人工知能市場規模、シェア及び業界分析:コンポーネント別(ハードウェア、ソフトウェア、サービス)、導入形態別(オンプレミス&クラウド)、企業規模別(大企業、中小企業)、機能別(人事、マーケティング&営業、製品/サービス展開、サービス運用、リスク、サプライチェーン管理)、技術別(機械学習、自然言語処理、コンピュータビジョン)、 産業別(医療、自動車、小売、BFSI、製造、農業)及び地域別予測、2026年~2034年

人工知能の市場規模と将来の見通し

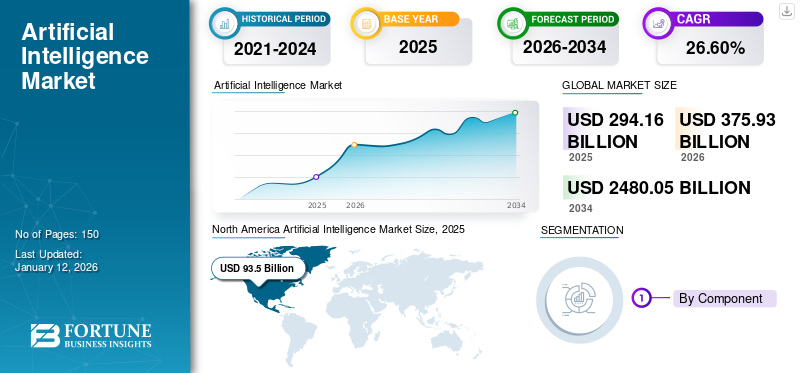

世界のAI市場規模は2025年に2,941億6,000万米ドルと評価され、2026年の3,759億3,000万米ドルから2034年までに2兆4,800億5,000万米ドルへ成長し、予測期間中に年平均成長率(CAGR)26.60%を示すと予測されている。北米は2025年に31.80%のシェアで世界市場を支配した。

機械を用いて人間の知能プロセスを模倣する技術を人工知能(AI)と呼ぶ。学習や問題解決といった人間の能力を再現するスマートなソフトウェア・ハードウェアの開発がこれに含まれる。多くの企業が意思決定のためのデータ分析にAIを活用しており、約35%の企業がAIを統合済みで、10社中9社が市場優位性を維持するためにこの技術を利用している。世界各国の政府はAI研究開発に多額の投資を行っており、ゴールドマン・サックスによれば、世界のAI投資額は2025年までに約2000億米ドルに達すると予測されている。

無料サンプルをダウンロード このレポートについて詳しく知るために。

上記のグラフは、2024年に資金調達を受けたAI企業の総数が2,049社、うち米国が1,143社であったことを示しています。これは同セクターの可能性に対する継続的な関心と楽観的な見方を示唆しています。今後、2025年には継続的なイノベーションがもたらされ、有望な資金調達機会とAI市場のさらなる成長が予想される。

日本の人工知能(AI)市場インサイト

日本では、産業の高度化やデジタルトランスフォーメーションの加速を背景に、AIの導入が幅広い分野で進展しています。製造、金融、医療、物流などの主要産業において、効率化・精度向上・自動化を実現する高度なアルゴリズムやデータ活用技術への期待が高まっています。また、グローバルで技術革新が進む中、日本企業にとっては、独自の品質基準と信頼性を生かしながら先進AIソリューションを取り入れ、競争力を強化する重要な機会となっています。

生成型人工知能が業界に与える影響とは?

ChatGPTの導入によりAI技術が引き続き主導権を握る

生成AIツールは、人間の文章に似たテキストを生成する能力を持ち、短編小説の作成、論文や音楽の作曲、数学問題の解決、基本プログラムのコーディング、翻訳など、幅広いタスクをカバーします。OpenAIの報告によると、2022年11月のリリースからわずか5日間で、同社のAIツールChatGPTは100万人以上のユーザーを獲得しました。下記の統計は、人気オンラインサービスが同数のユーザーを獲得するまでに要した期間を示している。比較すると、他の著名なオンラインプラットフォームは100万ユーザーというマイルストーンに到達するまでに、より長い期間を要した。

