South East Asia Omega-3 Supplements Market Size, Share, and Industry Analysis, By Type (Fish Oil, Algal Oil, Krill Oil, and Other Plant Sources), By Form (Tablet, Capsule, Liquid, and Powder), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, and Others), and Country Forecast, 2024-2032

KEY MARKET INSIGHTS

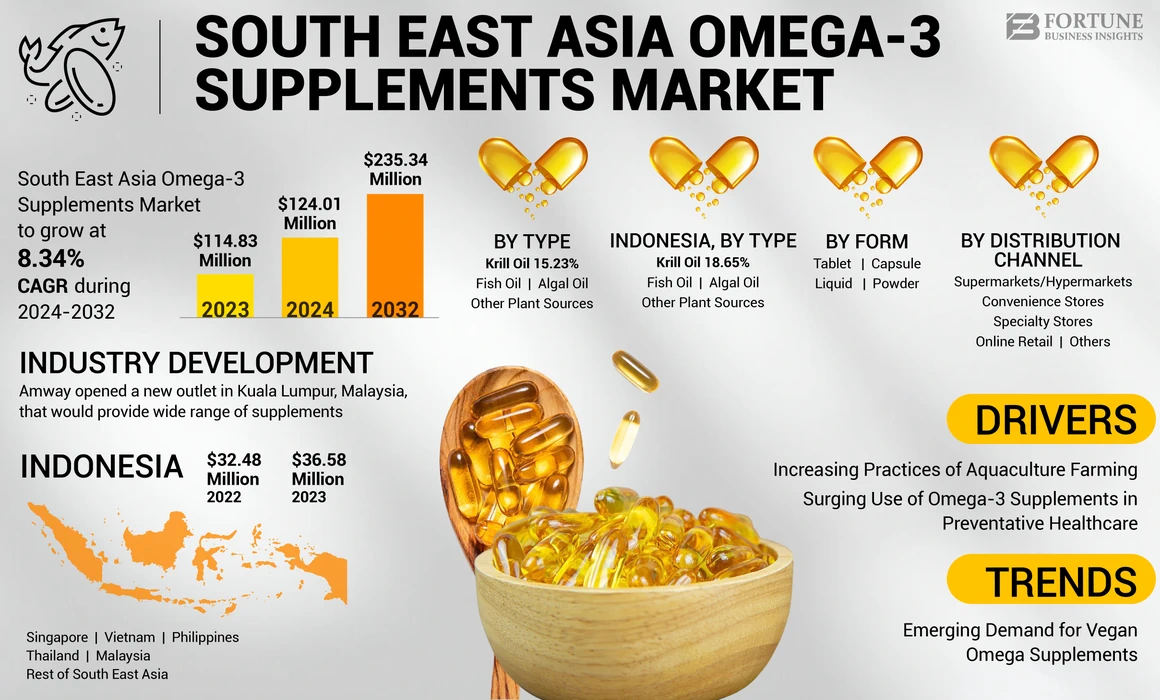

The South East Asia Omega-3 supplements market size was valued at USD 114.83 million in 2023. The market is projected to grow from USD 124.01 million in 2024 to USD 235.34 million by 2032, exhibiting a growth at a CAGR of 8.34% during the forecast period. Indonesia dominated the south east asia omega-3 supplements market with a market share of 31.86% in 2023. Few of the active players in the omega-3 supplements industry include Amway, Reckitt Benckiser Group plc, NOW FOODS, and NutraBio.

Omega-3 supplements are a form of dietary supplement comprising of omega-3 fatty acids, essential fat required for the proper functioning of the human body. These omega-3 fatty acids are primarily found in shellfish, fatty fish, chia seeds, flaxseeds, and soybeans and are recognized as healthy fats. In terms of health advantages, omega-3 fatty acids, also play a substantial role in providing support to every cell of the human body. Moreover, omega fatty acids are available in several forms, ranging from alpha-linolenic acid, docosahexaenoic acid (DHA), and eicosapentaeonic acid (EPA), which aids in improving cardiovascular health and cognitive ailments. Incorporating such omega-3-enriched supplements into daily diets minimize the risk of heart disease, reduces triglycerides, and lower blood pressure.

