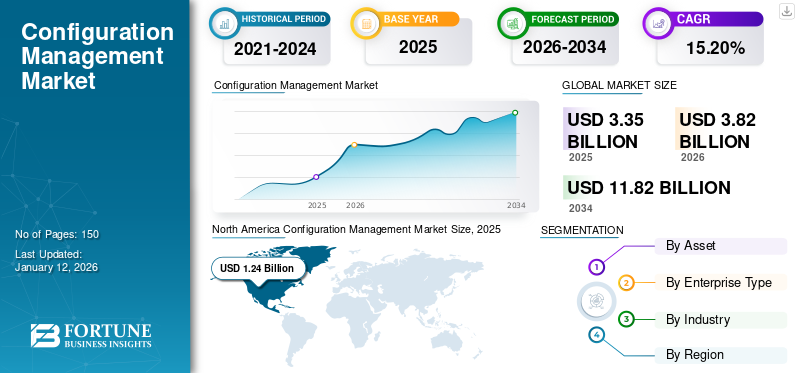

Configuration Management Market Size, Share & Industry Analysis, By Asset (Server Infrastructure, Cloud Resources, Network Devices, Security Devices, and Edge Infrastructure), By Enterprise Type (Large Enterprises and SMEs), By Industry (BFSI, Retail, Healthcare, Manufacturing, IT & Telecom, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global configuration management market size was valued at USD 3.35 billion in 2025 and is projected to grow from USD 3.82 billion in 2026 to USD 11.82 billion by 2034, exhibiting a CAGR of 15.20% during the forecast period. North America dominated the global configuration management market with a share of 37.00% in 2025.

This market study considers configuration management solutions offered by market players, such as VMware, Inc., Atlassian, Cisco Systems, Inc., Microsoft Corporation, Oracle Corporation, Cloudbees, Puppet, ServiceNow, Amazon Web Services, Inc., and NetApp, among others.

Configuration management is a systems engineering process used to achieve consistency between physical and logical assets within a production environment. This process helps track and identify individual configuration elements while documenting functional capabilities and interdependencies. Engineers, administrators, and software developers use these tools to observe the impact of converting configuration items on other systems.

The COVID-19 pandemic was disruptive and unprecedented, with configuration management experiencing higher-than-expected demand across all regions compared to pre-pandemic levels. The CM (configuration management) area that was affected the most was change management, with comments regarding the need to move CCB online, integration issues, and high-volume email circulation. They relate to aspects of working from home, social distancing, and communicating through online media.

Configuration Management Market Trends

Increased Demand for Automated IT Resource Management Across Multiple Industries to Propel Market Growth

Rising demand for automated management of IT resources across multiple industries is driving the market. For instance,

- According to industry analysis, 50% of companies are planning to incorporate AI and automation technologies and will continue to invest in automated products in the coming years.

The market is growing rapidly due to the complexity of services and products, integration of electrical, firmware, mechanical & software components, and increasing need to simplify and synchronize IT resources. Adoption of CM is increasing due to the implementation of formal policies and procedures to monitor, audit, and identify asset status. Configuration management is also becoming more popular as improved visibility & tracking, and enhanced control, stability, and efficiency.

Download Free sample to learn more about this report.

Configuration Management Market Growth Factors

Rising Demand for Product Configuration Management to Boost Market Growth

Product configuration, also referred to as knowledge-based configuration, is the process of arranging and selecting components to meet a specific set of requirements. Customers in discrete manufacturing sectors progressively expect products to be tailored to their specific needs and meet their requirements.

For enterprises dealing with complex platforms and products or go-to-market strategies based on variants, product configuration management improves coordination, efficiency, and process of product development across manufacturing, engineering, and services. For instance,

- According to the findings of Configit 2023, manufacturing companies striving to enhance their product portfolios and increase profits are looking at product CM as a competitive advantage.

Integrating a linked digital thread with a strong product CM solution offers visibility into the changes to all product stakeholders, thereby improving quality, increasing confidence in compliance, and facilitating efficient concurrent manufacturing.

RESTRAINING FACTORS

Regulatory Compliance and Lack of Training and Awareness to Hamper Market Growth

Compliance requirements, such as industry standards or government regulations may impose constraints on configuration management practices, leading to additional documentation and validation efforts. Furthermore, insufficient training and awareness about the importance and benefits of CM can result in poor adoption and inconsistent practices within the organization.

