Japan Dietary Supplements Market Size, Share & Industry Analysis, By Form (Tablets, Capsules, Liquids, Powder, and Others), By Type (Vitamins, Minerals, Enzymes, Fatty Acids, Proteins, and Others), By Application (Energy & Weight Management, Bone & Joint Health, General Health, Immunity, Brain & Mental Health, Skin/Hair/Nails, Cardiac Health, Healthy Aging, and Others), By End-Users (Children, Adults, Pregnant Women, and Geriatrics), By Distribution Channel (Supermarkets/Hypermarkets, Pharmacies, Online, and Others) and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

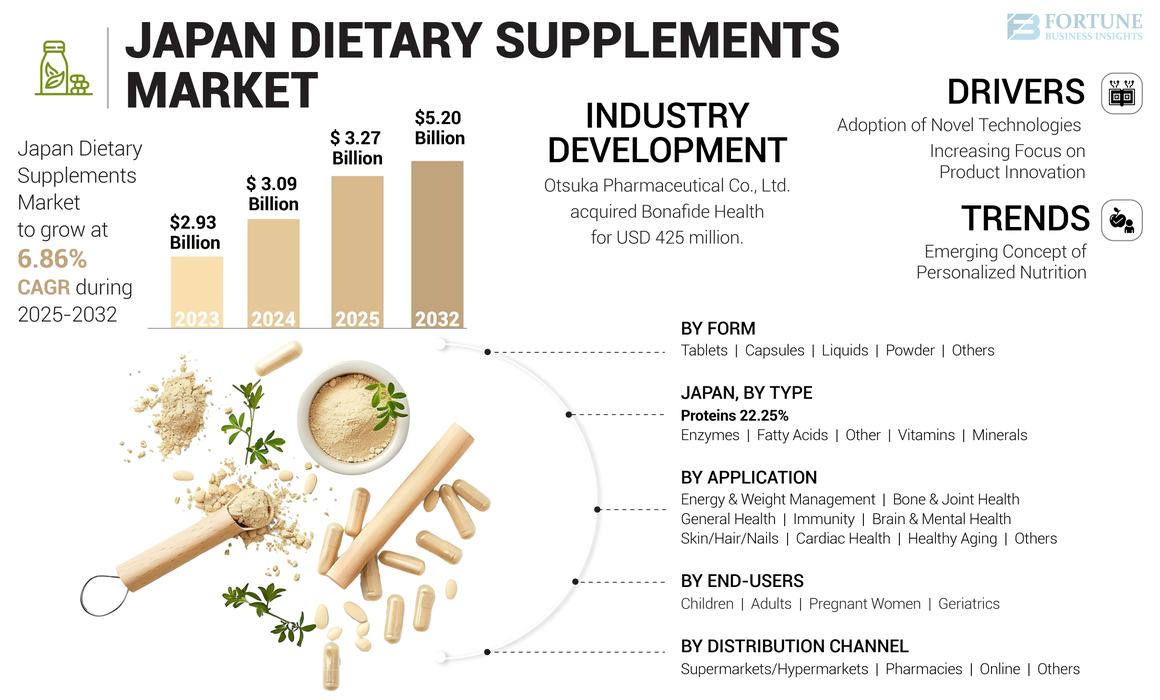

The Japan dietary supplements market size was valued at USD 3.09 billion in 2024. The market is expected to grow from USD 3.27 billion in 2025 to USD 5.20 billion in 2032, exhibiting a CAGR of 6.86% during the forecast period.

Dietary supplements come in the form of pills, capsules, powders, and drinks that contain minerals, vitamins, amino acids, herbs, and other nutrients. They are developed with the intention of adding the nutrients that are lacking in a conventional diet. The market has seen positive growth with increasing demand for athletic and physical performance-enhancing supplements among adults. Additionally, the popularity of nutritional supplements and importance of preventive healthcare among adults and geriatric consumers is positively impacting the market. Increasing athletic activities, building muscles, beauty supplements, and weight management concern among millennials and Gen Z consumers is supporting the growth of the Japanese dietary supplement market. Emerging concept of personalized nutrition, technical advancements, new product developments, and key players' geographical expansion activities are also supporting the market growth in the country.