Rising trend of health consciousness and the growing number of athletes in the South East Asia region are prime factors supporting the market growth.

South East Asia Omega-3 Supplements Market Overview

Market Size & Forecast:

- 2023 Market Size: USD 114.83 million

- 2024 Market Size: USD 124.01 million

- 2032 Forecast Market Size: USD 235.34 million

- CAGR: 8.34% from 2024–2032

Market Share:

- Indonesia dominated the South East Asia omega-3 supplements market with a 31.86% share in 2023, driven by the country’s aging population and rising health consciousness, particularly in addressing chronic illnesses like hypertension and cardiovascular diseases through nutritional supplements.

- By type, fish oil led the market in 2023 due to its recognized benefits for brain and heart health, ease of blood clot prevention, and widespread acceptance among consumers seeking animal-sourced supplements.

Key Country Highlights:

- Indonesia: Omega-3 supplements are increasingly used to address health concerns among the growing elderly population, projected to reach 48.20 million by 2035.

- Vietnam: High seafood imports support strong omega-3 availability, helping mitigate chronic illness risks.

- Singapore: Rising veganism has led to increased demand for plant-based omega-3 supplements from algae, flaxseed, and chia.

- Philippines: Growth in the sports industry is driving demand for omega-3 supplements to enhance performance and fitness.

- Thailand: Increased use of omega-3s in infant nutrition is supporting healthy development in children.

- Malaysia: A robust nutraceutical sector supports product innovation and growing consumer adoption of omega-3 supplements.

- Rest of South East Asia: Social media is significantly increasing awareness and visibility of omega-3 supplements across platforms like Facebook, Instagram, and TikTok.

MARKET DYNAMICS

Market Drivers

Increasing Practices of Aquaculture Farming Enhances the Production of Natural Supplements

Aquaculture in the Southeast Asia market has emerged as a rapidly developing and growing sector, playing a remarkable role in catering to the increasing sustainable and affordable seafood protein demand. For decades, the region has been experiencing a blue revolution, as fish-based products are a staple in the diets of the majority of Southeast Asian populations. Thus, with a surge in demand for eco-friendly production and an abundance of water resources, aquaculture presents a spectrum of opportunities for responsible fish production, leading to increased production of such natural supplements. In today’s health-conscious era, apart from dietary sources, Southeast Asian consumers are also looking for omega supplements, which are widely promoted as a means of enhancing health and longevity. The omega-3 supplements are majorly developed from fish oil and algae oil as they are recognized as the pivotal sources of omega fatty acids supplements. As a result, the expansion of aquaculture farming in the region opens diverse opportunities for the production of natural supplements.

Surging Use of Omega-3 Supplements in Preventative Healthcare Facilitates the Market’s Potential

The Southeast Asian market is undergoing an epidemiological transition, with non-contagious diseases becoming highly important, yet communicable diseases (HIV and tuberculosis), remain common in some populations. Such difficulties stem from poverty, inadequate physical health, unhealthy diet, and low income, which makes Southeast Asia, a hotspot for emerging chronic illnesses.

Although, habitants in the region face a burden of chronic ailments, the prevalence of non-transmissible diseases is at its peak, representing 60% of deaths across the region. As per the “Ministry of Health of Singapore,” a government agency, 37% of Singaporeans aged 18 to 69 years suffered from hypertension in 2021-22. In order to avoid the risk of contracting such diseases, consumers in the region are seeking health supplements such as omega-enriched supplements, which can aid in improving the individual’s health. Moreover, the healthcare system of Southeast Asia needs to prioritize increased health expenditure to enhance the accessibility and availability of omega supplements for consumers.

Market Restraints

Rising Cases of Lipid Oxidation and Difficult Extraction Methods Restrain Market Momentum

Lipid oxidation in omega-3-enriched food products is one of the biggest challenges faced by Southeast Asia omega producers. Owing to their polyunsaturated nature, omega-3 fatty acids are liable to lipid oxidation, which leads to the development of rancid or undesirable fishy flavors. As a result, such scenarios deter consumers from purchasing omega–infused supplements, thereby affecting the overall sales of the products across the Southeast Asia market. Apart from this, the omega–enriched product manufacturers in the Southeast Asia market are also facing crucial difficulties in extracting omega-3 fatty acids. Traditional extraction methods, which often involve high temperatures, can deteriorate heat-sensitive compounds and rely on toxic solvents, which can lead to contamination of the end product. Moreover, problems in controlling the fish-off taste and odor while extraction is another prominent hurdle observed by the producers.

Market Challenge

Incidences of Fish Allergies and Other Gastrointestinal Disorders Are Major Challenges in the Industry

Omega supplements contribute to human health but are also responsible for creating several gastric side effects, such as constipation, vomiting, diarrhea, and other allergic reactions. In more severe cases, it can lead to heartburn and nose bleeding. Such adverse health effects can discourage consumers from shopping omega-3 supplements, posing a challenge to their widespread adoption.

Another challenge is the variations in regulations in several Southeast Asian countries with respect to labeling and health claims. Complying with stringent regulations while conveying the health advantages of omega-3 is a complex task that obstructs the South East Asia Omega-3 supplements market growth potential.

Market Opportunity

Technological Advancements in the Production of Omega Supplements Pave Growth Opportunities

The adoption of advanced technologies to enhance production has opened enormous opportunities for growth in the Southeast Asia natural supplements industry. The players in the region are focusing on adopting innovative technologies to strengthen the quality and effectiveness of their products. Molecular distillation is one of the highly developed techniques that is used to improve the sustainability, purity, and potency of omega–3–infused products. Other than this, microencapsulation technology is also utilized to infuse fish oil into various food items, thus responsible for boosting the stability and palatability of edible products. These microencapsulated powders are increasingly incorporated in dietary supplements and other food & beverage ranges to augment the quality of finished products.

MARKET TRENDS

Emerging Demand for Vegan Omega Supplements is the Current Trend

Plant-based omega-3 supplements have gained widespread traction due to their several health advantages, ranging from cognitive function to heart health. With increasing awareness of veganism and the importance of plant-centric products, consumers in Southeast Asia are shifting toward vegan–omega supplements, such as flax seed and chia seed supplements, which are recognized as rich sources of omega-3 fatty acids. In order to fulfill growing consumer demands, manufacturers in the Southeast Asian market are capitalizing on this emerging trend by introducing omega supplements derived from algae and other seeds. These products cater specifically to the increasing population of plant-centric consumers in the region. Blackmores, Mega Food, and Nordic Naturals are a few of the active players producing vegan supplements.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic posed unusual challenges on every sector of the market, with the omega supplements industry experiencing a positive impact in terms of demand from South East Asian countries. Initially, the supplement market faced disruptions in the supply chain due to labor shortages, lockdowns, and travel restrictions. These challenges affected the transportation and production of omega-3-based byproducts. However, the rising awareness about natural supplements amid the pandemic driving individuals to concentrate on immune-building supplements such as omega-3 products. Moreover, the need for plant-sourced supplements also increased during the pandemic. Food supplements that included ingredients of plant origin, such as nuts, flaxseed, and others, grew in terms of popularity among consumers.

SEGMENTATION ANALYSIS

By Type

Fish Oil Led the Market Due to Its Several Health Advantages

Based on type, the market is divided into fish oil, algal oil, krill oil, and other plant sources.

The fish oil segment led the market in 2023 and generated the maximum share. Fish oil is recognized as the biggest dietary source of Omega-3 fatty acids and is widely known for supporting brain and cardiac health. Additionally, fish oil supplements ease blood clot prevention and cut down the incidences of stroke or heart attack. The growing demand for animal-sourced supplements further contributes to the demand for fish oil-based supplements.

Other plant sources, which include flax seed and chia seed supplements, witnessed the highest CAGR in the market in 2023, specifically due to the inclination toward veganism and increasing demand for clean-label supplements.

To know how our report can help streamline your business, Speak to Analyst

By Form

Capsule Form Dominated the Market Owing to its Easier Swallowing Properties

Depending on the form, the South East Asia market is divided into tablet, capsule, liquid, and powder.

