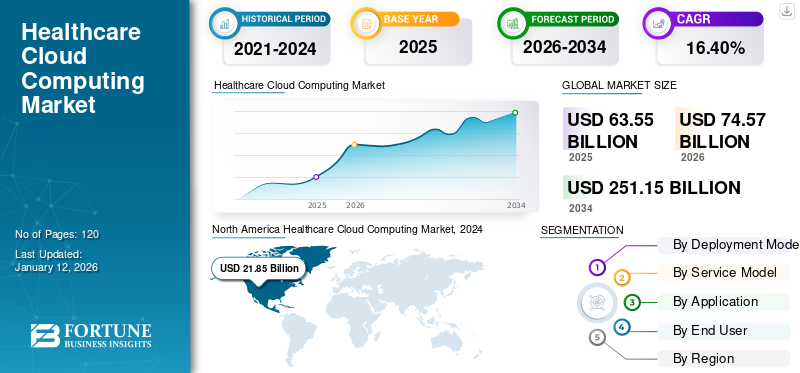

Healthcare Cloud Computing Market Size, Share & Industry Analysis, By Deployment Model (Public Cloud, Private Cloud, and Hybrid Cloud), By Service Model (Software as a Service (SaaS), Platform as a Service (PaaS), and Infrastructure as a Service (IaaS)), By Application (Clinical Information Systems (CIS) and Non-clinical Information Systems (NCIS)), By End User (Healthcare Providers and Healthcare Payers), and Regional Forecast, 2026-2034

Healthcare Cloud Computing Market Size

The global healthcare cloud computing market size was valued at USD 63.55 billion in 2025 and is projected to grow from USD 74.57 billion in 2026 to USD 251.15 billion by 2034, exhibiting a CAGR of 16.40% during the forecast period. North America dominated the global healthcare cloud computing market with a share of 39.60% in 2025.

Cloud computing is a popular technology, which is significantly used in the healthcare industry to permit the deployment of remote servers accessible through the internet to store, manage, and process healthcare data. One of the primary and most important reasons behind the healthcare sector choosing cloud computing technology is that they get real-time availability of computer resources, such as data storage and computing power. Moreover, cloud computing technology enables healthcare providers to access patient information from anywhere, facilitating better patient care and coordination. This is particularly beneficial for telemedicine and remote patient monitoring. Also, this technology allows for seamless sharing of patient data among different healthcare providers, improving collaboration and ensuring that all providers have up-to-date information. These factors will play an important role in driving the market growth during the forecast period.

The COVID-19 pandemic accelerated the adoption of cloud computing solutions to support remote work, telehealth, and data sharing. Healthcare providers quickly transitioned to cloud-based systems to ensure continuity of care and operational efficiency under lockdown conditions. Healthcare organizations significantly increased investment in their cloud infrastructure and services to enhance their digital capabilities. This included investments in telemedicine platforms, electronic health records (EHRs), and data analytics tools.

In the scope of work, the report has included solutions offered by companies, such as Amazon Web Services, Inc., Microsoft, IBM Corporation, Siemens Healthcare Private Limited, CareCloud, Inc., Cleardata, and others.

IMPACT OF GENERATIVE AI

Growing Demand for Enhanced Data Analysis and Insights in Healthcare Cloud Computing to Boost Market Growth

Generative AI tools are capable of analyzing large datasets to identify patterns and anomalies, improving diagnostic accuracy. These tools can integrate and process data from diverse sources stored in the cloud, such as medical records, imaging studies, and generic data, leading to more precise and timely diagnoses. Further, generative AI can predict patient outcomes by analyzing historical data and identifying risk factors. This enables healthcare providers to proactively manage patient care, particularly for chronic diseases and complex conditions. For instance,

- In September 2023, CareCloud engaged in collaboration with Google Cloud to help ambulatory practices and small and medium healthcare providers with the use of generative AI technology to boost operational efficiencies.

Also, by leveraging data stored in the cloud, generative AI can create personalized treatment plans tailored to individual patients based on their medical history, genetic information, and lifestyle factors. This leads to more effective and efficient care. These factors are expected to bolster the growth of the healthcare cloud computing market during the forecast period.

