Middle East & Africa Jewelry Market Size, Share & COVID-19 Impact Analysis, By Product (Necklaces, Earrings, Rings, Bracelets, and Others), By Material (Gold, Diamond, Platinum, and Others), By End-user (Men and Women), By Distribution Channel (Offline Retail and Online Retail/E-Commerce), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

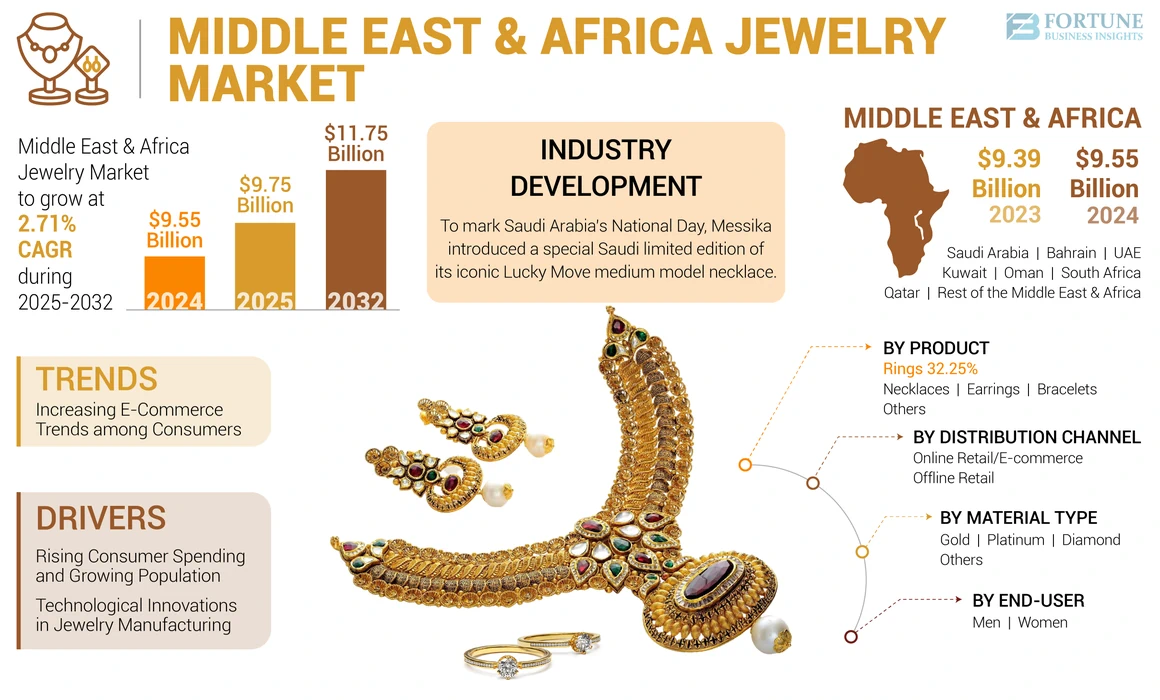

The Middle East & Africa jewelry market size was valued at USD 9.55 billion in 2024. The market is projected to grow from USD 9.75 billion in 2025 to USD 11.75 billion by 2032, exhibiting a CAGR of 2.71% during the forecast period.

Precious ornaments are considered trendy in the Middle East region; hence, diamonds and gemstones are in high demand. Gold is regarded as a sign of affluence and wealth in the Middle East culture, a significant factor propelling the product demand in the region. Rising population, infrastructural growth with increasing tourism, the growing spending power of tourists, and changing consumer preferences coupled with demand for premium, high-end, and designer products will boost the Middle East & Africa jewelry market growth.

Product designers in the Middle East focus on making modern jewels with unique designs that reflect Arabic history globally, favoring market expansion. Saudi Arabia, the UAE, and Bahrain are global shopping destinations for jewels and electronic items. Recently, tourism in Middle Eastern countries has become one of the fastest-growing industries for leisure, social, or business purposes and is expected to grow significantly soon, boosting the demand for jewels and gems in the region. According to the World Tourism Organization (UNWTO), in January, international arrivals to Middle East destinations increased by 52% over the same month in 2021.

International brands, such as Chanel, Louis Vuitton, and Tiffany & Co., focus on launching premium products in the Middle East due to the growing demand for modern jewel products. For instance, in May 2020, Louis Vuitton, a France-based company, launched an exclusive piece from its B Blossom Collection in the GCC region. The jewels and gem pieces were exclusively found for the Ramadan season in the Middle East region.