AIツールの最近のリリースを受けて、世界中の主要テック企業が自社開発のAI駆動型チャットボットを相次いで公開している。これらのチャットボットはChatGPTに対抗し、各社が業界での地位を維持するための支援を目的として設計されている。ChatGPTへの対応として最近発表された主な事例には以下が含まれる。

- 2023年2月 – 百度(バイドゥ)は英語版「Ernie bot」、中国語版「文心一意」という自社AIチャットボットを発表。これを受け、百度の香港上場株は13%以上上昇した。

このようにChatGPTの登場は、企業がAI技術に積極的に関与・投資し、これらのAI駆動型ツールを活用する動きを促している。このAI技術推進が市場成長を牽引しており、この需要が今後数年間にわたりAIの主導的地位を維持すると予想される。

生成AIのグローバルな産業横断的拡大は2024年も継続すると見込まれる。ブルームバーグ・インテリジェンス(BI)は報告書で、生成AI市場が今後10年間で1.3兆米ドル規模に達すると予測した。さらに、フォーチュン・ビジネス・インサイトによると、世界の生成AI市場規模は2023年に438億7000万米ドルに達した。現在、生成AIはトランスフォーマーベースのテキスト生成モデルと拡散ベースの画像生成モデルを活用している。これらのモデルにより、システムは既存データから学習し、入力データに酷似した膨大な情報を生成できる。さらに、ChatGPTやLLM(大規模言語モデル)などのAIモデルは、銀行・金融サービス、医療、旅行・ホスピタリティなどの分野で応用が進み、人的介入の削減につながっている。

相互関税が人工知能産業に与える影響とは?

人工知能にはGPU、サーバー、センサー、カメラ、エッジコンピューティングチップなどの高度なコンポーネントが組み込まれています。米国が中国のAIチップに関税を課したり、中国が米国製サーバーに報復関税を課したりすると、生産コストの上昇につながります。このため、クラウドコンピューティング、自律システム、AI研究所などの企業は、特殊な輸入ハードウェアへの依存度が高いため、特に影響を受けます。製造コストの上昇は消費者価格の値上げにつながる。相互関税は企業のグローバル調達戦略の見直しを迫る可能性がある。FPGAボード、高性能ネットワークユニット、AIサーバーなどの主要AIコンポーネントは、関税対象国以外の代替サプライヤーや製造拠点から調達する必要が生じるかもしれない。こうした変化は、リードタイムの長期化、新規ベンダーの再認定、規制再認証といった業務上の複雑さを生む。相互関税は、企業がAI搭載製品・サービスをコスト効率良く輸出する能力に影響を及ぼす。国境を越えたAI導入(クラウドAI API、スマートシティソリューション、またはエンタープライズAIスイート)は、コンプライアンスコストの増加、地域固有の導入の必要性、または強制的なローカライゼーションに直面する可能性があります。

今後10年を形作る主要なAI市場の動向、ブレークスルー、投資機会とは?

量子AI、ニューロモーフィックコンピューティング、次世代生成モデルの画期的な進歩に後押しされ、AI市場は大変革の瀬戸際に立っている。今後10年間で、AI駆動型自動化、精密医療、自律システム、倫理的なAIガバナンスへの投資が爆発的に増加するでしょう。しかし真のゲームチェンジャーは産業融合にあります——AIがバイオテクノロジー、金融、IoTとシームレスに融合し、エコシステム全体を再構築する領域です。AIが単なる効率化を超え、創造性や自律的意思決定の領域へ進出すにつれ、企業はこうした変革を受け入れるだけでなく、先読みする必要があります。未来は、AIの進化に追随するだけでなく、積極的に形作る者たちのものとなるでしょう。

市場動向

市場推進要因

人間のエージェントに対するAI支援が市場成長にどう寄与するか?