Healthcare Cloud Computing Market Trends

Increased Adoption of Telehealth Services Among Healthcare Providers to Fuel Market Growth

The COVID-19 pandemic accelerated the adoption of telehealth services, which rely heavily on cloud computing for data storage, security, and real-time communication. This trend continues as patients and providers recognize the convenience and efficiency of remote consultations. Healthcare providers are increasingly using integrated cloud platforms that combine telehealth with electronic health records (EHRs), scheduling, and billing systems, enhancing operational efficiency and patient care. Cloud computing supports the storage and analysis of vast amounts of patient data, enabling personalized treatment plans based on individual health profiles, genetic information, and lifestyle factors. For instance,

- January 2023: Masimo and Philips engaged in a partnership to improve patient monitoring abilities in-home telehealth applications by using Masimo’s W1 advanced health-tracking watch. This watch measures precise pulse oximetry and other useful health information.

These factors play an important role in increasing the adoption of telehealth services among healthcare providers, which will fuel the healthcare cloud computing market growth during the forecast period.

Download Free sample to learn more about this report.

Healthcare Cloud Computing Market Growth Factors

Growing Demand for Enhanced Data Accessibility and Personalized Medicine Drives Market Growth

Cloud computing enables healthcare providers to access patient data anytime and anywhere, facilitating better coordination of care and improving patient outcomes. This is particularly beneficial for telehealth and remote patient monitoring. The ability to analyze large datasets in the cloud supports the development of personalized treatment plans based on individual patient data, including genetic information and medical history.

In addition, cloud platforms support interoperability, allowing different healthcare systems and applications to work together seamlessly. This enhances collaboration among healthcare providers, improving the healthcare industry. Moreover, cloud-based patient portals enable patients to access their health records, communicate with providers, and manage their health proactively, fostering greater patient engagement and participation in their own care. These factors play a vital role in driving the healthcare cloud computing market’s growth worldwide.

RESTRAINING FACTORS

Data Security Concerns and High Initial Costs May Hinder Market Growth

Healthcare data is highly sensitive and valuable, making it a prime target for cyberattacks. The risk of data breaches and unauthorized access can deter healthcare organizations from adopting cloud solutions. Ensuring the privacy of patient data is crucial. Any compromise can lead to legal repercussions and loss of trust among patients, making healthcare providers wary of cloud adoption.

Moreover, the initial investment required for migration, training, and integration can be substantial, particularly for smaller healthcare providers. Subscription fees, data storage, and maintenance costs can add up over time, potentially straining the budgets of healthcare organizations, especially those with limited financial resources. These factors are expected to hinder the market’s growth.

Healthcare Cloud Computing Market Segmentation Analysis

By Deployment Model Analysis

Growing Need for Scalable and Cost Efficient Infrastructure Fueled Demand for Public Cloud Deployment

Based on deployment model, the market is divided into public cloud, private cloud, and hybrid cloud.

The public cloud segment led the market accounting for 54.72% market share in 2026, as it eliminates the need for significant upfront investments in IT infrastructure. Healthcare organizations can pay for services on a subscription basis, reducing capital expenditures and shifting costs to operational budgets. Public cloud offers scalable resources that can be adjusted based on demand. This flexibility allows healthcare providers to manage costs effectively, scaling up during peak times and scaling down when demand is lower.

The hybrid cloud segment is expected to record the highest CAGR during the forecast period as it enables healthcare organizations to optimize resources allocation by keeping critical workloads and sensitive data on private clouds and shifting less critical applications to cost-effective public clouds. By leveraging public cloud resources for non-sensitive operations, organizations can reduce the need for expensive on-premises infrastructure, thus lowering capital expenditure.

By Service Model Analysis

Growing Demand for Innovative and Easy to Implement Solution Among Healthcare Providers Drove Demand for SaaS Solutions

Based on service model, the market is categorized into Software as a Service (SaaS), Platform as a Service (PaaS), and Infrastructure as a Service (IaaS).