COVID-19 IMPACT

Low Footfall in Stores during Pandemic Restricted Market Growth

The global COVID-19 pandemic has been unprecedented and staggering, with jewelry experiencing lower-than-anticipated demand across countries in the Middle East & Africa (ME&A) compared to pre-pandemic levels. The COVID-19 outbreak affected the global economy negatively. The closure of offline retail stores in various parts of the Middle East region resulted in low footfall in jewel gem stores in 2020. The sales of jewels and gems products were highly reliant on offline retail stores, and the lockdown resulted in a steep decline in demand during the pandemic.

With the unprecedented impact of the COVID-19 pandemic, the government restricted all events, shows, exhibitions, and weddings for a few months, negatively impacting the Middle East & Africa market growth. Manufacturing limitations, international and domestic flight restrictions, and labor and logistics shortages disrupted the global jewels and gems supply chain. Many jewelers had to shut down their shops in malls and shopping complexes. The price of gold increased during the pandemic, resulting in less demand for gold, and ultimately led to a decline in profits for gold and silver jewelry designers in 2020.

LATEST TRENDS

Increasing E-Commerce Trends among Consumers are Propelling Product Demand

The e-commerce industry in the Middle East & African countries is developing rapidly. At a macro level, a growing tech-savvy population, online penetration, and increasing demand for luxury products drive market growth. E-commerce platforms have gained momentum across Saudi Arabia, the UAE, and Bahrain as consumers shifted from brick-and-mortar stores to online shopping during the pandemic. Furthermore, the availability of multiple product offerings and price comparisons on online shopping sites significantly increased the number of online shoppers, making it convenient for retailers as it involved zero expenditure on physical outlets or stores.

Major brands in the Middle East region, including Hand Diamond & Jewelry LLC, L’AZURDE, Safa group, and Chanel, increased their online retailing platforms to grow the Middle East & Africa jewelry market share in 2021. For instance, in October 2021, TOUS, a Spanish brand, launched its e-commerce website in Arabic to better communicate with shoppers in the Middle East region and expand its market in the Middle East countries.

Download Free sample to learn more about this report.

DRIVING FACTORS

Rising Consumer Spending and Growing Population to Drive Market Growth

The global market growth is attributable to the population's growing disposable income, and the changing lifestyle of individuals in Arabic countries is set to propel market growth. Improvements in the standard of living of the middle-class population, along with growing spending power, fuel market growth. The increasing working population of women in the Middle East region and rising awareness regarding modern products and premium-class gems will further fuel market growth.

According to the World Gold Council (WGC), the demand for gold jewelry in GCC countries grew by 80% in the second quarter of 2022 due to increased oil prices, rising income levels, and improved buying sentiment for the wedding and festival season. Furthermore, in Saudi Arabia and Kuwait, the demand for gold products has increased by 22% and 24% in 2022. In addition, the Middle East & African population is gradually inclining toward sophisticated, designer, and premium products. Luxury brand manufacturers, such as L'Azurde and GHASSAN, develop modern designer products, which will further fuel the market growth.

Technological Innovations in Manufacturing to Favor Market Expansion

The global market is adapting to various technological advancements and changing market dynamics. Trends, such as 3D printing and Computer-aided Design (CAD), are a few revolutions that boosted market growth in 2021. Faster production time, desired customization, a high amount of product detailing, and easy corrections for gold and silver ornaments are possible as modern technology boosts the demand for contemporary designs in the Middle Eastern Market.

The rising availability of modern designs across offline and online distribution channels propels market growth. The Market in the Middle East region is constantly evolving regarding quality, methods, and varieties. The increasing use of 3D printing and the service of artificial intelligence to make customized and personalized customer designs have revolutionized the industry regarding value.

RESTRAINING FACTORS

Implementation of Value-added Taxes is Restricting Market Growth

On January 1, 2018, the Middle East government announced that the UAE's gold, silver, and platinum ornaments would be subjected to a 5% Value Added Tax (VAT). The tax will apply to the jewelry piece, not the making charges, making products more expensive. The wholesale sector that relies on selling its products by weight has been adversely affected by rising gold prices and higher VAT rates, which put increased pressure on the company's business or profit in the short term.

On January 1, 2022, the standard VAT rate in Bahrain increased from 5% to 10%, making Bahrain the second GCC country to raise the VAT rate from the 5% originally agreed under the VAT Framework Agreement of the GCC. The VAT rate is estimated to increase government revenue by 1.5% to 2% of GDP. Thus, changing the taxation policy of gold may have increased the price of gold, restraining the market's growth.

SEGMENTATION

By Product Analysis

Rings Segment Takes the Lead Due to Escalating Demand for Ethnic and Personalized Rings

By product, the market is segmented into necklaces, earrings, rings, bracelets, and others. The rings segment holds a significant market share, owing to increasing popularity among women and rising demand for traditional and ethnic products. The rings segment is expected to grow significantly throughout the forecast period owing to increasing popularity and preference for corporate dressing rings and rising trends of personalized rings, such as wedding rings, engagement rings, and promise rings in the Middle East and Africa.

Necklaces are the most popular ornaments among women in the Middle East and African countries. Trending necklaces, such as diamond collars & choker necklaces, chain link necklaces, celestial & locket necklaces, and charm necklaces, among millennials, and the growing popularity of necklace layering are driving the market growth.

Bracelets and earrings segments are also expected to grow steadily throughout the forecast period. The trend of hoop earrings with clustered diamonds, engagement bands, and tennis bracelets is driving market growth in Saudi Arabia, Turkey, South Africa, and the UAE.

To know how our report can help streamline your business, Speak to Analyst

By Material Analysis

Gold Segment Leads Due to High Availability of Gold Ornaments in the Region

Based on material, the market is segmented into gold, diamond, platinum, and others. Gold holds a significant market size. Gold has been used for centuries to make ornaments, making it an integral part of lifestyles, cultures, and occasions. The rising demand for gold ornaments is boosting, owing to increasing consumer spending on weddings and festive seasons. According to the World Gold Council, demand for yellow gold ornaments across the UAE surged by 80% in August 2022.

The diamond segment is expected to grow significantly during the forecast period. Diamonds are considered women’s pride and are more attractive owing to their ability to reflect light and sparkle. The demand for diamonds is growing across countries in the Middle East & Africa due to the growing popularity of mixed-cut, rose-cut, and briolette diamonds, offering a 360-degree view of the diamond. Furthermore, lab-grown diamonds are an important trend in the Market, and manufacturers are introducing fully certified imported lab-grown diamond collections in the Middle East & African countries.

By End-user Analysis

Women Segment Dominates due to Ornaments being an Integral for Women’s Fashion

Based on end-user, the market is divided into men and women. The women segment holds a significant market share, owing to the wide product availability for women and their interest in products. The growing preference for ornaments-enhancing looks among women and the wide availability of products drive the market's growth. Manufacturers are launching new distinct products, particularly for women, owing to increasing demand for vintage and traditional designs for ethnic looks and simple modern designs for working women.

The men segment is expected to grow steadily throughout the forecast period owing to high-profile celebrity influencers such as Harry Styles, Lewis Hamilton, and Will Smith and increasingly genderless aesthetics. Significant players in the market are introducing men's and genderless ornaments, surging the product demand among men in the MEA region. For instance, Tiffany & Co. launched an exclusive men’s engagement ring collection in June 2021.

By Distribution Channel Analysis

Offline Retail Segment Growth Owed to Increasing Number of Boutiques

The market is segmented into offline retail and online retail/e-commerce based on distribution channel. The offline retail segment holds a significant share of the market. Consumers primarily depend on offline stores, owing to increased conversion rates, and their preference to try jewelry before purchasing is surging the demand for offline retail. Manufacturers are focusing on launching offline stores to expand their products in the Middle East & African countries. For instance, Damas, a design house, launched its new boutique at Vendome Mall in Qatar in May 2022.

Online retail/e-commerce is expected to grow significantly throughout the forecast period. The growing number of Gen Z and millennials willing to shop online and increasing internet penetration drive online retail growth. Manufacturers are launching online stores to reach consumers absent from retail stores.

COUNTRY INSIGHTS

UAE Takes the Lead due to the Presence of Mining Sites

The market in the Middle East & Africa market is categorized geographically into Saudi Arabia, Bahrain, UAE, Kuwait, Oman, Qatar, South Africa, and the rest of the Middle East & Africa.

The UAE is one of the significant and fastest-growing markets. The presence of mining sites and the largest trading hub for rough diamonds worldwide contribute to market growth. According to the World Gold Council (WGC), the demand for gold ornaments in Saudi Arabia increased by 22% in the first half of 2022.

Saudi Arabia is the largest retail market, and prominent players focus on expanding and introducing new products, especially in Riyadh and Jeddah. Qatar is expected to grow steadily, owing to the popularity of Turkish ornaments. The demand for gold and diamond handcrafted custom designs is driving market growth in this country. Kuwait is famous for gold ornaments and has several traditional souks that sell gold and silver adornments.

KEY INDUSTRY PLAYERS

Product Innovations and Market Expansion by Major Players to Achieve High Market Share

The global market is highly competitive, with domestic and internationally renowned players competing for higher market share in the Middle East & Africa. Major industry participants focus on revolutionizing ornaments with cutting-edge technology and vintage offerings. Additionally, manufacturers are focusing on enhancing the design and looks of the ornament to meet the ever-changing demand of consumers and market trends.

List of Key Companies Profiled:

- Hans Diamond & Jewellery L.L.C. (UAE)

- L'AZURDE (Saudi Arabia)

- SAFA Group (India)

- Bymystique (UAE)

- Yessayan Jewellery (Lebanon)

- Azza Fahmy Jewellery (Egypt)

- Chanel (U.K.)

- LVMH Moët Hennessy Louis Vuitton (France)

- Compagnie Financière Richemont S.A. (Switzerland)

- Caspian Jewellery (UAE)

KEY INDUSTRY DEVELOPMENTS

- May 2023: The Gem & Jewellery Export Promotion Council (GJEPC), Mumbai, India-based Government of India (GOI) organization, launched the India Jewellery Exposition Centre to enhance trade relations between Dubai and India.

- April 2023: Cara Jewelers, a Dubai-based company, announced its expansion across international markets by opening its first international store in London, U.K. This strategic initiative highlights the rising demand for Middle Eastern product designs across international markets.

- September 2022: Messika, a modern diamond jewelry house, launched a special Saudi limited edition of its iconic Lucky Move medium model necklace to mark Saudi Arabia’s National Day.

- August 2022: EdgeStone, a contracting company, launched Rock Gold Mall, the first specialized mall in gold ornaments in Egypt.

- May 2022 – Kalyan Jewelers, an India-based company, recently launched its new showroom at the Dubai Gold Souk. According to the company, the new store will offer designs from the exclusive collection showcasing bridal designs from India. The brand’s strategy is to increase accessibility for customers in the Middle East market, where they will attract tourists to the Dubai Gold Souk in the UAE.

- May 2022: DAAMC Group, a UAE-based Property Development Company, announced the acquisition of Swiss luxury brand de GRISOGONO, a Switzerland-based company after filing for bankruptcy. De GRISOGONO manufactures necklaces, earrings, rings, and bracelets. The company's strategy is to expand its business in luxury and high-end fashion products.

- March 2021: L’azurde, a brand headquartered in Saudi Arabia, launched its new collection of high-quality gold and encrusted with diamonds, pearls, and precious stones for women. The company launched an advertising campaign to show selected pieces for the valentine’s day collection and a limited bridal collection in 2021.

REPORT COVERAGE

The Middle East & Africa market research report analyzes the market in-depth and highlights crucial aspects such as prominent companies and products. Moreover, the research report provides insights into recent market trends and highlights vital industry developments. In addition to the details mentioned earlier, the report notes several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 2.71% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

By Material

By End User

By Distribution Channel

By Country Middle East & Africa (By Product, Material, End-User, Distribution Channel, and Country)

|

Frequently Asked Questions

Fortune Business Insights says that the market size was USD 9.55 billion in 2024 and is anticipated to reach from USD 9.75 billion in 2025 to USD 11.75 billion by 2032.

Ascending at a CAGR of 2.71%, the Market will exhibit steady growth over the forecast period (2025-2032).

By product, the rings segment is expected to dominate the Middle East market throughout the forecast period (2025-2032).

The growing population and increasing disposable income of the Middle East region are driving market growth.

L’AZURDE, SAFA Group, Bymystique, Chanel, Hand Diamond & Jewelry LLC, LVMH Moet Hennessy Louis Vuitton, and others are the leading companies in the Middle East market.

The UAE dominated the Middle East market in 2024.

Growth in population and increase in disposable income of individuals are surging the product demand.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us