accelerator for Salesforce OMS with connectivity between Salesforce OMS and MuleSoft’s Anypoint Partner Manager. It allows the bidirectional exchange of business communications, such as shipment notices, purchase orders, invoices, payments, and other supply chain or logistics messages via modern API communications and traditional EDI standards.

- March 2024: OpenText and X12 announced the renewal of their commercial use partner license agreement. This partnership highlights OpenText's commitment and support for X12 standards across the supply chain network. X12 standards play a significant role in EDI, serving businesses across diverse industries, including retail, auto high-tech, consumer goods, motive, general manufacturing, and insurance.

- February 2024: Monini, the Italian company, adopted Comarch's EDI technology to slow down manual transcoding activities, and develop the management of order cycle flows tailored to each player in the retail sector.

REPORT COVERAGE

The market report highlights leading regions across the world to offer a better understanding of the user. Furthermore, it provides insights into the latest industry and market trends and competitive landscape and analyzes technologies deployed at a rapid pace at the global level. It further highlights some of the growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 12.30% from 2026 to 2034 |

|

Segmentation |

By Type

By Deployment

By Industry

By Region

|

Frequently Asked Questions

The market is projected to record a valuation of USD 5.30 billion by 2032.

In 2024, the market size stood at USD 2.08 billion.

The market is projected to grow at a CAGR of 12.6% over the forecast period of 2025-2032.

The retail segment dominated in terms of market share.

Increasing adoption by small & medium businesses is expected to drive the market growth.

Dell Boomi, SPS Commerce, Inc., MuleSoft LLC, Open Text Corporation, and Software AG are the top players in the market.

The North American region is expected to hold the highest market share.

Asia Pacific is expected to grow with the highest CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

_software_market.webp)