The Software as a Service (SaaS) segment led the market accounting for 49.46% market share in 2026. SaaS solutions are typically easy to implement and require minimal IT resources for maintenance and updates, allowing healthcare organizations to focus on patient care rather than IT infrastructure management. Additionally, SaaS providers continuously update their platforms with the latest features and advancements, allowing healthcare organizations to leverage cutting-edge technology without the need for costly upgrades or migrations.

Infrastructure as a Service (IaaS) is expected to record the highest CAGR during the forecast period. It eliminates the need for upfront capital investments in hardware infrastructure as healthcare providers can pay for computing resources on a pay-as-you-go basis, reducing overall IT costs. Moreover, IaaS providers typically offer robust disaster recovery solutions, including data replication and failover capabilities, ensuring that healthcare organizations can quickly recover from unforeseen disasters or disruptions. Thus, they are expected to fuel the market growth in the coming years.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Increasing Demand for Electronic Health Records Among Healthcare Providers Drove Demand for Clinical Information Systems

Based on application, the market is divided into clinical information systems (electronic health records, picture archiving and communication system, radiology information system, and others) and non-clinical information systems (revenue cycle management, billings & accounts management solution, and others).

The Clinical Information Systems (CIS) segment dominated the market accounting for 62.06% market share in 2026. Cloud-based Electronic Healthcare Record (EHR) systems can be integrated with other healthcare systems and devices, facilitating seamless data exchange between different healthcare providers from anywhere with an internet connection, and ensuring that patient information is accessible across healthcare systems.

The Non-clinical Information Systems (NCIS) segment is expected to register the highest CAGR during the forecast period as cloud-based solutions automate billing and accounts management tasks, reducing manual efforts and streamlining administrative workflows. This efficiency leads to faster processing times and fewer errors. These factors are expected to bolster the market growth during the forecast period.

By End User Analysis

Increasing Adoption of Easy Accessibility Solutions Fueled Demand for Cloud Computing Technology Among Healthcare Providers

Based on end user, the market is categorized into healthcare providers (hospitals, pharmacies, diagnostic and imaging centers, and ambulatory centers) and healthcare payers (public payers and private payers).

The healthcare providers segment captured the maximum share of the market in 2024. Cloud computing technology allows healthcare providers to access patient records, medical images, and other critical data from any location with an internet connection. This accessibility improves collaboration between healthcare professionals and enables remote patient monitoring and telemedicine.

The healthcare payers segment will account for 58.05% market share in 2026. Cloud-based solutions automate and streamline payer processes, such as claims processing, member enrollment, and eligibility verification. This automation reduces manual efforts, speeds up processing times, and improves overall operational efficiency.

REGIONAL INSIGHTS

By region, the market has been analyzed across five major regions, namely North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America Healthcare Cloud Computing Market, 2024

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 25.39 billion in 2025 and USD 29.55 billion in 2026. The growing adoption of cloud services, AI, and big data applications has fueled a surge in healthcare cloud computing demand in the region. Cloud computing enables healthcare organizations to leverage advanced technologies, such as Artificial Intelligence (AI), machine learning, and predictive analytics. These technologies can help improve clinical decision-making, personalize patient care, and optimize operational efficiency. These factors play an important role to boost the market growth in the region. The U.S. market is expected to reach USD 20.87 billion by 2026. For instance,

- In September 2023, According to a survey conducted by Global Healthcare Exchange (GHX), nearly 70% of U.S. health systems and hospitals are planning to implement cloud-based solutions to supply chain management by 2026.

Asia Pacific is expected to register the highest CAGR during the forecast period. Many countries in the region are experiencing rapid digital transformation across various sectors, including healthcare. Governments and healthcare organizations are investing heavily in digital health initiatives to improve healthcare delivery and patient outcomes. The region’s growing population, coupled with increasing healthcare needs, puts pressure on healthcare systems to be more efficient and scalable. Cloud computing offers a solution to handle this growing demand by providing scalable and flexible IT infrastructure. The Japan market is expected to reach USD 3.51 billion by 2026, the China market is expected to reach USD 3.88 billion by 2026, and the India market is expected to reach USD 2.84 billion by 2026. For instance,