Amongst all, the capsule segment dominated the Southeast Asia market and is expected to maintain its growth trajectory in the future. As compared to other forms, capsules possess higher bioavailability and act faster than other forms. Moreover, capsules are cost-effective, compared to various forms, and are easy to swallow.

Tablets secured the second position in the market, owing to their durability and inexpensive nature. Compared to other forms, tablets can accommodate higher doses of active ingredients and have lower production costs compared to capsules, making them a cost-efficient option for both manufacturers and consumers.

By Distribution Channel

Supermarkets/Hypermarkets Dominated Owing to Their Wide Product Collection

On the basis of distribution channels, the market is divided into supermarkets/hypermarkets, convenience stores, specialty stores, online retail, and others.

Out of all the channels, supermarkets/hypermarkets led the market and secured the largest share in 2023. Supermarkets/Hypermarkets emerged as “one-stop shops,” as they provide a wide collection of products, ranging from food, household products, and beverages. Moreover, the convenient shopping hours and prime locations of supermarkets support the segment’s growth. The cost-saving benefits and bulk purchasing options further contribute to the growth of this sector.

Online retail experienced the fastest CAGR in 2023 and is predicted to proliferate at a higher pace due to the faster buying process and 24/7 access. The surging internet penetration and growing smartphone usage in South East Asia have influenced individuals to purchase omega supplements via online mode.

South East Asia Omega-3 Supplements Market Regional Outlook

On the basis of countries, the market is segmented into Indonesia, Singapore, Vietnam, Philippines, Thailand, Malaysia, and the Rest of SEA.

Indonesia

Indonesia dominated the South East Asia market by generating the maximum share in 2023. The nation’s population is undergoing a rapid demographic transition and gradually turning into an aging society. This share of the elder population is mainly intensified by the dipping fertility and increasing life expectancy rates. As per the “United Nations Population Fund,” a UN agency, the number of older adults is anticipated to grow to 33.70 million by 2025 and reach 48.20 million by 2035. Owing to such a spike in the aging population, senior citizens face numerous morbidity challenges, which include hypertension, asthma, and cardiovascular diseases. Thus, to overcome such hurdles, omega-3 supplements are widely utilized to improve the inflammation and cognitive function of geriatric groups.

To know how our report can help streamline your business, Speak to Analyst

Vietnam

Vietnam ranked second in the market and experienced the highest CAGR in 2023. Vietnam emerged as one of the leading trade hubs for seafood, with most of the seafood consumed being imported. The low local aquaculture production and strong demand for superior quality products in the nation increases the reliance on imports from high seafood-producing countries. This trend improves the availability of omega-3 products, which are helpful in reducing the risk of chronic diseases.

Singapore

In Singapore, the trend of veganism has gained the utmost traction as most individuals are concerned about their health and the environment. The improved awareness of the health benefits of plant-centric diets has influenced a large mass of Singaporeans as they learn about how their food patterns can affect their health. This shift has driven growth in the vegan supplements industry, prompting producers to align their offerings with consumer needs for plant-based products.

Philippines

The sports industry in the Philippines is currently flourishing, with volleyball, basketball, and boxing, being a few of the most famous sports. As individuals in the Philippines are trying to adopt healthier lifestyles, this shift in consumer lifestyle, is contributing to the demand for superior quality sporting goods, and supplements. As a result, sports professionals are spending high on premium quality sporting goods and supplements that can enhance their overall experience and performance, helping them maintain their fitness regimens.

Thailand

In Thailand, the use of omega-3 fatty acids in infant nutrition is increasing as parents are trying to add supplements to an infant’s diet, apart from mother’s milk, to promote healthy growth and development. Omega-3 fatty acids are considered vital nutrients for proper eye development, a strong immune system, and cognitive function, which has led to their increased use in infant formulas.

Malaysia

In Malaysia, the nutraceutical market has observed substantial growth over the past few decades and has been recognized as a key growth sector. The emerging new product launches, heightened health consciousness, and economic stability are cumulatively supporting the growth of the nutraceuticals market. As a result, this well-developed sector is facilitating the introduction of new product launches in the country.

