Healthcare IT Market Size, Share & Industry Analysis, By Solution (Clinical Solutions {Electronic Health Records (EHR), Population Health Management Solutions, Mobile Health Applications, Telehealth Solutions} and Non-Clinical Solutions {Revenue Cycle Management, Customer Relationship Management Solutions, Supply Chain Management Solutions}), By Component (Hardware and Software & Services), By End-User (Healthcare Providers {Hospitals & ASCs, Diagnostic Imaging Centers, Pharmacies, and Others} and Healthcare Payers {Private Payers and Public Payers}), and Regional Forecast, 2026-2034

Key Market Insights

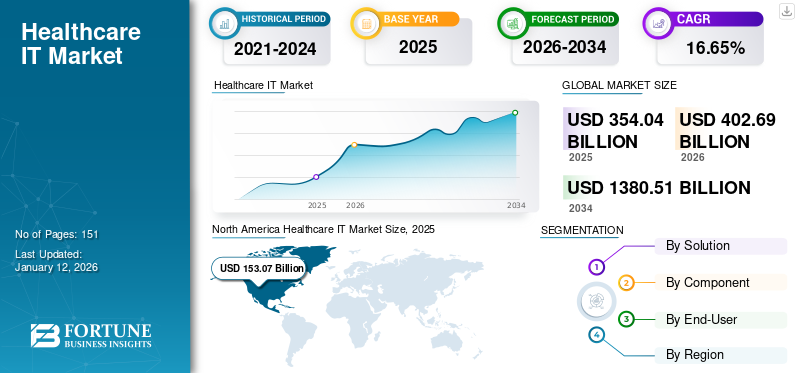

The global healthcare IT market size was valued at USD 354.04 billion in 2025. The market is projected to grow from USD 402.69 billion in 2026 to USD 1380.51 billion by 2034, exhibiting a CAGR of 16.65% during the forecast period. North America dominated the healthcare IT market with a market share of 43.23% in 2025.

The healthcare sector has observed significant growth in blockchain technologies, artificial intelligence, and the internet of things. Emerging devices and infrastructures provide doctors, healthcare organizations, and patients with immediate access to healthcare information, enabling better decision-making and treatment options. This increased demand for advanced healthcare solutions such as mHealth, telemedicine, e-prescribing, and others is driving the growth of the healthcare IT market.

Furthermore, integrating healthcare information technology offers several opportunities, such as improving clinical outcomes, reducing human error, improving practice efficiencies, and facilitating care coordination.

- In October 2023, Augmedix entered into a collaboration agreement with The Sullivan Group. This collaboration aims to improve the value delivered to health systems by offering high-quality solutions that integrate medical documentation with a reduction in doctor’s exposure to diagnostic-related errors through the Clinical Decision Support System (CDSS).

The COVID-19 pandemic slowed the healthcare IT market growth in 2020 as the healthcare industry largely relied on conventional methods and equipment for several healthcare procedures. However, in 2021, there was a slight increase in the adoption of advanced technologies due to their potential to enhance healthcare delivery. Virtual care, telehealth, digital therapeutics, and other advancements have made healthcare more accessible globally, playing crucial roles in monitoring, diagnosing, and managing COVID-19 cases.

- In 2021, Cerner Corporation experienced a 4.7% revenue increase, driven by heightened implementation activity across its business.

Global Healthcare IT Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 354.04 billion

- 2026 Market Size: USD 402.69 billion

- 2034 Forecast Market Size: USD 1380.51 billion

- CAGR: 16.65% from 2026–2034

Market Share:

- Region: North America dominated the market with a 43.23% share in 2025, driven by growing awareness of digital health, the integration of big data into healthcare management, and an increasing shift toward value-based care.

- By Solution: Clinical solutions held the largest market share, owing to constant technological development, a growing focus on patient care and safety, and the increasing need for integrated healthcare systems.

Key Country Highlights:

- Japan: As part of the fastest-growing Asia Pacific region, the market is driven by the increasing adoption of digital technologies, a rising prevalence of chronic diseases, and continuous advancements by key market players.

- United States: The market is fueled by a high prevalence of chronic diseases, with six in ten adults having at least one. Growth is also supported by a rapidly aging population and government initiatives aimed at promoting e-health technology.

