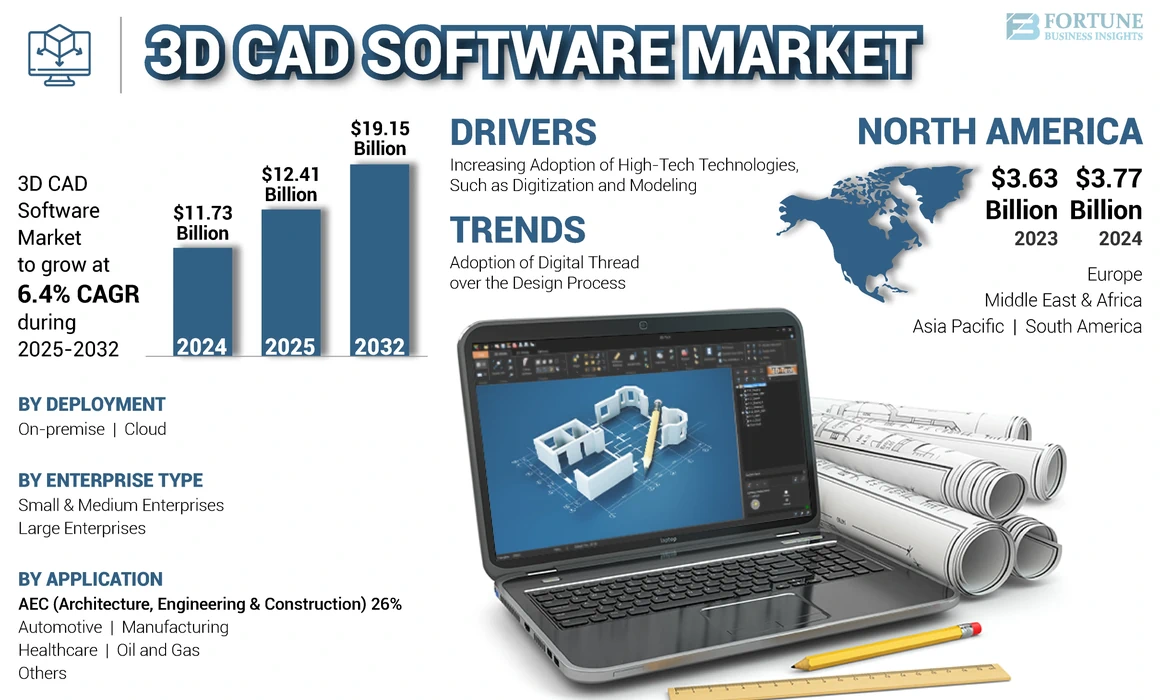

3D CAD Software Market Size, Share & Industry Analysis, By Deployment (On-premise and Cloud), By Enterprise Type (Small and Medium Enterprises (SMEs) and Large Enterprises), By Application (AEC (Architecture, Engineering & Construction), Automotive, Manufacturing, Healthcare, Oil and Gas, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

The global 3D CAD software market size was valued at USD 11.73 billion in 2024. The market is projected to grow from USD 12.41 billion in 2025 to USD 19.15 billion by 2032, exhibiting a CAGR of 6.4% during the forecast period. North America dominated the global market with a share of 32.14% in 2024.

3D CAD, also known as 3-dimensional computer-aided design, is a technology that product developers, designers, and engineers use to fabricate practical, virtual prototypes of three-dimensional entities. Through the power of 3D CAD, designers possess the ability to dynamically generate and alter every intricate aspect of a product, component, or assembly. This advanced software streamlines and automates various facets of product engineering, including drawing and drafting, simulation testing, data management, manufacturing, and computer-generated animation, and also offers a range of additional functionalities.

The growth is expected to remain strong in the future as industries continue to rely on digital technologies to streamline their operations and improve their products and services. Several factors, such as the growth of the manufacturing industry, the increase in infrastructure development, and the adoption of advanced technologies such as 3D printing and virtual reality, influence the demand.

Industry 4.0 could create USD 3.7 trillion in value creation potential for manufacturers and suppliers by 2025, according to the industry report, which is likely to bring about the next industrial revolution in discrete manufacturing.

