Dental Bridges Market Size, Share & Industry Analysis, By Material (Ceramics, Metal, and Porcelain Fused to Metals), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

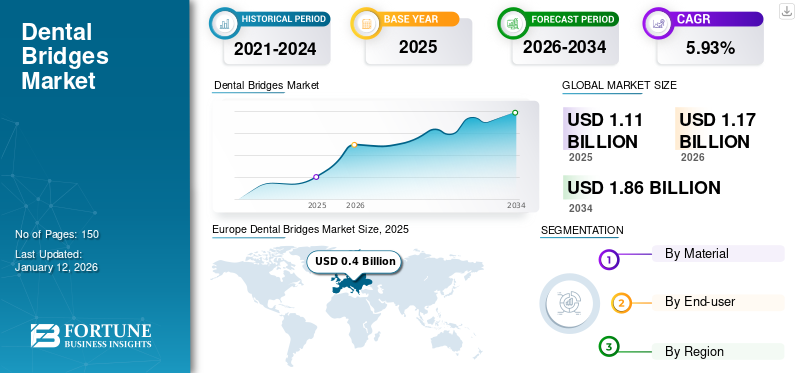

The global dental bridges market size was valued at USD 1.11 billion in 2025. The market is projected to grow from USD 1.17 billion in 2026 to USD 1.86 billion by 2034, exhibiting a CAGR of 5.93% during the forecast period. Europe dominated the dental bridges market with a market share of 35.70% in 2025.

Dental bridges are restorative solutions for missing teeth, comprising artificial teeth anchored to adjacent natural teeth or implants. They restore dental function and aesthetics and prevent problems associated with tooth loss, such as the shifting of remaining teeth and difficulty chewing. Bridges are made of various materials, including porcelain, metal alloys, or a combination, designed to match the natural teeth's appearance and provide long-lasting support for oral health.

The global market growth is attributed to the increasing prevalence of dental diseases, such as tooth loss. Rising awareness about oral health and aesthetics fuels the demand for these restorative solutions. Technological advancements in dental materials and techniques enhance the bridge’s durability and aesthetics. Additionally, the growing geriatric population and expanding access to dental care drive the global market growth, and the rise in cosmetic dentistry procedures worldwide.

The COVID-19 pandemic significantly impeded the market, causing a decline due to reduced dental visits and elective procedures, such as bridges procedures. However, in 2021, as the restrictions eased and dental care resumed, the market gradually rebounded, driven by the increased adoption and high demand for these restorative solutions, such as bridges in the market.

Global Dental Bridges Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 1.11 billion

- 2026 Market Size: USD 1.17 billion

- 2034 Forecast Market Size: USD 1.86 billion

- CAGR: 5.93% from 2026–2034

Market Share:

- Europe dominated the dental bridges market with a 35.70% share in 2025, driven by a high preference for aesthetic prosthetic procedures, rising disposable income, and advanced dental care infrastructure across the region.

- By material, the ceramics segment is expected to retain its largest market share owing to its superior aesthetics, biocompatibility, and growing demand for long-lasting restorative dental solutions.

Key Country Highlights:

- United States: Growth is fueled by the increasing adoption of advanced dental materials like titanium and a significant rise in root canal procedures enhancing the need for durable bridges.

- Europe: Demand is driven by the rising inclination towards aesthetic dental restorations and expanding access to cutting-edge prosthetic technologies in dental clinics.

- China: The surge in dental clinic visits and government-led initiatives to boost oral healthcare awareness are contributing to increased adoption of dental bridges.

- Japan: An aging population combined with a growing preference for minimally invasive dental prosthetics is accelerating the demand for advanced bridge solutions.

Dental Bridges Market Trends

Increasing Adoption of Digital Dentistry in Bridges Manufacturing

The advancements in bridges involve utilization of digital technologies such as computer-aided design/computer-aided manufacturing (CAD/CAM) systems and 3D printing to enhance the design, fabrication, and fitting process of these products.

This digitalization offers numerous benefits, including improved accuracy and precision in the design of bridges, leading to better fit and aesthetics for the patients. Such advancements allow for more efficient and streamlined workflows, reducing the time required for bridge production and delivery. Additionally, digital technologies enable customization and personalization of these products to match individual patient needs and preferences more closely.

Moreover, adopting digitalization in these products aligns with the broader market trends toward digitization and automation in dentistry. As technology continues to advance and become more accessible, digital workflows are expected to become increasingly prevalent in dental practices worldwide.

Download Free sample to learn more about this report.

Dental Bridges Market Growth Factors

Increasing Prevalence of Oral Health Issues to Drive Market Growth

Dental caries, commonly known as tooth decay, remains one of the most prevalent diseases globally, affecting individuals of all ages. Untreated dental caries can lead to tooth loss, impacting oral health and function.

As the increasing population ages and dietary habits change, the prevalence of dental caries and tooth loss continues to rise. Factors such as poor oral hygiene, consumption of sugary foods and beverages, and inadequate access to dental care contribute to the increasing prevalence of these conditions.

- For instance, according to a study published by NCBI in 2020, in Kabul, periodontal disease was 39%, followed by caries, which was 20%. These diseases were the city’s most common reasons for tooth extraction.

The growing prevalence of oral diseases can be catered by using bridges as dental restorative treatment. Bridges offer a durable solution for replacing missing teeth, restoring oral function, and preventing complications associated with tooth loss, such as bone resorption and misalignment of remaining teeth.

Moreover, advancements in dental materials and techniques have improved these bridge’s durability and longevity, making them an option for patients seeking tooth replacement solutions. Overall, the rising prevalence of dental caries and tooth loss drives the demand for these bridges, fueling the market growth as individuals seek effective and reliable solutions to restore their oral health and quality of life.

Growing Awareness of Oral Healthcare to Boost Market Growth

Rising awareness makes individuals more proactive in seeking dental treatments to address tooth decay, gum diseases, and tooth loss. Rising awareness leads to increased demand for dental procedures and treatments, including bridges, which effectively replace missing teeth and restore oral function.

Furthermore, dental professionals and oral health organizations actively promote the benefits of maintaining good oral hygiene and seeking regular dental check-ups. These efforts contribute to the spread of information about available dental treatments, including bridges, and encourage individuals to prioritize their oral health.

- For instance, in September 2021, the Department of Periodontics and Public Health Dentistry of Aligarh, India, conducted an awareness program for dental health and hygiene.

Overall, the rising awareness of oral care drives the demand for these products as people increasingly recognize the importance of preserving their natural teeth and restoring oral function is expected to continue fueling the dental bridges market growth.

RESTRAINING FACTORS

High Cost of Dental Bridges Hampers Market Growth

The high cost associated with dental bridges treatment may limit patients from seeking treatment, which is a significant barrier to the market’s growth. Dental bridge procedures can be expensive, and their cost may vary depending on the number of missing teeth and the material used for the bridge.

- For instance, according to the Evans Family Dentistry, the average retail cost in the U.S. is between USD 1,500 and USD 5,000, which might vary depending on the geographic location of the dental clinic and the type of dental bridges treatment.

Furthermore, in many developing nations, healthcare systems struggle to provide comprehensive coverage for dental services, including procedures such as dental bridges. Due to the lack of reimbursement, patients often have to pay out of their pockets for dental treatments, which can be prohibitively expensive for many individuals, limiting the adoption of these procedures in developing countries.

Such high costs and inadequate reimbursement of bridges are expected to hinder the market’s growth during the forecast period.

Dental Bridges Market Segmentation Analysis

By Material Analysis

Ceramics Segment Dominates Owing to Their Growing Adoption in Prosthetic Procedures

By application, the market is segmented into ceramics, metals, and porcelain fused to metals.

The ceramics segment accounted for the largest dental bridges market share of 49.39% in 2026. The segmental growth is owed to the increasing demand for these materials among dentists. Ceramic materials closely mimic the appearance of natural teeth, offering aesthetic solutions to patients, especially women. Additionally, ceramics are resistant to staining and wear, providing long-lasting results. The biocompatibility of these materials ensures minimal risk of adverse reactions, making them a preferred choice for dental restoration, thereby propelling segmental growth.

In 2024, the porcelain fused to metals segment accounted for a significant market share and is expected to grow at a substantial CAGR during the forecast period. The bridges of these materials combine the aesthetic benefits of porcelain with the strength and stability of metal alloys. The combination of these two materials has increased the adoption of the porcelain fused to metals bridges among dentists, propelling segmental growth.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Solo Practices Held a Major Share due to Increasing Prosthetic Procedures in these Settings

In terms of end-user, the market is segmented into solo practices, DSO/group practices, and others.

In 2026, the solo practices segment accounted for the largest market share, at 63.87%.The segmental growth is attributed to growing incidences of dental ailments across the globe, increasing the number of patient populations in solo practices. Furthermore, the significant uptake of such advanced tools by solo practitioners to produce dental bridges is projected to contribute to segmental growth in the future.

The DSO/group practices segment is projected to grow at a substantial CAGR during the forecast timeframe, 2026-2034. The segment’s growth is owed to the rising preference of dentists toward DSO/group practices. For instance, according to the HPI survey published by the ADA, in 2021, 67.8% of clinics were operating with two to nine dentists, and 70.6% of clinics were operating with ten or more dentists in U.S. Such large number of dentists in DSO/group practices is expected to large number of prosthetic procedures, thereby boosting the adoption of bridges in these facilities.

