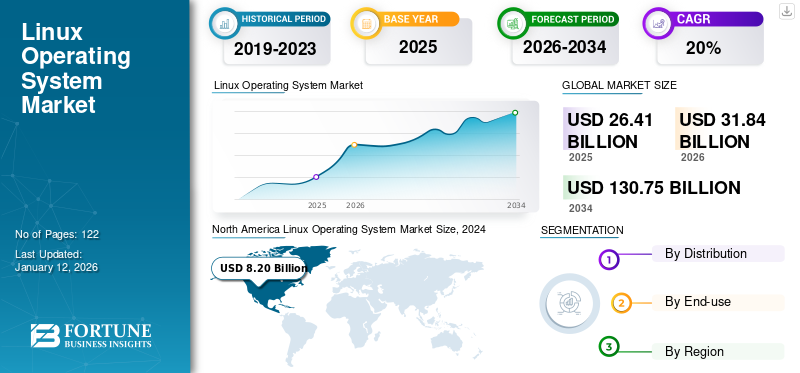

Linux Operating System Market Size, Share & Industry Analysis, By Distribution (Virtual Machines, Servers, and Desktops), By End-use (Commercial/Enterprise and Individual), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

The global Linux operating system market size was valued at USD 21.97 billion in 2024. The market is projected to grow from USD 26.41 billion in 2025 to USD 99.69 billion by 2032, exhibiting a CAGR of 20.9% during the forecast period. North America dominated the global market with a share of 37.32% in 2024. Additionally, the U.S. linux operating system market is predicted to grow significantly, reaching an estimated value of USD 25,261.3 million by 2032, owing to robust IT infrastructure characterized by high-speed internet connectivity, advanced data centers, and widespread adoption of cloud computing technologies.

The LINUX Operating System, or Linux OS, is an open-source operating system that allows users to modify, distribute, and enhance the code according to their needs, fostering a vibrant community of developers and contributors. It offers stability, security, and versatility, and it is widely used in various computing environments, including desktops, servers, and virtual machines.

In our scope, we have considered solutions provided by companies, including Amazon Web Services, Inc., IBM Corporation, Oracle Corporation, Canonical Ltd., SUSE, Microsoft Corporation, Wind River Systems, Inc., MONTAVISTA SOFTWARE, LLC, Google LLC, and Alibaba Group among others. These companies offer Linux OS distribution in three types: virtual machines, servers, and desktops for commercial and individual end-users. For instance,

- In September 2022, IBM Corporation introduced the LinuxONE server to enterprises looking for lower energy-consuming solutions as a business sustainability strategy. This is a Kubernetes and Linux-based platform that can enable huge workloads with thousands of footprints under a single system.

Furthermore, the need for open-source digital workplace solutions, such as chat applications, video conferencing platforms, and others, gained momentum during the COVID-19 pandemic. The increased demand for open-source software boosted the Linux operating system market growth amid the pandemic.

IMPACT OF GENERATIVE AI

Increased Adoption of Generative AI to Streamline Software Development Processes to Fuel Market Growth

Businesses are increasingly realizing the importance of leveraging and investing in open-source solutions. There has been a remarkable shift in enterprise adoption of open-source software, as well as an increased dependence on open-source software as a base of proprietary software solutions.

Generative AI can streamline software development processes by automating tasks, such as code generation, bug fixing, and even software testing. This could lead to faster development cycles and reduced time-to-market for Linux-based projects. Generative AI platforms can facilitate collaborative development and knowledge sharing within the Linux community. By analyzing vast repositories of code and documentation, AI algorithms can extract insights, identify best practices, and assist developers in resolving technical challenges more efficiently.

To conclude, the impact of generative AI on the Linux OS market is contingent upon the adoption of these technologies within the development community, as well as the ability to address associated challenges, such as ethical considerations, security risks, and integration with existing workflows.

Linux Operating System Market Trends

Increasing Adoption of Hybrid Cloud Technology to Increase Demand for Linux Operating Systems

Major players in the market, such as CloudLinux, Inc., IBM Corporation, and others, are developing OS-based hybrid cloud computing models. Increasing adoption of OS-based hybrid cloud platforms with advanced security, enhanced server stability, and density has propelled the demand for Linux operating systems. The cloud-based Linux operating system is mainly developed for hosting users. This cloud-based operating system helps isolate users in a separate Lightweight Virtualized Environment (LVE). This offers users secure allocation, partitions, and restrictions for server resources. Cloud-based OS helps to protect the users’ database and websites from unstable and unwanted scripts and cyber-attacks. For instance,

- In February 2023, Abu Dhabi-based G42 Cloud announced a partnership with Red Hat to make Enterprise Linux and OpenShift available in its cloud. Through this cloud provision, companies are offering secured capabilities to clients and supporting digital transformation.