COVID-19 IMPACT

Rapid Adoption of Cloud-based 3D CAD Software During Pandemic Propelled Market Growth

The COVID-19 pandemic had a positive impact on the market. One of the most significant impacts of the pandemic was the increased adoption of remote work and collaboration tools. This led to an increased demand for cloud-based 3D CAD software, which can be accessed and used from anywhere with an internet connection. Many businesses had to adapt quickly to the new remote work environment and turned to cloud-based software to help them maintain productivity and collaboration.

Additionally, the pandemic led to increased demand for 3D printing, particularly in the healthcare industry. 3D printing is used to produce medical equipment and supplies, such as personal protective equipment (PPE), ventilator parts, and testing swabs. This increased the demand for 3D CAD software, as it is essential for designing and modeling these parts and equipment.

- In April 2020, the World Health Organization (WHO) recommended the global public adopt the WFH (work from home) policy. This will likely raise the adoption of CAD software and services, increasing the demand for these solutions across manufacturing, automotive, electrical & electronics, healthcare, and other industries.

3D CAD Software Market Trends

Adoption of Digital Thread over the Design Process to Expand Market Growth

A digital thread connects the physical and digital realms, improving products, processes, people, and areas. It allows easy access to various sources and data. By implementing the digital thread in product development, users can eliminate data handoffs between different tools, saving time and energy while reducing errors. Digitizing the process divides tasks between manufacturing, delivery, and maintenance stages, enabling partners to work with greater accuracy and efficiency, with complete visibility into the progress and expected outcomes.

Hence, various enterprises and organizations build fully associative deliverables that are quickly efficient and reusable as designs progress through digital threads. For instance,

- In September 2022, Birdon Group chose Siemens' Xcelerator portfolio to aid its current strategy of progressing a digital shipyard to service international and Australian shipbuilding customers. The software will be implemented for modernized project data management and engineering design across Australia and other global operations. Birdon uses Siemens' NX CAD and PLM software to update product design data improvement by generating a digital thread.

Download Free sample to learn more about this report.

3D CAD Software Market Growth Factors

Increasing Adoption of High-tech Technologies such as 3D Modeling and Digitization to Upsurge Market Growth

Enterprises seek ways to increase productivity and efficiency while reducing the time it takes to bring their products to market to stay ahead of their competitors. As a result, many companies have either adopted or are transitioning from 2D CAD to 3D CAD.

3D modeling helps architects to develop detailed virtual models of building spaces. It allows them to evaluate and visualize various aspects of a project, such as materials, lighting, proportions, and composition, even before physical construction starts. This helps them to captivate their end-users on a large scale as their customers are able to visualize their virtualized building.

In addition, the AEC industry is realizing the need for sustainable and energy-efficient buildings. 3D modeling enables architects to design buildings that contribute to developing environmentally sustainable spaces for people around the world.

RESTRAINING FACTORS

Complexity of CAD Software and Lack of Standardization Impede Market Expansion

CAD software is equipped with different features and tools, as well as integrating technologies, which makes it difficult to use. This complexity can be particularly challenging for new users. Additionally, complex CAD software requires a powerful computer with ample storage and memory space. As a result, the software is not easily portable or compatible with low-power devices, such as tablets and laptops.

The software requires additional computer resources to deal with more complex models effectively. While this may not be a problem for users with high-performance systems, it could cause the program to crash or be deemed unusable for the majority of users. As a result, CAD software complexity leads to a range of issues, including difficulties in user operations, storage problems, costly errors, and more, ultimately hindering the overall usage and development of the software.

3D CAD Software Market Segmentation Analysis

By Deployment Analysis

Increasing Use of SaaS-based Cloud 3D CAD Software to Drive Cloud Segment Growth

Based on deployment, the market is bifurcated into on-premise and cloud.

In 2024, the cloud segment dominated the market share and is expected to continue its strong growth in the coming years. Cloud-based software is becoming more prevalent in the tech industry, benefiting various sectors. The market for cloud-based solutions has doubled in the last three years.

- In the next few years, more than half of all companies' spending will be on SaaS-based applications, as stated in the PTC CAD software Trends 2023 report. These companies are increasing their investments in the cloud and SaaS, and they anticipate software vendors to take advantage of the cloud and SaaS capabilities.

As cloud becomes more popular in tech industries, 3D CAD software developers are also adapting the same. They are shifting from on-premise solutions to Software-as-a-Service (SaaS), catering to organizations prioritizing the cloud. According to industry forecasts, cloud technologies will make up 37% of digital transformation IT spending in 2026, compared to 27% in 2021. This shift is driven by the increasing prevalence of remote work, highlighting the important role of the cloud in the market.

During the projected timeframe, the on-premise segment is anticipated to grow consistently. On-premise software can be directly installed on the user's computer or server, allowing them to keep the design data on their system. However, on-premises deployment may have limitations in terms of scalability. Companies might have to invest in additional hardware and servers to accommodate their growing user base.

By Enterprise Type Analysis

Growing usage of Advanced Manufacturing Technologies among Large Enterprises Drives Large Enterprises Segment Expansion

Based on enterprise type, the market is segmented into small and medium enterprises (SMEs) and large enterprises.

In 2024, the large enterprises segment dominated the market in terms of revenue share. Large enterprises use advanced and complex 3D CAD software to design and manufacture competitive products with state-of-the-art features. It enables them to produce highly customized products to meet a variety of customer needs. Additionally, CAD software helps large enterprises maximize product design production and reduce overall production costs. Moreover, for large enterprises, this software aids in complex engineering and design tasks, enables collaboration among different departments, enhances product development, and reduces time-to-market.

The small and medium enterprises (SMEs) segment is expected to register the highest CAGR during the forecast period. Awareness of cloud services is growing in the small business community. The use of 3D CAD software helps them compete in their respective markets, as the software enables them to create accurate CAD designs economically and quickly. It helps businesses simulate their products in 3D format before they opt to manufacture them, which leads to improved product quality and cost savings.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Adoption of 3D CAD Software in AEC (Architecture, Engineering & Construction) Sector Owing to Detailed Visualization and Cloud Collaboration Practices

By application, the market is divided into AEC (architecture, engineering & construction), automotive, manufacturing, healthcare, oil and gas, and others (packaging, media and entertainment).

The AEC (architecture, engineering & construction) segment is currently at the forefront in terms of market share. Modern 3D CAD software advancement has empowered industries and designers to produce superior, long-lasting, and environmentally friendly products and structures. With 3D CAD software, high-quality products can be developed without wasting materials on prototypes. Additionally, the construction industry is shifting toward cloud-based platforms for CAD collaboration. This enables teams to collaborate more effectively, exchange information instantly, and minimize construction delays.

The healthcare segment is projected to experience the highest growth in adopting 3D CAD software. Over the past few years, 3D CAD and modeling technology advancements have become crucial in the healthcare sector, providing groundbreaking solutions in different medical areas. These virtual models of anatomical structures and medical information have revolutionized the methods used by healthcare professionals for diagnosing, planning surgeries, educating patients, and conducting research.

REGIONAL INSIGHTS

Geographically, the market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America 3D CAD Software Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America accounted for the largest market share in 2024. The market’s growth in the region can be attributed to the early adoption of digitization and transformative technologies. In addition, the presence of major players, such as Autodesk, Bentley Systems, and PTC, among others, has also been contributing toward expanding the 3D CAD software market share in North America. The AEC industry in the area is going through fast development, which is helping the market to grow. As per the International Energy Agency, buildings use upto 30% of the world's energy and produce 26% of global energy-related emissions. Additionally, architecture and engineering companies expect a 17.6% rise in their net revenues in 2022, according to a report published by Deltek Inc. in May 2022.

Asia Pacific is projected to grow with the highest CAGR from 2025 to 2032. The significant expansion in this region's engineering, design, and development sectors is expected to drive the use of designing and modeling tools in the coming years. Moreover, Asia Pacific, particularly India, China, and Japan, holds the key to the potential adoption of 3D CAD software, accounting for most of the market share. This growth potential is driven by a strong industrial base, supportive government policies, and research and development funding provided by these countries. Japan and China have remarkable government initiatives and growth in this area.

The European market is experiencing growth potential as new startups and small businesses emerge, with a focus on digital technologies. The rise of Industry 4.0 and IoT is driving the digital transformation market in Europe. Additionally, the government and the Ministry for Economic Affairs and Energy (BMWI) have introduced Industry 4.0 as a national strategic initiative, emphasizing digitization, product interconnection, value chain, and business models.

Various factors, such as the adoption of new technologies and the development of the economy in the Middle East & Africa and South America, led to the 3D CAD software market growth. Rising investment in digital transformation across Brazil and Argentina drives market growth. In April 2021, the Inter-American Development Bank (IDB) provided around USD 1 billion of funding to Brazil to adopt the digital transformation strategy.

