Iron Powder Market Size, Share & Industry Analysis, By Type (Reduced, Atomized, and Other), By End-Use Industry (Automotive, Chemical, General Industrial, Food, and Others) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

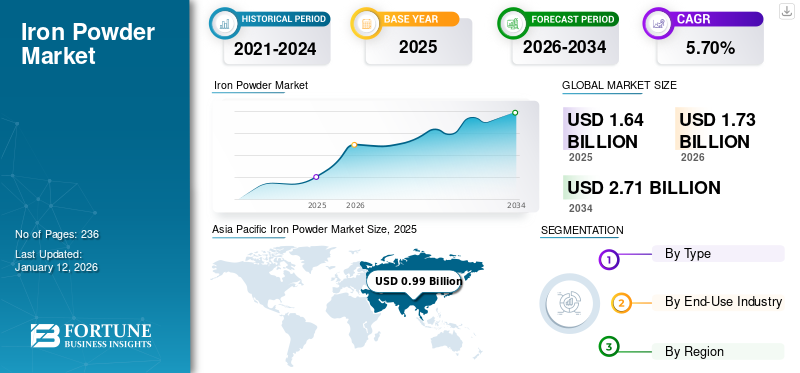

The global iron powder market size was USD 1.64 billion in 2025. The market is projected to grow from USD 1.73 billion in 2026 to USD 2.71 billion by 2034 at a CAGR of 5.70% during the period 2026-2034. Asia Pacific dominated the iron powder market with a market share of 60% in 2025.

Iron powder is a fine powder made of iron metal. There are several types of iron powder, including reduced iron powder, atomized iron powder, electrolytic iron powder, each tailored for specific applications. It is a versatile material widely used in industries such as automotive, chemical production, general industrial, food, and others.

The increasing demand for automotive vehicles and rising disposable income are the primary factors driving the market growth. The growing production of automobiles in countries such as China, Japan, and India is expected to support the demand for parts and components made using iron powder. The increasing penetration of additive manufacturing in the automotive industry is further anticipated to boost the market growth rate. Additionally, powdered iron as an alternative fuel is projected to have a positive influence on the market. Rio Tinto, Höganäs AB, and JFE Steel Corporation are the key players operating in the market. However, the rising incidence of chronic illness caused by excessive consumption of iron-rich supplements will act as a restraining factor for the market.

Global Iron Powder Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 1.64 billion

- 2026 Market Size: USD 1.73 billion

- 2034 Forecast Market Size: USD 2.71 billion

- CAGR: 5.70% from 2026–2034

Market Share:

- Asia Pacific dominated the iron powder market with a 60% share in 2025, driven by growing automotive production, rising demand for additive manufacturing, and robust exports of steel and electronics components from China, India, and Japan.

- By type, the atomized segment is expected to retain the largest market share in 2025, supported by its high purity and consistency for applications in 3D printing, welding, and metal injection molding across aerospace, healthcare, and electronics industries.

Key Country Highlights:

- China: In 2024, China imported a record 1.24 billion metric tons of iron ore, up 4.9% from 2023, driven by strong demand in steel exports and manufacturing of automotive and electronics parts.

- United States: Growth is supported by rising adoption of additive manufacturing and powdered iron in nutrition and EV technologies, along with anti-dumping measures promoting domestic production.

- Germany: High demand for precision automotive components and advanced additive manufacturing technologies is boosting the use of iron powder in lightweight design and high-performance applications.

- India: Strong growth in auto parts manufacturing and urban infrastructure projects are increasing demand for reduced and atomized iron powder from local SMEs and OEM suppliers.

- United Arab Emirates: Industrialization and expanding applications of iron powder in coatings, chemical reagents, and surface treatments are driving growth across the Middle East & Africa region.

IRON POWDER MARKET TRENDS

Growing Trend Toward Additive Manufacturing Positively Impacts Market Growth

Additive manufacturing allows for precise control over material properties and complex part geometries, making iron powder a valuable material for producing metal parts. The demand for powder in this sector is expected to grow as industries adopt 3D printing for rapid prototyping and production. The rise of 3D printing technologies has led to an increased demand for product as a key material in additive manufacturing processes. As the automotive industry seeks more efficient and sustainable processes, the use of product is set to increase. Major automakers are actively investing in additive manufacturing, with significant production volumes of 3D printed parts. Collaborations between industry leaders and technology suppliers are driving advancements in additive manufacturing technologies, further integrating products into automotive production. Thus, a rising trend toward the adoption of new additive manufacturing is likely to create new market growth opportunities, driving market growth during the forecast period.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Surging Product Demand from Automotive Industry to Drive Market Growth

The rapid growth in population and the rising disposable income are the prominent factors boosting the demand for automobiles globally. In the automotive industry, powdered iron consumption is owed to metallurgy applications through which various parts and components, including bearings, gears, camshaft pulleys, and crankshaft sprockets, are manufactured. In addition to this, powdered iron is used for cutting, welding, and producing structural parts. Moreover, processes such as metal injection molding and additive manufacturing have gained traction in the automotive industry due to their ability to produce complex designs

Automotive manufacturers such as Porsche, Mercedes-Benz, and Volkswagen produce parts and components using additive manufacturing technology. Such initiatives are expected to grow and contribute to the iron powder market growth during the forecast period.

Increasing Product Demand from Electronics Industry to Drive Growth

The electronics industry is experiencing exponential growth, driven by technological advancements and the proliferation of electronic devices. Iron powder is essential for producing components, such as magnetic cores, electromagnetic shielding, and electronic circuits, from smartphones and tablets to wearable gadgets and IoT devices. Additionally, emerging technologies, such as Electric Vehicles (EVs), renewable energy systems, and 5G infrastructure, require advanced electronic components, driving the product demand. This is integral to producing magnetic materials used in EV motors, renewable energy generators, and high-frequency electronics, further driving the market growth. Moreover, the increasing adoption of electronic devices across regions, such as Asia Pacific, North America, and Europe, contributes to the global expansion of the market.

MARKET RESTRAINTS

Risks Associated with High Consumption of Iron-Rich Products to Impede Growth

In the food industry, iron powder is in high demand for iron nutritional supplements and for treating iron nutritional deficiencies. However, higher consumption of iron-rich supplements is associated with the incidence of chronic diseases. Excessive consumption of iron can have detrimental effects on the gastrointestinal system. An out-of-proportion intake of iron causes vomiting, diarrhea, nausea, and stomach pain. Over time, iron accumulates in the organs, causing fatal damage to the brain and liver. The above-stated reasons are likely to act as a restraining factor for the market.

MARKET CHALLENGES

Fluctuations in Raw Material Prices May Hamper Market Growth

Price volatility in the market is a significant challenge that affects its growth and stability. This volatility primarily stems from fluctuations in the prices of raw materials, particularly iron ore, which is the primary input for iron powder production. Fluctuations in raw material prices, particularly iron ore, pose a significant challenge to the growth of the market. These fluctuations are driven by global supply-demand dynamics, geopolitical events, and macroeconomic conditions, which can lead to unpredictable production costs and affect market stability. As iron powder production heavily relies on the availability and cost of raw materials, sudden spikes or drops in iron ore prices can disrupt the cost structure for manufacturers, leading to uncertain profit margins and increased financial risks.

MARKET OPPORTUNITIES

Increasing Adoption of Iron Powder as an Alternative Fuel Source to Favor Growth

Powdered iron is slowly gaining popularity as a sustainable fuel option and is expected to replace industrial fossil fuels. Finely grounded powder, when burnt, produces high temperature and releases energy as it undergoes oxidation with zero carbon emission, and the iron oxide obtained as a residual product is recycled. Additionally, the powdered iron serves as an energy storage medium. Excess energy generated from solar panels is used to convert iron oxide into iron, which is later used as a fuel. Swinkels Family Brewers, a beverage company based in the Netherlands, has incorporated heat generation using powdered iron at an industrial scale. The cyclical iron fuel system installed at the company’s brewery can provide the heat necessary to produce 15 billion beer glasses.

TRADE PROTECTIONISM

Trade War Among Global Economic Powers to Influence Market Dynamics

The global iron powder market is influenced by trade policies and protectionist measures. For instance, the U.S. government imposed anti-dumping tariffs on all Chinese products, including metal powder, stating that unfair pricing threatened domestic production and jobs. Such measures aim to level the competitive landscape by raising import prices and encouraging local production. While protectionist policies can support local industries and preserve employment, they may also lead to higher costs for downstream users and trigger retaliatory trade actions, ultimately impacting global market dynamics.

IMPACT OF COVID-19

The COVID-19 pandemic inflicted a ban on human resources and materials transportation, resulting in abrupt stoppage of the production facilities and supply chains. As a result, automotive manufacturers were unable to procure raw materials to manufacture their products. The pandemic disrupted the production volume of vehicles in Europe, the exports of automotive parts and components from China, and the shutting up of assembly lines in the U.S. As per the statistics provided by the Society of Indian Automobile Manufacturers (SIAM), the total production of vehicles in India during the period of April-March 2023 declined by 14.7% compared to the same period in 2019.

SEGMENTATION ANALYSIS

By Type

Atomized Segment to Hold Majority Market Share Owing to Rising Demand from Various End-use Industries

Based on the type, the market is segmented into reduced, atomized, and others.

The atomized segment is likely to hold the dominant share of 75.14% in 2026. The atomized segment is expected to hold the largest global iron powder market share in revenue during the forecast period. Atomized powder, created by melting iron and atomizing it into fine particles, is favored for its high purity and consistency. It is extensively used in additive manufacturing (3D printing), metal injection molding, and welding industries. The global demand for atomized powder is rising, particularly due to the growth of 3D printing technologies and the need for advanced materials in aerospace, healthcare, and electronics.

Reduced powder, primarily produced through the reduction of iron ore using gases such as hydrogen or carbon monoxide, is widely used in industries such as automotive, metallurgy, and chemical manufacturing. The global demand for reduced powder has been steady, driven by its applications in powder metallurgy for producing high-strength, lightweight components. However, growth of this powder is influenced by fluctuations in the automotive sector, which is a major consumer, and the shift toward sustainable production methods.

Other types of iron powder, such as electrolytic and carbonyl powders, cater to niche applications such as electronics, magnetic materials, and food fortification. While these segments represent a smaller portion of the global market, they are growing due to advancements in technology and increasing demand for specialized materials.

To know how our report can help streamline your business, Speak to Analyst

By End-Use Industry

Automotive Segment to Remain Dominant Due to Product Adoption in Different Auto Components

Based on the end-use industry, the market is segmented into automotive, chemical, general industrial, food, and others.

The automotive segment is likely to hold the dominant share 53.76% in 2026. The automotive sector is one of the largest consumers of iron powder, primarily for the production of Powder Metallurgy (PM) components. The demand is driven by the need for lightweight, durable, and cost-effective materials that improve fuel efficiency and reduce emissions. With the global shift toward Electric Vehicles (EVs), iron powder is also gaining traction in the production of Soft Magnetic Composites (SMCs) used in electric motors and other EV components. Regions such as Asia Pacific, Europe, and North America are major contributors to this demand due to their robust automotive manufacturing bases.

In the chemical industry, the powder is used as a reducing agent, catalyst, and raw material for producing various chemical compounds. It plays a crucial role in processes such as the production of ammonia (via the Haber process) and the reduction of metal oxides. Additionally, this powder is utilized in wastewater treatment to remove contaminants and in the synthesis of iron-based chemicals such as ferrous sulfate and ferric chloride.

The powder is found to be extensively used in general industrial end-use industries, including the manufacturing of machinery, tools, and equipment. It is a key material in the production of sintered parts, filters, and friction materials. The construction industry also utilizes this powder in coatings and anti-corrosion applications.

The powder is also utilized in a variety of niche applications, which include magnetics in motors (renewable energy), 3D printing, pyrotechnics, and others. Technological advancements and the growing need for innovative materials in high-performance applications drive the demand in these sectors.

IRON POWDER MARKET REGIONAL OUTLOOK

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Iron Powder Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific dominated the market with a valuation of USD 0.99 billion in 2025 and USD 1.04 billion in 2026. This is primarily attributed to China being the manufacturing hub for products ranging from automotive OEM to electronic products. China, India, and Japan are the major contributors to the region's growth due to the demand from small and medium-sized component manufacturers. In 2024, China imported a record 1.24 billion metric tons of iron ore, a 4.9% increase from 2023, driven by lower prices and strong demand, particularly due to substantial steel exports.

The Japan market is projected to reach USD 0.2 billion by 2026, the China market is projected to reach USD 0.57 billion by 2026, and the India market is projected to reach USD 0.09 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

The North America region is expected to dominate the Share 12% in 2025. The increasing popularity of technologies such as additive manufacturing and powder forging in the U.S. is expected to drive the market in North America. Additionally, the rising consumption of iron and nutritional supplements amongst consumers is expected to surge the demand for powdered iron. The U.S. market is projected to reach USD 0.17 billion by 2026.