- In January 2023, Oracle Corporation announced a strategic collaboration with Red Hat to expand Red Hat Enterprise Linux on its Oracle Cloud Infrastructure (OCI). These companies are offering mission-critical cloud services, higher performance, and digitalization-supporting operations to their clients across the globe.

Owing to this, the adoption of cloud-based OS is growing in the market. In addition to this, cloud-based OS offers a wide range of features, such as 80% enhanced server utilization, increased stability, server control, managing and operating data and applications, and more. The increasing adoption of cloud platforms will aid the Linux operating system market growth.

Download Free sample to learn more about this report.

Linux Operating System Market Growth Factors

Increasing Adoption of Linux Operating Systems among Servers and Embedded Systems to Aid Market Growth

Linux, renowned for its robustness and security, is widely favored for deployment across desktops, servers, virtual machines, and embedded systems. Operating under an open-source license, Linux offers extensive customization options for its Graphical User Interface (GUI) at minimal cost, enabling users to develop their Linux distributions (Distros). This has led to a proliferation of Distros providers, such as Arch Linux, Ubuntu, Fedora, Kubuntu, and Linux Mint. According to hostingtribunal.com, in 2019, over 96% of the top 1 billion servers globally were powered by Linux. Furthermore, Linux has gained traction in commercial embedded applications, including communication, supercomputing, clustering, and medical imaging, driving its global market growth.

As of May 2020, Linux ranks among the top 500 most powerful operating systems globally, according to Net Applications. Additionally, based on the Linux kernel, the Android operating system boasts the largest installed base globally on tablets and smartphones. This increasing preference for embedded systems and servers is expected to propel the Linux operating system market share.

RESTRAINING FACTORS

Intense Competition from Windows and Limited Adoption of Linux OS is Hampering Market Growth

Although Linux possesses many features, such as better security, reliability, and flexibility in consumer markets, it comparatively has a low market share, owing to the penetration and adoption of Windows OS among large enterprises and consumers. Linux is not very user-friendly, whereas Windows GUI is simple and easy to use.

- According to StatcCounter’s March 2024 statistics, the Windows OS holds around 72.5% of the total global desktop operating system market share, while Linux has a 4.1% share.

Linux-based OS devices are complex against threats and have limited specific functionality. It is less user-friendly than Windows GUI. Moreover, to switch to Linux, it is essential to install the necessary compatible software, hardware, and drivers in the computer for this operating system. Also, there are limited hardware manufacturers that offer drivers for Linux-based OS as compared to Windows, which hinders the Linux OS market growth.

Furthermore, this OS is difficult to use compared to Windows, requiring a high skill set and knowledge about computing. This is challenging for beginners, as they have to learn many different processes and functionalities that hinder the market growth globally.

Linux Operating System Market Segmentation Analysis

By Distribution Analysis

Servers Segment to Dominate the Market Due to Highest Sales Generated

By distribution, the market is segmented into virtual machines, servers, and desktops. Among these, the servers segment is expected to dominate the market share during the forecast period. Key players in the market have generated the highest revenue through the sales of OS across servers and virtual machines. Server-based OS provides various benefits to organizations, such as pre- and post-customizations, advanced security models, high storage facilities, and others.

Prominent players, such as Red Hat, Inc., IBM Corporation, Oracle Corporation, and others, are developing Linux operating systems for virtual machines and web servers. For instance,

- In June 2020, the CloudLinux division of TuxCare security services launched the QEMUCare Live patching service for Linux. It runs on virtual machines and hosts through open-source QEMU, open-source hardware, and the emulator virtualization platform.

The virtual machines segment is expected to grow with the highest CAGR, owing to a surge in user adoption. The growth is primarily attributed to the rise in the adoption of the OS in virtual machines across commercial businesses, where security is essential.

To know how our report can help streamline your business, Speak to Analyst

By End-use Analysis

Rising Popularity of Cloud Computing Technologies and Surge in Online Gaming Software Users Boosts Commercial/Enterprise Segment Growth

By end-use, the market is bifurcated into commercial/enterprise and individual.

The commercial/enterprise segmental dominance is primarily attributed to the rising demand for cloud-based and hybrid OS among commercial and enterprise users. Several leading companies in the market are launching enhanced graphical interface, security, and reliability features-based systems for online gaming software users across the globe.