Addressing these restraining factors requires a combination of leadership commitment, resource allocation, organizational alignment, and cultural changes to implement and sustain configuration management successfully.

Configuration Management Market Segmentation Analysis

By Asset Analysis

Server Infrastructure Dominated Market Owing to Increased User Traffic and Transactions

Based on asset, the market is segmented into server infrastructure, cloud resources, network devices, security devices, and edge infrastructure.

The server infrastructure segment dominated the market with a share of 44.35% in 2026, and is expected to record the highest CAGR during the forecast period. A surge in user traffic, transactions, or computational tasks can necessitate the expansion of server infrastructure to maintain performance and reliability. For instance,

- According to the digital payment records of 2023, the number of UPI transactions rose from 151 million in January 2018 to 9.3 billion in June 2023, mainly due to an increase in person-to-merchant (P2M) transactions.

The cloud resources segment will continue to grow as they offer virtually limitless scalability, allowing companies to provide additional resources as demand increases rapidly. Configuration tools must effectively manage the dynamic nature of cloud resources, ensuring that configurations can seamlessly improve to meet evolving user needs.

By Enterprise Type Analysis

Rising Investments by Governments to Boost Product Adoption Across SMEs

Based on enterprise type, the market is divided into large enterprises and SMEs.

The SMEs segment will record the highest growth rate with a share of 51.81% in 2026. SMEs need to be agile and responsive to market changes to stay competitive. Configuration management supports agile practices, such as continuous integration, continuous delivery, and DevOps, enabling SMEs to innovate faster and bring new products and services to market more quickly. Many governments are investing in small and medium-sized enterprises to boost the economic revenues. For instance,

- In March 2022, the Government of India allocated USD 808 million for the MSME performance improvement and acceleration initiative. The program will improve MSMEs’ access to markets and credit, build institutions and governance at the federal and state levels, strengthen inter-state connectivity and cooperation, address payment delay issues, and make MSMEs greener.

The large enterprises segment held a major market share in 2023. Large companies often operate in regulated industries or have stringent security requirements. CM helps mitigate risks by enforcing standardized configuration, tracking changes, and ensuring compliance with industry regulations and internal policies. Many large enterprises are adopting cloud computing to increase flexibility, scalability, and cost efficiency.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Usage of Configuration Management for IT & Telecom operations Contributing to Segmental Growth

Based on industry, the market is divided into BFSI, retail, healthcare, manufacturing, IT & telecom, and others.

The IT & telecom segment dominated the market in 2023. Configuration management solutions play a critical role in IT as they support all stages of the infrastructure lifecycle. Moreover, this industry is witnessing rapid innovation and the introduction of new technologies every day. The speed of these innovations requires IT infrastructures and services to have high levels of scalability and flexibility to enable smooth integration into new applications and solutions. For instance,

- According to the Reserve Bank of India data 2022, India's exports of IT and IT-enabled services increased by USD 133.7 billion from 2021. Indian IT and IT-enabled services companies have set up 1,000+ global delivery centers in 80 countries. Additionally, business process management accounts for 32% of the revenue in the Indian IT market.

The healthcare segment is expected to record the highest share of 35.52% in 2026. The adoption of telemedicine and remote patient monitoring technologies has accelerated the segment’s growth. Healthcare data is highly sensitive, making it a prime target for cyberattacks and data breaches. CM helps healthcare companies enforce best security practices, such as access control, encryption, and vulnerability management to protect patient data and mitigate security risks.

REGIONAL INSIGHTS

Geographically, the market is divided into five key regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America. They are further categorized into countries.

North America

North America Configuration Management Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is expected to hold the largest configuration management market share. North America dominated the global market in 2025, with a market size of USD 1.24 billion. This is owing to the presence of large IT enterprises that are adopting advanced technologies to manage their IT infrastructure. The region also has key players in the market, including IBM, Microsoft, and BMC Software. The U.S. market is projected to reach USD 0.80 billion by 2026.

