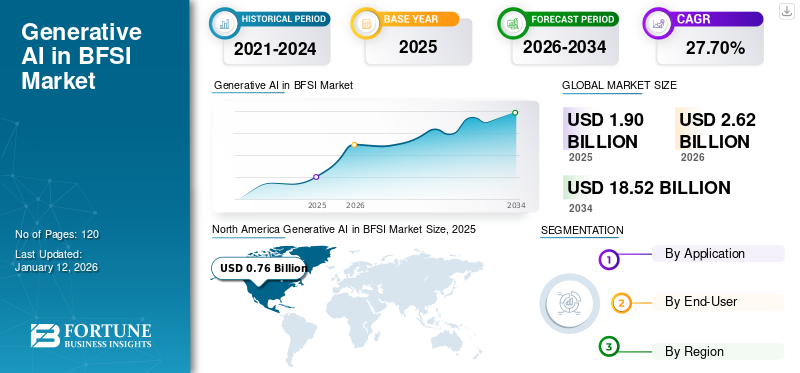

Generative AI in BFSI Market Size, Share & Industry Analysis, By Application (Fraud Detection, Risk Assessment, Customer Experience, Algorithmic Trading, and Others), By End-User (Banks, Insurance Companies, and Financial Service Providers), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

The global generative AI in BFSI market size was valued at USD 1.90 billion in 2025 and is projected to grow from USD 2.62 billion in 2026 to USD 18.52 billion by 2034, exhibiting a CAGR of 27.70% during the forecast period. North America dominated the generative AI in BFSI market with a market share of 40.11% in 2025.

Generative AI in BFSI (banking, financial services, and insurance) refers to applying advanced artificial intelligence techniques, particularly those involving generative AI models, to create, analyze, and optimize financial products, services, and operations. Generative AI technology can automatically generate financial reports, investment summaries, and market analysis, saving time and reducing manual errors. Moreover, generative AI in BFSI can ensure that transactions and operations comply with regulatory standards by continuously monitoring and analyzing data. In addition, AI is capable of generating accurate and timely reports, reducing the burden of compliance and minimizing errors.

In the scope of work, we have involved solutions offered by companies, such as Accenture, SAS Institute, Inc., DataRobot, Inc., Microsoft, IBM Corporation, NVIDIA Corporation, Salesforce, Inc., and others.

Download Free sample to learn more about this report.

Generative AI in BFSI Market Trends

Growing Demand for Enhanced Customer Service and Personalization Drives Market Growth

The use of AI-powered virtual assistants and chatbots is growing in the banking sector. These tools leverage Natural Language Processing (NLP) and generative models to provide personalized customer interactions, answer queries, and offer financial advice. Generative AI is being used to design personalized financial products and services, such as customized insurance policies and investment portfolios, based on individual customer data and preferences. Generative AI in BFSI simulates economic scenarios and conducts stress tests, helping to assess and mitigate risks under various conditions.

Moreover, generative AI in BFSI innovates and develops new products, such as dynamic pricing models for insurance and novel financial instruments. These factors play an important role in increasing the adoption of generative AI in BFSI, fueling market growth during the forecast period.

Generative AI in BFSI Market Growth Factors

Increased Need for Operational Efficiency and Cost Reduction Among Financial Institutions Fuels Market Growth

Generative AI in BFSI automates routine tasks, such as data entry, report generation, and compliance checks, reducing manual effort and operational costs. AI enhances the speed and accuracy of data processing, allowing financial institutions to handle large volumes of transactions and data more efficiently. Further, financial institutions are under constant pressure to reduce operational costs. Generative AI in BFSI offers cost-saving solutions by automating processes and optimizing resource allocation. AI solutions are scalable and can be easily adapted to changing business needs, providing flexibility in managing costs and resources.

In addition, financial institutions are increasingly partnering with fintech companies and technology providers to integrate AI solutions, driving innovation and expanding capabilities. These factors play a vital role in driving the global generative AI in BFSI market growth.