AIは確かに、一般的な問い合わせの対応や顧客を関連リソースへ誘導するカスタマーエクスペリエンスチャットボットを通じて、コンタクトセンターを支援します。2024年までに、AIはエージェントアシスタントとして仮想エージェントを支援するようになります。一例として、AIが顧客の感情を分析し、人間エージェントがより良い顧客サービスを提供できるよう提案応答を提供できる点が挙げられます。さらに、AIはエージェントが通常行う反復的なタスクの一部、例えば将来の参照用に会話を要約・分類する作業などを処理できます。

AIはあらゆるカスタマーサービス提供を包括的に支援し、基本業務を処理することでエージェントへの依頼を最小限に抑えます。人間のエージェントが必要な場面では、AIが効果性を高め、全タッチポイントにおける顧客対応を改善します。AIの進化に伴い、人間のエージェントを支援する能力はさらに向上するでしょう。したがって、人間のエージェント向けAI支援の導入が、世界的な人工知能市場シェアを牽引しています。

市場の制約要因

AIツールの全面導入は市場成長を阻害する課題を生む可能性があるか?

発展途上国におけるAI人材の不足、AIツールの全面導入に伴う課題、ブラックボックス効果が市場の抑制要因となっている。企業はこれらの要因に対抗するため、ブラックボックス効果を排除する倫理的で説明可能なAIモデルへソリューションをアップグレードしている。ブラックボックス効果とは、AIアルゴリズムが検証困難な結果を生成する場合があることを意味する。これらのアルゴリズムの結果には、見つけにくい隠れたバイアスが存在する可能性がある。したがって、結果に対する十分な説明が存在しない。このため、ユーザーはAIツール導入において信頼性と安全性を欠く傾向にある。

さらに、政府や企業は世界的なAI人材不足を克服するため、研究機関や教育センターの開発を進めている。こうした要因により、今後数年間でこの産業の世界的な成長が加速することが期待される。

市場機会

AIスーパーコンピューターをサービスとして提供することは、市場プレイヤーにとって収益性の高い機会を開拓できるか?

スーパーコンピューティングは、ハイパフォーマンスコンピューティング(HPC)と同様の強力な処理能力を提供する。しかし、複数のアプリケーションをサポートできるHPCサーバーとは異なり、スーパーコンピュータは単一のコンピュータで構成され、特定のタスクを実行するためにカスタマイズされます。パンデミックによりスーパーコンピュータクラスターの需要が急増し、研究者が様々な薬の開発を進めるのを支援し、政府やその他の組織がパンデミック関連の取り組みを成功裏に完了することを可能にしました。

マイクロソフトやヒューレット・パッカード・エンタープライズ(HPE)などのハイパースケーラーは、この収益性の高い市場で最大のシェアを獲得するため、開発と投資に注力している。こうした投資と技術的専門知識により、これらのベンダーは市場リーダーとしての地位を確立している。例えば、マイクロソフトAzureはNVIDIAのA100 Tensor Core GPUを搭載した高精度パブリッククラウドスーパーコンピューターサービスをリリースした。同社はNVIDIAのプラットフォームを基盤とした同様のスーパーコンピューティング・アズ・ア・サービスを提供開始し、AWS、Oracle、Googleに続く存在となった。

- 2023年2月 - IBMは自社の大規模AIモデルを訓練するため、クラウド上にAIスーパーコンピューターを構築した。

- 2022年1月 - Metaは機械学習システムのトレーニング専用に開発された「AIスーパーコンピュータ」を構築した。

このように、サービスとして提供されるAIスーパーコンピュータの普及拡大は、AI市場で事業を展開する主要ベンダーにとって収益性の高い機会を生み出すと予想される。

人工知能市場の動向

量子AIが市場に与える影響とは?

AIにおける量子コンピューティング原理の応用は量子AIとして知られています。この形態のAIは、AIアルゴリズムを強化する能力により、ますます普及が進んでいます。量子AIは、材料科学、複雑系最適化、暗号化などの分野において、従来のコンピューターが苦戦する複雑な問題を迅速に解決することで、進歩を促進する可能性を秘めています。量子AIの主要な利点の一つは、大規模なデータセットを効率的に処理し、従来のコンピューターが苦戦する複雑な計算を実行することで、機械学習モデルを大幅に改善できる点です。材料科学、複雑なシステムの最適化、暗号化などにおいて、従来のコンピュータが苦戦する複雑な問題を迅速に解決することで、進歩を促進する可能性を秘めています。量子AIの主な利点の一つは、大規模なデータセットを効率的に処理し、現在では実現不可能な計算を実行することで、機械学習モデルを大幅に改善できることです。量子AIが進化を続けるにつれ、従来の処理能力によって制限されていた分野における革新と進歩を促進するでしょう。この種のAIは、様々な産業に革命をもたらす態勢が整っています。例えば、

- 創薬分野において、量子AIは治療薬候補となる新規分子の特定を加速する可能性を秘めています。卓越した精度で複雑な化学反応をシミュレートする能力により、これまで対処が困難だった疾患の治療に大きな進展をもたらすかもしれません。人間の健康への潜在的な影響は革命的となる可能性があります。

- 金融分野では、量子AIがリスク評価とポートフォリオ管理に革命をもたらす可能性があります。詳細な市場データの分析と無数の変数の同時考慮を通じて、投資家に大きな優位性をもたらす貴重な洞察を提供できるでしょう。現在の最先端アルゴリズムを単なる推測に過ぎなくする精度で市場パターンを予測できる可能性があります。

無料サンプルをダウンロード このレポートについて詳しく知るために。

量子AIは気候変動とその影響に関する予測精度を向上させることで気候モデリングを強化する可能性を秘めており、効果的な緩和策の開発に不可欠である。サイバーセキュリティ分野では、 量子AIは、現行の暗号化手法を脅かす可能性といった重大なリスクと、新たな量子耐性暗号の開発といった機会を同時に提示する可能性がある。量子AIの変革能力はほぼ全ての分野に影響を及ぼす。製造業では、サプライチェーンと生産プロセスを現在では想像し難いレベルで強化する潜在能力を持つ。運輸分野では、交通管理や自動運転技術を変革する可能性を秘めています。エネルギー分野では、より効果的な新たな再生可能エネルギー技術の開発を加速させる可能性があります。

大手テクノロジー企業もスタートアップもこの分野に多額の投資を行っており、世界中の政府が量子研究開発を支援するイニシアチブを立ち上げています。また、関係各社は協力してこの形態のAI開発を加速させています。例えば、

- 2024年7月、ザパタとD-Waveは量子AI融合の強化に向けた提携を結んだ。この協業の目的は、D-WaveのLeapクラウドプラットフォーム上で量子AIと生成AIを組み合わせたソリューションの開発・実装を加速することである。

このように量子AIの普及は、人工知能市場の成長機会を創出するだろう。

市場はどのように区分され、区分分析から得られる主な知見は何ですか?

コンポーネント別分析

複数産業におけるAI導入の増加は、AIソフトウェアの成長に寄与するでしょうか?

構成要素に基づき、市場はハードウェア、ソフトウェア、サービスに区分されます。

2024年にはソフトウェアが48.10%の市場シェアを占めました。AIソフトウェアはAIワークフロープロセス全体において重要な役割を果たすため、AIソリューションへの需要が高まっています。現在では、データサイエンティスト以外のユーザーでもモデルのトレーニングを簡素化するツールを提供する、様々なエンドツーエンドのAIソフトウェアプラットフォームが利用可能です。これにより、専門家の採用への依存度が低下し、開発と市場投入までの時間が短縮されます。さらに、ハードウェアの能力を活用し、リソース管理とコード効率を向上させるために数多くのソフトウェアツールが採用されており、ソフトウェアアプリケーションの全体的なパフォーマンスを向上させています。

予測期間中、サービス分野が最も高いCAGRで成長すると推定される。AI導入企業が増えるにつれ、導入・カスタマイズ・トレーニング・保守のための外部専門知識を求める傾向が強まり、これがAIサービス需要を牽引している。IBM、アクセンチュア、PwC、TCS、キャピジェミニは、2022年から2024年にかけてAIコンサルティングサービスの需要が2~3倍に増加すると報告している。

導入形態別インサイト

組織におけるクラウド導入の拡大が、クラウドベース導入の需要を促進しているのか?