- China: Growth is supported by the rising adoption of digital technologies and continuous advancements from key market players to address the healthcare needs of its large population and the increasing prevalence of chronic diseases.

- Europe: The market is propelled by growing R&D expenditure from biotechnology and pharmaceutical companies and the continuous introduction of new technologies designed to improve healthcare delivery and patient outcomes.

Healthcare IT Market Trends

Increasing Investments by Companies for Advancing Healthcare Infrastructure Globally

Pharmaceutical and biotechnology companies are continually striving to provide essential services and advanced treatment to patients. Many have integrated digital analytics into early-stage clinical and drug development processes to reduce timelines and increase success rates.

- In November 2023, GE HealthCare received the U.S. FDA authorization for its latest version of the digital expert access device. This device facilitates remote patient scanning and is compatible with GE HealthCare magnetic resonance technology.

Furthermore, several companies are securing funding to enhance their healthcare infrastructure. For instance, in May 2021, Huma Therapeutics Limited received USD 130.0 million in funding to digitalize its healthcare platform and support pharmaceutical industries in conducting decentralized clinical trials. This platform combines real-world data, digital biomarkers, and predictive algorithms to advance proactive research.

Download Free sample to learn more about this report.

Healthcare IT Market Growth Factors

Growing Prevalence of Chronic Diseases is Driving Market Growth

The increasing prevalence of chronic diseases such as cancer, cardiovascular diseases, diabetes, and others has boosted the demand for healthcare IT for better treatment options. Moreover, the rising number of patient visits in hospitals is raising awareness about the potential applications of these technologies, thereby further fueling the market growth. According to the data published by the CDC in August 2023, six in ten adults in the U.S. have chronic diseases. Additionally, with the aging population in the U.S., the prevalence of diseases is expected to rise, further driving growth in the healthcare IT market.

- According to the data published by the U.S. Centers for Disease Control and Prevention, in 2019, 54.1 million U.S. adults were 65 years and older, which represents 16% of the total population. In addition, by 2040, the number of geriatric population is projected to reach 80.8 million.

Furthermore, chronic disease management is a top priority for the healthcare system due to complexity and high cost associated with managing such conditions. Therefore, integrating EMRs is deemed the most effective approach to enhance information workflow efficiently.

- In July 2022, MyHealthcare launched a single-screen EMR in India, a system that allows clinicians and doctors to enter all patient’s medical records on a single screen.

Increasing Number of Product Launches Fuels Market Growth

Technology has revolutionized the way healthcare providers treat, diagnose, and manage patient care. The introduction of artificial intelligence and telemedicine is improving medical diagnosis and treatment significantly. Advanced imaging technologies are enabling minimally invasive procedures with higher precision, aiding in proper diagnosis and treatment. Integration of technology with pharmaceutical research is leading to the development of personalized medicine and targeted therapies.

- In September 2022, RxDefine launched the telehealth product for the life sciences brand, aiming to assist individuals in their health decisions, improving the consumer experience.

Thus, the increase in new product launches by key market players in healthcare IT is projected to impact market growth during the forecast period positively.

RESTRAINING FACTORS

Shortage of Skilled Workers to Operate Advanced Devices is Projected to Limit Market Growth

Recent advances in the technology field are driving a substantial demand for skilled technology workers. However, the ongoing shortage of healthcare workers poses a significant challenge for healthcare organizations. Factors such as staff burnout, overflow of appointments, stagnant growth, and inefficient processes have adverse effects on patient outcomes.

- According to the data published by Oracle in 2023, the healthcare industry was projected to witness a substantial shortage of up to 124,000 physicians by 2033.

Furthermore, rural areas face a significant shortage of skilled workers due to limited healthcare infrastructure quality. These workforce shortages contribute to increased errors and hinder adoption of advanced technologies. Consequently, these factors are expected to restrict the market growth during the forecast period.

Healthcare IT Market Segmentation Analysis

By Solution Analysis

Increasing Demand for Cost-effective Care is Boosting the Demand for Telehealth Solutions

By solution, the market is segregated into clinical solutions and non-clinical solutions. The clinical solutions segment is further segmented into Electronic Health Records (EHR), population health management solutions, mobile health applications, telehealth solutions, and others. The non-clinical solutions segment is further segmented into revenue cycle management, customer relationship management solutions, healthcare interoperability solutions, supply chain management solutions, and others.