- In July 2021, Valve launched Linux and KDE-powered portable gaming system platforms for desktop and PC users. Steam Deck is a Linux-powered KDE interface-based system that is compatible with playing Windows games on Linux without additional cost.

With the rise in demand for cloud-based OS and a surge in online gaming software users, the commercial/enterprise segment is expected to boost further during the forecast period.

Furthermore, the individual segment is expected to grow with a steady CAGR during the forecast period. The growth of the individual segment is primarily due to its low cost and ease of availability of OS for desktop users. Also, this OS is the most secure, user-friendly, reliable, and flexible operating system for desktops.

REGIONAL INSIGHTS

The global market scope is classified across five regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America Linux Operating System Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominates the market and boasts a robust IT infrastructure characterized by high-speed internet connectivity, advanced data centers, and widespread adoption of cloud computing technologies. This infrastructure provides a solid foundation for the deployment and management of Linux-based systems, which are renowned for their scalability, reliability, and security features. For instance,

- In January 2023, ManageEngine's introduction to new Canadian data centers in Toronto and Montreal met the increasing demand for localized data storage and processing in sectors, including government, banking, and finance. This emphasis on localized data management enhances the adoption of Linux in these data centers, contributing to market growth.

Europe holds the second-largest share of the market due to a combination of factors, including its strong technological infrastructure, widespread adoption of open-source principles, and supportive regulatory environment. European countries have well-established IT infrastructures characterized by high-speed internet connectivity and modern data centers, which provide a conducive environment for deploying and managing Linux-based systems. This infrastructure enables European enterprises to leverage the scalability, reliability, and security features offered by Linux for various applications and workloads. For instance,

- In December 2023, the European Commission dedicated USD 1.27 billion to IPCEI CIS cloud and Edge development, with an additional USD 1.49 billion expected from private sources. Supported by seven Member States, the initiative aims to bolster the European cloud infrastructure, reducing reliance on U.S. hyperscalers. This could boost the Linux OS market due to its widespread use in cloud environments.

Asia Pacific is expected to grow at the highest CAGR over the forecast period owing to the rapid digital transformation and adoption of cloud computing across various industries in countries, including China, India, and Japan, which are fueling the demand for Linux-based solutions. As organizations in the region increasingly migrate their workloads to the cloud, Linux emerges as a preferred operating system due to its scalability, flexibility, and cost-effectiveness in managing virtualized environments and containerized applications. For instance,

- In September 2023, Fujitsu Limited and the Linux Foundation launched Fujitsu's automated AI and machine learning technologies as open-source software during the "Open Source Summit Europe 2023" in Bilbao, Spain. These projects aim to provide users with tools for generating code for new machine learning models and addressing biases in training data. The Linux Foundation's approval of the "SapientML" and "Intersectional Fairness" projects encourages global developer experimentation and innovation in AI and machine learning, fostering collaboration and potentially enhancing the market.

The Middle East & Africa and South America have traditionally been dominated by proprietary software vendors, leading to a lower level of awareness and familiarity with Linux among businesses and individuals. Many organizations in the region already have established IT infrastructures built on proprietary operating systems, making it challenging to justify the switch to Linux. Despite these challenges, rising investments by large-scale organizations in the IT & telecom industry and an increasing number of regional startups offering OS will drive the market growth. For instance,

- In November 2023, The SUSE Linux Enterprise (SLE), NeuVector, and Rancher planned to double their presence in Latin America with hiring and investments in Mexico and Brazil. The company had set growth targets of 500% over the next five years, driven by new investments and a thriving market for cloud-based enterprise applications.

List of Key Companies in Linux Operating System Market

Market Leaders to Introduce New Capabilities in Their Product Offerings to Strengthen Market Position

The major players in the market offer user-friendly, reliable, and secure Linux operating systems for commercial and individual users at an affordable cost. IBM Corporation offers enterprise platforms, such as LinuxONE OS and IBM Z, to integrate data, transactions, and insights. IBM Corporation is a major distribution partner of Red Hat, SUSE Group, and Canonical (Ubuntu).

Leading players in the market are adopting several business strategies, such as new product launches, partnerships, mergers, and acquisitions, to remain competitive. For instance,

- February 2022: Slackware Linux Project launched Slackware version 15.0 for desktops. The release features a new user interface, updated applications, upgraded stability and performance, and other enhancements.

- December 2022: Siemens AG introduced customizable Linux Sokol Flex OS software for RISC-V architecture. The new system helps customers to detect and monitor vulnerabilities through built-in security.