導入形態に基づき、市場はクラウドとオンプレミスに区分される。

2024年にはクラウドが市場を支配する見込みです。クラウドセグメントは2025年に市場シェアの70.80%を占め、予測期間中に30.70%という顕著なCAGR(年平均成長率)が見込まれています。AIは日々進化を続けており、例えば現在進行中の生成AIのトレンドは、企業がAIツールへの投資と開発を推進する要因となっています。これは世界的にクラウドソリューションへの需要が高まっていることを示しています。さらに、パンデミック下でのクラウドコンピューティング技術採用の急増が、クラウド導入の拡大に一層寄与している。

オンプレミスは今後数年間で大幅な成長が見込まれる。オンプレミスソリューションはデータを特定の地理的領域内に保持することを保証し、厳格なデータ主権法が施行されている管轄区域で事業を展開する企業にとって極めて重要である。

企業タイプ別インサイト

AI導入は主に生産性向上を目指す大企業によって牽引されているのか?

企業規模別では、市場は大企業と中小企業に二分される。

2024年には大企業が大きな市場シェアを占めた。IBMの報告によると、大企業の約42%が事業運営にAIを導入しており、これらの組織のIT専門家の59%がAIの積極的な展開を確認しています。大企業セグメントは2025年に59.90%の市場シェアを占めています。

中小企業は予測期間中に32.10%という最高のCAGRを記録すると予想されています。AI技術を活用することで、財務管理、販売・マーケティング、人的資本管理、製品開発など、複数分野における中小企業の革新性とパフォーマンスを向上させることが可能です。SAPの調査によれば、中小企業はAI導入により収益が6~10%増加すると予測されています。

機能別インサイト

サービス運用は人気の高まりから市場を支配しているのか?

機能別では、市場は人事、マーケティング・販売、製品/サービス展開、サービス運用、リスク、サプライチェーン管理、その他に分類される。

2024年現在、サービス運用が市場を支配しています。人工知能はサービス管理業務を最小限に抑え、問題をより迅速に解決することで顧客サービスをさらに向上させます。BMCの最近の調査によると、69%の企業がITサービス管理およびIT運用管理プロセス(ServiceOpsと呼ばれる)に人工知能などの先進技術を導入している。サービスへのAI統合の理由は、運用効率の向上にある。サービス運用は2025年に市場シェアの21.20%を占める見込みである。

予測期間中、リスク分野は32.40%という最高CAGRで成長すると推定される。現代企業は詐欺、データ侵害、規制違反、気候関連影響、サプライチェーン混乱といった多次元リスクに直面している。従来のリスク管理システムは静的で事後対応型であるのに対し、AIはリアルタイムかつ予測的なリスクインテリジェンスを実現する。

サプライチェーン管理およびマーケティング/営業機能では、AIの導入が加速しています。これらの業務機能はAIを活用し、技術の効果を最大限に引き出し、顧客体験の向上を図っています。したがって、今後数年間でこれらのセグメントは有望な成長率を示すと予想されます。

技術別インサイト

機械学習は精度と正確性への広範な活用により主導的立場にあるのか?

技術別では、市場は機械学習、自然言語処理、コンピュータビジョン、ロボティクスと自動化、エキスパートシステムに区分される。

機械学習セグメントは2025年に40.00%のシェアを占め、予測期間中に32.60%という最高のCAGRを記録すると推定されています。これは、この技術が様々なタスクの精度と正確性を向上させる能力を持つためです。また、膨大な量のデータを処理し、人間が見落とす可能性のあるパターンを特定することもできます。傾向、相関関係、異常を特定することで、機械学習は企業や組織がデータに基づいた意思決定を行うのに役立ちます。Fortune Business Insightsによると、世界の機械学習市場規模は2025年までに約500億米ドルに達すると推定されています。

自然言語処理(NLP)は予測期間中に著しい成長が見込まれる。対話型音声応答(IVR)、仮想アシスタント、リアルタイム翻訳、チャットボットなどのNLP技術により、様々な業務の効率性が向上している。自然言語処理は、AIが顧客と直接対話することでシームレスなデータ収集を可能にします。また、膨大なデータの同期における俊敏性を構築し、運用コストの最適化を支援し、ビジネス生産性の向上に貢献します。技術進歩は産業に驚異的な精度と生産性向上をもたらしました。

業界別インサイト

このレポートがどのようにビジネスの効率化に役立つかを知るには、 アナリストに相談

増加する金融詐欺が、BFSIセクターに最大の市場シェア獲得を促しているのか?

