Smart Meter Data Management Market Size, Share & Industry Analysis, By Component (Software and Services), By Utility (Electricity, Water, and Gas), and Regional Forecast, 2026-2034

Smart Meter Data Management Market Size and Future Outlook

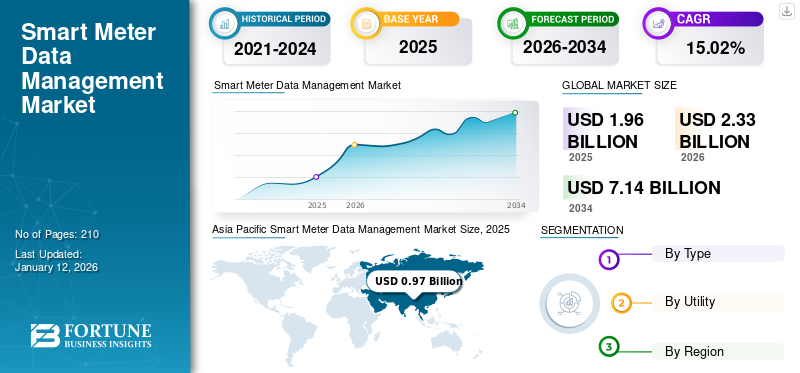

The global smart meter data management market size was valued at USD 1.96 billion in 2025. It is projected to grow from USD 2.33 billion in 2026 to USD 7.14 billion by 2034, exhibiting a CAGR of 15.02% during the forecast period. Asia pacific dominated the smart meter data management market with a market share of 49.50% in 2025.

Smart meter data management refers to the efficient collection, storage, processing, and analysis of data generated by smart meters, which monitor energy, water, and gas usage in real-time. This process enables utilities to optimize grid operations, enhance billing accuracy, and empower consumers with insights into their consumption patterns.

The growth of the smart meter data management market is driven by the increasing adoption of Advanced Metering Infrastructure (AMI), rising demand for real-time energy consumption insights, and integration of renewable energy sources.

Oracle Utilities Meter Data Management System (MDMS) helps utilities maximize the value of their smart meter data. It supports tasks from meter deployment to customer engagement and offers flexible deployment options, including on-premises and cloud (SaaS). As part of a scalable platform, Oracle MDMS serves water, gas, and electric utilities, enabling efficient and streamlined meter operations.

MARKET DYNAMICS

MARKET DRIVERS

Government Focus On Smart Meter Rollouts to Drive Smart Meter Data Management Market Growth

Governments across the globe have put strict regulations in place for the compulsory deployment of smart meters, thereby enabling accurate billing, reducing theft & consumption, and resulting in cost savings for consumers. For instance, in September 2024, Nama Water Services (NWS) announced plans to install over 400,000 smart meters across Saudi Arabia in the same year to improve water billing accuracy. The initiative was announced at a press conference in the presence of the Governor of North Batinah and other officials. These initiatives often come with regulatory mandates and funding support, enabling utilities to upgrade infrastructure and implement advanced metering systems. Large-scale rollouts generate vast amounts of data, necessitating efficient management systems to process, analyze, and secure this information.

Integration with Renewable Energy Sources to Accelerate Market Growth

The deployment of renewable energy sources has witnessed significant growth over the years owing to the strong measures taken by governments for limiting carbon emissions. According to the International Energy Agency (IEA), the global renewable capacity additions surged by nearly 50% to almost 510 gigawatts (GW) in 2023, marking the fastest growth in two decades. This was the 22nd consecutive year of record-breaking renewable capacity. While Europe, the U.S., and Brazil saw significant increases, China's growth was particularly remarkable. The integration of renewable energy plays a crucial role in advancing smart meter data management by creating a need for real-time data collection, analysis, and grid balancing. As renewable energy sources, such as solar and wind are variable, smart meters provide accurate electricity consumption and generation data, enabling utilities to predict demand-supply fluctuations and optimize energy distribution. This data management supports the efficient use of renewables, reduces reliance on fossil fuels, and enhances grid stability. Additionally, it facilitates net metering, where consumers can send excess energy back to the grid, promoting greater adoption of renewable energy technologies.