LIST OF KEY COMPANIES PROFILED:

- Amazon Web Services, Inc. (U.S.)

- IBM Corporation (U.S.)

- Oracle Corporation (U.S.)

- Canonical Ltd. (U.K.)

- SUSE (Germany)

- Microsoft Corporation (U.S.)

- Wind River Systems, Inc. (U.S.)

- MONTAVISTA SOFTWARE, LLC (U.S.)

- Google LLC (U.S.)

- Alibaba Group (China)

KEY INDUSTRY DEVELOPMENTS

- February 2024 – IBM unveiled the IBM LinuxONE 4 Express, enhancing the performance, security, and AI functionalities of LinuxONE to small and medium-sized enterprises and emerging data center settings. This pre-configured rack mount solution is engineered to deliver cost efficiencies and eliminate client uncertainties when rapidly deploying workloads, facilitating seamless adoption of the platform for addressing both modern and traditional use cases. The use cases include digital asset management, AI-driven medical imaging, and workload consolidation.

- November 2023 – Red Hat, Inc., an open-source solution provider, declared the upcoming accessibility of Red Hat Enterprise Linux 8.9 and the general accessibility of Red Hat Enterprise Linux 9.3. These recent versions of the enterprise Linux platform drove advancements in containers, provided full support for Stratis as a system storage option, and introduced new management facilities through Red Hat Insights.

- August 2023 – Wind River, a provider of software solutions for critical, intelligent systems, announced that ZEEKR, an electric mobility technology brand, has chosen Wind River Linux to drive the growth of its forthcoming software-defined vehicle electronic and electrical architecture. Wind River Linux, equipped with a full suite of tools and lifecycle services for developing and maintaining intelligent edge solutions, will be integrated into ZEEKR's future Electronic and Electrical Architecture (ZEEA) platform.

- July 2023 – Canonical Ltd. and Intel Corp. revealed a partnership centered on the recent enterprise-oriented release of Ubuntu, known as Real-time Ubuntu. This specialized version is engineered to support high-reliability applications, including medical devices and factory automation systems. Through this collaboration, Canonical has made Real-Time Ubuntu available on Intel Core processors, providing developers and manufacturers with a stable and secure framework for their devices' sustained performance and success in real-world deployments.

- July 2023 – China launched its inaugural domestically developed open-source desktop operating system, dubbed OpenKylin, according to state media reports. This move signifies China's increased efforts to reduce dependence on U.S. technology. OpenKylin is derived from the open-source Linux operating system and was constructed by a community of approximately 4,000 developers. It applies to various sectors, including space programs, finance, and energy industries.

- March 2023 – AWS launched Amazon Linux 2023 (AL2023), featuring high security, deterministic updates, and a predictable lifecycle. AL2023 ensures customers a consistent two-year major release cycle, frequent updates, ongoing support, and enhanced security measures, such as SELinux, kernel live-patching, OpenSSL 3.0, revised cryptographic policies, versioned repositories for smooth upgrades, kernel hardening, and more.

- January 2023 – IIT Madras unveiled BharOS, a domestically developed operating system designed to provide enhanced security and privacy for mobile devices. This Linux kernel-based Indian OS aims to cater to India's vast mobile user base of 1 billion people, many of whom currently rely on smartphones running foreign-owned Android and iOS operating systems.

REPORT COVERAGE

An Infographic Representation of Linux Operating System Market

To get information on various segments, share your queries with us

The research report provides a comprehensive analysis of the market. It focuses on key aspects such as prominent companies and leading product applications. Besides this, the report highlights key industry developments and offers insights into the market trends. In addition to the above-mentioned factors, the report includes several factors that have contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019–2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025–2032 |

|

Historical Period |

2019–2023 |

|

Growth Rate |

CAGR of 20.9% from 2025 to 2032 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Distribution

By End-use

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 21.97 billion in 2024.

Fortune Business Insights says that the market is expected to reach USD 99.69 billion by 2032.

The market will observe a CAGR of 20.9% will be observed in the market during the forecast period (2025-2032).

The commercial/enterprise segment led the market in 2024 within the end-use segment.

Growing preference for Linux operating system for servers and embedded systems is likely to drive the market.

Amazon Web Services, Inc, IBM Corporation, ClearCenter, Oracle Corporation, SUSE Group, MontaVista Software, LLC, and Slackware Linux Project are the top companies in the global market.

The virtual machines is expected to grow exponentially at the highest CAGR during the forecast period.

The revenue of the market in North America in 2024 was USD 8.20 billion.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic