Military Embedded Systems Market Size, Share, and Russia-Ukraine War Impact Analysis, By Technology (Software and Hardware), By Application (Surveillance, Communication, Command and Control Systems, Data Storage, Intelligence, Avionics and Ammunition Systems, and Others), By Platform (Land, Air, Water, and Space), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

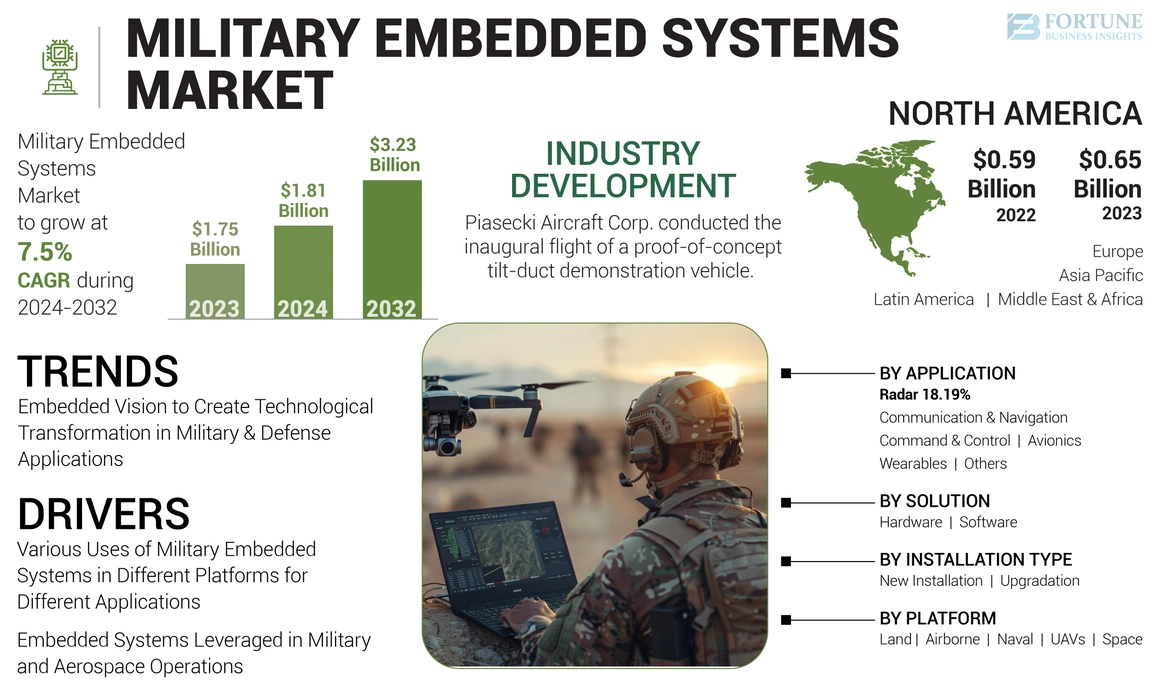

The global military embedded systems market size was valued at USD 1.75 billion in 2023. The market is projected to grow from USD 1.81 billion in 2024 to USD 3.23 billion by 2032, exhibiting a CAGR of 7.5% during the forecast period. North America dominated the military embedded systems market with a market share of 37.14% in 2023.

Military embedded systems are specialized computer systems integrated into larger military devices or platforms, designed to perform specific tasks critical to defense operations. These systems involve hardware, software, technology integration, management of obsolescence, and various other technical subjects specific to the military. In comparison to general-purpose embedded systems, these systems are characterized by their increased reliability, security, robustness, and structure.

The primary use of embedded systems is to oversee and safeguard these devices while analyzing large amounts of data collected from various sources. Essentially, these embedded systems facilitate the intelligent functioning of the devices, permit remote control of systems, and protect the devices from various malicious software attacks, thereby poised for the global market growth.

The COVID-19 pandemic caused the closure of manufacturing plants and disruptions in the supply chain. Lockdowns and travel restrictions hindered the movement of workers and materials, directly affecting the production of these systems.

The economic downturn triggered by the pandemic resulted in a decrease in defense budgets as governments redirected funds to healthcare and pandemic response efforts. This shift led to a reduction in demand for military systems, which are often linked to defense spending.

Moreover, the Russia-Ukraine war had a significant impact on the military embedded systems market as the war led to an increased demand for embedded systems as both Russia and Ukraine sought to upgrade their military capabilities. These systems are employed in various areas, from vehicles and aircraft to missiles and surveillance devices. The war accelerated the development of these military systems technology, as countries aimed to gain an edge on the battlefield.

GLOBAL MILITARY EMBEDDED SYSTEMS Market Snapshot & Highlights

Market Size & Forecast:

- 2023 Market Size: USD 1.75 billion

- 2024 Market Size: USD 1.81 billion

- 2032 Forecast Market Size: USD 3.23 billion

- CAGR: 7.5% (2024–2032)

Market Share:

- North America led the market in 2023 with a 37.14% share, driven by strong investments in next-gen military communication and computing infrastructure, particularly in the U.S.

- By Solution: Hardware dominated in 2023; software is the fastest-growing due to AI and electronic warfare integration.

- By Installation Type: New installations are expanding fastest, driven by modernization needs.

- By Application: Others (EW, ISR, missiles) led in 2023; communication & navigation is the fastest-growing segment.

- By Platform: Land platform led in 2023; UAVs are growing fastest due to demand for autonomous systems.

Key Country Highlights:

- United States: Dominant market with continued defense investments in AI-powered embedded systems, edge computing, and networked warfare.

- China: Rapid market expansion due to increasing military modernization programs and integration of AI in command systems.

- India: Actively upgrading embedded systems for ISR and UAV applications, supported by indigenous development under ""Make in India.""

- United Kingdom: Adoption of embedded vision systems for defense installations; recent contracts for customized solutions indicate strong growth.

- Germany & France: Key contributors to Europe's market, focusing on NATO interoperability and defense digitalization.

- Middle East: Growing investments in defense tech to enhance regional security, particularly in the UAE and Saudi Arabia.

Military Embedded Systems Market Trends

Embedded Vision to Create Technological Transformation in Military & Defense Applications Drives Market Growth

Embedded vision systems are shaping the future of military technology. These systems enhance the unique abilities of soldiers and introduce unprecedented levels of visibility and independence in military missions, contributing significantly to the ongoing technological revolution in the military. For instance, in June 2023, Concurrent Technologies announced that it had secured a contract with a UK FTSE 250 company to deliver a customized set of embedded systems for a national defense installation. The systems will be delivered by 2025. North America witnessed military embedded systems market growth from USD 0.59 Billion in 2022 to USD 0.65 Billion in 2023.

Soldiers benefit from enhanced visibility and autonomy through embedded vision systems. The primary embedded vision application in surveillance applications for drones and aircraft is multispectral imaging. Embedded vision cameras and sensors generate synthetic vision to provide pilots with essential information in situations with limited natural visibility. Embedded vision systems are integrated into autonomous military vehicles to maneuver through challenging terrains. Real-time access to navigation data and enemy locations is provided to soldiers through head-up displays that leverage embedded vision systems.

Embedded vision systems are reshaping the military technology landscape, impacting virtually every area. The increasing demand for military modernization and the critical role of embedded vision are reflected in the significant short-term growth. Advancements in embedded vision technology will lead to the emergence of new military and defense sector applications, propelling the world's militaries forward into the future.

Download Free sample to learn more about this report.

Military Embedded Systems Market Growth Factors

Various Uses of Military Embedded Systems in Different Platforms for Different Applications Catalyze Market Growth

The market is undergoing significant growth due to technological progress in electronics, semiconductors, and software. Robust cybersecurity is increasingly becoming a top priority as military systems are becoming more connected and data-driven. Embedded systems play a crucial role in safeguarding sensitive military applications and various operations. The operations are as follows:

- Command and Control Systems: Embedded systems play a crucial role in military command-and-control systems, enabling decision-making and the monitoring and management of military operations. These systems are indispensable infrastructure for military operations, facilitating the collection and sharing of information, the performance of commands, and communication with other systems.

- Joint Tactical Radio System (JTRS): The military sector of developed nations primarily utilizes a software-defined radio system known as JTRS. JTRS radios are integrated into various military equipment such as vehicles, aircraft, and handheld devices. The JTRS system is engineered to be extremely adaptable, enabling different radio types to establish communication with each other and with other military systems.

- Military Intelligence: Military intelligence agencies can tap into the radio, television, and other broadcasting networks of their adversaries. These tools can utilize embedded systems to aid intelligence personnel in their surveillance efforts. Furthermore, embedded systems are utilized in radar systems, surveillance satellites, and military traffic control systems. Additionally, they facilitate remote control operations, safeguard systems from unauthorized access, and improve system dependability.

- Weapons Systems: Embedded systems play a crucial role in developing and operating military weapons systems. Missiles and drones rely on embedded guidance and control systems to gather data on their position and flight dynamics, which are then used to control their movement.

Embedded Systems Leveraged in Military and Aerospace Operations Catalyze Market Growth

Military embedded systems find extensive usage across various platforms, including air, land, water, and space systems. They are employed in diverse electronic equipment and devices for various military applications, including surveillance, missile systems, satellite systems, communication, data storage and acquisition systems, ammunition and avionics systems, and so on.

Advancements in wireless technologies, multicore technologies, and cloud computing are driving present-day military systems. Embedded systems are essential in aerospace and defense, leading to technological progress and improved capabilities. They meet strict reliability, safety, security, and performance standards, driving innovation in these industries. As technology develops, embedded systems will have an increasingly important role in shaping the future of aerospace and defense, driving progress that strengthens national security and supports mission accomplishment.

For instance, in June 2024, AMETEK Abaco Systems introduced a new embedded single-board computer in a 3U VPX form factor that was specifically created to improve Artificial Intelligence (AI) capabilities for edge computing applications at the MOSA Industry & Government Summit.

RESTRAINING FACTORS

Shortages in Raw Materials and Delays in Shipping Restrain Market Growth

The military embedded systems market growth is currently encountering significant difficulties due to shortages in raw materials and delays in shipping. Key components used in embedded systems are experiencing price hikes due to the shortages in raw materials. Manufacturers are facing increased costs for semiconductors, circuit boards, and other materials.

As a result, profit margins are being squeezed, and the costs for end products are rising. The timeline for resolving supply chain issues remains unclear, adding ongoing challenges for manufacturers. Thus, managing customer expectations and production planning is a major challenge, also country-wise shipping policies differs, creating delay in shipments.

Embedded systems are facing reduced availability due to a combination of shortages and delays. Supply chain constraints are causing manufacturers to struggle to meet demand, which may affect the military's ability to acquire the latest embedded technologies when necessary.

Military Embedded Systems Market Segmentation Analysis

By Solution Analysis

Increasing Adoption of Advanced Hardware in Different Platforms Drives Segmental Growth

Based on the solution, the market is divided into hardware and software.

The hardware segment accounted for the largest market share in 2023 and is estimated to be the fastest-growing segment during the forecast period. The increasing demand for embedded systems, such as smart embedded computing, embedded communication navigation systems, and others, for various military applications in all types of platforms for seamless operations to catalyze segmental growth.

The software segment is projected to witness lucrative growth during the forecast period of 2024-2032. The growth is driven by the growing complexity of military operations and the need for advanced technological solutions. Innovations in multi-core technology and the adoption of electronic warfare systems are driving demand. For instance, systems such as the Mobile User Objective System (MUOS) enhance secure communications for military operations.

By Installation Type Analysis

Increasing Production of New Installation Systems for Different Platforms Creates Lucrative Opportunities for Segment Growth

Based on installation type, the market is distributed into new installation and upgradation.

The new installation segment is estimated to be the fastest-growing segment during the forecast period of 2024-2032. The increasing installation of new systems aimed at enhancing military capabilities. New installations often focus on enhancing communication, navigation, surveillance, and control systems within military equipment. The integration of these systems is crucial for modern military infrastructure and ensuring that new platforms meet evolving defense requirements.

The upgradation segment has seen lucrative opportunities during the forecast period of 2024-2032. The embedded systems market is undergoing significant changes driven by the need for upgrades to existing systems. The incorporation of cutting-edge technologies such as Machine Learning (ML), Artificial Intelligence (AI), and enhanced communication systems is driving the demand for upgrades.

By Application Analysis

Increasing Investment in Defense Modernization Program Catalyze Market Growth for Others Segment

Based on application, the market is divided into communication & navigation, command & control, radar, avionics, wearables, and others.

Others segment encompasses weapon fire control systems, electronic warfare, Intelligence Surveillance and Reconnaissance (ISR), missile systems, etc. Others segment dominated the global military embedded systems market share in 2023. The ISR system is expected to continue growing rapidly as nations prioritize national security. Moreover, the Electronic Warfare sector is anticipated to experience the most rapid growth because of the rising significance of electronic attack and defense mechanisms in contemporary military tactics. Embedded systems play a vital role in signal jamming, interception, and various countermeasures. The growth is attributed to governments investing heavily in defense mode programs aimed at improving military readiness and interoperability. The increasing focus on cybersecurity necessitates upgrades to ensure that embedded systems can withstand modern threats.

The communication & navigation segment is estimated to be the fastest-growing segment during the forecast period of 2024-2032. The segment is experiencing rapid growth and transformation due to the shift toward network-centric warfare necessitates robust communication systems that can operate seamlessly across various platforms. Embedded systems are increasingly being designed to facilitate interoperability among different military branches and allied forces, enhancing collaborative operational capabilities and driving segmental growth. The radar segment is expected to hold a 18.19% share in 2023.

To know how our report can help streamline your business, Speak to Analyst

By Platform Analysis

Modernization Efforts And Technological Advancements Drives Market Growth For Land Segment

Based on the platform, the market is classified into land, airborne, naval, UAVs, and space.

The land segment dominated the global military embedded systems market size in 2023. The segment is experiencing robust growth driven by modernization efforts and technological advancements in network convergence. Many countries are heavily investing in the modernization of their ground forces, which includes upgrading existing military vehicles and systems with advanced embedded technologies, anticipating segmental growth.

The market for UAVs has been estimated to be the fastest-growing segment during the forecast period. Unmanned Aerial Vehicles (UAVs) are undergoing significant transformation, driven by advancements in technology and increasing operational demands. The growing reliance on UAVs for autonomous missions necessitates sophisticated embedded systems that can handle complex tasks such as navigation, targeting, and communication. This trend is pouring the demand for lightweight, power-efficient, and robust embedded solutions capable of performing in diverse environments.

REGIONAL INSIGHTS

In terms of geography, the market is divided into North America, Europe, Asia Pacific, and the Middle East & Africa and Latin America.

North America Military Embedded Systems Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America holds the largest market share in 2023 and is estimated to be the fastest-growing region during the forecast period. North America has emerged as a prominent region for technologically advanced applications. The U.S., being a highly advanced nation in terms of technology, displays considerable potential for investment in these systems technology. Increased investments in integrated military capabilities and next-generation communication technology have simplified the expansion of the market in this region. Market growth is contributed by increased investments in military hardware and capabilities, alongside the adoption of network-centric infrastructure.

The market in Asia Pacific accounted for a substantial revenue share in 2023. The market growth is driven by increasing defense spending, geopolitical tensions, and modernization of military infrastructure. Countries such as India, South Korea, and Australia are investing heavily in upgrading their defense systems with advanced embedded technologies. The region's strategic focus on enhancing defense capabilities and improving technological integration contributes to the market's expansion.

The market in Europe is expected to experience a steady growth rate, with a focus on improving defense capabilities and incorporating cutting-edge technologies. Rising defense budgets in the region, as well as cooperative defense initiatives among EU members, coupled with NATO's modernization endeavors, drive the need for advanced embedded solutions. The focus on interoperability and the improvement of military infrastructure drives market expansion.

The Middle East & Africa market is expected to experience substantial growth as a result of increased defense spending and the upgrade of military technology. Regional geopolitical tensions and security concerns drive increased investments in advanced defense technologies. Emphasizing the improvement of military systems and boosting operational capabilities drives the need for high-performance embedded solutions.

The market in Latin America is evolving, driven by modernization efforts, technological advancements, and regional security concerns. The region is projected to grow significantly, with Brazil and Mexico being the primary contributors to this growth. The market is expected to benefit from increased defense spending and modernization initiatives aimed at enhancing military capabilities across various platforms, including land, air, and naval systems.