Clinical solutions dominated the market with a share of 70.12% in 2026, owing to constant technological development coupled with growing patient care and safety and the growing need for integrated healthcare systems. Moreover, the increasing use of EHR by several entities such as hospitals, primary care physicians, and insurance companies has boosted its demand. The growing focus on patients accessing their healthcare data to keep themselves updated has led to more personal use of EHR. Thus, ease of access to these clinical solutions among patients and healthcare providers is contributing to the segmental growth.

- According to the survey published by Independa in January 2023, 90% of Americans use telehealth services. Moreover, some of the services include teledentistry, vision appointments, and doctor appointments.

The non-clinical segment is projected to witness considerable growth during the forecast period due to growing awareness regarding advanced technologies that are streamlining healthcare operations. These systems would further help in managing clinical and administrative functions.

By Component Analysis

Increasing Adoption of Digital Technologies is Fueling the Demand for Services and Software

By component, the market is segmented into hardware and software & services.

The software & services segment dominated the market for healthcare IT in contributing 66.07% globally in 2026. Healthcare organizations increasingly rely on digital solutions to streamline their operations, improve patient care, and enhance overall efficacy. Electronic health record systems, revenue cycle management tools, and other digital platforms assist hospitals to automate data collection, provide instant access to information, and make faster decisions. These factors are driving growth in the segment.

- In April 2022, Emmaus Life Sciences, Inc. partnered with Bioservices Corporation, UpScriptHealth, and Asembia LLC to launch an advanced full-service telemedicine solution. The program is further expanding the telemedicine service for providers and patients in the U.S.

The hardware segment is projected to witness considerable growth during the forecast period. Increasing demand for advanced diagnostic and patient monitoring devices to provide proper patient outcomes has contributed to the segment’s growth. In addition, the increasing number of internet users is boosting the demand for hardware products.

To know how our report can help streamline your business, Speak to Analyst

By End-User Analysis

Growing Number of Patient Visits in the Hospitals are Contributing to the Healthcare Providers Segment Growth

By end-user, the market is segmented into healthcare providers and healthcare payers. The healthcare providers are further segmented into hospitals & ASCs, diagnostic imaging centers, and pharmacies. The healthcare payers are further segmented into private payers and public payers.

Healthcare providers dominated the market in accounting for 65.94% market share in 2026 owing to increasing spending by healthcare providers on IT and software, which has advanced the existing technologies and product offerings. Moreover, constant technological advancements and the availability of new solutions mainly focused on patient engagement and cybersecurity have further contributed to the segmental growth.

- In August 2023, HCA Healthcare collaborated with Google Cloud to use AI technology, which focuses to enhance workflows on time-consuming tasks, such as clinical documentation.

Healthcare payers segment is projected to grow at a nominal rate in the coming years as most of the payors are focusing on offering enhanced services to the patients. Several medicare companies are integrating Virtual Reality (VR) and Artificial Intelligence (AI) into their existing portfolio. The advancement focuses on shifting from managing healthcare payments and claims to a more comprehensive patient care management approach.

REGIONAL INSIGHTS

Geographically, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Healthcare IT Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the healthcare IT market share, generating a revenue of USD 133.68 billion in 2024. The region’s growth is attributed to growing awareness regarding digital health, integration of big data in healthcare management, and an increasing shift toward value-based care. Furthermore, a growing government initiative to promote e-health technology in the U.S. is further driving the country’s market growth. The U.S. market is projected to reach USD 160.56 billion by 2026.

- For instance, in September 2023, Oracle launched new cloud-based EHR capabilities. Healthcare providers and clinicians can leverage AI integrated with voice commands to reduce manual work. Moreover, the platform would assist in ordering medication and scheduling appointments.

Europe

Europe accounted for a substantial market share in 2024 and is expected to witness considerable growth during the forecast period. Growing R&D expenditure by biotechnology and pharmaceutical companies and the introduction of new technologies in the region are contributing to the region’s healthcare IT market growth. The UK market is projected to reach USD 18 billion by 2026, while the Germany market is projected to reach USD 26.05 billion by 2026.