Furthermore, the UAE has taken the lead in embracing Additive Manufacturing in the region. The Prime Minister of the UAE has introduced an initiative to utilize technology for the betterment of society and elevate the UAE and Dubai's position as a prominent center for 3D printing technology by 2030.

- In March 2023, ZWSOFT announced its collaboration with Redington, a technology aggregator in the Middle East and Africa. This partnership aims to distribute ZWSOFT's software solutions in the region. By working together, they aim to provide customers with dependable all-in-one CAx (CAD/CAE/CAM) solutions, which will help accelerate the digitalization of the AEC and MFG industries in the area.

Key Industry Players

New Product Launches and R&D Investments by Major Players to Gain Competitive Edge Drive Market Growth

Leading market players, such as Dassault Systèmes, Autodesk Inc., Siemens AG, ZWSOFT CO., LTD., PTC, and others, are implementing various commercial plans and strategies. As part of their growth strategy, these companies are focusing on new product launches and investment in R&D activity to expand their product portfolio.

- In September 2022, Autodesk expanded the digital thread and promoted sustainability by introducing cloud-based solutions. These solutions include Autodesk BIM Collaborate Pro, enhanced organization and association for Civil 3D, AutoCAD web subscription, Autodesk sheets, and more.

List of Top 3D CAD Software Companies:

- Dassault Systèmes (France)

- Siemens AG (Germany)

- Autodesk Inc. (U.S.)

- ZWSOFT CO., LTD. (China)

- Bentley Systems Inc. (U.S.)

- SCHOTT SYSTEME GmbH (Germany)

- Hexagon AB (Sweden)

- PTC (U.S.)

- Bricsys NV (Belgium)

- IronCAD, LLC (Georgia)

KEY INDUSTRY DEVELOPMENTS

- May 2023 – PTC unveiled the latest edition of Creo+, a CAD solution offered as a software-as-a-service. Creo+ combines the reliable features and capabilities of Creo with cloud-based tools to simplify CAD administration and augment design collaboration. This new version empowers customers to design with greater ease, speed, and collaboration.

- February 2023 – Nextech AR Solutions Corp. introduced the latest Quad Topology Converter Update for Toggle3D. This update positions Toggle3D as the leading CAD to web 3D design platform, allowing users to create quad tessellations. This enhancement significantly enhances the overall quality of 3D models.

- December 2022 – IronCAD has improved its CAD software to help customers design products more efficiently. They recently launched IRONCAD 2023, with several enhancements that make it easier to innovate and bring designs to life faster. These improvements include 2D drawing views, better performance for 3D assemblies, 3D curve constraints, 3D positional constraint categories, and more detailed 3D designs and environments.

- September 2022 – In collaboration with Ansys, Autodesk unlocked the innovative product design and manufacturing proficiencies of Fusion 360 at AU 2022. The new update enables faster iteration, automates the machine software design process, and brings Fusion's power and agility to the user's browser or device.

- June 2022 – Siemens and South Korea's Hyundai Shipbuilding group planned to develop and launch CAD software based on NX CAD, especially for ship design. This helped shipyards accelerate digital transformation.

REPORT COVERAGE

The research report includes prominent regions globally to understand the industry better. Furthermore, it provides insights into the most recent industry trends and an analysis of technologies that are being adopted quickly on a global scale. It also emphasizes the market’s drivers and restrictions, allowing the reader to understand the industry thoroughly.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019–2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025–2032 |

|

Historical Period |

2019–2023 |

|

Growth Rate |

CAGR of 6.4% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Enterprise Type

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 11.73 billion in 2024.

Fortune Business Insights says that the market is expected to reach USD 19.15 billion by 2032.

A CAGR of 6.4% will be observed in the market during the forecast period of 2025-2032.

By deployment, the cloud segment is expected to grow at the highest CAGR during the forecast period.

Increasing adoption of high-tech technologies, such as 3D modeling and digitization, will upsurge market growth.

Dassault Systemes, Siemens AG, Autodesk Inc., ZWSOFT CO., LTD., PTC, and Hexagon AB, among others, are the top players in the market.

Asia Pacific is expected to record the highest CAGR.

By application, the AEC (Architecture, Engineering & Construction) led the market in terms of share in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us