Europe

The Europe region is expected to dominate the Share 20% in 2025. Countries such as the U.K., Germany, and France have a major influence on the growing product demand in Europe. The need for automotive OEM manufacturers to produce components and parts with complex designs and geometry to reduce the total weight of vehicles is anticipated to fuel the region's market growth. The UK market is projected to reach USD 0.03 billion by 2026, and the Germany market is projected to reach USD 0.08 billion by 2026.

Latin America

The Latin America region is expected to dominate the Share 5% in 2025. Latin America is expected to showcase substantial growth due to increasing urbanization, infrastructure development, and the rising pharmaceutical industry.

Middle East & Africa

The Middle East & Africa region is expected to dominate the Share 4% in 2025. Rapid-paced industrialization drives the demand for iron-rich powder for several applications, such as chemical reagents, oxygen absorbers, and surface coating, in Middle Eastern countries. This is expected to propel the demand for the market in the Middle East & Africa in the forthcoming years.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Innovation in Production Technologies Amplify Market Competition

The market includes multiple established players with strong regional footholds and specialized capabilities. Competition is particularly intense in commoditized segments where cost efficiency is of high priority. Continuous technological improvements and process innovations drive companies to compete on quality, cost, and application-specific performance. There is high competitive rivalry due to the presence of multiple competitors and pressure to maintain profit margins in a technology-driven market.

LIST OF KEY COMPANIES PROFILED:

- JFE Steel Corporation (Japan)

- Höganäs AB (Sweden)

- Reade International Corporation (U.S.)

- Industrial Metal Powders (India) Pvt. Ltd. (India)

- American Elements (U.S.)

- BASF SE (Germany)

- CNPC Powder North America Inc. (Canada)

- American Carbonyl (U.S.)

- Rio Tinto Metal Powders (U.K.)

- Kushal Chemicals (India)

KEY INDUSTRY DEVELOPMENTS:

- March 2025 - Höganäs AB announced that it has entered into a partnership with Porite TAIWAN Co., Ltd., a prominent manufacturer of precision components. As per this partnership, Höganäs AB will supply its newly developed zero sponge iron powder to Porite, gradually replacing its currently used standard sponge iron powders. The move is expected to reduce carbon emissions during the production and overall lifecycle of products that Porite manufactures.

- January 2024 - JFE Steel Corporation announced that, in partnership with JFE Techno-Research Corporation and Armis Corporation from Shizuoka University, it developed an axial-gap motor using insulation-coated pure-iron powder Denjiro. This motor matches the power of larger radial-gap motors but is 48% thinner and 40% lighter than similar axial-gap models.

- April 2023 - Höganäs is the first company in the metal powder sector to obtain SBTi approval. This initiative encourages leading practices in establishing science-based targets and will assess Höganäs' advancement toward its carbon neutrality goals annually.

- November 2020 - Mimete S.r.l., Biassono, Monza, Italy, released two iron base powders, Super-duplex F53 and Duplex MARS F51. The launch will cater to the demand from oil & gas, power generation, and aerospace industries for additive manufacturing application.

- October 2020 - Sumitomo Electric Industries, Ltd., headquartered in Osaka, Japan, developed a power magnetic core for axial gap motors. The powder magnetic core is formed by die-pressing soft-magnetic iron powder into a three-dimensional shape. This enabled the company to fulfill the recent growth in demand for lightweight and high-performance motors.

REPORT COVERAGE

The global market report provides a detailed analysis of the market. It focuses on key aspects such as profiles of leading companies, product types, and leading applications of the product. Besides this, it offers insights into the analysis of key market trends and highlights key industry developments. In addition to the aforementioned factors, it encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Volume (Kiloton); Value (USD Billion) |

|

Growth Rate |

CAGR of 5.70% during 2026-2034 |

|

Segmentation |

By Type

|

|

By End-Use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 1.64 billion in 2025 and is projected to record a valuation of USD 2.71 billion by 2034.

In 2026, Asia Pacific stood at USD 1.04 billion.

Registering a CAGR of 5.70%, the market will exhibit steady growth during the forecast period.

The automotive segment is expected to lead this market during the forecast period.

The increasing incorporation of powdered iron in the automotive industry is the major factor driving the growth of the market.

JFE Steel Corporation, Hoganas AB, and Reade International Corporation are the major players operating in the market.

Asia Pacific dominated the iron powder market with a market share of 60% in 2025.

The growing usage of powdered iron as an alternative fuel, along with the integration of additive manufacturing technology in production lines, is expected to drive the adoption of this product.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us