Rest of South East Asia

In the Rest of South East Asia region, the thriving use of social media is projected to strengthen the awareness of omega supplements. Social media has become an important part of everyday business and individual life in the Rest of Southeast Asia (Brunei, Cambodia, Laos, and Burma), and its use is continuously evolving and expanding. In this digital world, social media helps in creating a product’s popularity by displaying its benefits on various social media applications such as Instagram, Facebook, and TikTok. This digital trend is helping to raise the awareness of natural supplements showcased by key players on social media.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Players Are Focusing on New Launches to Augment Their Profits

Major players in the South East Asia market include Amway, Kirin Holdings Company, Limited (Blackmores), NOW FOODS, NutraBio, and others. In today’s health-conscious era, Southeast Asian consumers are increasingly looking for options to enhance their immunity and overall body strength. In order to gain a competitive edge, these players are emphasizing on expanding their product offerings and launching new products, which can help in increasing the South East Asia Omega-3 supplements market share.

Major Players in the South East Asia Omega-3 Supplements Market

To know how our report can help streamline your business, Speak to Analyst

List of Key South East Asia Omega-3 Supplements Market Companies Profiled:

- Amway (U.S.)

- Kirin Holdings Company, Limited (Blackmores) (Japan)

- Nature Scienceuticals Sdn Bhd. (Malaysia)

- Nordic Naturals (U.S.)

- NOW FOODS (U.S.)

- NutraBio (U.S.)

- NYO3 International AS (Norway)

- Proteus Nutrition (Singapore)

- Reckitt Benckiser Group plc (U.K.)

- TruLife (Singapore)

KEY INDUSTRY DEVELOPMENTS:

- October 2024: Amway, one of the prominent conglomerates of beauty brands, opened a new outlet in Kuala Lumpur, Malaysia. This store, inaugurated on 25th October 2024, provides a range of supplements, including Omega-3 supplements.

- October 2024: Blackmores Singapore, a supplements brand by Kirin Holdings Company, Limited, announced its recognition in the Trusted Gold Brands Award. This accolade is mainly achieved by the votes of Singapore-based individuals, which helps in building its image across the Singapore market.

- April 2023: Nature Scienceuticals Sdn Bhd., a Malaysia-based pharma producer and distributor of health supplements, won awards for its products, including SAMBUVY’s elderberry supplement and FISOL3, at the Natural Health & Reader’s Choice Awards.

- December 2022: Amway Singapore, a subsidiary of Amway Global, entered into the idea of business expansion by opening an innovation hub in Singapore. This center is opened in partnership with the Singapore Economic Development Board, a government agency, and would focus on innovating new Omega-3 supplements.

- July 2023: Proteus Nutrition, a Singaporean supplement manufacturer, planned to strengthen the sales of its vegan Omega-3 supplements range via personal training gym outlets, coupled with the online sales platform in Malaysia and Hong Kong.

Investment Analysis and Opportunities

The omega-3 supplements market report provides comprehensive investment analysis and opportunities aimed at providing investors and business leaders with actionable insights. The report highlights the various opportunities that have the potential for investments, including new product launches, technological advancements, mergers & acquisitions, and geographic expansions.

REPORT COVERAGES

The market report includes quantitative and qualitative insights into the market. It also offers a detailed analysis of the market sizing and growth rate for all possible market segments. Key insights presented in the report include an overview of related markets, a competitive landscape, recent industry developments such as mergers & acquisitions, the regulatory environment in critical countries, and current market trends.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGEMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Unit |

Value (USD Million) |

|

Growth Rate |

CAGR of 8.34% from 2024 to 2032 |

|

Segmentation |

By Type

|

|

By Form

|

|

|

By Distribution Channel

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 114.83 million in 2023.

The market is expected to grow at a CAGR of 8.34% during the forecast period.

By type, the fish oil segment led the market.

Increasing practices of aquaculture farming and the surging use of omega-3 supplements in preventative healthcare are key factors facilitating market potential.

Amway, Kirin Holdings Company, Limited (Blackmores), and NOW FOODS are a few of the top players in the market.

Indonesia held the highest share of the market.

Rising cases of lipid oxidation could restrain market momentum.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us