MARKET RESTRAINTS

Rising Cybersecurity Concerns to Constrain Market Growth

Cybersecurity risks in smart meter data management are a significant concern due to the sensitive data involved and the interconnected nature of smart meter systems. Data breaches pose a threat as smart meters collect personal consumption information that could be exposed if hacked. Unauthorized access and manipulation of data could lead to inaccurate billing or even grid disruptions. Denial of Service (DoS) attacks can overwhelm systems, making them unresponsive and delaying vital processes. Weak authentication and poor access controls may allow cybercriminals to gain control over the meters, compromising system integrity. Additionally, supply chain vulnerabilities and insecure communication networks further heighten the risk of data interception or manipulation. To mitigate these threats, utilities must implement robust cybersecurity measures, such as encryption, secure authentication, regular updates, and compliance with industry standards to protect both consumer data and system reliability.

MARKET OPPORTUNITIES

Ongoing Technological Advancements to Offer Lucrative Opportunities for the Market

The growing adoption of smart meters is encouraging companies to integrate several technologies for better performance of these meters and smart meter data management systems. Technological advancements play a key role in enhancing smart meter data management by improving the efficiency, scalability, and capabilities of data collection, storage, and analysis. For instance, in December 2024, 4G hubs upgraded the U.K.'s smart meter network, improving energy efficiency and supporting net-zero goals. This upgrade replaced 2G and 3G technologies, helping households and businesses use energy more efficiently. The rollout was led by Data Communications Company (DCC) in collaboration with Toshiba, Vodafone, Accenture, CGI, and Deloitte to enhance sustainability and energy management.

Moreover, innovations in Internet of Things (IoT) devices, cloud computing, and Artificial Intelligence (AI) enable real-time data transmission, storage, and processing of vast amounts of meter data. AI and machine learning algorithms allow utilities to predict consumption patterns, optimize grid performance, and identify anomalies or inefficiencies.

MARKET CHALLENGES

High Deployment Costs to Restrain Market Growth

The high deployment cost of smart meters compared to that of the traditional meters is a significant challenge in smart meter data management due to the high initial investment and ongoing operational expenses. The upfront costs include purchasing and installing smart meters, setting up communication networks, and implementing data management systems. Additionally, utilities must invest in storage and processing infrastructure to handle large volumes of data generated by the meters. Ongoing expenses include maintaining the meters, communication networks, and software systems, as well as ensuring cybersecurity to protect sensitive consumer data. In addition, ensuring compliance with regulatory standards further adds to the company’s financial burden. While the long-term benefits of smart meters, such as improved efficiency, accuracy, and cost savings are clear, the initial and recurring costs can be a barrier, particularly for smaller utilities or regions with limited budgets.

SMART METER DATA MANAGEMENT MARKET TRENDS

The rising inclination toward reducing the use of conventional resources in power generation and limiting the consumption of power has led to the upgradation, modernization, and better management of grid infrastructures. For instance, in December 2024, Ottawa announced over USD 256.7 million in funding from the output-based pricing system proceeds fund for clean electricity and grid modernization projects in Saskatchewan. The fund collects pollution pricing from certain industries, with proceeds returning to the originating jurisdiction through two programs: The Decarbonization Incentive Program and the Future Electricity Fund. Enhanced grid management enables utilities to monitor and control the flow of electricity across the grid better. Smart meters provide real-time data on energy usage, allowing utilities to quickly identify and address inefficiencies, outages, or imbalances in the grid. This data helps optimize energy distribution, reduce peak demand, and integrate renewable energy sources more effectively. With detailed insights from smart meters, grid operators can make data-driven decisions, ensuring more reliable and efficient grid operations, improving overall system performance, and enhancing energy sustainability.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic had a notable impact on smart meter data management market growth, both in terms of challenges and opportunities. The pandemic increased reliance on remote monitoring and digital solutions as utilities faced restrictions on in-person meter readings. This accelerated the adoption of smart meters, which allowed utilities to continue providing accurate billing and monitoring without needing physical access to customer premises.