The COVID-19 pandemic supported the expansion of the industry in the country. The outbreak boosted the importance of dietary supplements in achieving effective health and immunity. As a result, the consumption of nutrition supplements, especially vitamins and minerals, increased considerably during this period. Additionally, the implementation of various precautionary measures, such as lockdowns, quarantines, and restricted social gatherings to control the virus spread affected the mental health of the Japanese significantly. It also affected the sales of supplements that support cognitive health during the pandemic period.

Japan Dietary Supplements Market Trends

Emerging Concept of Personalized Nutrition to Shape Industry Outlook

The Japanese have shown a radical change in supplement consumption patterns in recent times. Personalized nutrition is an emerging concept driving the dietary supplements and nutraceuticals industry globally. This emerging trend has also shaped the Japanese supplement industry in the last couple of years. The increasing elderly population, along with growing fitness concerns among adults, is driving the demand for tailored nutrition supplement products nationwide. For instance, a couple of years ago, Nestle Japan introduced personalized nutrition services using AI and DNA testing in the country. The company experienced nearly 2.8% growth in that segment in that particular financial year.

Download Free sample to learn more about this report.

Japan Dietary Supplements Market Growth Factors

Increasing Focus on Product Innovation to Propel Market Growth

Japan is one of the key markets in the Asia Pacific dietary supplement industry. Japanese consumers are health-conscious and searching for high-quality supplement products. The rising demand for supplement food products will unleash enormous opportunities for companies to bring novel products to retail shelves. As a result, numerous start-ups and new enterprises are collaborating with established players to explore advanced technologies and product innovations to develop health-promoting supplement products. Furthermore, new players in the industry are involved in developing tech-driven products to satisfy their client base and offer next-generation product solutions. To enhance their business operations and R&D activities, they are seeking financial support from investors. The rising product innovation, coupled with increased fundraising for product development activities, will positively impact the Japan dietary supplements market growth.

Adoption of Novel Technologies to Support Market Development

The emerging trend of personalized nutrition is strongly influencing prominent players to adopt advanced technologies, such as artificial intelligence, 3D mapping, and the Internet of Things (IoT). These advanced technologies assist them in developing customized products to meet their client’s requirements. For instance, in November 2022, Nourished, a brand of U.K.-based company Rem3dy, secured approximately USD 2.58 million in investments from Suntory Holdings, a leading Asian health food company. Suntory aimed to use Nourished's 3D printing methods and vegan encapsulation formula to create personalized daily nutrient gummies and supplement products for the Japanese market. Therefore, the increasing number of novel technologies in the industry is driving the dietary supplements market in Japan.

RESTRAINING FACTORS

Premium Price Range and Regulatory Complexities Associated With Product to Impede Market Growth

Dietary supplements are relatively expensive for consumers. Furthermore, continuously rising raw material prices further increases the price of final products. Therefore, price-conscious consumers opt for lower-priced substitutes, such as fruits, vegetables, meat, and fish, which may impede the market growth in the coming years. Furthermore, government interference in ensuring food product safety and efficiency is further creating challenges for manufacturers. Ingredients used in supplement products must meet regulatory restrictions. These regulatory challenges will further affect the market’s growth.

Japan Dietary Supplements Market Segmentation Analysis

By Type Analysis

Vitamin Deficiency among Users Boosts Demand for Vitamin Supplements

On the basis of type, this market is segmented into vitamins, minerals, enzymes, fatty acids, proteins, and others.

The vitamin supplements segment dominates the Japanese dietary supplement market share. Over the past decade, young adults across the country have been facing micronutrient deficiency, especially deficiency of Vitamins A, C, and iron. Furthermore, a larger proportion of pregnant women in Japan are facing deficiency of folate, vitamin B12, vitamin D, calcium, and magnesium. It significantly impacts an individual’s health and the overall birth rate. According to the WHO, approximately 23.4% of pregnant women in Japan have gestational anemia. Thus, the government and non-profit organizations are actively involved in educating consumers regarding the importance of vitamins. It will likely propel the demand for vitamins in the country.