RESTRAINING FACTORS

Data Security Concerns and Lack of Skilled Workforce May Hinder Market Growth

Financial institutions deal with highly sensitive and personal data. Ensuring the privacy and security of this data when using AI solutions is a major concern. The use of generative AI can introduce new cybersecurity vulnerabilities. Financial institutions must safeguard AI systems against cyber-attacks, which requires significant investment in security measures. Moreover, a shortage of skilled professionals with expertise in AI, data science, and machine learning makes it difficult for financial institutions to find and retain the necessary talent. In addition, training existing staff to use and manage AI technologies effectively requires time and resources. Thus, these factors are expected to hinder the market for generative AI in BFSI.

Generative AI in BFSI Market Segmentation Analysis

By Application Analysis

Growing Need for Real-Time Fraud Detection in Banking Sector Fueled Segment Growth

Based on application, the market is divided into fraud detection, risk assessment, customer experience, algorithmic trading, and others (portfolio optimization).

The fraud detection segment accounting for 42.92% of the market share in 2026. Generative AI can process and analyze data in real-time, immediately detecting and responding to suspicious activities. This is crucial for preventing fraud before it results in significant financial loss. Generative models can continuously learn and adapt from new data, improving their detection capabilities over time and staying ahead of evolving fraud techniques. AI can generate synthetic datasets to simulate various fraud scenarios, helping to train and improve detection models, especially for new and rare types of fraud.

The algorithmic trading segment is expected to grow at the highest CAGR during the forecast period, as automating trading processes reduces the need for manual intervention, lowering operational costs and human error. By optimizing trade execution, generative AI can minimize transaction costs and slippage, leading to more cost-effective trading.

To know how our report can help streamline your business, Speak to Analyst

By End-User Analysis

Increasing Focus on Adoption of Chatbots and Virtual Assistants in Banks Boosted Segment Growth

Based on end-user, the market is categorized into banks, insurance companies, and financial service providers.

The banks segment dominated the market with a 51.86% share in 2026. Generative AI powers banking services with sophisticated chatbots and virtual assistants that handle customer inquiries, provide account information and offer financial advice 24/7. This reduces wait times and improves customer satisfaction. AI can analyze customer data to provide personalized product recommendations and financial advice, enhancing the customer experience and fostering loyalty, which is vital in boosting segment growth.

The financial service providers segment is predicted to experience the highest CAGR over the forecast period. AI assists these providers in assessing various risks, including credit, market, and operational risks, by analyzing large datasets and identifying potential risk factors. Additionally, AI automates the monitoring and reporting of compliance activities, ensuring adherence to regulatory requirements and reducing the risk of non-compliance. Thus, they are expected to fuel the segment growth in the coming years.

REGIONAL INSIGHTS

The global market is segmented based on region into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America Generative AI in BFSI Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America ccounted for USD 0.76 billion in 2025. AI helps financial institutions in North America assess various types of risks, including credit, market, and operational risks, by analyzing large datasets and forecasting potential risk scenarios. Generative AI automates compliance processes, ensuring institutions adhere to regulatory requirements and reducing the risk of fines and penalties. Furthermore, market players operating in the region are engaged in partnerships to develop generative AI tools for use in the banking sector.

For instance,

- In May 2024, Accenture and Oracle extended their partnership to help clients boost their adoption of generative AI in BFSI.

Asia Pacific

Asia Pacific is anticipated to grow at the highest CAGR over the projected period. China, Japan, Singapore, and Australia, are becoming fintech innovation hubs, fostering the development and adoption of AI technologies in the financial sector. Several countries in the region have established regulatory sandboxes that allow financial institutions to experiment with AI-driven solutions in a controlled environment, encouraging innovation while ensuring compliance. For instance,

- In October 2023, OCBC Bank in Singapore bought a six-month generative AI chatbot trial. This tool helped them with a 50% productivity lift, translation, streamlining writing and research activities.