業界別では、市場は医療、自動車、小売、BFSI(銀行・金融・保険)、製造、農業、政府・公共部門、IT・通信、エネルギー・公益事業、教育に分類される。

2024年にはBFSIセクターが市場を支配しました。AIはパーソナライズされた金融アドバイスを可能にし、チャットボットやオムニチャネルサポートが顧客エンゲージメントと満足度を向上させています。金融機関におけるAI導入は、金融アクセスにおける従来の障壁に対処する革新的なソリューション開発に活用され、より多くの人々や中小企業が正式な金融システムに参加することを可能にしています。業界専門家によれば、 2030年までに銀行部門だけでGCCのGDPの最大13.6%をAIが貢献する可能性があり、大幅な効率化が示唆されている。BFSIセグメントは2025年に18.90%の市場シェアを占める。

医療業界は、この業界に特化した人工知能アプリケーションの開発が拡大しているため、予測期間中に36.50%という最高CAGRを記録すると予想される。医療機関では、管理業務から患者ケアに至るまで、様々なプロセスの効率化のためにAIが活用されている。IBMの調査によれば、患者の約64%が、看護師が提供するサポート回答への24時間365日アクセスを可能にするAI利用に前向きである。AIはまた、患者の自己投薬における誤りを検出するためにも活用できる。例えばNature Medicineの研究によると、最大70%の患者がインスリンの処方用量を遵守していない。患者の環境内に設置されたWi-FiルーターのようなAI搭載ツールは、患者がインスリンペンや吸入器を使用する際の誤りを特定するために活用できる。

人工知能市場の地域別展望

本市場は地理的に北米、南米、欧州、中東・アフリカ、アジア太平洋に分類され、各地域はさらに国別に分析される。

北米

North America Artificial Intelligence Market Size, 2025 (USD Billion)

この市場の地域分析についての詳細情報を取得するには、 無料サンプルをダウンロード

北米は、IBMコーポレーション、マイクロソフトコーポレーションなどのハイパースケーラーの存在により市場を支配している。最近進行中の生成AIトレンドは、これらのハイパースケーラーにAI技術のアップグレードと、変化するユーザー要件に対応するソリューションの開発を促している。2023年には、米国スタートアップへの投資の約25%がAI関連企業に流れた。さらに北米はAI技術革新において極めて重要な役割を担っている。以上の理由から、同地域が市場を支配している。

米国における人工知能産業の成長は、予測期間中に高い成長率を示すと予想される。同国の市場規模は2025年に664億2000万米ドルに達すると予測されている。米国には新規資金調達したAI企業が多数存在する。2022年AIインデックス報告書によると、世界中で1392社のAI企業がそれぞれ150万米ドル以上の資金調達を受けており、そのうち542社が米国企業である。さらに、米国企業の約73%が何らかの事業面でAIを活用している。生成AIは近年米国で著しい成長と投資を集めており、Fortune Business Insightsによれば、米国の生成AI市場規模は2024年に225億米ドルに達した。2023年のSkynova調査によると、米国を拠点とする中小企業のオーナーの約80%が自社のAI導入に楽観的でした。さらに、米国在住の回答者に対し、営業・マーケティングその他の用途で利用しているAIツールについて質問したところ、以下の表形式で回答が得られました。

アジア太平洋地域

アジア太平洋地域の市場規模は2025年に837億5000万米ドルと推定され、予測期間中に34.70%という2番目に高いCAGR(年平均成長率)を記録すると見込まれています。これは人工知能(AI)への投資増加によるものです。AIは2030年までに同地域のGDPに最大3兆米ドルの付加価値をもたらすと予測されています。Google.orgとアジア開発銀行は2024年5月、1,500万米ドルの「AI機会基金」を設立。進化する労働環境に必要なAI知識とツールをアジアの労働者に提供し、特にニーズが満たされていないコミュニティの人々を含む、より多くの人々がAIが創出する仕事や役割にアクセスできるようにすることを目的としている。

中国市場は2025年に281億米ドルに達すると予測され、これに続くのは130億米ドル規模のインド、156億米ドル規模の日本である。同地域の各国は、特に2025年までにAIが創出する仕事や役割にアクセスできるように、コミュニティのニーズが満たされていない人々を中心に、進化する労働環境に必要なAI知識とツールを提供するための取り組みの導入に注力している。