The pandemic also brought about operational challenges. Many utilities faced disruptions in their workforce and supply chains, delaying smart meter installations and maintenance. Furthermore, increased data volumes from remote meters put pressure on the existing data management systems, requiring utilities to quickly scale their infrastructure and enhance analytical capabilities to handle the surge in demand.

SEGMENTATION ANALYSIS

By Component

Rising Adoption of SaaS and other Platforms to Boost Software Segment Growth

The market is segmented by component into software and services.

The software segment accounts for the maximum share of the market in 2026 by 59.89% due to the growing adoption of SaaS (Software as a Service) platforms. This segment includes smart MDM platforms, analytics tools, and integration software, all of which benefit from key trends, such as the shift to cloud-based solutions for greater flexibility and cost-effectiveness. Additionally, the increasing integration of AI and machine learning enhances predictive analytics and anomaly detection capabilities, which are playing a key role in increasing the demand for smart meter data management software.

The services segment is also expected to grow substantially due to the growing outsourcing operations focused on core activities, thereby addressing the complexity of integrating MDM with AMI and other IT/OT systems in the utilities sector. In emerging markets, there is a strong demand for consulting and training services to support the effective adoption of MDM solutions, further leading to the growth of the services segment in the market.

By Utility

Rising Adoption of Smart Electric Meters for Limiting Consumption and Carbon Emissions to Drive Electricity Segment Growth

The market is segmented by utility into electricity, water, and gas. The electricity segment dominates the smart meter data management market due to the widespread deployment of smart electric meters, particularly in developed regions. This deployment is being supported by regulatory mandates for energy efficiency, decarbonization, and initiatives like net-zero goals and time-of-use (TOU) tariffs. Additionally, advancements in grid modernization facilitate better demand-side management and integration of renewable energy sources. The segment is expected to dominate the market share of 74.03% in 2026.

Water segment is anticipated to exhibit a CAGR of 16.50% during the forecast period.

Gas is the fastest-growing segment in the market owing to the rising adoption of smart gas meters offering enhanced safety features, such as leak detection and prevention. The segment also benefits from the rising demand for natural gas and Liquefied Petroleum Gas (LPG) in residential and industrial applications, alongside regulatory frameworks and initiatives promoting efficient energy use.

To know how our report can help streamline your business, Speak to Analyst

SMART METER DATA MANAGEMENT MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Increasing Penetration of Smart Meters in Countries to Foster Regional Market Growth

Asia Pacific Smart Meter Data Management Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific holds the dominating share of the market due to the adoption of smart meter data management systems in the region, further driven by large-scale deployments in countries, such as China, India, and Japan. The regional market value in 2025 was USD 0.97 billion, and in 2023, the market value led the region by USD 0.67 billion. The governments of these nations are prioritizing grid modernization to address aging infrastructure issues and meet rising energy demands. National policies and programs, including China's State Grid initiatives and India's Smart Cities Mission, actively support the rollout of Advanced Metering Infrastructure (AMI). India is promoting its plan to install 250 million smart meters, creating a USD 20 billion opportunity for the energy sector, according to Avener Capital. As of October 2nd, 2024, about 117.7 million meters were installed, with 14.5 million installed under the Advanced Metering Infrastructure Service Provider (AMISP) initiative, which is projected to grow at a 25% annual rate over the next 3-4 years. India is projecting to hit USD 0.13 billion and Japan is likely to hold USD 0.0957 billion in 2026.

China

Soaring Urbanization and Industrialization to Fuel Market

The market value in China is expected to be USD 0.73 billion in 2026. The robust growth in urbanization and industrialization in the country, coupled with government initiatives to deploy smart meters in industrial and urban areas, is expected to play a key role in the Chinese market growth. With urbanization leading to higher energy consumption and more complex infrastructures, smart meters help track and manage electricity usage more accurately, ensuring reliable supply and improving sustainability. Moreover, MDM systems allow for better integration of renewable energy, demand-side management, and grid optimization, supporting the growing urban and industrial sectors while reducing operational costs and environmental impact.