Europe

In Europe, end-users in the BFSI, healthcare, and manufacturing sectors are investing in robust CM tools. This is owing to the implementation of stringent regulatory compliances in the region. Additionally, organizations are aiming to streamline their operations and enhance security. Key countries in the region that are fueling the growth of the configuration management market include the U.K., Germany, and France, which are leading in terms of the adoption of this technology. The UK market is projected to reach USD 0.23 billion by 2026, while the Germany market is projected to reach USD 0.21 billion by 2026.

Asia Pacific

Asia Pacific is expected to witness the highest market growth. Expanding IT infrastructure and digital transformation initiatives across China, India, Japan, and Australia are key contributors to the market growth. Moreover, increasing investments in IT modernization, cloud computing, and cybersecurity will also contribute to the regional market’s growth. The Japan market is projected to reach USD 0.18 billion by 2026, the China market is projected to reach USD 0.30 billion by 2026, and the India market is projected to reach USD 0.15 billion by 2026.

Additionally, there is rising awareness about the importance of CM in optimizing IT operations.

Middle East and South America

In the MEA and South America, the growing adoption of cloud services and developments related to IoT, backed by cybersecurity concerns, will bolster the demand for these solutions. This demand will be witnessed in the UAE, Saudi Arabia, South Africa, Brazil, Argentina, and Chile. These nations are witnessing an increased adoption of CM solutions among enterprises.

The above-mentioned factors will result in the configuration management market growth. The market’s progress will also be driven by the increasing complexity of IT environments, need for efficient resource management, and rising importance of cybersecurity and compliance.

List of Key Companies in Configuration Management Market

Key Players to Emphasize On Building Configuration Management to Strengthen their Positions

The prominent players in the market, such as VMware, Inc., Atlassian, Cisco Systems, Inc., Microsoft Corporation, BMC Software, Oracle Corporation, Cloudbees, Puppet, ServiceNow, Amazon Web Services, Inc., and NetApp are expected to dominate the market. These players are focused on offering multiple scalable configuration management options to cater to the changing user requirements. Similarly, they are adopting various strategies, such as product launches and partnerships to continue their dominance in the coming years.

LIST OF KEY COMPANIES PROFILED:

- VMware, Inc. (U.S.)

- Atlassian (Australia)

- Cisco Systems, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- Oracle Corporation (U.S.)

- Cloudbees (U.S.)

- Puppet (U.S.)

- ServiceNow (U.S.)

- Amazon Web Services, Inc. (U.S.)

- NetApp (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Kandji, a U.S.-based device management and security platform provider under Apple, announced an integration with ServiceNow. This integration will automate the sync of Apple fleet information with the ServiceNow Configuration Management Database (CMDB). This partnership will allow Kandji to create better experiences and deliver value to customers created with ServiceNow.

- June 2020: ServiceNow acquired Sweagle, a Belgian startup that provides configuration management technologies for cloud infrastructure. This helped ServiceNow to integrate Sweagle's technology into its platform to enhance its capabilities in cloud configuration management. The acquisition was in line with ServiceNow's strategy to expand its offerings and strengthen its position in the cloud services market.

- October 2020: VMware Inc. acquired SaltStack, a U.S.-based provider of software configuration management and infrastructure automation solutions. The acquisition assisted VMware in strengthening its capabilities. VMware was able to serve its customers better by changing requirements to manage the complex IT environment.

REPORT COVERAGE

The study of the market includes prominent areas across the world to help the user get better knowledge of the industry. Furthermore, the research provides insights into the most recent market trends and an analysis of technologies that are being adopted quickly at a global level. It also emphasizes some of the growth-stimulating factors and restrictions, allowing the reader to obtain a thorough understanding of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 15.20% from 2026 to 2034 |

|

Segmentation |

By Asset

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

The market is projected to reach a valuation of USD 11.82 billion by 2034.

In 2025, the market value stood at USD 3.35 billion.

The market is projected to record a CAGR of 15.20% during the forecast period of 2026-2034.

By type, the server infrastructure segment led the market in 2025.

Rising demand for product CM across the globe will boost the market growth.

VMware, Inc., Atlassian, Cisco Systems, Inc., Microsoft Corporation, Oracle Corporation, Cloudbees, and Puppet are the top players in the market.

North America held the highest market share in 2025.

By application, the healthcare segment is expected to record the highest CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us