Moreover, generative AI enhances trading strategies by analyzing market data, identifying trends, and executing trades with high precision, thereby improving investment performance. The Japan market reaching USD 0.15 billion by 2026, the China market reaching USD 0.17 billion by 2026, and the India market reaching USD 0.10 billion by 2026.

Europe

The market in Europe is set to rise at a significant CAGR in the coming years. European financial institutions are leveraging AI-driven chatbots and virtual assistants to handle customer inquiries, provide financial advice, and perform routine transactions, resulting in improved customer satisfaction and reduced operational costs. Further, many traditional banks in Europe are partnering with fintech companies to integrate generative AI solutions, leveraging the agility and innovation of fintechs. In addition, there is a significant investment in AI research and development within Europe, supported by initiatives from the European Union and national governments. The UK market reaching USD 0.14 billion by 2026 and the Germany market reaching USD 0.13 billion by 2026.

Middle East & Africa

The Middle East & Africa is predicted to witness remarkable growth in the coming years. AI helps financial institutions in the region improve the accuracy of credit scoring models by incorporating a broader range of data points, leading to a more reliable assessment of creditworthiness. Moreover, the market is increasing steadily in South America, and financial institutions are increasing their investments in AI technologies to stay competitive and meet the evolving demands of customers. For instance,

- According to an industry survey, in April 2024, 54% of banks say they are already utilizing generative AI technology, as they are highly customizable and adaptable to meet the specific needs of businesses.

KEY INDUSTRY PLAYERS

Top Companies Focus on Partnership and Acquisition Strategies to Increase Their Analytics Solutions Globally

Prominent players implement several tactics to boost their competitiveness in the market. Leading companies offer industry-specific solutions to boost their geographical reach globally. They emphasize mergers and acquisitions with local companies to uphold control across regions. Major players introduce novel solutions to expand their consumer base. An increase in constant R&D investments for product innovations is enhancing market expansion.

List of Top Generative AI in BFSI Companies:

- Accenture (Ireland)

- SAS Institute, Inc. (U.S.)

- Quantifind (Germany)

- Microsoft (U.S.)

- OpenAI (U.S.)

- DataRobot, Inc. (U.S.)

- NVIDIA Corporation (U.S.)

- Google LLC (U.S.)

- IBM Corporation (U.S.)

- Salesforce, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- March 2024: J.P. Morgan Chase & Co. launched IndexGPT, an AI-powered tool built to offer investment advice to retail clients in Latin America. This tool analyzes and selects financial assets to fulfill customers' needs.

- February 2024: Mastercard launched a novel generative AI model designed to augment banks' ability to detect suspicious transactions across its network. This model is anticipated to boost fraud detection rates by up to 20%.

- February 2024: KakaoBank, South Korea’s mobile-only bank, developed an Artificial Intelligence (AI) lab to offer AI-powered services. It focuses on Research and Development (R&D) activities for new financial services.

- September 2023: Temenos launched a secure solution enabled with Generative Artificial Intelligence technology for banks. This solution categorizes customers’ banking transactions and helps banks provide personalized insights and recommendations.

- September 2023: Emirates NBD, a bank operating in the MENA region, plans to adopt generative AI tools with the help of McKinsey & Company. The company helps the bank to design and pilot generative AI use cases across the business.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2024-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 27.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application

By End-User

By Region

|

Frequently Asked Questions

The market is projected to reach USD 18.52 billion by 2034.

In 2025, the market was valued at USD 1.90 billion.

The market is projected to grow at a CAGR of 27.70% during the forecast period.

By end-user, banks are expected to lead the market.

Increased need for operational efficiency and cost reduction among financial institutions fuels market growth.

Accenture, SAS Institute, Inc., DataRobot, Inc., Microsoft, IBM Corporation, NVIDIA Corporation, and Salesforce, Inc. are the top players in the market.

North America is expected to hold the highest market share.

By application, algorithmic trading is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us