Furthermore, decreased expenses to restructure the unique operational environment is a key benefit, among other advantages DSO offers over solo practices. Hence, the revenues from the DSO/group practices segment is estimated to emerge in the future.

The others segment which includes community health centers, and hospitals is expected to grow at a significant CAGR during the forecast period.

REGIONAL INSIGHTS

Geographically, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Europe

Europe Dental Bridges Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the market with a revenue of USD 0.38 billion in 2024 and is expected to continue its dominance during the forecast timeframe. Furthermore, the increasing preference for aesthetic prosthetic procedures owing to rising disposable income in developed countries augments growth. The UK market is projected to reach USD 0.05 billion by 2026, while the Germany market is projected to reach USD 0.11 billion by 2026.

North America

North America held the second-highest share in 2025. The share is attributable to the increasing demand for titanium dental bridges and several companies focusing on developing such materials. Furthermore, the growing number of root canal procedures across the region is anticipated to propel market growth. The U.S. market is projected to reach USD 0.35 billion by 2026.

Asia Pacific

Asia Pacific market is expected to grow at the highest CAGR over the projected period. The high growth is supported by the increasing patient visits and growing government initiatives to increase dental practices. For instance, according to a data in 2019, 65.5% of adults aged 18–64 had a dental visit in the U.S., which reflects the potential of the U.S. market for dental services. The Japan market is projected to reach USD 0.06 billion by 2026, the China market is projected to reach USD 0.09 billion by 2026, and the India market is projected to reach USD 0.03 billion by 2026.

Middle East & Africa and Latin America

The Middle East & Africa and Latin America markets are expected to grow at a significant CAGR during the forecast period. The growth is attributed to increasing cases of dental ailments across the regions. Moreover, the increasing adoption of dental bridges with innovative technology as prosthetic devices across these regions is another factor stimulating the growth.

List of Key Companies in Dental Bridges Market

Companies with Advanced Milling Machines to Manufacture Bridges to Hold Key Market Share

The market is fragmented due to the presence of a large number of dental companies manufacturing these products across the world. 3M, DDS Lab Inc., and Cheng Crowns are some of the key players with a strong presence in the U.S. and Europe and have a diversified product portfolio of bridges. Moreover, these companies’ have a consistent focus on installing advanced milling machines to manufacture bridges to meet the needs of the dental clinics.

Other companies in this market include Glidewell, Directa AB, Altimed JSC, and other small & medium-sized players. These companies are engaged in various strategic developments, such as new product launches, partnerships, and collaborations.

LIST OF KEY COMPANIES PROFILED:

- Cheng Crowns (U.S.)

- Altimed JSC (Belarus)

- Acero Crowns (U.S.)

- Directa AB (Sweden)

- Hu-Friedy Mfg (U.S.)

- DDS Lab Inc (India)

- Glidewell (U.S.)

- Dental Lab India (India)

- Illusion Dental Lab (India)

KEY INDUSTRY DEVELOPMENTS:

- September 2023: Medit launches a scan-to-design prosthetics solution, such as bridges with AI-driven precision.

- March 2023 - PLANMECA OY introduced new AI-based tools for Planmeca Romexis. This software platform supports a versatile range of 2 Dimensional and 3 Dimensional imaging and CAD/CAM work and provides a complete solution, including bridges for all specialties and clinics of all sizes.

- February 2023 – HASSBio America partnered strategically with Roland DGA Corporation to combine Roland DGA Corporation's state-of-the-art DWX-42W wet milling solution with its newly launched Amber Mill Direct. This combined solution allowed dental practices to deliver chairside restorations, such as bridges, within one hour.

- February 2023: ZimVie Inc. launch of the RealGUIDE CAD and FULL SUITE modules, the latest innovations within ZimVie’s digital dentistry software platform for restorative design, such as bridge.

REPORT COVERAGE

The market research report focuses on qualitative and quantitative insights analysis of various segment, profiles of key companies offering bridges. Moreover, it provides, key industry developments such as mergers, partnerships, and acquisitions along with the impact of COVID-19 on the market. In addition to the above mentioned factors, the global dental bridges market analysis encompasses various factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.93% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

By End-user

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 1.11 billion in 2025 and is projected to reach USD 1.86 billion by 2034.

In 2025, the market in Europe stood at USD 0.4 billion.

The market is expected to exhibit a CAGR of 5.93% during the forecast period.

The ceramics segment led the market in 2026.

Digitalization of designing dental bridges, rise in the geriatric populations, and rise in the prevalence of tooth decay, and other oral diseases are the key factors driving the market growth.

Altimed JSC, Directa AB, Cheng Crowns, and 3M are the top players in the market.

Europe dominated the dental bridges market with a market share of 35.70% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us