The protein supplements segment is anticipated to record the fastest growth rate during the forecast period. Emerging concerns regarding bodybuilding and improving physical endurance among adults and millennials are driving the demand for these supplements in Japan.

To know how our report can help streamline your business, Speak to Analyst

By Form Analysis

Easy Availability and Storage Factors to Positively Influence Purchase of Tablet Form of Supplements

On the basis of form, the Japan dietary supplements market is divided into tablets, capsules, liquid, powder, and others. The others segment contains gummies and soft gels.

The tablets segment holds the largest market share. Tablet forms of dietary supplements come with several benefits, such as high affordability, convenient packaging, and more accessibility across various sales channels. These factors will significantly influence the product sales across the country. Tablet form has lower technical challenges during the processing stages and hides bad smell and taste. Thus, fewer technical challenges to produce, concentrated delivery of active ingredients, hiding bad smells, and long shelf life make it ideal for dietary supplements.

The increasing technological advancements, paired with the adoption of innovative solutions, are driving the popularity of capsule formats in the dietary supplement industry. Along with greater shelf-life, these capsules offer the benefit of convenient packaging. Since, tablets and capsules can be packed in small packets, it helps users complete their daily intake of supplements despite their busy schedules and travels. Therefore, the segment is anticipated to record the fastest CAGR during the forecast period.

By Application Analysis

Increasing Concern about General Health and Immunity to Drive the General Health Supplements Demand

On the basis of application, the market is divided into energy & weight management, bone & joint health, general health, immunity, brain & mental health, skin/hair/nails, cardiac health, healthy aging, and others.

The general health segment holds the largest share of the market. The increasing aging population in the country has created a positive impact on the demand for general health supplements. According to the National Institute of Population, individuals aged over 65 years are expected to account for 34.8% of the total country's population by 2040.

After the COVID-19 pandemic, consumers have become inclined toward supplements that enhance their immune systems. As a result, supplement manufacturers are introducing new products under this category. Therefore, immunity-boosting supplements are anticipated to expand at a prominent growth rate in the future.

The energy & weight management segment is anticipated to record the highest CAGR during the forecast period. Millennials and Gen Z consumers are inclined toward fitness and bodybuilding, which is strongly influencing the demand for weight management supplements. Furthermore, increased sports activities and events are further driving the demand for these products in the country.

By End-Users Analysis

Increasing Inclination of Adults Towards Healthy Lifestyles to Generate the Largest Sales from the Adults Segment

Based on end-users, the market has been segmented into children, adults, pregnant women, and geriatrics.

The adults segment dominates the Japan dietary supplements market share. Adults across Japan are emphasizing on adopting healthy lifestyles and diet practices for better long-term health and well-being. According to a research study conducted in 2021 and approved by the Research Ethics Committee of the National Institutes of Biomedical Innovation, Health, and Nutrition, approximately 35.1% of the Japanese use supplements more often. This study surveyed 14,741 Japanese adults and claimed that their perception toward different supplements varied. However, nearly 93.2% of respondents preferred to purchase vitamin C supplements for better health and immunity.

The children segment is anticipated to record a higher CAGR during the forecast period. The increasing popularity of nutritional supplements and their importance in children's growth and mental functioning are likely to help them gain more traction among parents in the country. Furthermore, increasing government initiatives and parents' positive attitude toward dietary supplements and nutrition are driving the sales of supplement products developed for children.

By Distribution Channel Analysis

Increasing Influence of Online Retailing to Make Online Stores as the Top Distribution Channels

Based on distribution channel, the market is segmented into supermarkets/hypermarkets, pharmacies, online stores, and others.

The online distribution channel is anticipated to record the highest CAGR in the coming years. The increasing influence of online retailing and rising internet accessibility across the country is driving the sales of nutraceuticals from online sales channels. Additionally, exposure to global supplement products that come with clear labelling and usage manuals are the other key factors that drive the popularity of online sales channels in the country.