North America

Increasing Government Support for Renewable Energy and Grid Modernization to Propel North American Market

North America region is to be anticipated as the third-largest market with USD 0.5 billion in 2026. North America holds a notable smart meter data management market share owing to the high penetration of smart meters, supported by government funding and utility mandates and a strong focus on grid modernization and renewable energy integration. For instance, In September 2023, Canadian utility SaskPower planned to invest USD 1.6 billion in the provincial electricity system during the 2024-25 fiscal year, focusing on grid maintenance, upgrades, new generation, growth projects, and smart meter deployments. This marked a USD 433 million increase compared to 2023-2024.

U.S.

Ongoing Investments in Grid Technologies to Drive Product Demand

The U.S. smart meter data management market continues to expand, supported by ongoing investments in smart grid technologies, renewable energy integration, and regulatory frameworks. The U.S.' 2022 Grid Resilience Innovative Partnership (GRIP) Program, with USD 10.5 billion in funding, aimed to upgrade and expand electric grids. This initiative boosts the adoption of smart meter by supporting grid modernization, enhancing system resilience, and enabling better integration of Advanced Metering Infrastructure (AMI) technologies. The U.S market is anticipating a market size of USD 0.42 billion in 2026.

Europe

Government Focus for Carbon Neutrality and Smart Meter Rollout to Push Market Growth

Europe also holds a notable share of the market driven by stringent energy efficiency regulations, including the European Union's ambitious climate targets aimed at reducing emissions and increasing renewable energy use. Europe is anticipated to account for the second-highest market size of USD 0.54 billion in 2026, exhibiting the second-fastest growing CAGR of 15.07% during the forecast period. The region has seen high adoption of smart meters, particularly in countries, such as the U.K., Italy, and Sweden, which have implemented comprehensive rollouts to enhance energy monitoring and efficiency. The U.K. government, for instance, wants energy suppliers to install smart meters in every home in England, Wales, and Scotland. There are more than 26 million homes for the energy suppliers to get to, with the goal of offering every home a smart meter by the end of the rollout. The market value in U.K. is expected to be USD 0.05 billion in 2026.

On the other hand, Germany is projecting to hit USD 0.05 billion in 2026. France is likely to hold USD 0.04 billion in 2025.

Latin America

Surging Deployment of Smart Meters to Control Electricity Theft to Positively Impact Market

Latin America is projected to show positive growth in the market during the forecast period. The need to address challenges, such as water and electricity theft have driven the demand for smart meters as tools for more accurate billing and improved monitoring. For instance, energy meter tampering and electricity theft are major issues in Brazil, with estimates suggesting that they could account for up to 10% of the country's total electricity generation. In 2020, the Brazilian Electricity Regulatory Agency reported that approximately 13.2 TWh of energy was stolen, equivalent to around USD 1.3 billion. Moreover, international investments in the regional utility sector are further expected to accelerate the adoption of smart meter data management systems across the region.

Middle East & Africa

Strong Focus On Management of Water Source and Other Utilities to Drive Market

The Middle East & Africa is anticipated to show positive growth in the market with a gradual but steady adoption of smart meters. This region is anticipated to be the fourth-largest market with a size of USD 0.09 billion in 2026. In Gulf Cooperation Council (GCC) countries, such as the U.A.E., Saudi Arabia, and Qatar energy conservation efforts and government initiatives to modernize the electricity infrastructure are key drivers behind the shift toward smart metering. Additionally, there is a strong focus on water resource management in the region's arid areas, where smart meters are being increasingly used to monitor water usage and reduce waste. For instance, in July 2024, the Dubai Electricity and Water Authority (DEWA) completed the installation of over one million smart water meters, achieving 100% coverage in Dubai. The growing demand for reliable energy supply, coupled with the need to reduce operational losses in both electricity and water sectors, will further accelerate the adoption of smart meters data management solutions. The GCC market size is estimated to hit USD 0.04 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Oracle's Advanced Utilities MDM Solution to Lead the Market Growth