18億ドルに達すると予測され、次いでインドが130億4000万ドル、日本は156億4000万ドルの規模を見込む。域内各国はAI安全対策関連の施策導入に注力すると同時に、AI能力の強化にも力を入れている。2025年2月にはインドと韓国が、主権強化と協力深化の二本柱でAI能力の向上を推進した。インドはAI開発向けに18,000台のハイエンドGPUベース計算施設を提供する計画を発表し、韓国では大統領直轄AI委員会会議で世界水準の大規模言語モデル(LLM)開発プロジェクトが提示された。

欧州

欧州は、AI開発の可能性を秘めた大量の公共・産業データに恵まれていることから、2025年には654億8000万米ドルという大きな市場規模を示すと予想される。2025年2月、欧州委員会は欧州をAI革命の最前線に位置付けるため、「AI大陸行動計画」と名付けた2250億米ドル規模のイニシアチブを開始した。このイニシアチブでは、AIスタートアップ、研究機関、新興技術、および超大規模AIモデルの訓練に特化するギガファクトリーに対し、約255億1000万米ドルが提供される。各施設には約10万個の先端AIチップが配備され、現在建設中のAI工場の約4倍の規模となる。

2025年時点での市場規模は、英国が158億6000万ドルと推定され、ドイツが121億8000万ドルでこれに続き、フランスは121億2000万ドルと見込まれる。

中東・アフリカ地域

中東・アフリカ地域は2025年に355億3000万米ドル規模への成長が見込まれる。2025年5月、シスコは湾岸地域におけるAI革命の全段階を対象とした一連の戦略的イニシアチブを開始した。これらの取り組みによりシスコは変革の最前線に位置づけられ、パートナー企業と連携して世界水準の信頼性の高い技術を提供している。GCC諸国は2025年の市場規模として156億米ドルを示している。

南米

南米市場は予測期間中に安定した成長率を記録する見込みである。グローバル企業と現地投資家が南米のAIスタートアップやデジタルイノベーションセンターに資金を提供している。ラテンアメリカ私募投資・ベンチャーキャピタル協会によると、2023年のラテンアメリカにおけるAIスタートアップへの資金調達は25億米ドルに達し、前年比40%増加しました。

競争環境

主要業界プレイヤー

市場プレイヤーは事業拡大のためM&A戦略を選択する見込み

人工知能市場のリーダー企業は、変化するユーザー要件に対応するため既存のAIソリューションをアップグレードしている。生成AIツールの最近のトレンドを受け、各社はAI技術で製品ポートフォリオを強化中だ。既存のAI強化に加え、AI市場の主要プレイヤーは、顧客に高度で強化されたサービスを提供するため、関連するパートナーシップや買収を模索している。この戦略は、自社のコンセプトや能力の優れた点を、買収したパートナーの専門知識や市場で入手可能な技術と組み合わせるために採用されている。

調査対象主要企業一覧:

- Microsoft Corporation (米国)

- com, Inc. (米国)

- IBM Corporation (米国)

- Alphabet Inc. (Google LLC) (S.)

- com, Inc. (U.S.)

- Baidu, Inc. (中国)

- NVIDIA Corporation (S.)

- ai (米国)

- Oracle Corporation (米国)

- Hewlett Packard Enterprise Development LP (米国)

- シスコ (米国)

- アリババクラウド (中国)

- ファーウェイ (中国)

- アピア (台湾)

- ガマヤ (スイス)

- ハイロ (イスラエル)

- Lumen5 (カナダ)

- Graphcore (英国)

- OpenAI (米国)

…その他多数

業界の最新動向とは?