The pharmacies segment holds the largest market share. Drugstores and pharmacies offer personalized supplements to consumers. Furthermore, these sales channels provide effective product knowledge and prescriptions for usage. Therefore, consumers often prefer to purchase the product from drugstores and pharmacies.

KEY INDUSTRY PLAYERS

Business Growth Strategies Executed by Key Companies to Strengthen their Market Presence

The Japanese dietary supplement market exhibits a moderately consolidated structure due to the establishment of several companies. The few prominent players in the industry, such as Otsuka Pharmaceuticals, Ajinomoto, Danone, and Nestle Health Science hold significant shares with their established supplier network, brand image, product portfolio, and client base. Thus, the business growth strategies executed by key players will assist them in strengthening their presence and staying ahead in the competitive landscape.

The Japanese market will have growth opportunities in the coming years owing to the increasing popularity of healthy and nutritional supplement products among younger consumers. It is creating more opportunities for emerging players, such as Fine Japan, Meiji Holdings, House Foods Group and others.

LIST OF TOP JAPAN DIETARY SUPPLEMENTS COMPANIES:

- Otsuka Pharmaceutical Co., Ltd. (Japan)

- FANCL Corporation (Japan)

- Ajinomoto Co., Inc. (Japan)

- Meiji Holdings Co., Ltd. (Japan)

- Groupe Danone (Japan)

- Nestle Health Science (Japan)

- House Foods Group Inc., (Japan)

- ORIHIRO Co., Ltd. (Japan)

- Fine Japan (Japan)

- Kowa Company, Ltd (Japan)

KEY INDUSTRY DEVELOPMENTS:

- June 2024 - Kirin Holdings Company Limited, a leading Japanese beer company, entered the cosmetics & food supplements industry by acquiring one of the leading Japanese dietary supplement companies, FANCL Corp, for around USD 1.4 billion.

- May 2024: Natural Tech Co. Ltd., a Japan-based start-up specialized in the manufacturing of wellness products, expanded its product offering by launching a new supplement ‘Eyepa’ to solve eye-related problems. The newly launched product claims to be an “all-in-one” supplement to solve multiple eye problems including eye strain, dry eye, and accommodation issues.

- March 2024: Nature Made, a subsidiary of Otsuka Pharmaceutical Co., Ltd., launched a range of Nature Made Zero Sugar‡ Gummies. The newly launched gummies are Nature Made Zero Sugar‡ Multivitamin Gummies, Nature Made Zero Sugar‡ Vitamin C Gummies, Nature Made Zero Sugar‡ Vitamin D3 Gummies, Nature Made Zero Sugar‡ B-12 Gummies, and Nature Made Zero Sugar‡ Melatonin Gummies. These products are available across the world including Japan.

- December 2023 - Otsuka Pharmaceutical Co., Ltd., a Japanese drugmaker, acquired U.S.-based women's health food company, Bonafide Health for USD 425 million. The acquisition helped the company expand its supplement products in both the U.S. and Japanese markets.

- March 2023 – Otsuka Pharmaceutical Co., Ltd., one of the leading pharmaceutical companies in Japan, launched a new range of supplements to support women's health and beauty - EQUELLE gelée. The new product offers all-in-one health and beauty support with vital ingredients, such as vitamin D, collagen, and calcium.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, types, and distribution channels. It also offers a detailed analysis and insights on the market share, trends, growth factors, and key market trends. Besides this, it offers insights into the key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.86% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Type

|

|

By Form

|

|

|

By Application

|

|

|

By End-Users

|

|

|

By Distribution Channel

|

Frequently Asked Questions

Fortune Business Insights says the market size was valued at USD 3.09 billion in 2024 and is expected to reach USD 5.20 billion in 2032.

The market is likely to register a CAGR of 6.86% over the forecast period.

The vitamin supplement is the leading segment in the market.

The increasing aging population, coupled with rising health consciousness, is driving the market.

Otsuka Pharmaceutical Co., Ltd., FANCL Corporation, Ajinomoto Co., Inc., Meiji Holdings Co., Ltd., Groupe Danone, Nestle Health Science and others are the major players in the market.

Increasing development of personalized dietary supplements is likely to drive the market in the coming years.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us