Europe is anticipated to record a noteworthy CAGR in the coming years. Cloud providers in Europe invest heavily in security measures to protect sensitive healthcare data. By adhering to strict security standards and regulations, such as the Health Insurance Portability and Accountability Act (HIPPA), cloud computing offers healthcare organizations peace of mind regarding data privacy and compliance. Moreover, various European governments and the European Union have launched initiatives and provided funding to support the digital transformation of healthcare. These efforts include promoting the adoption of cloud computing to improve healthcare delivery and efficiency. The UK market is expected to reach USD 3.69 billion by 2026, while the Germany market is expected to reach USD 3.49 billion by 2026. For instance,

- In December 2023, the European Commission launched a set of calls valued over USD 194 million in the field of data, artificial intelligence, cloud-to-edge infrastructure, and digital skills. These strategic investments are expected to play a vital role in making this Europe's digital decade.

The Middle East & Africa is expected to showcase prominent growth during the forecast period. Many governments in the MEA region are prioritizing digital health initiatives to modernize their healthcare systems. For example, the Saudi Vision 2030 and UAE’s vision 2021 include significant investments in healthcare IT infrastructure, including cloud computing.

Moreover, in South America the market is increasing steadily, as in many parts of the region, healthcare infrastructure is still developing. Cloud computing provides a way to leap traditional infrastructure challenges by offering scalable and flexible IT resources without the need for extensive physical infrastructure investments.

KEY INDUSTRY PLAYERS

Key Market Players to Focus on Partnership and Acquisition Strategies to Expand Their Analytics Services Worldwide

Key players are focusing on expanding their geographical presence across the globe by presenting industry-specific services. Major players are focusing on mergers and acquisitions with regional players strategically to maintain dominance across regions. Top market participants are launching new solutions to increase their consumer base. An increase in constant R&D investments for product innovations is enhancing market expansion. Hence, top companies are rapidly implementing these strategic initiatives to sustain their competitiveness in the market.

List of Top Healthcare Cloud Computing Companies:

- Amazon Web Services, Inc. (U.S.)

- CareCloud, Inc. (U.S.)

- Siemens Healthcare Private Limited (Germany)

- Microsoft (U.S.)

- Dell Inc. (U.S.)

- IBM Corporation (U.S.)

- Oracle Corporation (U.S.)

- Google LLC (U.S.)

- CLEARDATA (U.S.)

- Koninklijke Philips NV (Netherlands)

KEY INDUSTRY DEVELOPMENTS:

- May 2024: Athenahealth, a provider of Electronic Health Records (EHRs) launched specialty EHR solutions to meet the requirements of women's health and urgent care organizations.

- November 2023: Philips launched HealthSuite Imaging, a cloud-based PACS (Picture Archiving and Communication System). It offers integrated reporting, high-speed remote access for diagnostic reading, and AI-enabled workflow orchestration to reduce IT management burden.

- March 2023: Fujitsu launched a new cloud-based health data platform that securely collects, stores, and uses health and health-related data. Fujitsu developed this platform in collaboration with Microsoft Azure.

- June 2022: Siemens launched Siemens Xcelerator to boost digital transformation and value creation for customers of all sizes in various industries. This platform includes Internet of Things (IoT)-enabled hardware, software, and digital services to enhance the productivity and competitiveness of customers.

- March 2022: CareCloud, Inc. unveiled CareCloud Remote, a novel digital health solution that streamlines referral management and advances staff assignment for home case management.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 16.40% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment Model

By Service Model

By Application

By End User

By Region

|

Frequently Asked Questions

The market is projected to record a valuation of USD 251.15 billion by 2034.

In 2025, the market was valued at USD 63.55 billion.

The market is projected to grow at a CAGR of 16.40% during the forecast period.

Based on service model, Software as a Service (SaaS) is expected to lead the market.

Increased digitalization and cloud adoption among industries are the factors driving the market growth.

Amazon Web Services, Inc., Microsoft, IBM Corporation, Siemens Healthcare Private Limited, CareCloud, Inc., and Cleardata are the top players in the market.

North America is expected to hold the highest market share.

Based on end user, healthcare payers is expected to record the highest CAGR during the forecast period.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us