KEY INDUSTRY PLAYERS

High Adoption Rate of These Devices All Over Defense Platforms Drives Demand For Manufacturers

Key players are at the forefront of developing embedded systems that enhance military capabilities across various platforms, including land, air, and naval operations. For instance, in February 2024, Vecow Co., Ltd., a group of global embedded specialists, is excited to introduce the release of its Workstation-grade Fanless High-Endurance System. The Vecow HEC-1000 has been crafted to operate in the most demanding settings, featuring robust computing capability based on the 13th Gen Intel Core i9/i7/i5/i3 processor. It comes with reliable I/Os, making it suitable for outdoor applications such as ADAS, AMR, robotic control, and robust Edge AI deployments.

List of Top Military Embedded Systems Companies:

- Abaco Systems (U.S.)

- Advanced Micro Devices, Inc. (U.S.)

- Advantech Co. Ltd (Taiwan)

- Curtis-Wright Corporation (U.S.)

- General Dynamics Mission Systems, Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- Intel Corporation (U.S.)

- North Atlantic Industries Inc. (U.S.)

- NXP Semiconductors (Netherlands)

- QinetiQ (U.K.)

KEY INDUSTRY DEVELOPMENT

- September 2024 - Piasecki Aircraft Corp. achieved a major milestone in the development of tilt-duct technology by successfully conducting the inaugural flight of a proof-of-concept tilt-duct demonstration vehicle. The Aerial Reconfigurable Embedded System (ARES) is receiving support from U.S. military funding and can enhance combat and logistics support operations such as medevac or cargo resupply.

- March 2024 - The Space Force requested USD 79.7 million for the PATS ground system elements, which is an increase from the previous fiscal year's budget of USD 76.5 million. These ground system elements are collectively known as the Protected Tactical Enterprise Service (PTES). The main goal of PTES is to facilitate the widespread utilization of the Protected Tactical Waveform, which will eventually be integrated into payloads on both U.S. and allied military satellites, as well as commercial satellites.

- May 2024 - Aurora Flight Sciences completed the conceptual design for a vertical-takeoff-and-landing aircraft for DARPA and is progressing to the next stage. The experimental plane's blended-wing design would employ three integrated lift fans for vertical flight before transitioning to a different set of embedded engines for horizontal flight. This innovative design aims to minimize drag and enable high-speed flight.

- September 2024 - Hanwha Defence Australia (HAD) entered into agreements with Safran and Rohde & Schwarz, both European companies, to support its Redback Infantry Fighting Vehicles (IFVs) program for the Australian Army. The contract with Safran involves integrating the PASEO Joint Fires day-and-night panoramic sight onto the Redback. At the same time, the agreement with Rohde & Schwarz focuses on supplying an electromagnetic testing system for the vehicles. This system includes a rangefinder with a range of more than 7 km and a laser designator with a range of more than 6 km. Additionally, it incorporates an embedded Onyx inertial navigation system.

- September 2024 - A tilt-duct aircraft funded by the USAF completed its first flight, potentially serving as a future autonomous rescue platform. This aircraft could be used for autonomous evacuation and rescue operations, as well as for battlefield resupply missions. The proof-of-concept demonstrations, including the first demonstration for an autonomous tilt-duct aircraft, took place simultaneously at Piasecki's Essington, Pa. facilities. The initial flight involved the Aerial Reconfigurable Embedded System Demonstration Vehicle (ARES-DV) flown by Piasecki alone and consisted of one minute of hovering flight.

REPORT COVERAGE

The market report provides a thorough market analysis. It comprises all major aspects, such as R&D capabilities, supply chain management, competitive landscape, and optimization of the manufacturing capabilities and operating services. Moreover, it offers insights into the global military embedded systems market trends, market segment, growth analysis, and size and highlights key industry developments. In addition to the factors mentioned above, it mainly focuses on several factors that have contributed to the growth of the global market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 7.5% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Solution

|

|

By Installation Type

|

|

|

By Application

|

|

|

By Platform

|

|

|

By Region

|

Frequently Asked Questions

As per the study by Fortune Business Insights, the market size was USD 1.75 billion in 2023.

The market is likely to grow at a CAGR of 7.5% during the forecast period.

By platform, the land segment is the leading segment in the market.

The North America valued size was 0.65 billion in 2023.

Various uses of military-embedded systems in different platforms for different applications catalyze market growth.

ABB Group, Elcome International LLC, A.B. Volvo, Kongsberg Gruppen, and Wartsila are the top players in the market.

The U.S. is the dominant country in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us