Companies, such as Oracle, Siemens, Eaton, and Itron are some of the key players providing innovative solutions in this market, thereby driving the modernization of energy infrastructure and enabling the transition to smarter, more sustainable grids. The Oracle Utilities MDM collects and processes data from any device, validating, storing, and formatting it for use across various systems. It offers features, such as aggregations, event & usage subscriptions, bill determinants, and smart meter transition processes. The system automatically analyzes usage and event data, issuing Service Investigative Orders (SIOs) for issues, such as missing readings or exceptions, thereby helping with revenue protection and improving meter and network device performance. Additionally, it includes a 360-degree user interface, allowing users to view and analyze data alongside related information like weather, usage profiles, and service activities.

List of the Key Smart Meter Data Management Companies Profiled:

- Oracle (U.S.)

- Itron (U.S.)

- Eaton (Ireland)

- Schneider Electric (France)

- Siemens (Germany)

- ABB (Switzerland)

- Honeywell (U.S.)

- Landis+Gyr (Switzerland)

- Kamstrup (Denmark)

- Xylem (U.S.)

- Fluentgrid (India)

- Atos Group (France)

KEY INDUSTRY DEVELOPMENTS:

In October 2024, ST Engineering announced the deployment of a smart water platform for Aegea, a leading Brazilian sanitation company serving over 500 municipalities. Set to launch by late 2024, the cloud-based system will integrate Aegea's water metering operations, improve efficiency, optimize data usage, and reduce water losses. The system will enable automated monitoring and control across Aegea's water infrastructure, offering real-time alerts, trend analysis, and optimization insights to improve water management efficiency.

In September 2024, Metron, a leader in smart water metering, announced that it will launch two new products at the WaterPro Conference 2024 in Savannah, Georgia, from September 9 to 11. These products, part of Metron's data-first strategy, will use advanced analytics and machine learning to help utilities, property managers, and homeowners detect leaks, optimize water usage, reduce costs, and promote sustainability.

In September 2023, Itron, Inc. partnered with Jordan Electric Power Company (JEPCO), a leading utility in Jordan, to support its digital transformation. JEPCO will implement Itron's Enterprise Edition (IEE) Meter Data Management (MDM) system to centralize data and improve operations. Initially, the solution will manage data from over 1.5 million smart meters, with the capacity to handle 100,000 additional meters annually for the next five years. Advanced Technologies, an Itron channel partner, will deploy the system.

In November 2022, EKS upgraded its metering infrastructure with 32,000 E360 smart residential meters and 260 E570 industrial meters from Landis+Gyr over the next five years in Switzerland. The project included a 10-year as-a-service model featuring Landis+Gyr's AIM Smart Metering software, implemented as a cloud-based SaaS solution.

In November 2021- Siemens Smart Infrastructure upgraded its EnergyIP smart meter data management software to enhance user experience. The new EnergyIP Mosaic offers intuitive design, interactive visualizations, and shortcuts, reducing task time by up to 85%. Improved data transparency and anomaly detection enable faster, more confident decision-making.

REPORT COVERAGE

The report delivers a detailed insight into the market and focuses on key aspects, such as leading companies. Besides, it offers insights into the market trends & technologies and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors and challenges that have contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE AND SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.02% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component, By Utility, and By Region |

|

Segmentation |

By Component

|

|

By Utility

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 1.96 billion in 2025.

The market is likely to record a CAGR of 15.02% over the forecast period.

By utility, the electricity segment is expected to lead the market during the forecast period.

The Asia Pacific market size was valued at USD 0.97billion in 2025.

Government focus on smart meter rollouts is the key factor driving the market’s growth.

Some of the top players in the market are Oracle, Eaton, Itron, Siemens, and others.

The global market size is expected to reach a valuation of USD 7.14 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us