- 2025年5月 – OpenAIは、新たに開発したAI駆動型コーディングアシスタント「Codex」を発表しました。これは現在、特定のChatGPTサブスクライバー向けに研究プレビューとして利用可能です。このリリースは同社の大きな成果であり、ソフトウェア開発者が日常業務で人工知能と関わる方法を変革するという目標を示しています。

- 2025年5月 – HPはComputex 2025において、AI搭載PCの最新進化形となる「OmniBook 5」シリーズを発表した。これらの最先端マシンにはSnapdragon XおよびSnapdragon X Plusプロセッサが搭載されており、専用のニューラルプロセッシングユニット(NPU)により最大45テラ演算/秒(TOPS)という驚異的な演算性能を実現している。

- 2025年5月 – オラクルは、データサイエンスの強化と本番環境対応AIの構築・導入を簡素化する包括的なクラウドネイティブソフトウェアソリューション「NVIDIA AI Enterprise」が、Oracle Cloud Infrastructure(OCI)上で利用可能になると発表した。

- 2025年5月 – OpenAIはアラブ首長国連邦(UAE)における大規模な新データセンターの建設を支援する計画を発表。これは世界最大級となる可能性があり、中東地域への大規模投資と、同社のグローバルAIインフラ目標の大幅な拡大を示すものとなる。

- 2025年5月 – NVIDIAはクラウドベースのAI特化ソフトウェアソリューション「DGX Cloud Lepton」を発表。これにより、AIファクトリーがハードウェアを世界中の高性能コンピューティングを求める開発者に貸し出すプロセスが簡素化される。

AI市場の投資分析と機会に影響を与える主な要因は何か?

複数の中小企業が、人工知能エコシステムの加速と強化のために資金を確保している。非AIスタートアップと比較して、AIスタートアップは著しく高い評価額を得ており、この差は成長に伴い拡大し続けている。Bシリーズ資金調達段階において、AIスタートアップの評価額は非AI企業より60%高くなっています。AI分野への資金調達は2023年に大幅な増加を見せ、生成AIへの投資だけでも252億米ドルに達し、 これは2022年比で約8倍の増加となる。2024年第1四半期にはAI特化スタートアップが1,166件の取引で122億米ドルを調達したが、これは2023年第4四半期の1,072件取引・117億米ドルから4%の小幅増に留まった。2024年2月には、AI企業が47億米ドルのベンチャー資金を確保し、これは2月に投資されたベンチャーキャピタル総額の20%以上を占めた。

レポートのカバー範囲

人工知能市場調査レポートは詳細な市場分析を提供する。主要企業、提供サービス、応用分野などの重点項目に焦点を当てている。さらに、最新の市場動向の理解と主要な業界動向のハイライトを提供します。上記の要素に加え、本レポートには近年における市場成長に寄与した複数の要因が含まれています。

カスタマイズのご要望 広範な市場洞察を得るため。

レポートの範囲とセグメンテーション

|

属性 |

詳細 |

|

調査期間 |

2021-2034 |

|

基準年 |

2025年 |

|

推定年次 |

2026 |

|

予測期間 |

2026-2034 |

|

過去期間 |

2021-2024 |

|

成長率 |

2026年から2034年までの年間平均成長率(CAGR)は26.60% |

|

単位 |

金額(10億米ドル) |

|

セグメンテーション |

コンポーネント別

導入形態別

企業規模別

技術別

機能別

業界別

地域別

|

|

レポートで取り上げられた企業 |

オラクル・コーポレーション(米国)、マイクロソフト・コーポレーション(米国)、アマゾン・インク(米国)、アルファベット・インク(米国)、セールスフォース・ドットコム・インク (米国)、バイドゥ(中国)、エヌビディア(米国)、H2O.ai(米国)、HPE(米国)、その他。 |

よくある質問

市場は2034年までに2480.05億米ドルの規模に達すると予測されている。

2025年、市場規模は2941億6000万米ドルと評価された。

人工知能市場は、予測期間中に年平均成長率(CAGR)26.60%を示すと推定されている。

ソフトウェアセグメントは、シェアの観点から市場をリードすることが期待されています。

人間のエージェントに対するAI支援の採用の増加は、市場の成長を促進します。

Oracle Corporation、Microsoft Corporation、Amazon、Inc.、Alphabet Inc.、Salesforce.com、Inc.、Baidu、Inc.、Nvidia Corporation、H2O.AI、およびHPEは市場のトッププレーヤーです。

北米は最高の市場シェアを保持する予定です。

ヘルスケア業界は、予測期間中に最高のCAGRを記録することが期待されています。

専門家にお問い合わせください 専門家に相談する