Asia Pacific

Moreover, Asia Pacific is expected to expand at the fastest CAGR during the forecast period. The growing prevalence of chronic diseases, increasing adoption of digital technologies, and continuous advancement by key market players are contributing to the growth of the market. The Japan market is projected to reach USD 19.09 billion by 2026, the China market is projected to reach USD 15.06 billion by 2026, and the India market is projected to reach USD 12.15 billion by 2026.

Latin America and the Middle East & Africa

The Latin America and the Middle East & Africa are projected to witness lucrative growth during the forecast period. Increasing healthcare expenditure by the government and private sector in these regions is boosting the demand for advanced technologies.

- In March 2023, according to the data published by HSBC, Saudi Arabia had the highest number of ongoing healthcare projects, accounting for 12.9%, followed by Kuwait and Oman.

Key Industry Players

Companies are Focused on New Products Launches to Expand its Current Product Portfolio

Epic Systems, Cerner Corporation, Allscripts, Meditech, Health Catalyst, Inc., and Athenahealth, Inc. are some of the market players that captured a considerable market share in 2024.

- For instance, in March 2023, Epic Systems and Microsoft Corp. expanded their collaboration to integrate AI into healthcare by combining Epic's Electronic Health Record (EHR) software with Azure OpenAI Service. This will improve patient care and enhance financial stability.

Similarly, Meditech captured a considerable market share in 2024 owing to a strong brand presence and a robust product portfolio. Moreover, the company is also focusing on developing highly efficient and advanced healthcare IT solutions.

Other prominent players operating in the market, such as Health Catalyst, Inc., Athenahealth, Inc., InterSystems Corporation, Arcadia Solutions, LLC, and Capsule Technologies, Inc., emphasize several strategic developments, including partnerships, collaborations, and service expansion, which are some of the major factor expected to fuel the market shares of these companies in healthcare IT.

LIST OF TOP HEALTHCARE IT COMPANIES

- Epic Systems (U.S.)

- Cerner Corporation (U.S.)

- Veradigm LLC (U.S.)

- Meditech (U.S.)

- Health Catalyst, Inc. (U.S.)

- Athenahealth, Inc. (U.S.)

- InterSystems Corporation (U.S.)

- Arcadia Solutions, LLC (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Innovaccer, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023 – Epic Systems partnered with Qualtrics to offer software solutions that provide proper patient information to doctors, health systems, and hospitals. Moreover, the platform assists organizations to receive feedback about the consumer experience.

- October 2023 – Veradigm LLC collaborated with First Databank, Inc. to join the ePrescribing network. Veradigm will integrate the network into its available solutions and expand its dynamic community of companies, providing innovative insights, data-driven solutions, and advanced technologies.

- May 2023 – Doximity, Inc. integrated MEDITECH's Electronic Health Record (EHR) systems. The integration assists healthcare professionals in launching a Doximity Dialer video or voice telehealth visit directly from the app.

- April 2023 – LifeOmic announced the launch of the patient mobile app, which provides a two-way connection between the patient and the healthcare team. Healthcare providers have access to highly configurable solutions that integrate into existing workflows.

- July 2021 – Population Health Management Solutions launched Value Optimizer, a population health management solution that identifies valuable opportunities for Value-Based Care (VBC) performance improvement.

REPORT COVERAGE

The healthcare IT market report provides a detailed competitive landscape. It includes a number of key industry developments such as partnerships, mergers, and acquisitions. Additionally, it focuses on key points such as new product launches in the market. Furthermore, the report covers regional analysis of different segments, company profiles of key market players, market trends, and the impact of COVID-19 on the market. The report consists of quantitative and qualitative insights that contribute to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 16.65% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Solution

|

|

By Component

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 402.69 billion in 2026 to USD 1380.51 billion by 2034.

The market is expected to exhibit a CAGR of 16.65% during the forecast period (2026-2034).

The clinical solutions segment leads and dominated the market in 2025.

The key factors driving the market are the increasing prevalence of chronic diseases and constant technological advancement.

Epic Systems, Cerner Corporation, Allscripts, Meditech, Health Catalyst, Inc., and Athenahealth, Inc. are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us